Industry News

Reminder: 2017 OSHA Summary of Work-Related Injuries and Illness Must Be Posted

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

According to a recent memo, the State of California Department of Industrial Relations would like to remind employers that they are required to physically post their 2017 annual summaries of work-related injuries from February 1, 2018 through April 30, 2018.

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

According to a recent memo, the State of California Department of Industrial Relations would like to remind employers that they are required to physically post their 2017 annual summaries of work-related injuries from February 1, 2018 through April 30, 2018.

OSHA’s Summary of Work-Related Injuries and Illness, also known as Form 300A, must be completed and posted for employees to view.

If you are tracking work-related injuries in the Rancho Mesa Risk Management Center, the Form 300A can be generated from the system. From the Incident Track screen, click on "Reports," then "OSHA Reports," select "OSHA 300A Summary," the "2017." Complete any missing information and "Download."

To manually complete the Form 300A, review the instructions found on the Cal/OSHA or OSHA websites.

If you are unsure if you are required to maintain OSHA logs, visit the OSHA website.

Why Would a Contractor Purchase Employment Practices Liability Insurance?

Author, Kevin Howard, CRIS, Account Executive, Construction Gorup, Rancho Mesa Insurance Services, Inc.

Insurance is often considered a necessary evil by business owners. It can represent a significant line item on a profit & loss statement rivaling the cost in some cases of payroll, material costs and rent. With deductibles that can range from $15,000-$25,000 per claim, why then would a business spend dollars on an insurance policy that is not required by either state law or part of any General Contractor’s insurance specifications?

Author, Kevin Howard, CRIS, Account Executive, Construction Group, Rancho Mesa Insurance Services, Inc.

Insurance is often considered a necessary evil by business owners. It can represent a significant line item on a profit & loss statement rivaling the cost in some cases of payroll, material costs and rent. With deductibles that can range from $15,000-$25,000 per claim, why then would a business spend dollars on an insurance policy that is not required by either state law or part of any general contractor’s insurance specifications?

What does an EPLI policy cover?

Employment Practices Liability Insurance (EPLI) policies typically extend coverage to the following:

Wrongful termination of an employee who alleges violation of their contract;

Sexual harassment claims by one employee against another;

Wage related claims by employees who allege denial of overtime pay or tips, or working “off the books." Note: Most carriers offer a defense only sub limit for this type of claim;

Claims of unequal or unfair pay between employees performing the same job and having similar skills, education, seniority and responsibility;

Discrimination claims based on age, race, gender or sexual orientation;

Third Party. Example: Your employee out in the field of work upsets another subcontractor’s employee, a customer at their home, a student at a school enough to where they file a lawsuit against you.

Why do businesses resist purchasing EPLI?

Declining to purchase EPLI can stem from businesses feeling that they are not large enough for this type of claim to occur. Many owners have close relationships with their employees and never believe any of the above scenarios could occur within their organization. And yet, many more can assume that a General Liability policy would cover these types of potential claims when, in fact, most have specific EPLI exclusions. This type of thinking could result in losses that have severe financial consequences for your company. Let’s take a quick look at three common EPLI exposures facing the construction industry.

Common EPLI Claims in the Construction Industry

Rapid growth and layoffs are unique aspects of the construction industry that can cause the elimination of a specific position and/or termination. With these ebbs and flows, contractors unintentionally open themselves up to wrongful termination cases which can carry into discrimination charges, as well. It can also be common to see employees bring post-employment wage & hour claims, which center around improper overtime, breaks, etc. Lastly, contractors' work very often involves interaction and exposure to the public. This interaction can lead to comments, inferences, or specific actions that non-employees find offensive. Claims brought by these third parties are difficult to prove when the employer is unable to witness the events first-hand.

Light Bulb Moment

In these and other potential claim scenarios, employers without EPLI must outlay their own funds to find legal representation and fight the charges. Legal costs add up quickly regardless of the documentation an employer has kept on file and the conviction they have that an employee’s claim is frivolous. Defending yourself in today’s environment can become cost ineffective very quickly. Light bulb moments can occur when EPLI limits are unavailable because coverage is not in force and an owner is staring at a “balance sheet loss,” resulting in a six figure settlement.

Consult Your Broker for EPLI Options

At Rancho Mesa, as it relates to coverage for our clients, we often say "you would rather be looking at it than for it”. That is, you want to be looking at a policy that will respond to coverage than for one at the time of a loss. Take time to explore the nuances of employment practices liability insurance with a knowledgeable broker. Allow an expert to educate you on the real exposure to your company, ask to spreadsheet different policy forms, deductibles and limits in an effort to balance the annual premium with the potential impact of a large loss.

For more information about Employment Practices Liability Insurance, contact Rancho Mesa Insurance at (619) 937-0164.

Highlights of the New Tax Reform Law

Article provided by, Kevin Brown, Managing Partner, RBTK, LLP.

The new tax reform law, commonly called the “Tax Cuts and Jobs Act” (TCJA), is the biggest federal tax law overhaul in 31 years, and it includes both good and bad news for taxpayers.

Below are highlights of some of the most significant changes affecting individual and business taxpayers. (Except where noted, these changes are effective for tax years beginning after December 31, 2017.)

Article provided by, Kevin Brown, Managing Partner, RBTK, LLP.

The new tax reform law, commonly called the “Tax Cuts and Jobs Act” (TCJA), is the biggest federal tax law overhaul in 31 years, and it includes both good and bad news for taxpayers.

Below are highlights of some of the most significant changes affecting individual and business taxpayers. (Except where noted, these changes are effective for tax years beginning after December 31, 2017.)

