Industry News

Reporting Serious Workers’ Compensation Injuries

Author, Jim Malone, Workers’ CompensationClaims Advocate, Rancho Mesa Insurance Services, Inc.

Workers’ Compensation injuries occur every day. The majority of these injuries are minor incidents which require no medical treatment or loss of time from work. For others, the injury is reported to the insurance carrier, the injury is addressed, forms are provided, and the recovery from the injury is monitored until the employee is released back to work and a discharge from care is provided.

Author, Jim Malone, Workers’ CompensationClaims Advocate, Rancho Mesa Insurance Services, Inc.

Workers’ Compensation injuries occur every day. The majority of these injuries are minor incidents which require no medical treatment or loss of time from work. For others, the injury is reported to the insurance carrier, the injury is addressed, forms are provided, and the recovery from the injury is monitored until the employee is released back to work and a discharge from care is provided.

However, serious injuries, illnesses or even deaths occasionally occur at work because of a work related accident. These incidents usually require 911 calls, hospitalizations, emergency surgeries, family contact, and a longer road to recovery. They may also require immediate (within 8-24 hours) reporting to the California Occupational Safety and Health Administration (Cal/OSHA), if they meet the criterion that has been established.

As defined in the California Code of Regulations Title 8 §330(h), serious injury or illness means any injury or illness occurring in a place of employment, or in connection with any employment that:

Requires inpatient hospitalization for a period in excess of 24 hours for other than medical observation.

Results in a loss of any member of the body.

Results in a serious degree of permanent disfigurement.

Results in the death of the employee.

Does not include any injury, illness, or death caused by the commission of a Penal Code violation, except the violation of Section 385 of the Penal Code, or an accident on a public street or highway.

The California Code of Regulations Title 8 §342(a) states, “every employer shall report immediately by telephone or telegraph to the nearest District Office of the Division of Occupational Safety & Health any serious injury or illness, or death, of an employee occurring in a place of employment or in connection with any employment. Immediate means as soon as practically possible but not longer than 8 hours after the employer knows or with diligent inquiry would have known of the serious injury or illness. If the employer can demonstrate that exigent circumstances exist, the time frame for the report may be made no longer than 24 hours after the incident.”

The 8-24 hour time frame begins when the employer knows, or “with diligent inquiry” would have known of the serious injury, illness, or death. The “employer” means someone in a management or supervisory capacity.

As with any injury or accident, it can be a difficult and confusing time for all those involved and affected. It may seem like many things need to be done all at once. That is, of course, impossible. So, prepare yourself now. Make a list of your responsibilities and important contact numbers before a serious injury or accident occurs.

The order in which you perform each of these responsibilities may differ, according to the type of injury or accident that occurs. However, you will still have your checklist and contact numbers ready to use to ensure you do not forget any particular step or obligation. This emergency list of telephone numbers may be your broker, safety/loss control specialist, claims administrator, or workers’ compensation claims advocate. We are all available to provide you with any assistance you may need.

For those in California, the Cal/OSHA District Office contact list is below. Ask for the officer of the day.

Concord (925) 602-6517

Oakland (510) 622-2916

San Francisco (415) 972-8670

Cal/OSHA Link: www.dir.ca.gov/title8/342.html

For additional information, please contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164.

3 Key Differences Between Self-Insured Retention and Deductibles

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Every business or non-profit that purchases a form of liability insurance has seen the term deductible or self-insured retention (SIR). While many know the difference between the two, many do not. Deductibles and SIRs, while quite different, are both designed to keep your premiums down. Insurers are willing to reduce the premium on policies, which have a deductible or SIR, because the insured assumes some of the risk. This however, is where the similarities end.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Every business or non-profit that purchases a form of liability insurance has seen the term deductible or self-insured retention (SIR). While many know the difference between the two, many do not. Deductibles and SIRs, while quite different, are both designed to keep your premiums down. Insurers are willing to reduce the premium on policies, which have a deductible or SIR, because the insured assumes some of the risk. This however, is where the similarities end.

Below are the three key differences between self-insured retention and deductibles:

With a deductible, the insured notifies the insurer when there is a claim. The insurer provides immediate defense, pays for any losses incurred and then collects reimbursement from the policyholder after the claims is closed, up to the deductible amount. Under an SIR, the insured is still required to notify the insurer of any claim. The insured will immediately begin to make payments on that claim until the SIR is satisfied. At that point, the insurer will take over.

Deductibles erode the limit of your insurance policy, while SIR(s) do not. Let’s assume you have a standard $1 million policy limit with a $50,000 deductible. In the event of a loss, the insurer will be responsible for $950,000, since the insured is required to reimburse the insurer for the full deductible amount. Under the SIR, the insured is immediately responsible for the first $50,000 of any one claim, and the insurance company is responsible for the full $1 million limit.

Large deductibles often require that the insured provide a letter of credit or some other acceptable form of collateral to cover expected losses that occur within the deductible. With SIR(s), the insurer has no responsibility for paying losses until the SIR is exhausted; therefore, no collateral is required.

When reviewing your coverages and limits, if you see the terms ‘self-insured retention’ and/or ‘deductible’ please understand the terms may seem interchangeable, but there are major differences. Please contact Rancho Mesa at (619) 937-0164 with any further questions.

Developing an Effective Injury and Illness Prevention Program (IIPP)

Author, Daniel Frazee, Executive Vice President, Rancho Mesa Insurance Services, Inc.

If you have operated a business in the state of California for any period of time, you have very likely heard about or run across the acronym IIPP. Wherever you stand with your knowledge within the world of safety, injury, and illness, it is important for every organization to understand the mandatory parts of an IIPP. What is often overlooked is how developing an effective safety program can create positive change and truly impact your bottom line.

Author, Daniel Frazee, Executive Vice President, Rancho Mesa Insurance Services, Inc.

If you have operated a business in the state of California for any period of time, you have very likely heard about or run across the acronym IIPP. Wherever you stand with your knowledge within the world of safety, injury, and illness, it is important for every organization to understand the mandatory parts of an IIPP. What is often overlooked is how developing an effective safety program can create positive change and truly impact your bottom line.

What is an IIPP?

An Injury and Illness Prevention Program (IIPP) is a required written workplace safety document that must be maintained by California employers (Title 8 of the CA code of regulations, section 3203). These regulations require eight (8) specific elements that are summarized below. In many cases, this process requires direct questions about how the company currently views and manages safety. Answering these questions will begin to highlight the positive aspects of what already is currently in place and shed light on areas that need improvement.

Responsibility

Clarifying the name, title and contact information for the person(s) with overall responsibility for the IIPP is a critical first step to this process. Making the IIPP available and accessible at all business locations becomes the first task of the “responsible person.”

Compliance

What is the content of the company’s safety meetings? Who runs those meetings? How do you discipline employees if they do not follow safety guidelines? How might the company recognize or reward their employees for safe practices or behavior?

Communication

Safety meetings are held on what type of schedule within your organization? How can employees anonymously notify management of safety and health concerns without fear of reprisal? Is there a safety committee in place that provides communication to all employees? If not, who would be considered as important members of that committee?

Hazard Assessment

Who within the company is responsible for periodic inspections to identify and evaluate workplace hazards? Provide detail on this schedule along with accompanying documentation that these visits occurred. Continuously communicating with employees for feedback and constantly reviewing hazards on a jobsite or within the workplace are crucial. Lastly, does the company use a standard or tailored JHA (Job Hazard Analysis) checklist to accomplish this? Re-visiting these checklists regularly as exposures change is critical to reducing claim frequency.

