Industry News

Employers Beware! Ten Red Flags You May Have a Fraudulent Workers’ Comp Claim

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Workers’ Compensation is a form of insurance providing wage replacement and medical benefits to employees injured in the course of employment in exchange for mandatory relinquishment of the employee's right to sue their employer for the tort of negligence.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Workers’ Compensation is a form of insurance providing wage replacement and medical benefits to employees injured in the course of employment in exchange for mandatory relinquishment of the employee's right to sue their employer for the tort of negligence.

While most people would agree with the idea of a workers' compensation system, unfortunately, there are people who try to defraud it in an effort to earn an extra buck. These individuals include both employers and employees. For this article, I will focus solely on the most common workers’ compensation fraud, claimant fraud (i.e., when an employee commits the fraud).

Claimant fraud includes false claims and exaggerated claims. These claims typically involve soft-tissue symptoms, such as headaches, whiplash, or muscle strain, which are all very difficult to disprove. In order to increase the value of the claim, claimants will also include multiple body parts. The most common types of claimant fraud includes reporting fake claims, injuries not received on the job, exaggerated injuries, and claimants working for another employer while collecting benefits from an injury claim.

Claimant fraud causes extreme frustration, animosity, and can lead business owners to question all claims, including those that are legitimate. Employers can feel helpless, especially when the system gives the benefit of the doubt to fraudsters. There are, however, red flags that both employers and insurance companies can pick up on to fight against these individuals seeking easy money.

Ten Red Flags

The top ten red flags employers can look for on a possible fraudulent claims are: When the claimant;

Hires an attorney the day of the alleged injury.

Has several other family members also receiving workers’ compensation benefits.

Exhibits a strong familiarity with the workers’ comp system.

Has been disciplined several times or is disgruntled and fears termination.

Was engaged in seasonal work that is about to end.

Continues to cancel or fails to keep medical appointments or refuses a diagnostic procedure to confirm an injury.

Changes doctors when the original suggests they return to work.

Is seen working at another job while collecting total temporary disability.

Is reluctant to return to work and shows very little improvement.

Has problems with workplace relationships.

Contact me to learn strategies for combating fraudulent claims before and after it is reported.

Risk Management Center Streamlines Electronic OSHA Reporting

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

The Occupational Health and Safety Administration (OSHA) now require certain employers to electronically submit their completed 2016 Form 300A. OSHA has created a website that allows employers to manually complete the information or upload a formatted CSV (comma-separated values) file

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

Editor's Note: This post was originally published on November 9, 2017 and has been updated to reflect the latest available information.

The Occupational Health and Safety Administration (OSHA) now requires certain employers to electronically submit their completed Form 300A. OSHA has created a website that allows employers to manually complete the information or upload a formatted CSV (comma-separated values) file. Users of Rancho Mesa’s Risk Management Center have the ability to track incidents and generate the export file, making the electronic reporting process quick and simple.

Check federal OSHA or your state's OSHA website for specific filing date deadlines.

Prepare and Submit

Once an incident occurs, Risk Management Center users track the details within the online system. All of the required information is stored and made available through reports and an export.

Request a Risk Management Center Account.

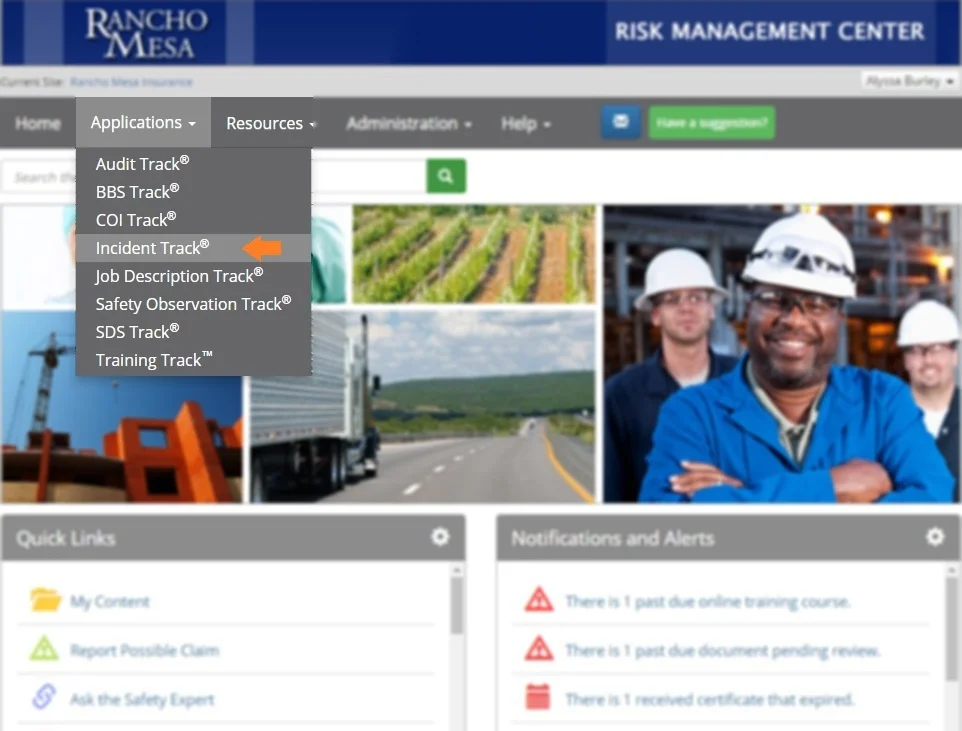

To export the OSHA 300A Report data, login to the Risk Management Center. Then, navigate to the Applications list and click on Incident Track®.

From this screen, click on the Reports menu and click the Export Data option.

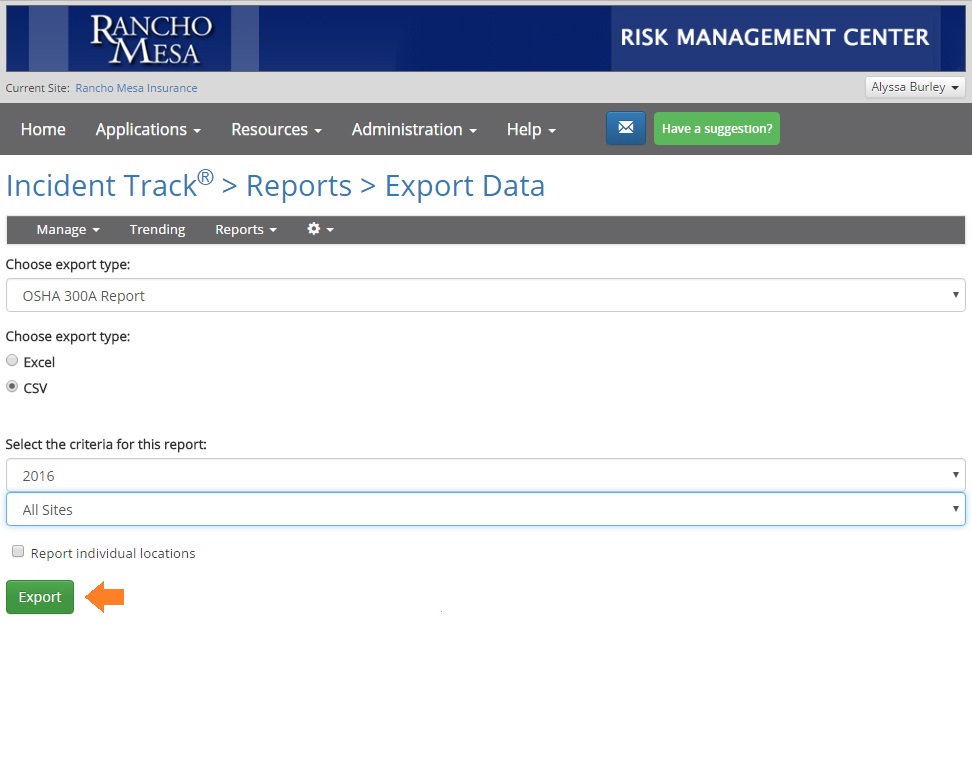

Choose the report, “OSHA 300A Report” and select the export type a CSV. Choose the year and either all your sites or just one. Click the Export button and enter your email address.