Individuals

Drops of individual income tax rates ranging from 0 to 4 percentage points (depending on the bracket) to 10%, 12%, 22%, 24%, 32%, 35% and 37% — through 2025

Near doubling of the standard deduction — through 2025

Elimination of personal exemptions — through 2025

Doubling of the child tax credit to $2,000 — through 2025

Elimination of the individual mandate under the Affordable Care Act — effective for months beginning after December 31, 2018

Reduction of the adjusted gross income (AGI) threshold for the medical expense deduction to 7.5% for regular and AMT purposes — for 2017 and 2018

New $10,000 limit on the deduction for state and local taxes (on a combined basis for property and income taxes; $5,000 for separate filers) — through 2025

Reduction of the mortgage debt limit for the home mortgage interest deduction to $750,000 ($375,000 for separate filers), with certain exceptions — through 2025

Elimination of the deduction for interest on home equity debt — through 2025

Elimination of miscellaneous itemized deductions subject to the 2% — through 2025

Elimination of the AGI-based reduction of certain itemized deductions — through 2025

Expansion of tax-free Section 529 plan distributions to include those used to pay qualifying elementary and secondary school expenses, up to $10,000 per student per tax year

AMT exemption increase — through 2025

Doubling of the gift and estate tax exemptions to $10 million (expected to be $11.2 million for 2018 with inflation indexing) — through 2025

Businesses

Replacement of graduated corporate tax rates ranging from 15% to 35% with a flat corporate rate of 21%

Repeal of the 20% corporate AMT

New 20% qualified business income deduction for owners of flow-through entities (such as partnerships, limited liability companies and S corporations) and sole proprietorships — through 2025

Doubling of bonus depreciation to 100% — effective for assets acquired and placed in service after September 27, 2017, and before January 1, 2023

Doubling of the Section 179 expensing limit to $1 million

New disallowance of deductions for net interest expense in excess of 30% of the business’s adjusted taxable income (exceptions apply)

New limits on net operating loss (NOL) deductions

Elimination of the Section 199 deduction, also commonly referred to as the domestic production activities deduction or manufacturers’ deduction — effective for tax years beginning after December 31, 2017, for noncorporate taxpayers and for tax years beginning after December 31, 2018, for C corporation taxpayers

New rule limiting like-kind exchanges to real property that is not held primarily for sale

New tax credit for employer-paid family and medical leave — through 2019

New limitations on excessive employee compensation

New limitations on deductions for employee fringe benefits, such as entertainment and, in certain circumstances, meals and transportation

More to Consider

This is just a brief overview of some of the most significant TCJA provisions. There are additional rules and limits that apply, and the law includes many additional provisions. Contact your tax advisor to learn more about how these and other tax law changes will affect you in 2018 and beyond.

OSHA Accepting Electronic Form 300A Data Submissions Through End of Year

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

In a recent news release from the U.S. Department of Labor (DOL), the Occupational Safety and Health Administration (OSHA) will be accepting electronically submitted 2016 OSHA Form 300A data through midnight on December 31, 2017. The previous deadline had been December 15, 2017.

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

In a recent news release from the U.S. Department of Labor (DOL), the Occupational Safety and Health Administration (OSHA) will be accepting electronically submitted 2016 OSHA Form 300A data through midnight on December 31, 2017. The previous deadline had been December 15, 2017.

According to a statement released by the DOL, as of January 1, 2018, the Injury Tracking System "will no longer accept the 2016 data."

Employers in California, Maryland, Minnesota, South Carolina, Utah, Washington and Wyoming are currently not required to submit their OSHA reports electronically. However, it is likely it will be a requirement in the future.

Update: 5/3/18 For updated information on State requirements, read "Federal OSHA Asserts Electronic Data Reporting Requirement Applies to Employers across All States."

For additional information about the OSHA electronic reporting, read "Risk Management Center Streamlines Electronic OSHA Reporting," "DHS Alerts OSHA of Possible Electronic Reporting Security Breach," "OSHA Launched Electronic Reporting System."

California Workers Compensation 2018 Annual Officer Payrolls Minimums and Maximums, Assessment Rates, and Dual Wage Thresholds Announced by WCIRB

ICW Group Insurance Company, the largest group of privately held insurance companies domiciled in California, recently released an announcement that outlines the details and is attached for your review.

ICW Group Insurance Company, the largest group of privately held insurance companies domiciled in California, recently released an announcement that outlines the details of California Workers Compensation 2018 Annual Officer Payrolls Minimums and Maximums, Assessment Rates, and Dual Wage Thresholds. The document is available for your review.

For any questions concerning the changes, please contact your Rancho Mesa service team.

3 Steps to Developing Your 2018 Safety Training Calendar

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

The end of the year is the perfect time to evaluate your company’s overall safety program. One important element in a successful safety program is the weekly safety meetings (aka training shorts, tailgate talks, or toolbox talks).

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

Example of a construction training short calendar.

The end of the year is the perfect time to evaluate your company’s overall safety program. One important element in a successful safety program is the weekly safety meetings (aka training shorts, tailgate talks, or toolbox talks).

Rancho Mesa’s Risk Management Library provides the content employers need to educate their employees on how to be safe in the workplace.

The library includes hundreds of English and Spanish training shorts designed to educate employees on various safety topics in a quick and concise manner. Each training short typically includes 1-2 pages of easy to follow content and a sign-in sheet.

Rancho Mesa recommends choosing 52 topics that are relevant to your industry. This will serve as your training short calendar for 2018.

Step 1: Review the Training Shorts Library

To access the training shorts within the library, login to the Risk Management Center, click “Resources,” then click “Risk Management Library. Click on “Training Shorts,” then click “Safety.”

Review the list to determine which topics are appropriate for your industry.

Step 2: Save the Training Topics

It is recommended that you save your selected Training Shorts to your “My Content” folder. This will make it easily to find them later.

From the list of training shorts, check the box to the left of the title(s) you would like to save to the “My Content” folder. Then, click “Add to My Content” in the upper right corner. Choose the subfolder to save the training shorts. Now, you can refer back to the list of topics, later.

Step 3: Schedule the Trainings

Now, that you have picked your 52 training topics from the library, we recommend putting them on a calendar. Pick a day during the week when you’ll have your safety meeting and include the topic for each week. Training may also be scheduled within the Risk Management Center.

For recommendations for your training calendar, contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164.