Accident/Exposure Investigation

Post-accident, who is the name of the person within the organization responsible for conducting those investigations? What type of form or checklist are you using to establish “root causes” of the accident or injury? And, back to the compliance section, what type of discipline could be handed down in the event of employee error that causes an accident or injury?

Hazard Correction

After the company has identified the hazard and determined exactly how and why an incident occurred, the IIPP must provide detail on how the company will correct the problem from happening again. One solid first step can include a review of Personal Protective Equipment (PPE) use. That is, did the equipment being used cause the accident or injury and, if yes, why? Answering the\is question may show that the piece of equipment was not appropriate for the task, or the item was defective or too old, which caused failure.

Training and Instruction

Ongoing and job specific training and instruction are really the lifeblood of any truly effective IIPP. Presenting the information in a clear, concise format that is easily understood is often the most difficult task in this process. Yet, it remains perhaps the most important as it is vital that employees are continually educated and RETAIN their instruction. Peeling back this process with managers, foreman, superintendents, etc. and learning specifically how the training is being disseminated, allows for a true baseline to be established.

Recordkeeping

Document, document, document! While establishing a written version of the IIPP might be the first step, and revising/editing on an annual basis is recommended, having the proper documentation that accompanies each section is just as important. This provides the responsible person(s) an important tool to continually compare the company’s actions, trainings, assessments and prevention techniques with the available documentation.

Can An Effective IIPP Impact my Bottom Line?

Building an effective IIPP means that the document represents a part of the company’s culture. For it to be meaningful and have a real impact on reducing workplace injuries and illnesses, it must reflect what your company is actually doing on a day to day basis. As the company’s ownership ties this into the overall business, building the IIPP from the ground up into a living, breathing document has measurable impact on controllable costs like workers’ compensation. Reducing frequency of injury can help lower the experience modification, improve the loss ratio, and establish a solid risk profile in the insurance marketplace. Having the supporting documentation along with specific examples of forms, checklists and assessments can arm an insurance broker with the tools they need in the marketplace. More specifically, this information provides a broker important leverage points when negotiating the most competitive terms possible for the employer with the insurance carrier’s underwriter. Those points can lead directly to premium savings, which leads to healthier margins and stronger profitability. Build the IIPP because it is a CA state requirement and it is the right thing to do. But, believe that building a first class safety program will absolutely lower your long-term insurance costs.

For a sample IIPP, visit the Risk Management Center or contact Alyssa Burley at (619) 438-6869.

Six Reasons for Promptly Reporting a Workers’ Compensation Claim

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Reporting workers’ compensation claims in a timely manner can have a huge impact on the severity of the claim. Some policyholders believe the practice of not reporting employee injuries early is a good business practice. This could not be further from the truth.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Reporting workers’ compensation claims in a timely manner can have a huge impact on the severity of the claim. Some policyholders believe the practice of not reporting employee injuries early is a good business practice. This could not be further from the truth. Below are six reasons why reporting claims early can reduce the overall impact of a claim on an employer’s insurance premiums:

Lowers the cost of a claim – The cost of a claim gets higher and higher for each day it is not reported. Claims reported after 30 days of the injury on average cost 30% more than those reported right away.

Ensures that key evidence is secured – The prompt reporting of a claim allows the claims adjuster to ensure key evidence is preserved. It also ensures that the supervisor’s accident report and witness statements are taken while things are still fresh in their minds.

Potential hazards are identified as early as possible – When an injury or near miss occurs, there should be an accident investigation completed to find out the root cause of the injury. Identifying the cause or potential hazard will reduce the likelihood of a similar claim from occurring in the future. It can also be useful as a training topic during safety-related meetings.

Could identify “red flags” for fraud – It is very important to understand that an insurance company only has 90 days from the employer’s (or their management or supervisors) date of knowledge to accept or deny a claim. If the claim is reported late, it leaves the adjuster little time to investigate the validity of a claim, which might force them to accept it. If the claim is reported 90 or more days after the date of knowledge, the adjuster has no choice but to accept the claim. The impact of a fraudulent claim can have a significant effect on future workers’ compensation pricing.

Reduces litigation – When an injury claim is not reported in a timely manner by the employer, it can make the injured employee feel neglected or disgruntled. Reporting the claim early, showing compassion towards the employee, and keeping the lines of communication open will significantly reduce the likelihood of a litigated claim. Employees need to feel they are going to be taken care of medically and still have a job at the company. Employees are more likely to hire an attorney when they feel uneasy about their job security or they are not receiving proper treatment. When a claim becomes litigated, it typically prolongs the time it takes to close the claim and increases the cost by an average of 30%.

Untreated medical only injuries could develop into indemnity claims – A small percentage of medical only claims can turn into indemnity claims as a result of unforeseen complications. For example, if an employee has a small metal shard stuck in their finger and chooses not to receive treatment, the finger could become infected, require surgery, and ultimately cause nerve damage. Had this injury been properly treated from the beginning, it likely would have simply been a first aid claim. Early treatment is key to minimizing indemnity claims.

Quickly reporting claims is simply one risk management strategy to controlling a business’s insurance costs. To discuss this strategy and others please feel free to contact Rancho Mesa Insurance at 619-937-0174.

California SB 1343 Expands Sexual Harassment Training Requirements

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc,

On September 30, 2018, California Governor Jerry Brown, approved Senate Bill 1343 (SB 1343), which expands rules for required sexual harassment prevention training for businesses.

Currently, employers with 50 or more employees must provide supervisors with sexual harassment prevention training every two years. By January 1, 2020, employers with 5 more employees must provide at least 2 hours of sexual harassment prevention training and at least 1 hour of training to non-supervisory employees. The trainings are required every 2 years.

Editor’s Note: This article was originally published on November 15, 2018 and has been updated for accuracy on September 12, 2019.

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc,

On September 30, 2018, California Governor Jerry Brown, approved Senate Bill 1343 (SB 1343), which expands rules for required sexual harassment prevention training for businesses.

According to the passing of Senate Bill 778, approved on August 30, 2019, by January 1, 2021, employers with 5 more employees must provide at least 2 hours of sexual harassment prevention training and at least 1 hour of training to non-supervisory employees every 2 years.

The bill requires “the Department of Fair Employment and Housing (DFEH) to develop or obtain 1-hour and 2-hour online training courses on the prevention of sexual harassment in the workplace, as specified, and to post the courses on the department’s Internet Web site. The bill also requires the department to make existing informational posters and fact sheets, as well as the online training courses regarding sexual harassment prevention, available to employers and to members of the public in specified alternate languages on the department’s Internet Web site.” However, the DFEH currently does not have the required training materials available, as of yet.

Rancho Mesa offers free Anti-Harassment training to all of its clients’ supervisors and employees throughout the country in response to California’s Senate Bill 1343 (SB 1343) and Senate Bill 1300 (SB 1300). The deadline for this training is January 1, 2021, according to Senate Bill 778.

Until the DFEH releases its supervisor and employee sexual harassment prevention trainings, Rancho Mesa recommends devising a training schedule/plan for your supervisors and employees in order to meet the January 1, 2021 deadline.

Resources:

legislature.ca.gov: SB-1343 Employers: sexual harassment training: requirements

legislature.ca.gov: SB-778 Employers: sexual harassment training: requirements

For questions about this training requirement or to learn how to enroll your supervisors and employees, register for the “How to Enroll Supervisors and Employees in the Online Anti-Harassment Training” webinar or contact Rancho Mesa’s Client Services Department at (619) 438-6869.