The .CSV file will be generated and emailed to you. Save the file on your computer so it can be uploaded to OSHA’s Injury Tracking Application (ITA).

To upload the .CSV file, login to OSHA’s ITA and follow the instructions on the screen.

Who is Required to Submit?

According to OSHA, “establishments with 250 or more employees are currently required to keep OSHA injury and illness records and establishments that are classified in certain industries with historically high rates of occupational injuries and illnesses.” Some of those industries include construction, manufacturing, health and residential care facilities, and building services.

On April 30, 2018, OSHA announced State Plans have been informed “that for Calendar Year 2017 all employers covered by State Plans will be expected to comply. An employer covered by a State Plan that has not completed adoption of a state rule must provide Form 300A data for Calendar Year 2017. Employers are required to submit their data by July 1, 2018. There will be no retroactive requirement for employers covered by State Plans that have not completed adoption of their own state rule.

Cal/OSHA released a statement explaining that "even though California has not yet adopted its own state rule, employers are advised to comply with federal OSHA's directive to provide Form 300A data covering calendar year 2017." In addition, other states like Maryland, Minnesota, South Carolina, Utah, Washington and Wyoming may follow California's lead.

For questions about tracking and exporting OSHA reports with the Risk Management Center, contact Rancho Mesa at (619) 937-0164

Federal OSHA Asserts Electronic Data Reporting Requirement Applies to Employers Across All States

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

The federal Occupational Safety and Health Administration (OSHA) announced Monday, April 30, 2018 it has “taken action to correct an error that was made with regard to implementing the final rule” which required some employers to electronically submit their injuring and illness reports via the Injury Tracking Application (ITA) online.

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

The federal Occupational Safety and Health Administration (OSHA) announced Monday, April 30, 2018 it has “taken action to correct an error that was made with regard to implementing the final rule” which required some employers to electronically submit their injuring and illness reports via the Injury Tracking Application (ITA) online.

Federal OSHA has determined that Section 18(c)(7) of the Occupational Safety and Health Act requires employers in State-administered OSHA plans “to make reports to the Secretary in the same manner and to the same extent as if the plan were not in effect.” Therefore, federal OSHA’s statement asserts “employers must submit injury and illness data in the Injury Tracking Application (ITA) online portal, even if the employer is covered by a State Plan that has not completed adoption of their own state rule.”

According to the announcement, State Plans have been informed “that for Calendar Year 2017 all employers covered by State Plans will be expected to comply. An employer covered by a State Plan that has not completed adoption of a state rule must provide Form 300A data for Calendar Year 2017. Employers are required to submit their data by July 1, 2018. There will be no retroactive requirement for employers covered by State Plans that have not completed adoption of their own state rule.”

“Even though California has not yet adopted its own state rule, employers are advised to comply with federal OSHA’s directive to provide Form 300A data covering calendar year 2017.”

This announcement comes on the heels of a March 2018 report by Bloomberg Environment that indicated federal OSHA anticipated more than 350,000 worksites to submit Form 300A reports via the online portal, yet nearly 200,000 weren’t submitted by the December 31, 2017 deadline. That means only 153,653 Form 300A reports were submitted and another 60,992 worksites submitted reports that were not required.

In May 2017, Cal/OSHA published a statement indicating “California employers are not required to follow the new requirements and will not be required to do so until ‘substantially similar’ regulations go through formal rulemaking, which would culminate in adoption by the Director of the Department of Industrial Relations and approval by the Office of Administrative Law." However, with the recent announcement from federal OSHA, Cal/OSHA released a statement explaining that "even though California has not yet adopted its own state rule, employers are advised to comply with federal OSHA's directive to provide Form 300A data covering calendar year 2017." In addition, other states like Maryland, Minnesota, South Carolina, Utah, Washington and Wyoming may follow California's lead.

Rancho Mesa’s Incident Track® is an effective way to manage incidents and maintain required OSHA logs. As just one of the many “tracks” inside the Agency’s “Risk Management Center,” Incident Track can also generate electronic report files that can be uploaded into the Federal OSHA’s ITA online portal.

Contact Alyssa Burley with follow up questions about these OSHA requirements and/or an interest in learning more about tracking incidents through our client based portal.

Benefits of a Student/Volunteer Accident Policy

Author, Chase Hixson, Account Executive, Human Services Group, Rancho Mesa Insurance Services, Inc.

Organizations like nonprofits, schools, home health care facilities and other entities that rely on volunteers or frequently interact with the public, may be vulnerable to accidents not covered by workers' compensation insurance. These accidents can cause an unexpected financial burden on the organization if they don't have an accident policy.

Organizations like nonprofits, schools, home health care facilities and other entities that rely on volunteers or frequently interact with the public, may be vulnerable to accidents not covered by workers' compensation insurance. These accidents can cause an unexpected financial burden on the organization if they don't have an accident policy.

What is an Accident Policy?

An accident policy offers a specified dollar amount, typically between $10,000 and $50,000, to cover medical costs to qualified participants in the event of an injury. They are fairly inexpensive and offer an added layer of defense, should an accident occur. Typically, these policies cover volunteers and/or students (for schools), and they are written on a no-fault basis. While most general liability policies require a liable party in order to pay out, accident policies pay out quickly and efficiently.

It’s important to note that these policies only cover medical costs. If the injured party were to seek legal action against your organization, your liability policy would respond.

Example of a Covered Event

If a student falls down on the playground, breaking an arm, the school has an accident policy that covers all students, providing $15,000 for each incident. The student's medical bills total $12,000. Neither the school nor the child’s parents would end up paying any money out of pocket for the accident.

Advantages of an Accident Policy

Accidents, by nature, are sudden and unexpected, as are the associated medical costs. An accident policy can reduce those financial burdens and give peace of mind knowing there is a set amount of money readily available should something go wrong.

In addition, an accident policy can help reduce the likelihood of future lawsuits. While any accident can result in subsequent legal action, there’s a greater likelihood of litigation if the injured party receives a large medical bill.

Mitigate the Financial Burden

Accident policies are a great option for those who have volunteers or students in their care. They are inexpensive and offer an added layer of financial protection that can provide significant financial relief in the wake of an accident.

Please feel free to reach out if you have any questions, and we can determine if an accident policy is the right fit for you.

The Changing Definition of Employee: What you need to know about SB 189

Author, Yvonne Gallagher, Landscape Division Account Manager, Rancho Mesa Insurance Services, Inc.

California State Capital Building.

State Bill 189 (SB 189) (Bradford) was recently enacted by the California State Legislature. It is intended to correct issues resulting from the passage of Assembly Bill 2883 (AB 2883) (Daly et. al) in 2017, which changed the requirements for business owners to exclude themselves from workers' compensation coverage.

Author, Yvonne Gallagher, Landscape Division Account Manager, Rancho Mesa Insurance Services, Inc.

California State Capital Building.

State Bill 189 (SB 189) (Bradford) was recently enacted by the California State Legislature. It is intended to correct issues resulting from the passage of Assembly Bill 2883 (AB 2883) (Daly et. al) in 2017, which changed the requirements for business owners to exclude themselves from workers' compensation coverage.