OSHA Pushes Back Electronic Reporting Deadline

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

In a recent news release from the U.S. Department of Labor (DOL), the Occupational Safety and Health Administration (OSHA) announced it has extended its electronic reporting deadline from December 1, 2017 to December 15, 2017.

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

In a recent news release from the U.S. Department of Labor (DOL), the Occupational Safety and Health Administration (OSHA) announced it has extended its electronic reporting deadline from December 1, 2017 to December 15, 2017.

The extension was made "to allow affected employers additional time to become familiar with the new electronic reporting system launched on August 1, 2017," according to the statement issed by the DOL's OSHA.

Employers in California, Maryland, Minnesota, South Carolina, Utah, Washington and Wyoming are currently not required to submit their OSHA reports electronically. However, it is likely it will be a requirement in the future.

Update: 5/3/18 For updated information on State requirements, read "Federal OSHA Asserts Electronic Data Reporting Requirement Applies to Employers across All States."

For additional information about the OSHA electronic reporting, read "Risk Management Center Streamlines Electronic OSHA Reporting," "DHS Alerts OSHA of Possible Electronic Reporting Security Breach," "OSHA Launched Electronic Reporting System."

Berkshire Hathaway Homestate Companies and Rancho Mesa Participate in Nationally Renowned LANDSCAPES 2017

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

The Berkshire Hathaway Homestate Companies (BHHC) and Rancho Mesa Insurance Services (RMI) teamed up at the annual LANDSCAPES 2017 convention, the Green Industry & Equipment (GIE) Expo, and the Hardscape North America (HNA) Tradeshow, in Louisville, Kentucky, on October 17-20, 2017.

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

Berkshire Hathaway Homestate Companies and Rancho Mesa Insurance Services NALP Program Team

The Berkshire Hathaway Homestate Companies (BHHC) and Rancho Mesa Insurance Services (RMI) teamed up at the annual LANDSCAPES 2017 convention, the Green Industry & Equipment (GIE) Expo, and the Hardscape North America (HNA) Tradeshow, in Louisville, Kentucky, on October 17-20, 2017.

The group consisted of Senior Vice President Margaret Hartmann, NALP Assistant Director of Underwriting Valerie Contreras, NALP Program Underwriter Davis Cooper, NALP Client Services Coordinator Emily Docuyanan, and NALP Senior Loss Control Specialist Steve Hamilton from BHHC, and agency Principal Dave Garcia and NALP Program Director Drew Garcia from RMI.

Davis Cooper, NALP Program Underwriter, Berkshire Hathaway Homestate Companies

The BHHC and RMI group participated in a multitude of event programs as speakers, ambassadors, and audience. BHHC and RMI championed four breakfast table topics, a breakout education session based on risk mitigation and cost savings, and took time to speak with association members about the program within National Association of Landscape Professionals' (NALP) booth at the expo.

NALP Program Board Presentation

Sam Steel, NALP Safety Advisor & Steve Hamilton, BHHC

Membership Meeting

“The event was a great success," said Dave Garcia. "It’s amazing to see so many like-minded people dedicated to improving themselves and their companies while building upon the professionalism this industry holds as standard. We are so proud to be a part of this amazing industry and look forward to a long lasting partnership with NALP for years to come.”

NALP Group

Davis Cooper and Drew Garcia at the booth

Davis Cooper speaking with attendees at the booth

I really enjoyed connecting with NALP members and learning about their individual companies. LANDSCAPES provides an environment for motivated industry professionals to share ideas, learn, and form long lasting relationships. The overwhelming commonality is this identified desire for industry veterans to give back to the community that helped them succeed. It’s easy to build off that energy and puts into perspective that our Work Comp Program is providing the level of specialized attention this industry deserves. I'm excited to keep the momentum going while constantly looking for ways to improve our product so that we can provide more to lawn and landscape professionals.

For more information about the NALP Workers' Compensation Program, contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164.

NALP Announces 2017 Safety Award Recipients

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

Rancho Mesa would like to congratulate all 263 National Association of Landscape Professionals (NALP) members who achieved recognition for their safety efforts in 2017.

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

Rancho Mesa would like to congratulate all 263 National Association of Landscape Professionals (NALP) members who achieved recognition for their safety efforts in 2017.

"The National Association of Landscape Professionals Safety Recognition Awards Program is designed to reward landscape industry professionals who consistently demonstrate their commitment to safety, and reflects the dedication of these individuals and their companies to creating and maintaining safe work environments," according to the NALP website.

Companies are evaluated in the following categories:

- No vehicle accidents

- No injuries or illness

- No days away from work

We would like to encourage all professional lawn and landscape companies to partake in NALP’s safe company program because participation as a group will continue to evolve and strengthen safety within the industry as whole.

I’m looking forward to supporting the association and these individual achievements in Louisville on October 19th at the annual awards ceremony.

On behalf of Rancho Mesa, congratulations to the participants!

5 Steps to Avoiding Workers’ Compensation Claim Litigation

Author, Jeremy Hoolihan, CRIS, Janitorial Group Leader, Rancho Mesa Insurance Services, Inc.

Workers’ Compensation claims can cost a company time, money, employee productivity, and morale. Litigation is one of the most costly results of a workers’ compensation claim. Once an employee hires an attorney, the time and money it takes for the claim to close drastically increases.

Author, Jeremy Hoolihan, CRIS, Janitorial Group Leader, Rancho Mesa Insurance Services, Inc.

Workers’ Compensation claims can cost a company time, money, employee productivity, and morale. Litigation is one of the most costly results of a workers’ compensation claim. Once an employee hires an attorney, the time and money it takes for the claim to close drastically increases.