California Insurance Commissioner Announces Rate Cuts for 2019

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

California employers received some great news regarding their Workers Compensation premiums for 2019. On November 6, 2018, Insurance Commissioner Dave Jones recently announced his decision to cut California Workers’ Compensation advisory pure premium rates by 8.4% significantly higher than the initial recommended 4.5%. This change will affect policies that renew or incept on or after January 1, 2019.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

California employers received some great news regarding their Workers Compensation premiums for 2019. On November 6, 2018, Insurance Commissioner Dave Jones recently announced his decision to cut California Workers’ Compensation advisory pure premium rates by 8.4% significantly higher than the initial recommended 4.5%. This change will affect policies that renew or incept on or after January 1, 2019.

To learn more about how this decrease will affect your company’s workers’ compensation premium in 2019, contact Rancho Mesa Insurance Services at (619) 937-0164.

Cal/OSHA Issues Electronic Filing Requirement For 2017 OSHA 300A Form

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

In April 2018, federal OSHA announced all affected employers are required to submit injury and illness data (i.e., Form 300A data) via the Injury Tracking Application (ITA) online portal by July 1, 2018, even if the employer is covered by a state plan like those in California, Maryland, Minnesota, South Carolina, Utah, Washington or Wyoming.

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

In April 2018, federal OSHA announced all affected employers are required to submit injury and illness data (i.e., Form 300A data) via the Injury Tracking Application (ITA) online portal by July 1, 2018, even if the employer is covered by a state plan like those in California, Maryland, Minnesota, South Carolina, Utah, Washington or Wyoming.

Cal/OSHA then issued a statement in May 2018, advising affected employers “to comply with federal OSHA’s directive to provide Form 300A data covering calendar year 2017," even though it was not a Cal/OSHA requirement.

“On November 1, 2018,” according to the Cal/OSHA website, “the Office of Administrative Law approved the emergency action. This means that the employers in California described below are now required to submit Form 300A data covering calendar year 2017 by December 31, 2018. These employers should follow the instructions posted at federal OSHA's ITA website:

Check Appendix H for your industry. It includes industries like: Construction; Community/Nursing/Residential Care facilities; Community Food/Housing Relief Services; and many more.

All employers with 250 or more employees, unless specifically exempted by section 14300.2 of title 8 of the California Code of Regulations

Employers with 20 to 249 employees in the specific industries listed in Appendix H of the emergency regulations.”

This emergency action by the Office of Administrative Law brings Cal/OSHA’s requirements up to the federal OSHA’s minimum standards, with one difference. Federal OSHA required affected employers covered by state plans to submit the 2017 Form 300A data electronically by July 1, 2018, while this new action requires affected California employers to submit the data by December 31, 2018.

Since the Federal OSHA deadline has already passed, it is recommended that all affected employers in California who have not already submitted the 2017 Form 300A data via the ITA, submit it as soon as possible, but no later than December 31, 2018.

Next year, the deadline for electronically submitting 2018 Form 300A data will be March 2, 2019.

Rancho Mesa has put together a 9-minute tutorial video on how to generate the electronic Form 300A data file from the Risk Management Center, that can be uploaded to the ITA website for reporting the data.

For questions about how to track the injury and illness data in the Risk Management Center, contact Alyssa Burley at (619) 438-6869.

How a Medical Billings Errors & Omissions Policy Can Protect Against A Medicare Recovery Audit

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

Human Service agencies billing Medicare may find themselves paying thousands of dollars in defense costs and regulatory fines resulting from a Medicare Recovery Audit. According to the Centers for Medicare and Medicaid Services, “the Medicare Fee for Service (FFS) Recovery Audit Program’s mission is to identify and correct Medicare improper payments through the efficient detection and collection of overpayments made on claims of health care services provided to Medicare beneficiaries.”

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

Human Service agencies billing Medicare may find themselves paying thousands of dollars in defense costs and regulatory fines resulting from a Medicare Recovery Audit. According to the Centers for Medicare and Medicaid Services, “the Medicare Fee for Service (FFS) Recovery Audit Program’s mission is to identify and correct Medicare improper payments through the efficient detection and collection of overpayments made on claims of health care services provided to Medicare beneficiaries.”

The audit process can uncover medical billing errors that result in very costly penalties. Under the Civil Monetary Penalties Law, civil penalties may include an assessment of up to three times the amount claimed for each item or service. These audits are conducted by outside independent contractors and medical collection agencies, collectively referred to as Recovery Audit Contractors (RACs). The RAC firm is compensated between 9%-12.5% of the overpayments identified and recovered.

The Recovery Audit Program targets healthcare organizations, including social service agencies, behavioral health facilities, physician groups, hospitals, and billing entities.

To address this exposure to financial loss, Human Service agencies should explore a Medical Billings Errors & Omissions policy and the coverage it provides. These policies will often cover the following:

1) Defense costs and regulatory fines from actual or alleged billings errors for claims brought by:

Governmental agencies

Recovery Audit Contractors

Qui Tam Plaintiffs

Commercial Health Insurance Payers

2) Coverage for regulatory actions:

Billings error proceeding

Health insurance portability and accountability act (HIPAA)

Physician Self-Referral (STARK)

Emergency Medical Treatment and Active Labor Act (EMTALA)

To learn more about your organization’s exposure and the appropriate insurance options, please contact Rancho Mesa Insurance Services at (619) 937-0164.

Benefits of using GPS Tracking Devices for Automobile Fleets

Author, Chase Hixson, Account Executive, Human Services Group, Rancho Mesa Insurance Services, Inc.

Global Positioning System (GPS) tracking devices have become a popular topic with employers who maintain vehicle fleets. The companies want to know what the advantages are of having these devices installed on their fleet vehicles and will it reduce their insurance costs.

Global Positioning System (GPS) tracking devices have become a popular topic with employers who maintain vehicle fleets. The companies want to know what the advantages are of having these devices installed on their fleet vehicles and will it reduce their insurance costs.

The short answer is yes. Some insurance carriers provide a credit for having GPS systems installed on vehicles. Others may include a discount in their overall assessment of the company’s risk profile. Taking a proactive stance will be noticed by a carrier and taken into account.

The most important element of having GPS tracking is what the company does with the information received. It’s not enough to just install the device. The information generated should be used to promote corrective and preventative action within the organization. Rancho Mesa suggests organizations provide trainings, periodic ride-a-longs by a supervisor, and implement some kind of corrective behavior should the GPS show unfavorable driving behavior such as speeding or taking a less favorable route.

Other Benefits

Rancho Mesa clients have experienced indirect, sometimes unexpected, benefits from implementing a GPS System. These benefits include decreased fuel and labor costs, and ultimately more efficiency. Knowing the routes are being tracked can lead to a greater sense of accountability from employees as to what routes they are taking and how long they are spending on each trip. It can also allow decision makers to properly direct service calls to the right technician knowing who is in the vicinity.

For more information about the benefits of using a GPS system to lower insurance costs, contact Rancho Mesa Insurance Services at (619) 937-0164.

Distracted Driving, Not Just an Automobile Insurance Issue, Bad News for Workers Compensation Too

Author, David J Garcia, A.A.I, CRIS, President, Rancho Mesa Insurance Services, Inc.