SB 189 is written to expand:

The scope of the exception from the definition of an employee to apply to an officer or member of the board of directors of a quasi-public or private corporation, except as specified, who owns at least 10% of the issued and outstanding stock, or 1% of the issued and outstanding stock of the corporation if that officer’s or member’s parent, grandparent, sibling, spouse, or child owns at least 10% of the issued and outstanding stock of the corporation and that officer or member is covered by a health care service plan or a health insurance policy, and executes a written waiver, as described above. The bill would expand the scope of the exception to apply to an owner of a professional corporation, as defined, who is a practitioner rendering the professional services for which the professional corporation is organized, and who executes a document, in writing and under penalty of perjury, both waiving his or her rights under the laws governing workers’ compensation, and stating that he or she is covered by a health insurance policy or a health care service plan. The bill would expand the scope of the exception to include an officer or member of the board of directors of a cooperative corporation, as specified. The bill would also expand the definition of an employee to specifically include a person who holds the power to revoke a trust, with respect to shares of a private corporation held in trust or general partnership or limited liability company interests held in trust, and would authorize that person to also elect to be excluded from the requirement to obtain workers’ compensation coverage, as specified. The bill would provide that an insurance carrier, insurance agent, or insurance broker is not required to investigate, verify, or confirm the accuracy of the facts contained in the waiver. (Legislative Counsel, 2018)

Once a waiver is signed and on file with the insurance carrier it will remain in effect until there is a written withdrawal. When changing insurance carriers a new waiver must be signed with the new carrier.

Effective 1/1/18

- Carriers were able to accept waivers up until 12/31/17 for policies issued in 2017 that weren't turned in on time and the officer exclusion is being honored from the inception of the policy and is being applied at final audit.

Effective 7/1/18

- Trusts will be eligible for officer exclusion.

- To be excluded, the required ownership percentage will change from 15% to 10%.

- An officer with 1%-9% ownership that is related to an excluded officer that owns 10% or more may also be excluded as long as they have health insurance.

- Waivers currently are required at the policy effective date. SB 189 provides a 15-day grace period from the effective date to turn in the waiver. The waiver may only be backdated 15 days.

Examples: With a 1/1/18 effective date, if the waiver is turned in and accepted by 1/15/18, the officer exclusion will be effective 1/1/18. With a 1/1/18 effective date, if the waiver is turned in and accepted by 2/15/18, the officer exclusion will be effective 2/1/18.

For specific questions about your workers' compensation policy, contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164.

Workplace Violence Insurance Surges in Aftermath of Shootings

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

In response to the hundreds of mass shootings taking place each year, the insurance marketplace has produced new workplace violence products to help employers and employees recover from a crisis.

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

In response to the hundreds of mass shootings taking place each year, the insurance marketplace has produced new workplace violence products to help employers and employees recover from a crisis.

U.S. employers have an obligation for duty of care for the safety, health, and security of employees (see Occupational Safety and Health Administration (OSHA) Act of 1970). Duty of care requires protection against workplace violence hazards.

A mass shooting is an attack resulting in 4 or more.

| Year | # of Incidents |

|---|---|

| 2017 | 327 |

| 2016 | 385 |

| 2015 | 333 |

It is the employer's obligation to protect its employees from violence. Homeland Security defines an active shooter as “an individual actively engaged in killing or attempting to kill people in a confined and populated area.” While OSHA describes workplace violence as “any act or threat of physical violence, harassment, intimidation, or other threatening disruptive behavior that occurs at the work site.” What is your organization doing to protect its people from these types of events?

Over the last three years, the United States recorded an average of 348 mass shootings per year.

| Description | Cost |

|---|---|

| Support for survivors and families of victims | $2.7 million |

| Cleanup, renovations, and other facility changes | $6.4 million |

| Settlement payments and other legal costs | $4.8 million |

Costs to Consider

As victims, families, and co-workers struggle to heal after losing friends and loved ones, the costs continue to mount.

Aside from treating survivors, consider some of the costs from the Virginia Tech University shooting: survivor support, cleanup, renovations, facility changes, settlement payouts and legal costs.

How would your organization absorb the cost of such an event?

Workplace Violence Policy Coverage

In addition to providing a consultant to guide businesses through an emergency event, a covered event will trigger legal liability coverage to address legal expenses. These expenses may be related to the following:

- Business interruption expense

- Defense and indemnity expenses

- Public relations counsel

- Psychiatric care

- Medical or dental care

- Employee counseling

- Temporary security measures

- Rehabilitation expenses

- Limits start at $1,000,000 with $0 deductible

Among other underwriting considerations, when pricing workplace violence policies, carriers factor in operations like exchanging money with the public, working with volatile or unstable people, providing services and care to the public, and working where alcohol is served. Take a look at your organization's operations to see if there is a risk.

Please contact Rancho Mesa Insurance Services to discuss whether this insurance is right for your organization.

Information sourced from McGowan Program Administrators.

The Rising Risk of Metal Theft from Jobsites

Author, Kevin Howard, Account Executive, Construction Group, Rancho Mesa Insurance Services, Inc.

Metal theft is one of the fastest growing crimes in the country. Copper, aluminum, nickel, stainless steel and scrap iron have become the desired target of thieves looking to make a quick buck.

Author, Kevin Howard, Account Executive, Construction Group, Rancho Mesa Insurance Services, Inc.

Metal theft is one of the fastest growing crimes in the country. Copper, aluminum, nickel, stainless steel and scrap iron have become the desired target of thieves looking to make a quick buck.

Of particular concern is copper, which is found in gutters, flashings, downspouts, water lines and electrical wiring – all of which can be quickly stripped from vacant buildings, industrial facilities, commercial buildings and construction sites. Air conditioning units are especially attractive, and are often tampered with or stolen for their copper coils and pipes that connect to HVAC systems. The metal is then sold to recycling companies and scrap yards for a tidy profit.

Common Targets

Subcontractors who store material on jobsites overnight are a common target for metal theft. Typically, subcontractors are designated specific areas on jobsites for their product waiting to be installed. And, it remains common for this material to be stored over multiple nights. Electricians often leave copper wiring; HVAC contractors can store duct work; and, plumbing contractors may store valuable fixtures. Exposure to theft can come from employees of other trade contractors on the site, as well as professionals who monitor the job, picking the right time and place to strike.

Preventing Metal Theft

To combat theft of materials, many states and municipalities have passed laws tightening the restrictions on scrap dealers. In some instances, purchases of scrap metal are required to be held in reserve for a week or more before being resold in case they have been stolen. In other instances, states require dealers to record the seller’s name, address and driver's license.

Another approach to prevent metal theft involves reducing exposure to risk at the jobsite. Examples can include:

Installing security cameras with video recordings that are maintained for sufficient periods of time.

Securing all equipment and scrap metals in locked buildings or in properly lit areas secured by fencing.

Posting "No Trespassing" placards or signs indicating the presence of a surveillance or security system.

Removing access to buildings and roofs, such as trees, ladders, scaffolding, dumpsters and accumulated materials such as pallet piles.

Securing your building access with deadbolts on doors and window locks.

Increasing exterior lighting and protecting fixtures (such as AC units) with locked metal cages.

Protecting Contractors’ Equipment on the Jobsite

Insurance for contractors that wish to transfer risk of theft at jobsites is commonly seen with Installation Floaters and Builder’s Risk policies.

Installation Floaters cover business personal property and materials that will be installed, fabricated or erected by a contractor while away from their premises. They extend coverage to the property until the installation work is accepted by the purchaser or when the insured's interest in the installed property ceases.