There are several reasons why an employee will find the need to hire an attorney. Practicing a sound Risk Management Program can dramatically reduce the likelihood of litigation. Here are some ways you can prevent most workers’ compensation claims from ever reaching that point:

- Acknowledge why employees hire attorneys. The employee/employer relationship is a critical factor in determining if a workers’ compensation claim results in litigation. Employees who feel threatened in some way are more likely to hire an attorney. A few key reasons are:

a. The employee is concerned they will be fired because of the injury and/or ownership or management doesn’t truly feel the injury was work related.

b. The employee feels they will face retaliation for reporting the claim.

c. There is a lack of understanding of the workers’ compensation claim process. For those employees that are faced with a workers’ compensation injury, it can be a very stressful time.

d. There is a fear the claim will be denied or they will be treated unfairly. Attorneys can prey on vulnerable injured employees. Radio and television ads imply injured employees need their assistance in order to get proper treatment and/or a huge settlement they deserve.

- Keep lines of communication open with your employee. Reassure the employee that he or she will have a job when they are able to return to work. In addition, show some compassion and stay in regular contact with the individual. An employee is far more likely to hire an attorney if they are concerned about losing their job or no longer of value to the company.

- Consider the ramifications before firing an injured employee. Termination of an employee after they have been injured on the job can put the company at risk of a lawsuit (Section 132 claim). In addition, terminating an injured worker could cost the company more in wage loss benefits; an injured employee will continue to draw from the workers’ compensation policy if they are unable to return to work, regardless if the company continues to employ them or not. Often, employees are released to modified duty (Return To Work Program). If an employer can accommodate the work restrictions, the employee’s temporary benefits are reduced or eliminated. This can significantly reduce the total cost of the claim.

- Act before a problem employee becomes injured. Once an injury has been reported, it becomes extremely risky to discipline or terminate a problem employee. Address and deal with the employee immediately and be consistent with your documentation.

- Train your supervisors!!!! It is vital that supervisors are trained in reporting and handling claims. They are your first line of defense in preventing claim litigation. Businesses should have a formalized Accident Investigation Program in place. Rancho Mesa provides a Supervisor’s Report of Accident or Near Miss form and a Witness’ Accident Statement form to assist in the investigation process. In addition to all the formal documentation, there are other key strategies a supervisor can use:

a. Do not accuse the injured employee of fraud, even if you know fraud is involved. Supervisors should simply document the facts. If there is suspicion of fraud, make sure you document any supporting evidence in the report and inform the adjuster.

b. Do not negotiate the injured worker’s treatment or return to work schedule. Leave that determination to the claims adjuster.

c. Keep in touch. Instruct the supervisor to check on the injured worker from time to time. Show some compassion and build trust. Assure the employee that their job is secure.

While there is no surefire way to eliminate litigated claims, by following these five steps you should see results. With the average litigated claim costing 30% more than a non-litigated claim, the savings over time could be significant. To discuss implementing this strategy within your company’s Risk Management Program, please contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164.

Assembly Bill 72 Passes to Limit Unexpected Medical Costs to Californians

Effective July 1, 2017, Assembly Bill 72 (Bonta) went into effect by protecting Californians from unexpected medical bills when visiting in-network facilities (i.e., hospitals, labs, and imaging centers). No longer can providers who aren’t contracted with a patient’s health plan step into the operating room, for instance, and charge the patient more than the patient would have expected to pay an in-network provider. Furthermore, the patient can only be billed for his or her in-network cost-share, meaning in-network benefits apply to all providers seen, and services rendered, in an in-network facility.

Effective July 1, 2017, Assembly Bill 72 (Bonta) went into effect by protecting Californians from unexpected medical bills when visiting in-network facilities (i.e., hospitals, labs, and imaging centers). No longer can providers who aren’t contracted with a patient’s health plan step into the operating room, for instance, and charge the patient more than the patient would have expected to pay an in-network provider. Furthermore, the patient can only be billed for his or her in-network cost-share, meaning in-network benefits apply to all providers seen, and services rendered, in an in-network facility.

Over the course of my career, I’ve had to help many clients understand and appeal surprise charges from out-of-network doctors, anesthesiologists, etc., who’ve charged patients separately from the in-network facility, and I have experienced this myself when receiving care. With many/most Preferred Provider Organization (PPO) plans, there is a separate deductible that a member has to satisfy for care received from out-of-network providers, after which, there is less coverage than in-network providers, and the member can be “balance-billed” between what the insurance company pays and what out-of-network providers charge. AB 72 goes a long way toward eliminating such surprise charges.

As always, it’s important to review the Explanations Of Benefits (EOB’s) you receive from your insurance company, to make sure that your benefits have been applied correctly, according to your plan. This is a smart piece of legislation that will help prevent unsuspecting patients in California from getting charged more from out-of-network providers, at least not without prior written consent.

For more information, contact Rancho Mesa at (619) 937-0164.

DHS Alerts OSHA of Possible Electronic Reporting Security Breach

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

On August 1, 2017, the Occupational Safety and Health Administration (OSHA) launched its online electronic data filing application. It was designed to collect and publish injury data on companies throughout the United States in order to comply with a new requirement.

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

On August 1, 2017, the Occupational Safety and Health Administration (OSHA) launched its online electronic data filing application. It was designed to collect and publish injury data on companies throughout the United States in order to comply with a new requirement.

Within just a few weeks of its launch, according to an OSHA spokesperson, the United States Department of Homeland Security’s Computer Emergency Readiness Team alerted OSHA of a possible data breach within the newly launched Injury Tracking Application (ITA).

The warning indicated user information for the tracking application system could have been compromised and the affected company was notified about the apparent breach.

According to a Department of Labor official on August 14, 2017, “Access to the ITA has been temporarily suspended as OSHA works with the system developer to examine the issue to determine the extent of the problem.”

As of today, August 23, 2017, OSHA’s ITA webpage displays an “Alert: Due to technical difficulties with the website, some pages are temporarily unavailable,” preventing anyone from uploading their data.

In an article published by Business Insurance, legal experts were cited as advising companies to wait to file their reports. “I’m not advising anybody to file it before Dec. 1 because it might change,” said Mark Kittaka, a Columbus, Ohio-based partner with Barnes & Thornburg L.L.P. “I don’t know why you’d want to file it early. You may not have to file it all.”