I’ve written at length on the negative effects distracted driving is having on the automobile insurance industry and its impact on the rise in accidents, claim costs, and increases to your automobile premiums. But, have you considered its effects on your Experience Modification Rate (EMR) and ultimately workers’ compensation cost?

Author, David J Garcia, A.A.I, CRIS, President, Rancho Mesa Insurance Services, Inc.

I’ve written at length on the negative effects distracted driving is having on the automobile insurance industry and its impact on the rise in accidents, claim costs, and increases to your automobile premiums. But, have you considered its effects on your Experience Modification Rate (EMR) and ultimately workers’ compensation cost?

When one of your employees is injured in an automobile accident while working on your behalf, Arising out of Employment (AOE) / Course of Employment(COE) their sustained injury will be covered by your workers’ compensation policy, regardless of fault.

“Regardless of fault?!”

When a third party is deemed at fault and the injuries to your employee(s) have been settled, your workers’ compensation insurance carrier may “subrogate” their costs to the carrier representing the at fault driver. Now, here is the realty – studies have shown that 14.7% (4.1 million) of all California drivers are uninsured, while another large percentage of drivers hold the California minimum limits of $15,000/$30,000. What this means is that even if subrogation is a possibility, the likelihood of a “full” recovery is not probable. Thus, all the costs of the injury to your employee(s) will likely be the sole responsibility of your workers’ compensation carrier and this claim cost negatively affects your EMR and loss ratios for years to come.

What can you do?

You can implement a strong fleet safety program that includes a policy pertaining to distracted driving. When your employee is involved in a motor vehicle accident, adherence to your company’s accident investigation protocol is crucial. Documentation will prove pivotal for your carrier if subrogation becomes a possibility.

For our clients, through RM365 Advantage, we have a number of resources: fleet safety programs that can be customized, fleet safety training topics, fillable and printable accident investigation forms, archived fleet safety workshop videos, and more, in both English and Spanish. You can access this through our RM365 Advantage Risk Management Center or contact our Client Services Coordinator Alyssa Burley at aburley@ranchomesa.com.

If you are not a current client of Rancho Mesa, we encourage you to reach out to your broker for assistance or email Alyssa Burley to get additional information or to ask any questions.

Fleet Safety: Four Steps to Effective-Driver Selection

Author, Sam Clayton, Vice President Construction Group, Rancho Mesa Insurance Services, Inc.

Driver selection guidelines are one of the most important things a company can implement to prevent vehicle accidents. A company should manage a written Motor Vehicle Records (MVR’s) program to assure that they are selecting the right employees to drive for the company and annually qualify each driver for desirable driving records. The following are some “best practices” guidelines that will help businesses implement and improve the driver selection process.

Author, Sam Clayton, Vice President Construction Group, Rancho Mesa Insurance Services, Inc.

Driver selection guidelines are one of the most important things a company can implement to prevent vehicle accidents. A company should manage a written Motor Vehicle Records (MVR’s) program to assure that they are selecting the right employees to drive for the company and annually qualify each driver for desirable driving records. The following are some “best practices” guidelines that will help businesses implement and improve the driver selection process.

Step 1: Determine who drives for the company.

The first thing a business must do to control driver selections is knowing who is driving on behalf of the company. Most companies have drivers that fall into several categories:

Non-employees operating company vehicles

Drivers of vehicles owned or leased by the company

Drivers with a Commercial Drivers License (CDL)

Employees driving their own vehicle for company business

Step 2: Establish specific requirements depending on whose is driving.

For all employees, regardless if they are operating a company owned or leased vehicle, the company must:

Verify the person has a valid Driver License.

Determine that the license is appropriate for the type of vehicle they will be operating.

Request a copy of their Motor Vehicle Record (MVR) and compare it to the acceptable criteria before they drive for the company, and again on an annual basis.

For drivers of vehicles owned or leased by the company, it is wise to ask for a:

Completed written application that includes a section that lists all driving violations and/or accidents within the last 3 years.

Substance abuse test (optional).

For drivers with a Commercial Driver License:

Conduct a Department of Transportation (DOT) physical examination.

Create a driver qualification file for each driver that complies with DOT.

Conduct a drug test for each driver, following DOT regulations (pre-hire, random, post-accident and suspension).

For employees using their own vehicles for company business:

Require proof of insurance.

Establish minimum personal limits of insurance. Rancho Mesa recommends a minimum of $100,000/$300,000/$100,000.

Step 3: Establish MVR Qualification Process

Managing the driver selection and ongoing qualification process is the employer’s responsibility. There is a broad range of driving violations that can be classified into two major categories “A” and “B.”

Category “A” would include driving under the influence of drugs, refusing to take a substance test, reckless/careless driving, speeding in excess of 14mph over the posted speed limit, texting, hit and run, speeding in a school zone, racing, driving with a suspended or revoked license, vehicular assault etc.

Category “B” would include, speeding 1-14 mph over posted speed limit, improper lane change, failure to yield, failure to obey traffic signal or sign, accidents, having a license suspended in the past for moving violations, etc.

Best practices for MVR qualifications include:

Anyone with a type “A” driving violation in the last five years is undesirable for a driving position.

Anyone with three or more type “B” violations, or two or more at fault accidents in a three-year period, is undesirable for a driving position.

Anyone with two type “B” moving violations, or one driving accident in the last three-year period, should be put on warning and MVR’s reviewed semi-annually.

In addition to the initial MVR check upon hire, all employees who routinely drive their personal vehicle on company business should have their MVR screened at least once every 12 months to ensure their driving record remains acceptable.

Step 4. Enroll all employees in the DMV Pull Notice Program.

For a nominal annual fee, employers can enroll in the Department of Motor Vehicles' Pull Notice Program. This service provides employers with a notice of any moving violations within 24 hours. So, an employer will know right away if one of their drivers' records has changed. Not participating in the program makes the company vulnerable to going months with an unqualified driver before an annual MVR review is completed.

Following these best practices for effective driver selection takes the guest-work out of determining who should drive for a company. Following these four steps can help ensure the company has qualified drivers at all times.

For questions about driver selection, contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164.