Builder’s Risk policies protect insurable interest in materials, fixtures and/or equipment being used in the construction or renovation of a building. While trade contractors can be held responsible for securing a Builder’s Risk policy, it is more typical that general contractors and/or building owners carry these policies during the course of construction. As a result, these policy terms fluctuate based on the length and scope of each project.

Rely on your insurance advisor to discuss these and other exposures to risk on jobsites. In advance, consider the amount of product stored at any jobsite at one time, the amount of product that can be at risk in transit, the value of product stored offsite (i.e., storage units) and the protections in place that secure your product. These will offer your broker, and ultimately the underwriter, key information in developing the right program for coverage.

For more information, contact Rancho Mesa at (619) 937-0164.

How To Lower Your Experience MOD by Understanding Your Primary Threshold

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

The Experience Modifier (i.e., experience MOD, MOD, XMOD, experience modification rating, EMR) weighs heavy on the calculation of your workers' compensation premium. With a MOD rating of 1.00 signifying unity (i.e., the average for your industry), any MOD above 1.00 is considered adverse. Thus, any MOD below 1.00 is considered better than average. Higher MODs will debit the premium, resulting in higher workers' compensation premiums, while lower MODs will credit the premium, resulting in lower workers' compensation premiums.

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

The Experience Modifier (i.e., experience MOD, MOD, XMOD, experience modification rating, EMR) weighs heavy on the calculation of your workers' compensation premium. With a MOD rating of 1.00 signifying unity (i.e., the average for your industry), any MOD above 1.00 is considered adverse. Thus, any MOD below 1.00 is considered better than average. Higher MODs will debit the premium, resulting in higher workers' compensation premiums, while lower MODs will credit the premium, resulting in lower workers' compensation premiums.

How do I decrease my MOD to lower my workers compensation premium?

A few factors can be addressed to reduce the workers' compensation premium. The most important is the primary threshold. Each individual employer has their own primary threshold that is determined by the class of business they operate and the amount of field payroll they accrue over a three year period. The primary threshold is the point at which any claim maximizes its negative impact on the MOD. You must be sensitive to this number because any open claim with paid amounts under the threshold, provides an opportunity to save points to the MOD. Once a claim exceeds paid amounts over your threshold, it no longer can negatively impact your MOD. However, you would still want to monitor and manage these claims to ensure your injured employee is being provided attentive care and to maintain knowledge of your loss experience.

Example

You’re a landscaping company and your primary threshold is $33,000. The most any claim can affect your MOD is $33,000 and the most points that any claim can add to your MOD is 13.

You have a claim open for $40,000 with paid amounts of $10,000 and reserved amounts of $30,000.

This claim will go into the calculation at $40,000 (Paid + Reserved) but because the total amount succeeds the primary threshold of $33,000, it will only show up on the rating sheet totaling $33,000 of primary loss and contribute 13 points to your MOD.

It would behoove you to analyze and monitor this open claim, because it has paid out amounts well below your primary threshold of $33,000.

If this same claim closes for a total paid amount of $22,000, the closed claim would go into your MOD at $22,000 with 8 points contributing to the MOD.

The difference between a $40,000 claim and a $22,000 claim is 5 points to your MOD, or, 5% to your premium!

Knowing your primary threshold is the most important piece of information when managing your XMOD. Fortunately, Rancho Mesa can help you manage your experience MOD by tracking your primary threshold and maintaining the other critical elements that go into establishing a sustainable low experience MOD.

For more information about lowering your experience MOD or a detailed analysis of your current MOD please reach out to Rancho Mesa.

Below is an example worksheet for Landscapers to determine the primary threshold.

| Annual Landscape Payroll | 2018 Primary Threshold | Max Points to MOD | Lowest MOD |

|---|---|---|---|

| $100,000 | $5,500 | 53 | .84 |

| $250,000 | $10,000 | 38 | .75 |

| $500,000 | $15,500 | 30 | .65 |

| $1,000,000 | $22,000 | 21 | .56 |

| $1,500,000 | $26,000 | 17 | .51 |

| $2,000,000 | $30,000 | 14 | .47 |

| $2,500,000 | $32,000 | 12 | .45 |

| $3,000,000 | $35,000 | 11 | .42 |

| $5,000,000 | $41,000 | 8 | .36 |

| $10,000,000 | $40,000 | 5 | .30 |

Why All Trade Contractors Must Consider Pollution Liability

Authors Sam Clayton, ARM, CRIS, Vice President, Construction Group and Daniel Frazee, ARM, CRIS, Executive Vice President, Rancho Mesa Insurance Services, Inc.

Contractor’s Pollution Liability (CPL), once viewed as expensive and unnecessary, has now become an integral part of every trade and environmental contractor’s insurance program. The industry is seeing requirements for this coverage from a combination of building owners, developers and general contractors for projects of all sizes.

Authors Sam Clayton, ARM, CRIS, Vice President, Construction Group and Daniel Frazee, ARM, CRIS, Executive Vice President, Rancho Mesa Insurance Services, Inc.

Contractor’s Pollution Liability (CPL), once viewed as expensive and unnecessary, has now become an integral part of every trade and environmental contractor’s insurance program. The industry is seeing requirements for this coverage from a combination of building owners, developers and general contractors for projects of all sizes.

Protecting contractors from pollution exposure by transferring this risk to a CPL policy supports a best practice approach. Contractors' pollution liability insurance provides coverage for third party bodily injury, property damage and pollution clean-up costs as a result of pollution conditions for which the contractor may be responsible. A pollution condition can include the discharge of pollutants brought to the job site, a release of pre-existing pollutants at the site or other pollution conditions due to the performance of the contractor’s or a lower tier subcontractor’s operations. In addition to the potential loss of reputation, often overlooked expenses that can negatively impact a profit & loss statement are the costs incurred to defend a company involved in a pollution claim.

Contractors who choose not to purchase Contractor’s Pollution Liability Insurance generally fall into two categories. Many believe that their operations do not have a pollution exposure. And countless others assume that their Commercial General Liability (CGL) policies offer protection in the event a pollution claim arises. Neither of these assumptions is accurate. Pollution coverage is not commonly found in CGL policies by virtue of the Total Pollution Exclusion. This form excludes pollution coverage for any bodily injury, property damage and/or the clean-up costs. Examples of pollution incidents apply to many different types of trade contractors, in addition to traditional environmental contractors. A handful of those are listed below:

- An HVAC system is installed improperly which, over time, causes moisture and ultimately mold to spread throughout a residential building, causing bodily injury and property damage

- A painting contractor accidentally disposes paint thinner through a public drain causing polluted water to a local community

- Dirt being excavated from one area of a job site to another is contaminated with arsenic and lead. The chemicals are then spread to a larger area which is later found by a soils expert

- Construction equipment on a project site has hydraulic fuel lines cut by vandals, causing fuel to leak out and contaminate the soil

- A contractor punctures an underground storage tank during excavation, causing the product to spill into the soil and groundwater.

- A gas line ruptures during excavation causing a gas leak into a neighboring building that leads to an explosion

The common thread seen above describes how contractors are causing some type of “contamination” on a job site. And, contamination is the operative word in all pollution exclusions. With such a broad definition extending to so many types of construction, beginning your search now for CPL options is just simply good business.

And, with a multitude of insurance companies aggressively pricing CPL policies, securing competitive quotes to compliment your current insurance program can fill significant gaps at more reasonable costs than you think.

Take time to consult with your broker and learn more about how pollution liability impacts your firm.

For more information, contact Sam Clayton at (619) 937-0167 or Daniel Frazee at (619) 937-0172.