However, Rancho Mesa Insurance Services advises its clients to continue to keep track of their incidents in the Risk Management Center, regardless of what happens with the OSHA electronic reporting requirement. Companies will still need to maintain current OSHA logs, even if the electronic system is unavailable or the electronic reporting requirement changes. If the December 1, 2017 deadline remains in effect, clients will be prepared to submit the data via the Risk Management Center, if the data has been maintained.

Contact Rancho Mesa Insurance Services at (619) 937-0164 if you have questions about how to track your incidents in the Risk Management Center and generate the required OSHA logs.

Surviving an Active Shooter Event: Recognize, React and Prevent Workplace Violence

Author, Sam Brown, Vice President of Human Services Group, Rancho Mesa Insurance Services, Inc.

In the ongoing effort to keep employees safe from workplace violence, it is very important to train workers how to recognize, react to and prevent active shooter events. In most cases, simply having a plan can mean the difference between life and death.

Author, Sam Brown, Vice President of Human Services Group, Rancho Mesa Insurance Services, Inc.

In the ongoing effort to keep employees safe from workplace violence, it is very important to train workers how to recognize, react to and prevent active shooter events. In most cases, simply having a plan can mean the difference between life and death.

PLAN FORMATION

When forming a workplace violence emergency plan, try to answer the following questions:

- How will first observers/responders communicate the threat and to whom?

- How will the threat be communicated to everyone in the facility? Through code words?

- Should the facility be locked down or evacuated?

- Has your security been trained in providing guidance to employees for this type of emergency?

- If your site does not have security, are your workers trained for this type of emergency? Do they know who to call if something happens?

- Do you have site-specific emergency plans in place?

- Do you have the capability to lock down your buildings remotely or deactivate card readers?

PREVENTION

Preventing workplace violence is your first line of defense. Try the following tips to defuse a situation:

- Don't pick fights. Loud and aggressive arguments can easily escalate into physical fights.

- Take verbal threats seriously. Do not aggravate the situation with a threatening response. Report all threats to your supervisor or the company's security department.

- Report any suspicious person or vehicle to security personnel, especially at night. The suspect could be casing the place for a break-in. Or, the person could be stalking an ex-spouse who works with you.

- Also, watch for unauthorized visitors who appear to have legitimate business at your plant. Crimes have been committed by people posing as employees, contractors and repair persons.

- Observe your company's rules prohibiting drugs and alcohol at work. Many violent incidents at work can be traced to the use of these substances.

- Be aware of the neighborhood in which you work and the areas you drive through on your commute. Gang activity and other violence does not always stop at the gate to your plant. Keep to well-traveled and well-lighted areas as you drive to and from work.

- If you drive on the job, don't pick up hitch-hikers. The most important reason for this rule is your personal safety.

- Keep your keys in a secure place so they cannot be stolen or copied. Notify plant security if you have lost your key to the premises.

- Learn how to contact help in an emergency. Speed-dialing numbers should be programmed into phones and emergency numbers should be listed at each phone.

- Some workplaces also have pre-determined code words so one employee can tell another about a dangerous customer or visitor without tipping off the suspect. Learn the distress signals used in your workplace.

- Follow lockup procedures. Wear your identification badge as you are instructed. Never lend your key or entry card to anyone. Keep your entry password a secret by memorizing it instead of writing it down.

TIPS TO SURVIVING A WORKPLACE SHOOTING

RUN: First and foremost, try to escape.

- If there is an escape path, attempt to evacuate.

- Evacuate whether others agree to or not.

- Leave your belongings behind.

- Help others escape if possible.

- Prevent others from entering the area.

- Call 911 when you are safe.

HIDE: If you cannot escape safely, find a place to hide.

- Lock and/or blockade the door.

- Silence your mobile phone.

- Hide behind large objects.

- Remain very quiet.

The hiding place should:

- Be out of the shooter’s view.

- Provide protection if shots are fired in your direction.

- Not trap or restrict your options for movement.

FIGHT: As a last resort, if your life is at risk, act with aggression.

- Attempt to incapacitate the shooter.

- Act with physical aggression.

- Improvise weapons.

- Commit to your actions.

The U.S. Department of Labor Occupational Safety and Health Administration (OSHA) also offers Guidelines for Preventing Workplace Violence for Healthcare and Social Service Workers to help employers prevent such incidents.

For additional resources on Workplace Violence and Active Shooter Preparedness, visit the Rancho Mesa Risk Management Center or contact us at (619) 937-0164.

OSHA Launches Electronic Reporting System

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

It is official – the Occupational Safety and Health Administration (OSHA) released its website for the electronic submission of employers’ injury and illness records (i.e., OSHA 300 logs).

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

It is official – the Occupational Safety and Health Administration (OSHA) released its website for the electronic submission of employers’ injury and illness records (i.e., OSHA 300 logs).

After a delay, the Injury Tracking Application website is now available to employers. According the OSHA.gov, “certain employers are required to submit the information from their completed 2016 Form 300A electronically from July 1, 2017 to December 1, 2017.” This means employers have about four months to submit their reports online.

The new requirement was designed to make OSHA records publicly available on the internet in hopes that it would encourage employers to maintain safer working environments.

On the website, employers will be able to manually enter data into a web form, upload a .CSV file, or utilize an automated recordkeeping system with the ability to transmit data electronically via an API (application programming interface).

Rancho Mesa clients who are using the Risk Management Center can expect a .CVS export to be available in October 2017. As long as you have the information in the Risk Management Center, you will be able to generate the .CVS file and upload the reports to the OSHA website.

For those who are not currently using the Risk Management Center to track your incidents, now is a great time to enter the data from 2016, so it is archived in the system and you’ll be able to transfer it once the export is available.

For details regarding who must keep and report OSHA records, visit www.osha.gov/injuryreporting.

Hired and Non-Owned Liability Coverage: The Sleeping Giant

Author, Daniel Frazee, Vice President, Rancho Mesa Insurance Services, Inc.