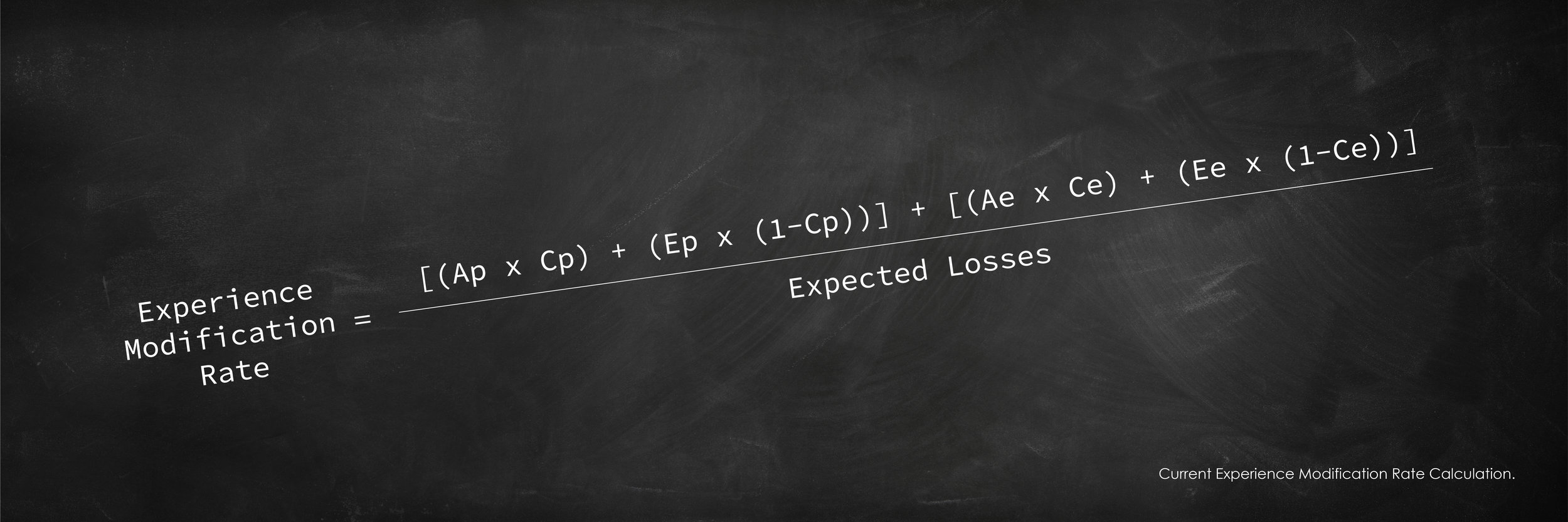

Changes in the 2019 Experience Modification Formula – Are You Ready? (Part 2)

Author, David J. Garcia, A.A.I, CRIS, President, Rancho Mesa Insurance Services, Inc.

As we approach 2019, there will be several changes in the experience modification formula that directly affects the calculation of an employer's 2019 Experience Modification Rate (EMR).

Part 1 of this article describes the Primary Threshold and Expected Loss Rate. Read Part 1 of this article. Part 2 provides an overview of the changes to the EMR calculation.

Author, David J. Garcia, A.A.I, CRIS, President, Rancho Mesa Insurance Services, Inc.

As we approach 2019, there will be several changes in the experience modification formula that directly affects the calculation of an employer's 2019 Experience Modification Rate (EMR).

Part 1 of this article describes the Primary Threshold and Expected Loss Rate. Read Part 1 of this article. Part 2 provides an overview of the changes to the EMR calculation.

The Simplified Formula

Individual claim cost (i.e., both paid and reserved) will go into the calculation up to the primary threshold limit are considered the actual primary losses. Any claim cost that exceeds your primary threshold is considered the actual excess loss. In past experience mod formulas, the actual excess loss was used in the factoring of your EMR; in 2019, it will have no effect. However, under the new calculation, the industry expected excess losses will be considered in the 2019 simplified formula.

Actual Primary Losses + Expected Excess Losses / Expected Losses

The expected excess losses are calculated by multiplying your class code’s payroll per $100 by the expected loss rate for that same class code. This number is then discounted by the “D Ratio” to determine expected primary losses and expected excess losses. There are 90 different D-Ratios for each classification based on the primary threshold. The D-Ratio is different for each classification and is determined by the severity of injuries that occur within that particular class code.

The first $250 of all claims will no longer be used in the calculation of your EMR.

This is a major change and one that was initiated in part to encourage all employers to report all claims, including those deemed first aid, without having a negative impact on the companys’ EMR. This change will affect all claims within the 2019 calculation; so yes, it will include years previously completed and reported. This will have a positive impact on EMRs in that claim dollars will be removed from the EMR calculation.

Confused – Want more details?

Help is on the way. We are going to hold a statewide webinar on Thursday, October 4th at 9:00am in order to dig deeper into this subject and answer specific questions. You may register for the webinar by contacting Alyssa Burley at (619) 438-6869 or aburley@ranchomesa.com.

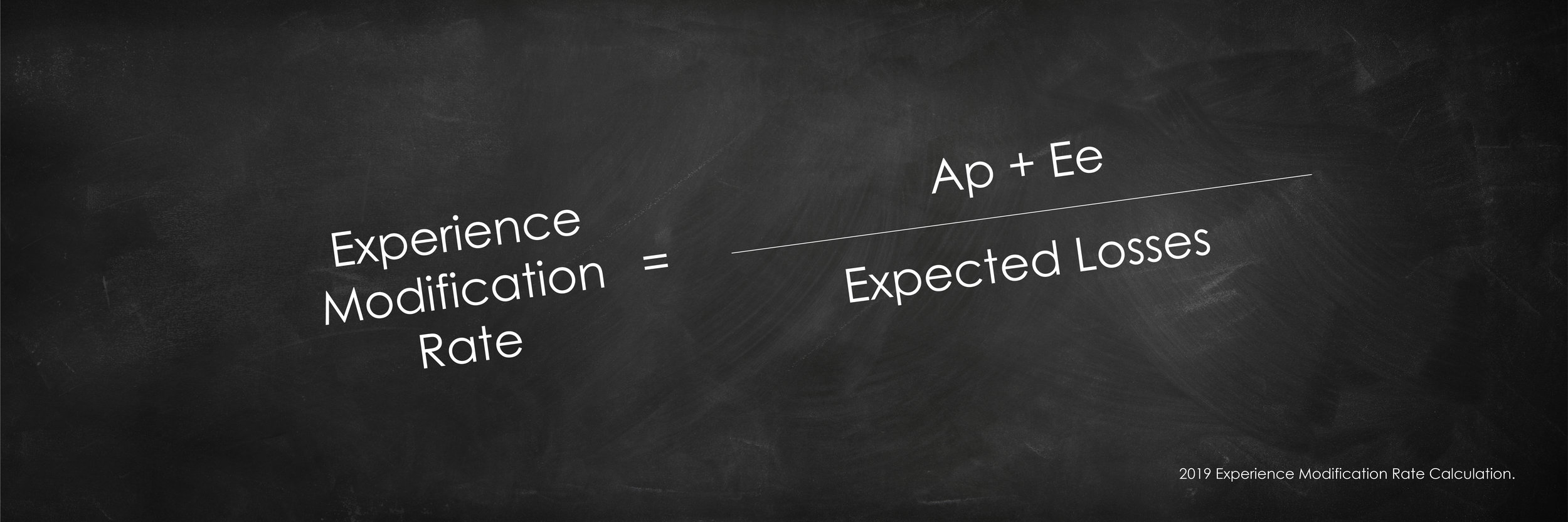

Changes in the 2019 Experience Modification Formula – Are You Ready? (Part 1)

Author, David J. Garcia, A.A.I, CRIS, President, Rancho Mesa Insurance Services, Inc.

As we approach 2019, there will be several changes in the experience modification formula that directly affects the calculation of an employer's 2019 Experience Modification Rate (EMR). Sadly, most businesses are both unaware and unprepared.

Author, David J. Garcia, A.A.I, CRIS, President, Rancho Mesa Insurance Services, Inc.

As we approach 2019, there will be several changes in the experience modification formula that directly affects the calculation of an employer's 2019 Experience Modification Rate (EMR). Sadly, most businesses are both unaware and unprepared.

Before we breakdown the changes to the 2019 EMR formula, we must first have a strong understanding of the two critical components that directly affect the outcome of the EMR. This article will be broken out into 2 parts. Part 1 will describe the Primary Threshold and Expected Loss Rate. In Part 2, I will provide an overview of the changes to the EMR calculation.

The single most important number to my EMR is not my final rating?