The Hidden Gems in the OSHA Silica Regulation

Author, Glenn Ingraham, MS CIH.

If you’re complying with the OSHA Silica Standard for Construction by following the requirements in Table 1, then congratulations! You’re doing well. But do you know about the two little hidden gems in the standard? Those two requirements are connected to the use of respirators in Table 1.

Author, Glenn Ingraham, MS CIH, Technical Specialist, ICW Group Insurance Companies.

If you’re complying with the OSHA Silica Standard for Construction by following the requirements in Table 1, then congratulations! You’re doing well. But do you know about the two little hidden gems in the standard? Those two requirements are connected to the use of respirators in Table 1.

https://www.cdc.gov/niosh/npptl/pdfs/n95-infographic-mask-labeling.pdf

For those tasks that require a respirator, OSHA only says “APF 10”. You probably know that APF 10 means that the worker is to use either a filtering face-piece (dust mask), or a re-usable cartridge-equipped half-mask respirator. But do you know that being required to use a respirator during that task also means that your organization must write and implement a Respiratory Protection Program (RPP)? And that means all the bells and whistles such as respirator selection, medical clearance (OSHA Questionnaire), fit testing (initial and annual), and training.

The second little gem is a bit more technical. Because the Silica standard is focused on protecting workers from ‘Respirable Dust’ (very fine particles), then the respirator used must be capable of protecting against those extremely small dust particles. That’s no problem if your workers are using a re-usable ½ mask respirator with filter cartridges since those filter cartridges are HEPA filters, which protect against 99.97% of particles down to 0.3 microns. Very effective. But if you choose to use a dust mask, then you have to be careful. The most commonly used dust mask is the N-95. The ‘95’ means that the mask is only 95% effective against those small particles. So, you need a better dust mask. One that is equivalent to the HEPA filter. No problem. Just ask your supplier to provide you with a N-100 dust mask and you’re good to go!

And with regard to that letter ‘N’ in N-95: Sometimes dust masks are used to protect workers from exposure to oil mist. Dust masks that offer protection against oil mists have a ‘R’ (Oil Resistant) or a ‘P’ (Oil Proof) designation. Masks designated with ‘N’ are the least expensive (and most common) since they are NOT treated to provide protection against oil mists.

N-100 dust masks are made by Moldex, 3M, and other manufacturers. But wherever you buy your dust masks, be sure that they are always NIOSH approved. Beware cheap un-approved knock-offs!

Published with permission.

Source

3 Practical Reasons for Timely Claims Reporting

Author, Jim Malone, Claims Advocate, Rancho Mesa Insurance Services, Inc.

When a work-related accident occurs, as a business owner or manager, it is our nature to want to analyze the situation in order to learn how to avoid it in the future. However, the reporting of the incident is equally as important. With the recent requirement to report first aid claims, timely reporting for all claims is recognized as being critical for a number of reasons.

Author, Jim Malone, Claims Advocate, Rancho Mesa Insurance Services, Inc.

When a work-related accident occurs, as a business owner or manager, it is our nature to want to analyze the situation in order to learn how to avoid it in the future. However, the reporting of the incident is equally as important. With the recent requirement to report first aid claims, timely reporting for all claims is recognized as being critical for a number of reasons.

Employee Morale

First and foremost, timely reporting allows for immediate care of any injuries that may have occurred as a result of the incident. It promotes prompt referral for medical evaluation, documentation of the bodily areas affected, and provides recommendations for treatment.

Promptly reporting an injury shows the injured employee, and their coworkers, that the company cares about them. When an employee knows the employer cares, they are less likely to litigate the claim, which can significantly reduce the overall cost to the employer.

Elimination of Hazards

Timely reporting can trigger the immediate assessment of the scene and cause of the accident. The initial focus is to document the area and determine if there is still an injurious exposure or condition present that may need to be addressed to prevent further incidents or injuries. Timely reporting also allows for prompt investigation of the accident and the scene of the accident, identify witnesses, secure faulty tools or equipment for safety and subrogation purposes, and to convey a sense of responsibility and concern for the employee that their safety is of extreme importance.

Prompt investigations into the cause of a near miss, accidents, and injuries can lead to an understanding of the factors that lead up to the incident. Thus, the employer has the opportunity to make changes in processes and improvements in safety in order to prevent future near miss events or accidents from occurring.

Cost Savings

Timely reporting can directly affect the overall costs of a claim. Decreased medical costs are realized when injuries are promptly assessed, allowing for treatment to start immediately. Injured employees tend to recover quickly when treatment is provided right away. Swift recoveries usually result in shorter periods of temporary total and/or temporary partial disability, fewer diagnostic studies, physical therapy visits, injections, surgeries, permanent physical limitations, work restrictions or permanent disability percentages, and lower future medical care needs. This translates into lower financial resources allocated to these claims.

The timely reporting of a claim promotes positive morale among employees; helps remove potential future hazards from the workplace and can significantly reduce overall the cost of incidents.

For more information about claims reporting, contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164.

Simple Steps to Developing a Personal Protective Equipment Program

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

In the workplace, employees can be exposed to potentially harmful hazards. Identifying these hazards and using precautionary measures such as personal protective equipment (PPE) can mean the difference between a safe jobsite and an injury.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

In the workplace, employees can be exposed to potentially harmful hazards. Identifying these hazards and using precautionary measures such as personal protective equipment (PPE) can mean the difference between a safe jobsite and an injury.

PPE “is equipment worn to minimize exposure to a variety of hazards,” according to the Occupational Safety and Health Administration’s (OSHA) booklet on the subject. Examples of PPE include gloves, foot and eye protection, earplugs, hard hats, respirators and full body suites.

Implementing a PPE program can greatly reduce the chances of workplace injuries and increase a business’s productivity.

A PPE Program consists of three main components:

- An assessment of the workplace hazards and procedures, and determining what PPE will be used to protect employees.

- Employee training.

- Documentation of hazard assessment and employee training.

Conducting a Hazard Assessment

The OSHA Personal Protective Equipment Standard (29 CFR 1910.132-138) requires that employers ensure appropriate PPE is “provided, used, and maintained in a sanitary and reliable condition whenever it is necessary” to protect workers from hazards. Employers are required to assess the workplace to determine if hazards that require the use of personal protective equipment are present or are likely to be present. The following information will aid in the hazard assessment process:

- Develop a Hazard Assessment Checklist (a sample is available in the Risk Management Center) to identify exposures in the workplace that could injure a specific body part such as eyes, face, hand, arms, feet, legs, body, head, or hearing. Once you have identified the potential exposures, include the required PPE to minimize or eliminate the exposure.

- Conduct a walk-through survey of the workplace and complete the information on the Hazard Assessment Checklist. The purpose of the survey is to identify sources of hazards to workers such as chemical exposures, harmful dust, sharp objects, electrical hazards, etc.

- Select suitable PPE. Should an employer determine that PPE is necessary, they are then required to ensure that it is available and used. It is not enough to select PPE and witness its use, however. Employers must also make sure that the PPE is suitable for protection from the identified hazards, is properly fitted, and is not defective or damaged in any way.

Employee Training

Before doing work which requires PPE, employees must be trained to know the following:

- When PPE is necessary.

- The type of PPE that is necessary.

- How the PPE is properly worn.

- PPE's limitations.

- How to properly care, maintain, and disposal of the PPE.

Written Verification of Hazard Assessments and Employee Training

Employers are responsible for ensuring that employees are trained in the use of PPE and must provide written certification to that effect. Employers must also certify in writing that the employees understand the training. Also, in general, employers must provide required PPE at no cost to employees.