Could your company have underlying Auto related exposures that you are not aware of? Let’s assume you have taken several precautions to properly manage the safety of your fleet. But has your management team contemplated potential losses arising from employees operating their own personal vehicles as they relate to your business?

Author, Daniel Frazee, Vice President, Rancho Mesa Insurance Services, Inc.

Could your company have underlying Auto related exposures that you are not aware of? Let’s assume you have taken several precautions to properly manage the safety of your fleet. But has your management team contemplated potential losses arising from employees operating their own personal vehicles as they relate to your business?

Consider the following examples where an employer can be held accountable as a result of actions of your employees using their own vehicles:

- Field employees on the way to or leaving a jobsite

- Administrative employees running errands to the bank, supply store or post office

- An employee runs out to pick up lunch and/or supplies for the team

- An owner or manager decides to rent a vehicle at an out of town conference

- Outside sales reps are provided a car allowance for business use of their personal autos

- A foreman leaves a jobsite and runs to Home Depot for some tools

If an employee in any of these situations is in an at fault accident while driving their own vehicle, the employer can be held responsible for all damages. Typical Auto liability policies only cover employees while they operate company-owned vehicles that are being used for business purposes. Since this coverage does not contemplate nor cover the use of a hired (rented) or non-owned vehicle, a gap in coverage is created. This gap can be filled for a nominal additional premium, by adding hired and non-owned liability coverage. Specifically, these coverages respond when a company is found legally liable for damages after the employee’s personal auto insurance is exhausted. The employee’s personal auto coverage will always be primary to both the employee and the business assuming it was found that the employee at fault while using their vehicle in the course of employment. Without hired and non-owned liability coverage, a company remains exposed to significant costs depending on the degree of bodily and/or physical damage to the vehicle and other parties involved.

Many employers are simply unaware or unwilling to address this ticking time bomb that is non-owned liability. Several “best practice” control measures can be implemented to reduce this exposure:

- Designate a person within the company that will oversee those employees with a non-owned vehicle exposure

- On a bi-annual or annual basis, require employees driving personal vehicles to provide the proof of valid auto insurance

- Consider establishing company mandated minimum limits that are higher than the CA statutory minimum of $15,000/$30,000/$5,000.

- Consider reimbursing employees for any additional premium incurred for increasing limits on their personal policy to reach minimum limits set by the company

- Enroll all employees driving company and/or personal vehicles in the DMV’s employer pull notice program.

In summary, take time to learn more about hired and non-owned liability coverage and how it can impact your bottom line with exposure to severe auto losses. As a National Best Practice Agency 11 years running, Rancho Mesa takes pride in thorough and exacting policy audits that uncover these and many other silent exposures. Through their continually developing Risk Management Center, they offer clients unmatched support with topical safety resources, monthly workshops & trainings, and valuable content.

Contact Rancho Mesa if you have questions about your auto policy.

7 Tips to Protect Your Business from a Fire

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services

As San Diego’s East County battles a series of wild fires, it is a perfect time for business owners to review their insurance policies and proactively manage their fire risk, especially those who are located in semi-rural and rural areas.

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services

As San Diego’s East County battles a series of wild fires, it is a perfect time for business owners to review their insurance policies and proactively manage their fire risk, especially those who are located in semi-rural and rural areas.

Wildfires can quickly turn into structure fires, which can devastate a business. Unfortunately, San Diego County’s fire season has already begun. With scorching temperatures and an abundance of dry brush left over from last year’s rains, this season is particularly dangerous.

In an instant, you can lose everything you have built. Let us make sure you are covered. And, let us help you protect your business with these easy and effective steps:

- Review your insurance policy with your broker.

- Comply with all fire safety codes – we can provide a fire safety company referral, if one is needed.

- Schedule regular landscaping around your building which includes lawns, brush and trees – we would love to introduce you to some of our landscape clients, if you need a referral.

- If a fire threat is issued in your immediate area, run the exterior sprinklers or dampen the building and landscaping with a hose.

- Keep fully charged fire extinguishers on site at all times and have your fire detection and suppression systems tested – we can provide a fire safety company referral, if one is needed.

- Train employees on what to do if there is a fire, including calling 911 and where to access a fire extinguisher – the Risk Management Center has training materials for fire prevention and fire extinguisher use.

- Have a formalized evacuation plan – the Risk Management Center has a great template to help get you started.

These steps are simple and effective ways to help protect your business from fires.

Contact Rancho Mesa with questions about your coverage.

Control your Experience MOD through the MOD Doctor Process.

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

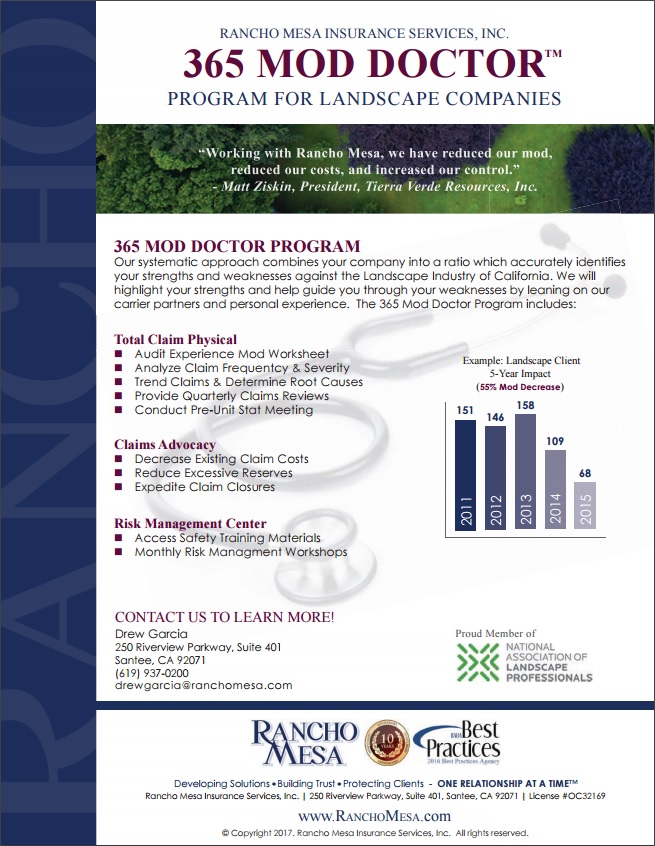

Successfully maintaining low and predictable workers' compensation costs is a product of establishing a routine that constantly “checks and balances” your all-encompassing insurance program. Our "MOD Doctor" technique lays out a road map so we can guide you throughout the year to gain more control, become more efficient, and ultimately drive down your insurance cost; at no extra expense. What can you expect from this process?