Primary Threshold

Rancho Mesa has long taken a stance on the importance of a business owner knowing their primary threshold as it relates to the EMR. Proactive business owners should monitor their primary threshold annually as it is subject to change due to payroll fluctuations, operations, and the annual regulatory filing of the expected loss rate. In general terms, the more payroll associated with your governing class (the class code with the preponderance of your payroll) the higher your primary threshold will be. The primary threshold is unique to every business. The 2019 EMR formula is heavily weighted by the company's actual primary losses, the claim cost (both paid and reserved) that goes into the calculation up the primary threshold amount. Controlling claim cost and knowing your company's primary threshold is the first step to understanding the EMR.

Expected Loss Rates

The expected loss rate is the factor used to anticipate a class code's claim cost per $100 for the experience rating period. The expected loss rate (ELR) is not to be confused with the pure premium rate (PPR). The ELR differs from the PPR in that the ELR simply measures the basic claim cost for a class code without including loss adjustment expense, excess loss load (capped at $175,000 for X-MOD purposes), and loss development. The PPR includes all of the mentioned above factors and is the rate for which a carrier can expect to pay all of the cost associated with claims in a specific industry. The PPR does not account for the carrier’s overhead, profit, tax, and commissions.

The ELR changes, annually. It’s important to monitor the change; if your expected loss rates go down (from our analysis this is the direction most are going) and if nothing else changes, your EMR will go up. Why is this? Again, without going too deep, in simple terms, your EMR is a ratio of actual losses to expected losses. If your expected losses go down, but your actual losses remain the same, then your EMR will go up.

To illustrate this, consider the following. Actual losses are $25,000 and your expected losses are $25,000 your EMR would be 100. Now, if your actual losses stay the same at $25,000, but your expected losses drop to $20,000, your EMR would now be 125%. (There are other factors that would go into the actual calculation, so your actual EMR would be different – this was just to illustrate the expected losses impact to the EMR.)

In Part 2 of this article, will cover the actual changes to the EMR calculation.

For more information about the EMR, contact Rancho Mesa Insurance Services at (619) 937-0164.

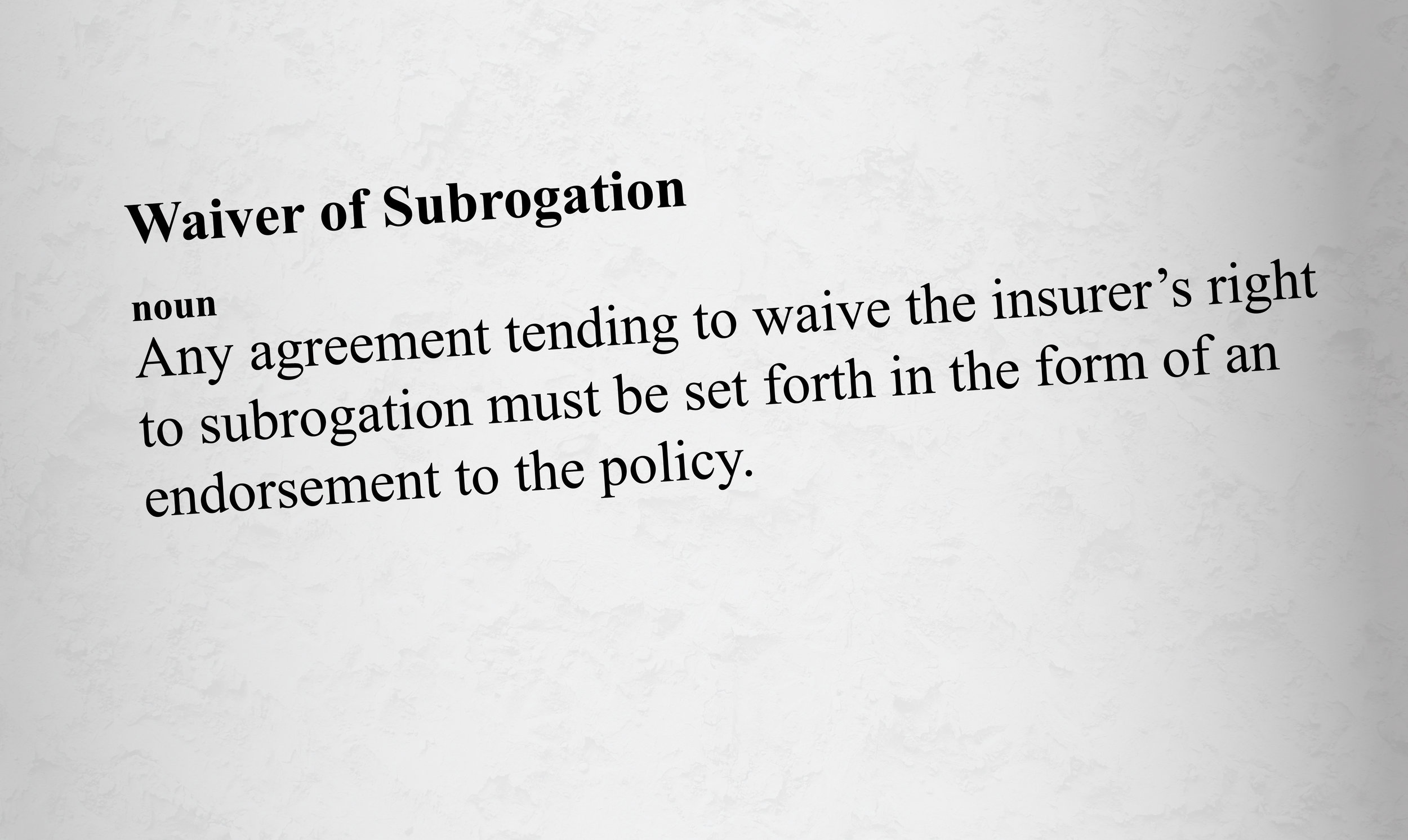

Understanding Waivers of Subrogation for Contractors

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

In an era where general contractors commonly require a Waiver of Subrogation from its sub-contractors before they are allowed to step foot on the jobsite, it is important to understand how a Waiver of Subrogation functions. Most companies simply tell their agent they need the waiver added to their contract, but what does this mean? How does it affect the policy?

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

In an era where general contractors commonly require a Waiver of Subrogation from its sub-contractors before they are allowed to step foot on the jobsite, it is important to understand how a Waiver of Subrogation functions. Most companies simply tell their agent they need the waiver added to their policy, but what does this mean? How does it affect the policy?

Subrogration is "the legal process by which an insurance company, after paying for a loss, seeks to recover all or a portion of the loss from another party who is legally wholly or partially liable for that loss," according to the Workers' Compensation Insurance Rating Bureau of California (WCIRB). So, a Waiver of Subrogration prevents your insurance carrier from recovering funds paid on a claim from the named party requesting the waiver.

When subrogating, three things must be established:

1) The defendant was negligent (or that a product was defective),

2) Negligence proximately caused the damages for which the carrier paid, and

3) The amount and nature of the damages.

If you cannot establish any one of these three, there will be no subrogation.

Subrogation is used throughout various lines of insurance. It is very common in dealing with auto insurance claims. If you are in an accident and the other driver is deemed to be at fault, your insurance company will respond first by paying to have your vehicle fixed. Then, the carrier will collect from the at fault driver’s insurance company to recover the amount they had to pay to fix your car. The insured’s carrier jumps on the claim immediately so that the insured will not have to wait for the claim to be disputed and resolved before their car is repaired. Claims are handled the same for every line of insurance, unless there is a Waiver of Subrogation in place.