A large majority of workplace injuries are preventable through the implementation of a PPE Program. It is the employer’s responsibility to keep their employees adequately protected at all times. After all, it is certainly difficult to imagine a firefighter performing his or her duties without a helmet, boots, gloves and other necessary protective equipment.

Rancho Mesa Insurance Services has expertise in risk management for the construction industry. We can provide you with assistance in developing a PPE Program, as well as other risk management and insurance needs. Please contact me with any questions at (619) 937-0174 or jhoolihan@ranchomesa.com.

Berkshire Hathaway's Steve Hamilton Discusses Workplace Injury Trends for the Landscape Industry in Recent Webinar

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

In this webinar, Steve Hamilton, Senior Loss Control Specialist from Berkshire Hathaway Homestate Companies, reviews workplace injury trends for the landscape industry, along with OSHA’s most cited regulatory violations.

Author, Drew Garcia, NALP Program Director, Rancho Mesa Insurance Services, Inc.

Steve Hamilton, Senior Loss Control Specialist from Berkshire Hathaway Homestate Companies, reviews workplace injury trends for the landscape industry, along with OSHA’s most cited regulatory violations, in his Landscape Industry Injury Trends for 2017 webinar.

This information will help landscapers focus their training efforts to improve compliance and reduce the risk potential for frequency and severity.

Start the year off right with a plan to address these common injury trends!

A National Association of Landscape Professionals (NALP) login is required to view the webinar.

Top Three Benefits of Conducting an In-Home Health Care Safety Inspection

Author, Chase Hixson, Account Executive, Human Services, Rancho Mesa Insurance Services, Inc.

For many Home Health Care companies, conducting an in-home inspection on all new cases is standard practice. The intent of these inspections is to improve the quality of services offered; however, there is also an additional opportunity to improve the risk profile for those health care companies and thereby help them reduce their insurance costs.

For many Home Health Care companies, conducting an in-home inspection on all new cases is standard practice. The intent of these inspections is to improve the quality of services offered; however, there is also an additional opportunity to improve the risk profile for those health care companies and thereby help them reduce their insurance costs.

Best practices suggest that Home Health Care companies conduct safety inspections in the home for all new clients prior to having a caregiver work the case. If possible, have the caregiver(s) that will be in the home, conduct the inspection with you. Following are 3 ways inspections with an eye toward safety can help improve your risk profile.

Providing An Opportunity to Point out Safety Hazards

The most obvious outcome is the opportunity to point out safety hazards. Having two sets of eyes on the home will help to identify potential hazards such as a poorly lit staircase, an over stocked bookshelf where the caregiver might obtain supplies, a crowded kitchen, or loose carpet or rug.

Engaging the Employee as an Equal Partner in Safety

Studies show claims are less likely to occur when the employee is engaged in the safety process. For example, if the employee is involved with assessing their own hazards and determining their own safety, they are more likely follow the guidelines.

Improving your Frequency Rate

Conducting pre-case safety inspections is known to reduce the frequency of claims. It’s no surprise taking this step will positively impact the employer’s insurance premium. Not only is the likelihood of a claim reduced, the ability to react to a claim with proper corrective action increases, as well. If an accident were to occur, prior inspections will speed up the discovery process and allow the proper changes to be made, in theory, reducing the likelihood of the incident occurring again.

Conducting safety inspections in the home prior to assigning a case workers is a great way to not only benefit pricing immediately, reduce the likelihood of a claim in the future, thereby helping you to sustain favorable pricing in the future.

If you would like to learn more, or have any questions, please contact Rancho Mesa at (619) 937-0164.

Ask the Expert: Insurance Questions from the Lawn and Landscape Industry

Author, Drew Garcia, NALP National Program Director, Rancho Mesa Insurance Services, Inc.

Drew Garcia answers common insurance questions for the landscape industry.

Author, Drew Garcia, NALP National Program Director, Rancho Mesa Insurance Services, Inc.

How can I control and/or lower my experience rating?

Without getting into detail about the formula or governing insurance bodies, here are some key items to focus on in order to lower your experience rating (i.e., experience modification, MOD), no matter your jurisdiction.

Frequency vs. Severity (Proactively Track and Eliminate the Claim Before it Happens)

Analyze your work related injuries and near misses to search for trends that will help to prevent similar claims from occurring. Your rating will typically see more of a negative impact with multiple claims (frequency) as opposed to one large loss (severity). Frequency drives the probability for more claims to occur in the future which would make your company a higher risk to insurer.

Return to Work (Make it Mandatory)

All claims may potentially impact the experience rating in one way or another, with frequency having a large role in the mathematical formula. Another key part of managing claim costs is the focus on reducing indemnity expenses on every claim. By returning an employee to work you eliminate any claim cost that would have been allocated to temporary disability. The savings you will see on your experience MOD is remarkable. If you need help creating a return to work program, reach out to your workers compensation insurance carrier for guidance. If you decide to implement any of these strategies going forward, implement a mandatory Return to Work program.

Example:

An injured employee will earn $400 a week on temporary disability and is estimated to need three months of recovery. The claim closes three months later with a total incurred claim cost of $4,800 in indemnity (wages) and $2,000 in medical, equaling $6,800.

With a Return to Work program, the injured employee is right back to work on modified duty and earns no temporary disability. The claim closes for $2,000. Not only will the claim have less of an effect on your experience MOD, but you will also have constant communication with the injured employee, which keeps them feeling part of the team, boosts their morale, and perhaps expedites the length of the injury.

Carrier Analytics (Save a $1 Today That Will Cost You $5 in the Future)

Who is handling your insurance claims? When you purchase workers compensation insurance, you are buying a company’s ability to handle claims and how those claims are handled will determine your experience MOD, your cost, and your bottom line for years to come. Carrier benchmarking reports are becoming critical in helping to evaluate the impact each carrier will have on your claim experience. You should place your insurance with a carrier who has a history of writing policies for your specific industry and a proven track record of closing claims faster than the industry, and for less money, because that money is what drives your modifier through the roof.

What are your thoughts on a safety incentive program?

I would suggest safety recognition as opposed to safety incentive, here’s why. An incentive program might keep employees from reporting work related injuries in fear that they might “ruin” a streak of consecutive days without an injury. You do not want to make an employee fearful of reporting an injury. OSHA and the Department of Labor have started to enforce these “dis-incentive” programs in a more visible way.

Safety recognition would mean identifying an employee who has successfully executed your company’s standard safety requirements or has gone above and beyond to better the company’s safety culture. A type of recognition could be handing out raffle tickets to employees who have executed standard safety protocol and having a monthly drawing for prizes.

What is the key to having a safe company? We have all the safety programs; we do tailgates every week; and, we still have claims, routinely!

In one word, the companies that experience the best safety records all share this common trait, communication. You can have all the compliance based safety programs in place but without superior communication they will lack true execution. Proactively communicating with your team in the field, every day, is what it takes. Safety must become a common attribute employees think of when they talk about your company. It takes participation and “buy-in” on all levels from ownership to employee. Employees must understand the exposures and job hazards associated with their work, but, the culture you are trying to create within your company should generate excellent decision making, like employees who think:

- “I probably shouldn’t lift this alone.”

- “That slope looks wet."

- “I should pick this up before someone steps on it.”

You cannot buy a good safety company. Like anything in life, it is earned. With a concentrated effort, you can establish a solid safety program that becomes routine and everyone in your company will benefit from it.

Reminder: 2017 OSHA Summary of Work-Related Injuries and Illness Must Be Posted

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

According to a recent memo, the State of California Department of Industrial Relations would like to remind employers that they are required to physically post their 2017 annual summaries of work-related injuries from February 1, 2018 through April 30, 2018.