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

Successfully maintaining low and predictable workers' compensation costs is a product of establishing a routine that constantly “checks and balances” your all-encompassing insurance program. Our MOD Doctor™ technique lays out a road map so we can guide you throughout the year to gain more control, become more efficient, and ultimately drive down your insurance cost; at no extra expense. What can you expect from this process?

Audit Experience MOD Worksheet. Our team analyzes your experience MOD worksheet to ensure the information is accurate with payrolls, claim information, and class codes.

Analyze Claim Frequency, Severity, and Trends. It’s important to analyze your company’s loss information and specifically look for trends in order to prevent further claim activity with similar causes. Furthermore, we compare your loss experience against the landscape industry, in your state, to determine whether you are outperforming or underperforming your industry.

Claims Meetings. The largest companies maintain claim review meetings on a consistent basis. We bring this service to you and adjust the frequency of the meeting to fit your needs. It’s important to have updated information on your open claims, without sacrificing your time or your employee’s time tracking down this data.

Pre-Unit Stat. Your experience MOD is calculated on claims information which is sent into the governing bureau roughly six months into your policy period. Knowing this information, we can accurately project your MOD six months in advance giving you the information you need to begin budgeting for future work,while considering where your insurance cost will be headed.

Claims Advocacy. Our team is your advocate in helping to seek information on your claims, both in the current year and in the past. Our goal through this process is to decrease existing claim costs, reduce excessive reserves, and expedite claim closure, all while considering your unit stat date.

Risk Management Center. We know maintaining up to date and accurate information for tailgate topics, safety procedures, and incident tracking is important. The Risk Management Center streamlines these functions by making them accessible to our clients online.

Contact our Rancho Mesa staff to learn more about how the MOD Doctor can help you control your workers' compensation costs.

Uninsured and Underinsured Motorists Coverage - Are Your Limits Adequate? - Be Careful!

Author, David J. Garcia, A.A.I., CRIS, Rancho Mesa Insurance Services, Inc.

Earlier in the year, we published the article "Commercial Auto Premiums Are Rising - What’s Driving the Increases?," which addresses how insurance companies are all experiencing adverse loss experience within their commercial automobile books of business. The result of these mounting losses is causing a dramatic rise in commercial Auto premiums for most policyholders.

Author, David J. Garcia, A.A.I., CRIS, Rancho Mesa Insurance Services, Inc.

Earlier in the year, we published the article "Commercial Auto Premiums Are Rising - What’s Driving the Increases?," which addresses how insurance companies are all experiencing adverse loss experience within their commercial automobile books of business. The result of these mounting losses is causing a dramatic rise in commercial Auto premiums for most policyholders.

As a result of this trend, we are seeing many carriers and brokers reducing coverage limits and terms on certain lines of automobile coverage. This represents a major concern for any business owner that has any size fleet of vehicles. Reducing limits and/or modifying terms of coverage simply transfers more claim exposure directly to the business owner. And, unfortunately, in many cases, business owners are unaware of the change or ill informed.

One specific line of coverage that we are seeing this occur, and creates great concern, is uninsured/underinsured motorist coverage. The number of uninsured motorists nationwide is alarming and here in California there are between 3.6 million and 4.1 million uninsured drivers, or 14.7 percent of all drivers. Additionally, the minimum limit of insurance in California is only $15,000. So, while many motorists may have insurance, they are woefully “underinsured.” These factors pose potential catastrophic exposures to any business. To illustrate this point, we will briefly define these coverage’s and then look further into how these lower limits of coverage terms may impact the health of your business.

Uninsured Motorists Coverage

Uninsured Motorist Coverage (UM) helps pay your, your employees and your passenger’s medical expenses, lost wages and related property damages if you're in an accident caused by a driver who doesn't have liability insurance.

Underinsured Motorist Coverage

Underinsured Motorist Coverage (UIM) helps pay your, your employees and your passenger’s medical expenses, lost wages, and related property damages, if any of you are hurt in a car accident caused by someone with liability insurance, but whose coverage limits are lower than those you choose for this coverage, and aren't high enough to pay the damages.

Best practices suggests anything less than $1,000,000 limit for uninsured/underinsured coverage is inadequate and puts the business at extreme financial risk. Let me explain by sharing just two, of many real-world, examples of how this could occur. The following examples assume the accident is the fault of an uninsured or underinsured driver:

Example 1. If one of your employees is involved in an automobile accident by either an uninsured or underinsured motorist and it involved the use of a vehicle for business purposes, the resulting medical and indemnity costs would be covered under your company’s workers' compensation policy. Two negative consequences to your overall insurance program develop as a result of this incident. First, your workers' compensation claims experience (loss ratio and EMR) will be negatively impacted. Second, since the “at fault” driver is either uninsured or underinsured, subrogation (or the recovery of the claim dollars from the responsible party) is ruled out as a viable option to your workers' compensation carrier.

Therefore, the auto loss described above would not only negatively affect your auto insurance experience but also your workers' compensation experience, as well. By having a minimum of $1,000,000 UM/UIM limits, you would have allowed you workers' compensation carrier to subrogate the costs of the claim to the auto carrier and thereby reduce the impact to your workers' compensation loss ratio and EMR

Example 2. Let’s assume you have a non-employee in the vehicle and they are involved in an accident involving an uninsured/underinsured motorist and they are injured. Since this is a non-employee, their injuries would not be eligible for coverage under your workers' compensation policy and rest solely on your automobile insurance limits and coverages. Thus, these injuries, once the uninsured/underinsured limit of your automobile policy is exhausted, would become the responsibility of the business. By having a minimum of $1,000,000 UM/UIM limits, you would fill the gap created by the uninsured/underinsured motorist's lack of coverage and protect your business from this catastrophic loss.