When a sub-contractor is hired and has signed a Waiver of Subrogation for the project owner or general contractor, they are essentially waiving their carrier's ability to recover the money that was paid out on a claim that was caused by a third party's negligence. Waivers of subrogation often come in two formats. Either, the waiver specifically names an entity that the carrier waives its’ right to subrogate against, or a Blanket Waiver of Subrogation. If a Blanket Waiver of Subrogation is provided, the carrier must obtain permission from the named insured to subrogate against a third party.

When adding a Blanket Waiver of Subrogation to a policy, there is an additional fee to offset the carrier’s ability to reclaim money from any losses that were caused by a third party's negligence. These fees can change from carrier to carrier and it is a good move to review each policy to know exactly what you are paying for waivers. Adding a blanket waiver of insurance does not increase coverage or limits, it simply absolves an owner/general contractor of their liability.

With Waivers of Subrogation becoming more prevalent, it is easy to see how important it is as a business owner to know exactly what is covered and what you are waiving.

If you have any questions or would like to understand subrogation further, please contact Rancho Mesa at (619) 937-0164.

Update: 8868 Class Code Changes - Proposed WCIRB Changes Awaiting Public Hearing August 3rd

Author, Chase Hixson, Account Executive, Human Services Group, Rancho Mesa Insurance Services, Inc.

On August 3, 2018, the California Department of Insurance will hold a public hearing regarding the proposed changes to the 8868 Class Codes.

On August 3, 2018, the California Department of Insurance will hold a public hearing regarding the proposed changes to the 8868 Class Codes.

The proposed changes, at the recommendation of the Workers’ Compensation Insurance Rating Bureau (WCIRB), will break the 8868 class code into the following divisions:

8868 & 9101 – K-College Schools (Academic Professionals & Non-Academic Professionals, Respectively)

8869 & 9102 – Vocational Schools, Academic Professionals & Non-Academic Professionals respectively)

8871 – Supplemental Education

8872 – Social Services

8873 – Training or Day Programs for Adults

8874 – Special Education Services for Children & Youth

8876 – Community Based Adult Services

These changes, if approved, could have a significant impact on California businesses. A recent article by the Workers’ Compensation Executer, a leading news source in the insurance industry, suggest up to 25% increases in some of the proposed class codes.

Rancho Mesa has specialized in the education arena for nearly 20 years and is prepared to assist clients with this transition. If you have any questions, please contact Rancho Mesa Insurance Services at (619) 937-0164.

Six Reasons a Company’s Experience Modification Could be Recalculated

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Workers’ Compensation costs continue to be one of the most costly expenses for business owners in California. With recent reform, California has maintained steady rate decreases in the workers’ compensation marketplace. Unfortunately California still maintains some of the highest rates in the country, often times two to three times the nations average.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Workers’ Compensation costs continue to be one of the most costly expenses for business owners in California. With recent reform, California has maintained steady rate decreases in the workers’ compensation marketplace. Unfortunately, California still maintains some of the highest rates in the country, often times two to three times the nations average.

Controlling insurance costs is vital to staying profitable and often times, staying in business. An important way business owners can control their insurance costs is by controlling their Experience Modification or X-MOD. An X-MOD is a benchmark of an individual employer against others in its industry, based on that employer's historical claim experience. This comparison is expressed as a percentage which is applied to an employer's workers' compensation premium.

The premium impact of a credit X-MOD (less than 1) vs a debit X-MOD (more than 1) can be significant. Business owners budget around their insurance costs. When there are unforeseen changes to their insurance costs it can have a dramatic effect. While it is rare, there are situations when an X-MOD can change in the middle of a policy term. Below are six circumstances when this could happen:

- If a claim that has been used in an X-MOD calculation is subsequently reported as closed mid policy term AND closed for less than 60% of the aggregate of the highest value, then the X-MOD is eligible for recalculation.

- In cases where loss values are included or excluded through mistake other than error of judgement. Basically, this rule takes into consideration the element of human error.

- Where a claim is determined non-compensable. Meaning the injury was determined to be non-work related.

- Where the insurance company has received a subrogation recovery or a portion of the claim cost is declared fraudulent.

- Where a closed death claim has been compromised over the sole issue of applicability of the workers’ compensation laws of California. Basically, if a person passes away at work but it was determined that the person had a pre-existing condition which caused the death, not work itself.

- Where a claim has been determined to be a joint coverage claim. This occurs mainly with cumulative trauma claims where there was no specific incident that caused an injury, but an injury that developed over time (i.e., wear and tear).

If any of the circumstances above have occurred, than a revised reporting shall be filed with the Workers’ Compensation Insurance Rating Bureau (WCIRB) and it shall be used to adjust the current and two immediately preceding experience ratings.

If you would like to discuss this topic in further detail, and learn how Rancho Mesa Insurance can audit your X-MOD worksheet for potential recalculations, please contact us at (619) 937-0164.

Six Proactive Steps to Prevent Heat Illness During a Scorching Summer

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

The National Weather Service has issued heat warnings for many parts of California starting today, and excessive heat warnings for some other areas. Temperatures are expected to rise to 110ºF in some parts of the Sacramento Valley, for instance. In the desert areas of Imperial and San Diego counties, they will soar as high as 114ºF.

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

The National Weather Service has issued heat warnings for many parts of California starting today, and excessive heat warnings for some other areas. Temperatures are expected to rise to 110ºF in some parts of the Sacramento Valley, for instance. In the desert areas of Imperial and San Diego counties, they will soar as high as 114ºF.

Recommendation

If you have employees working outdoors, you should have an effective heat illness prevention plan in place and train your workers on it's content. Elements of the plan include:

- Making sure those toiling outside have plenty of fresh, cool water – workers need to drink at least a quart an hour. Just providing it isn’t enough, according to the heat illness prevention standard (General Industry Safety Orders section 3395). You must encourage employees to drink water.

- Providing shade when the temperature reaches 80ºF, or when employees request it.

- If an employee is in danger of developing heat illness, they must be allowed to take a rest in the shade until their symptoms disappear.

- Having emergency procedures, including effective communication with workers in remote areas.

- Designating employees at each work site to call emergency medical services if someone starts to develop heat illness.

- Keeping a close eye on workers who have been on the job for two weeks or less. They may not have the prior training to be aware of the early signs of heat illness.

In order to prepare our clients, Rancho Mesa recently conducted a Heat Illness Prevention Workshop. For those of you who were not able to attend, the training videos are available in the Risk Management Center or via the Workshop Video Request Form.

Should you have any questions or need further assistance, please contact a member of your Rancho Mesa team. Please be safe!!

Independent Contractor Classification Changes Expected to Impact Construction Industry

Author, David J. Garcia, AAI, CRIS, President, Rancho Mesa Insurance Services, Inc.

With the recent ruling by the California Supreme Court concerning how 1099 employees (independent contractors) are defined, the construction industry's approach to utilizing these workers has changed significantly. The Court adopted a new test to determine whether the worker should be classified as an employee or independent contractor. The previous test to determine if a worker was an employee or independent contractor was whether the employer had the right to direct the manner and means by which the worker performed the services.

Author, David J. Garcia, AAI, CRIS, President, Rancho Mesa Insurance Services, Inc.