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

According to a recent memo, the State of California Department of Industrial Relations would like to remind employers that they are required to physically post their 2017 annual summaries of work-related injuries from February 1, 2018 through April 30, 2018.

OSHA’s Summary of Work-Related Injuries and Illness, also known as Form 300A, must be completed and posted for employees to view.

If you are tracking work-related injuries in the Rancho Mesa Risk Management Center, the Form 300A can be generated from the system. From the Incident Track screen, click on "Reports," then "OSHA Reports," select "OSHA 300A Summary," the "2017." Complete any missing information and "Download."

To manually complete the Form 300A, review the instructions found on the Cal/OSHA or OSHA websites.

If you are unsure if you are required to maintain OSHA logs, visit the OSHA website.

Why Would a Contractor Purchase Employment Practices Liability Insurance?

Author, Kevin Howard, CRIS, Account Executive, Construction Gorup, Rancho Mesa Insurance Services, Inc.

Insurance is often considered a necessary evil by business owners. It can represent a significant line item on a profit & loss statement rivaling the cost in some cases of payroll, material costs and rent. With deductibles that can range from $15,000-$25,000 per claim, why then would a business spend dollars on an insurance policy that is not required by either state law or part of any General Contractor’s insurance specifications?

Author, Kevin Howard, CRIS, Account Executive, Construction Group, Rancho Mesa Insurance Services, Inc.

Insurance is often considered a necessary evil by business owners. It can represent a significant line item on a profit & loss statement rivaling the cost in some cases of payroll, material costs and rent. With deductibles that can range from $15,000-$25,000 per claim, why then would a business spend dollars on an insurance policy that is not required by either state law or part of any general contractor’s insurance specifications?

What does an EPLI policy cover?

Employment Practices Liability Insurance (EPLI) policies typically extend coverage to the following:

Wrongful termination of an employee who alleges violation of their contract;

Sexual harassment claims by one employee against another;

Wage related claims by employees who allege denial of overtime pay or tips, or working “off the books." Note: Most carriers offer a defense only sub limit for this type of claim;

Claims of unequal or unfair pay between employees performing the same job and having similar skills, education, seniority and responsibility;

Discrimination claims based on age, race, gender or sexual orientation;

Third Party. Example: Your employee out in the field of work upsets another subcontractor’s employee, a customer at their home, a student at a school enough to where they file a lawsuit against you.

Why do businesses resist purchasing EPLI?

Declining to purchase EPLI can stem from businesses feeling that they are not large enough for this type of claim to occur. Many owners have close relationships with their employees and never believe any of the above scenarios could occur within their organization. And yet, many more can assume that a General Liability policy would cover these types of potential claims when, in fact, most have specific EPLI exclusions. This type of thinking could result in losses that have severe financial consequences for your company. Let’s take a quick look at three common EPLI exposures facing the construction industry.

Common EPLI Claims in the Construction Industry

Rapid growth and layoffs are unique aspects of the construction industry that can cause the elimination of a specific position and/or termination. With these ebbs and flows, contractors unintentionally open themselves up to wrongful termination cases which can carry into discrimination charges, as well. It can also be common to see employees bring post-employment wage & hour claims, which center around improper overtime, breaks, etc. Lastly, contractors' work very often involves interaction and exposure to the public. This interaction can lead to comments, inferences, or specific actions that non-employees find offensive. Claims brought by these third parties are difficult to prove when the employer is unable to witness the events first-hand.

Light Bulb Moment

In these and other potential claim scenarios, employers without EPLI must outlay their own funds to find legal representation and fight the charges. Legal costs add up quickly regardless of the documentation an employer has kept on file and the conviction they have that an employee’s claim is frivolous. Defending yourself in today’s environment can become cost ineffective very quickly. Light bulb moments can occur when EPLI limits are unavailable because coverage is not in force and an owner is staring at a “balance sheet loss,” resulting in a six figure settlement.

Consult Your Broker for EPLI Options

At Rancho Mesa, as it relates to coverage for our clients, we often say "you would rather be looking at it than for it”. That is, you want to be looking at a policy that will respond to coverage than for one at the time of a loss. Take time to explore the nuances of employment practices liability insurance with a knowledgeable broker. Allow an expert to educate you on the real exposure to your company, ask to spreadsheet different policy forms, deductibles and limits in an effort to balance the annual premium with the potential impact of a large loss.

For more information about Employment Practices Liability Insurance, contact Rancho Mesa Insurance at (619) 937-0164.

The Number 1 Reason a CPA Reviewed Financial Statement Can Benefit a Contractor

Author, Matt Gaynor, Director of Surety Bonding, Rancho Mesa Insurance Services, Inc.

One of the key documents required when we are assembling the Bonding Programs for our construction clients is a fiscal year-end financial statement prepared by an outside Certified Public Accountant (CPA). Although we monitor internal financial information from our contractors throughout the year, at the fiscal year-end (usually 12/31), the bond company will require that the statement come from a third party CPA. That way, they have some certainty that the information has been prepared by an independent financial source that has a background in working on contractor financial statements.

Author, Matt Gaynor, Director of Surety Bonding, Rancho Mesa Insurance Services, Inc.

One of the key documents required when we are assembling the Bonding Programs for our construction clients is a fiscal year-end financial statement prepared by an outside Certified Public Accountant (CPA). Although we monitor internal financial information from our contractors throughout the year, at the fiscal year-end (usually 12/31), the bond company will require that the statement come from a third party CPA. That way, they have some certainty that the information has been prepared by an independent financial source that has a background in working on contractor financial statements.

When working with a new client or raising the aggregate program for an existing client, we often discuss recommendations about what type of financial presentation (i.e., compilation or review) they should request from their CPA. From a cost basis, the compilation may save the contractor a few thousand dollars. Here is a description of each financial presentation:

- Compilation - the CPA takes financial data provided by the contractor and puts them in a financial statement format that complies with generally accepted accounting principles. There are no testing or analytical procedures performed during a compilation.

- Review - inquiries and analytical procedures present a reasonable basis for expressing limited assurance that no material modifications to the financial statements are necessary and they are in conformity with generally accepted accounting principles.

As a bond agent, I have noticed the historical decision point for when bonding companies ask for a contractor to upgrade to a review is when the single job size they are bidding exceeds $500,000. Of course, we have many exceptions to this rule:

a. If the contractor rarely requires bonding and will only need an occasional $600,000 - $700,000 bond, a compilation is more than acceptable.

b. If the contractor has strong internal financial statements and only requires a bond less than $1,000,000 every few years.

c. If the contractor has a very strong cash position and a solid personal financial statement several sureties will require copies of tax returns but may waive the requirement for a CPA issued statement.

On the flip side, on several occasions we have used the future requirement that they upgrade to a CPA review at their fiscal year-end to provide approval for a bond they need now. Under that scenario, both the bond company and the contractor have an understanding in place that the request for an upgraded financial statement will allow a positive approval to increase the bonding capacity in advance of the fiscal year end.

Keep in mind, it would be also be prudent to check with your bank to determine what level of financial statement they may require.

In closing, for contractors looking to grow their business, it is best to provide a CPA review (and pay the extra money) then to risk not getting approved for that larger project or increased program. It can also help to have a review as the owner starts to get a little further away from the numbers and they can get some level of comfort with a review as to the strength of their accounting system.

Talk to your bond agent and CPA now, to ensure all three parties are on the same page.

For more information about surety bonding, contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164

Experience Modification Factors and the Pre-Qualification Process

Author Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

As we enter 2018, government agencies, project owners and general contractors often require subcontractors to enter their pre-qualification process. Many of these entities will look closely at your Experience Modification Rate (EMR).