These examples have only touched on the medical and indemnity portion of the loss. Consider there may be property damage involved as well, which only further increases the potential of out of pocket expenses a business might be responsible for paying. Additionally, keep in mind that any excess liability policy you may have in place does not cover uninsured/underinsured motorist claims.

In summary we recommend that you review your coverage limits and terms for adequacy concerning these critical coverages. At a minimum, you should have a limit of no less than a $1,000,000 for these coverages. The premium savings by lowering this limit or modifying its coverage terms is insignificant to the catastrophic loss you are exposing your business to. Do not allow one terrible incident to take your business from you when the cost to transfer this risk is marginal.

If you have any questions or need help in accessing your exposures, please call our Rancho Mesa Team. We offer full policy audits as part of our RM365 Advantage Program that helps you to identify any gaps in coverage and provide you with Best Practices risk management recommendations.

OSHA Launches Inaugural Safe + Sound Week

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

The Occupational Safety and Health Administration (OSHA) launched its inaugural Safe + Sound Week, which runs from June 12 - 18, 2017. According to OSHA, Safe + Sound week is "a nationwide event to raise awareness and understanding of the value of safety and health programs that include management leadership, worker participation, and a systematic approach to finding and fixing hazards in workplaces."

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

The Occupational Safety and Health Administration (OSHA) launched its inaugural Safe + Sound Week, which runs from June 12 - 18, 2017. According to OSHA, Safe + Sound week is "a nationwide event to raise awareness and understanding of the value of safety and health programs that include management leadership, worker participation, and a systematic approach to finding and fixing hazards in workplaces."

Why should your company participate?

Workplace safety and health programs can help companies proactively identify and manage workplace hazards before they cause injury or illness. That is good news for companies and employees.

How can businesses participate?

There are three easy steps to participating in Safe + Sound Week. Visit OSHA's Safe + Sound Week webpage for more information on each of these steps:

Step 1: Select the activities you would like to do at your workplace. There are three activities to choose from: Management Leadership, Worker Participation, and Find and Fix Hazards.

Step 2: Plan and promote your events. OSHA has provided Event Tools, Graphics & Signage, Customizable Communications materials, Social Media (#SafeAndSound), and Recruitment Tools.

Step 3: Get recognized for your participation. Complete the online form to generate a Safe + Sound Week Certificate of Recognition and web badge for your organization.

Timely Claim Reporting Lowers Work Comp Claims Costs and Improves Your Bottom Line

Author, David J. Garcia, A.A.I., CRIS, President, Rancho Mesa Insurance Services, Inc.

Studies have shown, by reporting your workers compensation claims in a timely basis, not only will your injured employee receive better medical treatment, it will boost company morale. Both the injured worker, as well as other employees, will see your sincere concern for their wellbeing. In addition, timely reporting practices will also improve your risk profile through reducing the overall cost of the claim, which leads to lower loss ratios and lower experience modifiers, thus, resulting in lower premiums and improvement in your bottom line.

Author, David J. Garcia, A.A.I., CRIS, President, Rancho Mesa Insurance Services, Inc.

Studies have shown, by reporting your workers compensation claims in a timely basis, not only will your injured employee receive better medical treatment, it will boost company morale. Both the injured worker, as well as other employees, will see your sincere concern for their wellbeing. In addition, timely reporting practices will also improve your risk profile through reducing the overall cost of the claim, which leads to lower loss ratios and lower experience modifiers, thus, resulting in lower premiums and improvement in your bottom line.

The following are four areas that support the early and timely reporting of claims:

- Manage Claims More Efficiently Reporting a claim quickly allows the claims examiner:

- To determine whether or not the claim is compensable.

- To meet state regulations that prohibit denial of claims after a specified time period.

- To secure appropriate treatment for the injured worker.

- To conduct an investigation and determine if fraud is suspected.

- To receive timely witness statements and pictures of the incident.

- Keep The Claim Costs Down – Improve Loss Ratio – Improve Experience Modifier Delayed reporting can significantly increase workers’ compensation claim costs, according the National Council on Compensation Insurance.

- Claims reported after 2 weeks of occurrence are 18% more expensive than those reported within 1 week of occurrence.

- Claims reported after 3-4 weeks of occurrence are 30% more expensive than those reported within 1 week of occurrence.

- Claims reported 1 month of occurrence are 45% more expensive than those reported within 1 week of occurrence.

- Most significantly, back injuries, as a group, are 35% more expensive if not reported within the first 7 days post-injury.

- Reduce Litigated Claims

- 47% of all claims reported after 4 weeks become litigated, which on average increase claims costs by 30%.

Source: NCCI’s Detailed Claim Information data for Report Years 2010 and 2011 case incurred losses valued as of 18 months after report date; not developed to ultimate - Close Claims Faster

- 50% of claims that are reported within the first two weeks close within 18 months.

- Only 29% of claims that are reported more than a month after the accident close within the same timeframe.

Source: NCCI’s Detailed Claim Information data for Report Years 2010 and 2011 case incurred losses valued as of 18 months after report date; not developed to ultimate.

| Reporting (Lag) Time | Expense Increase |

|---|---|

| 2 Weeks | 18% |

| 3 Weeks | 29% |

| 4 Weeks | 31% |

| 4 Weeks | 31% |

| 5 Weeks | 45% |

If you’re not currently reporting your claims timely, we strongly encourage you to adopt this “Best Practice” and make it a part of your company’s overall risk management program. Reporting your claims on a timely basis will get your injured employee the proper treatment quicker, provide your carrier the controls they need to manage the claim effectively, improve your risk profile, and lower your insurance costs.