With the recent ruling by the California Supreme Court concerning how 1099 employees (independent contractors) are defined, the construction industry's approach to utilizing these workers has changed significantly. The Court adopted a new test to determine whether the worker should be classified as an employee or independent contractor. The previous test to determine if a worker was an employee or independent contractor was whether the employer had the right to direct the manner and means by which the worker performed the services. Under the new test, a worker is considered to be an independent contractor only if all three of the following factors are present:

- The worker must be free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of the work and in fact;

- The worker must perform work that is outside the usual course of the hiring entities business;

- The worker must be customarily engaged in an independently established trade, occupation, or business of the same nature as that involved in the work performed.

These new factors have major implications for contractors, or any business for that matter, where previously they had classified a worker as an independent contractor and now have to classify them as an employee. This will impact several lines of insurance, but most critically workers' compensation, general liability and employee benefits.

Workers' Compensation

Currently, if an employee is classified as an independent contractor, they would not be subject to any workers' compensation premium nor workers' compensation benefits. If their status should change to employee, they now would be entitled to workers' compensation benefits and would have their payroll accounted for in the employer’s premium. In addition, based on the work being performed, this may change the employer’s risk profile, creating negative underwriting consequences in the workers' compensation carrier marketplace, resulting in coverage not being offered or higher premiums.

General Liability

The impact to general liability insurance is very similar to that of workers' compensation. Additional payroll or sales will need to be accounted for as the employer will become directly responsible for the work being performed without the benefit of any hold harmless agreement or other risk transfer methods. This could potentially change the risk profile of the employer’s operations, which could result in the employer needing to provide additional underwriting information.

Employee Benefits

Since 1099 contract workers are not employees and are considered self-employed, they do not show on the Quarterly Wage and Withholding Report (DE9 and DE9C) to the State of California. Because of this status, they typically cannot enroll in a group health insurance plan. Many workers who are now classified as independent contractors will be considered employees in the eyes of the state and will be eligible for group benefit offerings from their employer.

Employers may need to reevaluate their group size to ensure that they remain compliant with the Affordable Care Act (ACA). Employers with 50 or more full-time employees working a minimum of 30 hours per week, and/or full-time equivalents (FTEs) must offer health insurance that is affordable and provides minimum value to 95% of their full-time employees and their children up to age 26, or be subject to penalties.

While these changes are new and just beginning to take affect, we believe your best strategy moving forward is to consult with your trusted advisors in legal, accounting and risk management. This will have a significant impact to the construction industry throughout California and we intend to take a leadership role in helping those companies with concerns and questions. So, please reach out to our Rancho Mesa Team to help you navigate these changes. Contact Alyssa Burley at aburley@ranchomesa.com for assistance.

Key Steps to Take Before, During, and After an OSHA Inspection

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

An OSHA officer can show up to your facility or worksite for any number of reasons: employee complaints, accidents, programmed inspections, sweeps, follow-up or a drive-by observation. In order to ensure a smooth inspection, we suggest you prepare before OSHA appears at your door. Here are some key steps to take before, during and after an OSHA inspection.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

An OSHA officer can show up to your facility or worksite for any number of reasons: employee complaints, accidents, programmed inspections, sweeps, follow-up or a drive-by observation. In order to ensure a smooth inspection, we suggest you prepare before OSHA appears at your door. Here are some key steps to take before, during and after an OSHA inspection.

Before the Inspection

Every company should have a formal plan in place detailing what should be done before, during and after an OSHA inspection. This procedure should be site specific and available to all supervisors. Site specific information should include company contacts for the project if OSHA arrives, location of documents like OSHA 300 logs and the Injury and Illness Prevention Program (IIPP).

Upon arrival of the OSHA inspection officer, the company should verify the officer’s credentials and try to determine why they are at the site. Before the opening conference begins, the employer should assign specific individuals to be the note taker and the photographer. It is also extremely important to remind everyone involved to be professional and treat the compliance officer with respect.

During the Inspection

Opening Conference: During the opening conference, you will want to establish the scope of the inspection, the reason for the inspection, and the protocol for any employee interviews or production of documents. If the inspection is triggered by an employee complaint, the employer may request a copy.

Physical Inspection: During the inspection, the OSHA compliance officer will conduct a tour of the worksite or facility in question to inspect for safety hazards. It is likely pictures will be taken by the compliance officer. Instruct your photographer to also take the same pictures and possibly additional pictures from different angels while the note taker should take detailed notes of the findings.

Closing Conference: At the closing conference, the OSHA compliance officer typically will explain any citations, the applicable OSHA standards and potential abatement actions and deadlines. It is important that during this process the company representative takes detailed notes and asks for explanations regarding any violations. If any of the alleged violations have been corrected, you will want to inform the OSHA compliance officer.

After the Inspection

If you are told no citations will be issued, contact the compliance officer and obtain a Notice of No Violation after Inspection (Cal/OSHA 1 AX). If you receive a citation, it is important to take immediate action because a company only has 15 working days after the inspection to notify the Appeals Board, if they choose to appeal the citation. Citations can be issued up to six months after the inspection, so it is important to watch your mail closely during this time.

For a proactive approach to OSHA inspections, contact the Consultation Services Branch for your state (i.e. Cal/OSHA) or Federal OSHA Consultation. They will be able to provide consultative assistance to you through on-site visits, phone support, educational materials and outreach, and partnership programs.

Register for the "How to Survive an OSHA Visit" webinar hosted by KPA on Monday, June 25, 2018 from 11:00 am - 12:00 pm PST to learn about what OSHA looks for during an inspection.

For additional information, please contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164.

WCIRB Proposed Changes Affecting Schools and Disabled Services

Author, Chase Hixson, Account Executive, Rancho Mesa Insurance Services, Inc.

The Workers' Compensation Insurance Rating Bureau of California (WCIRB) recently announced plans to reclassify the 8868 (i.e., professors, teachers or academic professional employees) and 9101 (i.e., all employees other than professors, teachers, or academic professional employees) class codes under the belief that there is significant disparity between the businesses that currently fall under these two classifications. These changes are planned to go into effect January 1, 2019.

The Workers' Compensation Insurance Rating Bureau of California (WCIRB) recently announced plans to reclassify the 8868 (i.e., professors, teachers or academic professional employees) and 9101 (i.e., all employees other than professors, teachers, or academic professional employees) class codes under the belief that there is significant disparity between the businesses that currently fall under these two classifications. These changes are planned to go into effect January 1, 2019.

Currently the 8868 and 9101 classes, titled “schools,” consist of not only kindergarten through college schools, but also vocational schools, special education for disabled children, social services for children, and training programs for the developmentally disabled. While these businesses are similar in many ways, the claims appear to differ uniformly between these specific niches. This has a direct impact on the Experience Modifications (i.e., x-mod) of the organizations. According to the WCIRB, the average x-mod for K-12 schools and colleges is .81, vocational schools are 1.08, programs offering special education services for children are at 1.40 and training programs for developmentally disabled are at 1.30.

Average X-Mod within 8868 and 9101 Class Codes

The proposed changes will continue to include the 8868 and 9101 class codes while adding four new classifications. The theory is that this will create more homogeneous classes for the members while at the same time leveling out the X-mods for all. As the process unfolds, it could create higher insurance costs and you will want to fully understand how these changes could affect your bottom line.

While there are still more details to be worked out, it’s apparent that there are significant changes heading towards those operating with the 8868 and 9101 class codes. Whether or not an employer will be positively or negatively affected will depend on their individual risk profile.

Rancho Mesa’s Human Services Group will be taking a leadership position in understanding these changes and their impacts. To learn more about how these changes will affect your organization, please Rancho Mesa at (619) 937-0164.