Author Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

As we enter 2018, government agencies, project owners and general contractors often require subcontractors to enter their pre-qualification process. Many of these entities will look closely at your Experience Modification Rate (EMR).

EMR is a numeric representation of a company’s payroll and claims history, compared to businesses in the same industry or standard industry classification. EMRs create a common baseline for businesses while allowing for a surcharge when employers' claims are worse than expected and credit when employers' claims are better than the industry average. More specifically, companies with an EMR rate of 1.00 are considered to have an average loss experience. Factors greater than 1.00 are considered worse than average, while less than 1.00 are considered better than average.

Pre-Qualification Process

In the highly competitive world of construction bidding, it has become more common that contractors can be precluded from the pre-qualification process due solely to above average EMRs. This represents an oversight as many companies have strong, well-developed safety programs, yet their EMR is holding them back. Some examples of this are:

- EMRs are lagging factors. They only factor the last three policy periods, not including the current policy period.

- EMRs can include claims that may have been unavoidable and do not represent a lack of safety (i.e. an employee is rear ended by an uninsured motorist).

- Large severity claims from smaller sized companies can impact the EMR much more negatively than a similar sized claims at a larger firm.

- The effectiveness of claims handling may vary from one insurance company to another, thus impacting certain employers when cases remain open with high reserves.

Rather than placing such a critical importance on the EMR Rate, owners and contractors designing the pre-qualification document should include frequency indicators like incident and DART Rate (i.e., days away, restricted or transferred) forms. These measuring tools incorporate current year totals and can provide up to 5 years of historical data. Incident Rate calculations indicate how many employees per 100 have been injured under OSHA rules within the specific time period. The DART rate looks at the amount of time an injured employee is away from his or her regular job. Lastly, contractors attempting to become pre-qualified should have the ability to provide a detailed explanation should their EMR exceed 100. This can include loss data, a summary of the company’s Illness and Injury Prevention Plan (IIPP) and code of safe practices, and more information on what exactly the company is doing to reduce future exposure to loss.

Given the importance of the pre-qualification process and the potential for contractors to be precluded from new opportunities to bid work, we’ve developed a “Best Practices” approach to assist companies in managing their EMR.

Managing Your EMR with Best Practices

The Best Practices approach to high EMRs includes a total claim physical, claims advocacy, and implementation of the Risk Management Center.

Total Claim Physical

The total claim physical accurately identifies your company's strengths and weaknesses, and then scores the company against others in the industry. It includes an audit of the EMR, analysis of claim frequency and severity, claim trends and determine root causes, provide quarterly claims reviews, and conduct pre-unit stat meetings.

Claims Advocacy

Utilizing a claims advocate can decrease existing claim costs, reduce excessive reserves, and expedite claim closures, which can reduce the EMR.

Risk Management Center

The Risk Management Center provides access to safety training materials and tracking, analysis of incidents and OSHA reporting, monthly risk management workshops and webinars.

For more information on managing your EMR before the pre-qualification process, contact Rancho Mesa Insurance Services at (619) 937-0164.

Building an Effective Fall Protection Program

Author, Daniel Frazee, Executive Vice President, Rancho Mesa Insurance Services, Inc.

In a Census summarizing fatal occupational injuries from 2016, those originating from falls continued a steady upward trend that began in 2011 and increased another 6% in 2016. More specifically, falls increased more than 25% for roofers, painters, carpenters, tree trimmers & pruners. Since 2013, fall protection citations have been #1 or #2 on OSHA’s most cited violations. Now, more than ever, it is essential for employers with personnel who work at heights to provide comprehensive fall protection.

Author, Daniel Frazee, Executive Vice President, Rancho Mesa Insurance Services, Inc.

In a Census, summarizing fatal occupational injuries from 2016, those originating from falls continued a steady upward trend that began in 2011 and increased another 6% in 2016. More specifically, falls increased more than 25% for roofers, painters, carpenters, tree trimmers & pruners. Since 2013, fall protection citations have been #1 or #2 on OSHA’s most cited violations. Now, more than ever, it is essential for employers with personnel who work at heights to provide comprehensive fall protection.

Job Hazard Analysis

While developing any type of new safety program, experts encourage breaking the process into steps. These steps must be designed for all construction sites where exposure to height exists. And the plan must be prepared by a competent (qualified) person, defined as someone with extensive knowledge and training on fall protection systems. The initial step requires a job hazard analysis to be performed at the location in advance of work commencing. The analysis can include determining the average & maximum height at which work will be performed, identifying the number of employees using the area, observing potential hazards that might compromise the work, and modifying work to reduce exposure. According to the American National Standards Institute (ANSI), “the most desirable form of protection is elimination of the need to work from height” (Z359.2, section 5.1).

Types of Fall-Arrest Systems

Assuming hazards cannot be eliminated and the need to work from height still exists, employers can implement both passive and active fall-arrest systems. Passive systems can include examples such as guardrails or ladder cages while the more technical active fall-restraint systems can use specialized lanyards and anchors to eliminate fall exposure. These require individualized training that is crucial for proper use and effectiveness.

Proper Implementation & Calculating Fall Clearance

Once you have identified the appropriate system for the jobsite, the implementation is critical to the success of the program. Using the more complex active fall-arrest system as an example, employers can track their progress with four steps:

- Anchorage-the secure point of attachment to the fall arrest system. The structure must be capable of supporting at least 5,000 pounds/worker or meet OSHA’s criteria of a 2:1 safety factor.

- Body Support-the connection point to the anchorage, commonly seen with a full body harness that distributes the forces of a fall over the chest, shoulders, pelvis & thighs.

- Connectors-examples include lanyards and self-retracting lifelines, devices that connect or link the harness to the anchorage.

- Descent & Rescue-all good fall protection programs must have a plan for rescue or retrieval of a fallen worker. Employees need to be raised or lowered to a safe location when needed.

As employers build out their fall-arrest system, calculating fall clearance and swing fall hazards represent key components to a successful program. In part, this can be achieved by determining sufficient clearance below the worker to stop the fall before he/she hits the ground or another object. It should include an awareness of the anchorage location, the connecting system, deceleration distance, the height of the suspended worker, etc.

Training, Training, Training

Formal, written training programs only become effective tools when employers combine classroom knowledge with practical, hands-on experience. Competent persons need to continually educate workers on industry regulations, proper equipment selection/use and ongoing maintenance standards. This must be emphasized on a consistent basis so that workers understand the importance of fall protection as it relates to their own safety and that of the company.

Improving Your Risk Profile

Without argument, the most important reason for introducing a Fall Protection program is the safety and well-being of your employees. Getting workers home safely at the end of every work day remains every employer’s ultimate goal. A second goal for consideration is that of improving your company’s risk profile to the insurance marketplace. If your construction firm performs work in excess of 2 stories, underwriters expect to see details on your Fall Protection program. While just one aspect of a Best Practices renewal strategy, providing a copy of your program with training examples and site specific layouts can give insurance company underwriters the comfort level they need to deliver more competitive quote proposals. Allowing your insurance broker these reference points can help them engage more options which can lead to better terms and pricing, and lower overall insurance costs for your company.

As your company builds out safety modules and looks to refresh or develop new a Fall Protection program, look to Rancho Mesa Insurance and their Risk Management Center (RMC) for assistance. The RMC contains endless content, program templates and resources for our construction partners. Additionally, the Agency’s monthly offerings of industry specific trainings and webinars provides the education our clients need to stay ahead of their competition.

For more information about fall protection, contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164.