Industry News

How Janitorial Firms Can Avoid OSHA Fines

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Avoiding government standards in the janitorial industry can be costly in the event of an unexpected OSHA visit or after a serious injury. In an industry that generally has lean profit margins, OSHA fines could be detrimental to the stability of the business. Knowing the most common OSHA violations and protecting your business from them can help insulate your organization from costly fines while also keeping your company safe. Here are five of the most common OSHA violations in the janitorial industry and strategies to avoid potential fines.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Avoiding government standards in the janitorial industry can be costly in the event of an unexpected OSHA visit or after a serious injury. In an industry that generally has lean profit margins, OSHA fines could be detrimental to the stability of the business. Knowing the most common OSHA violations and protecting your business from them can help insulate your organization from costly fines while also keeping your company safe. Here are five of the most common OSHA violations in the janitorial industry and strategies to avoid potential fines.

Hazard Communication Standard:

A hazard communication standard requires that all cleaning businesses provide written information to their employees about hazardous chemicals used in the course of business and stored on site. The employer is required to label all chemicals with information relating to its hazard classification, and the employer must maintain safety data sheets (SDS) at each jobsite. In addition to having this information available, the employer is also responsible for training the employees on the proper handling of each chemical before they begin using it. Having a hazard communication standard in place can help you avoid an OSHA fine while also creating a safe work environment.

Proper Use of Personal Protective Equipment (PPE):

It is critical that all janitorial staff is trained on the proper use of PPE. PPE can help protect employees against harmful exposures that occur while performing their normal duties. Examples of PPE include gloves, masks, safety glasses, and back braces. Proper training on the use of PPE should be done with each employee and documented in their employee file. Supervisors should monitor the use of PPE by employees to ensure consistent use. If employees are seen not wearing the proper PPE for the task at hand, this should be addressed verbally, and in writing to minimize future injuries. Serious injuries and OSHA fines are avoidable if the proper use of PPE is taught and monitored.

Slip, Trips, and Falls:

One of the most common injuries in the janitorial industry comes from slips and falls. Some falls can result in serious injuries, workers’ compensation claims, lawsuits, and OSHA fines. The most common slip and fall hazard is from wet floors, typically while mopping. These wet floors not only pose a problem for janitors, they are also a huge concern for the general public. Common ways to avoid these types of injuries include using caution cones to alert people of the wet surfaces, closing off areas that are being cleaned, and mopping areas after hours when there is less foot traffic. Using caution cones and proper signage can warn others of wet surfaces to avoid serious injuries and OSHA fines.

Bloodborne Pathogen Standard:

For those janitorial businesses that work within a healthcare setting, it is imperative that they follow the Bloodborne Pathogen Standard. This policy establishes an easy and safe way to handle blood and other bodily fluids. If you work in a setting where blood contact is common, it is important that you have the proper training. Otherwise, it could result in an OSHA citation.

Record Keeping:

Proper record keeping is critical if and when your firm is presented with an unexpected OSHA visit. Keeping updated records such as your injury & illness protection program, safety data sheets, documented employee training, and employee handbooks can help avoid common administrative fines.

Organizing and implementing these strategies can be overwhelming for many janitorial companies that may not have the resources for full-time human resources directors and/or safety coordinators. Through the Risk Management Center, Rancho Mesa and MaintenanceOne™ offers clients the tools and programs that can proactively manage these risks and the documentation required to be prepared when OSHA knocks on your door. Reach out Jeremy Hoolihan at jhoolihan@ranchomesa.com or 619-937-0174 to learn more about how we can assist you.

Premium Cost Per Vehicle Continues to Increase for Landscape Professionals

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

Commercial auto premiums for landscape companies continue seeing heavy increases, and there is no end in sight.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

Commercial auto premiums for landscape companies continue seeing heavy increases, and there is no end in sight.

Knowing your cost per unit (CPU) is a critical component landscape owners and CFO’s must follow to properly monitor, budget, and forecast fleet related premium. Landscape companies with the lowest CPU’s minimize accident frequency and severity by practicing proactive and reactive risk management techniques.

Proactive management can include routine MVR checks, continuous driver monitoring, and ongoing driver training.

Reactive management can consist of reporting, analyzing, and correcting both near miss and post-accident incidents.

Fortunately for companies working with Rancho Mesa, we offer a number of video training series in English and Spanish including accident prevention, defensive driving, distracted driving, and more.

When an auto accident occurs, Rancho Mesa’s client services department will analyze the incident and recommend specific training back to our landscape customers, encouraging proactive safety and helping to mitigate future accidents.

What is your CPU, are you addressing accidents with training, and is your program leaking premium dollars?

For more information on how to help control rising premium costs, contact Drew Garcia at (619) 937-0200 or drewgarcia@ranchomesa.com.

Pure Premium and How It Impacts Your Company

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

The Workers Compensation Insurance Rating Bureau (WCIRB) is an agency that compiles essential data annually which determines how your Experience MOD is impacted.. These factors establish the baseline average MOD of 1.00 for California companies that produce enough payroll and premium to qualify within the guidelines. These factors can change year to year and represent a key rate trend indicator for all policyholders.

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

The Workers’ Compensation Insurance Rating Bureau (WCIRB) is an agency that compiles essential data annually which determines how your Experience MOD is impacted. These factors establish the baseline average MOD of 1.00 for California companies that produce enough payroll and premium to qualify within the guidelines. These factors can change year to year and represent a key rate trend indicator for all policyholders.

There are different rates generated for different classifications based on exposure and projected losses. The premium company’s pay for workers' compensation begins with multiplying the insurer's rate for the assigned classification(s) by the payroll developed in each classification. Workers' compensation rates are applied per $100 of payroll.

Pulling directly from the WCIRB website, “The WCIRB submits advisory pure premium rates to the California Department of Insurance (CDI) for approval. Insurer rates are usually derived from the advisory pure premium rates developed by the WCIRB and approved by the Insurance Commissioner. Advisory pure premium rates, expressed as a rate per $100 of payroll, are based upon loss and payroll data submitted to the WCIRB by all insurance companies. These rates reflect the amount of losses an insurer can expect to pay in benefits due to workplace injuries as well as the cost for adjusting and settling workers' compensation claims. Pure premium rates do not account for administrative and other overhead costs that an insurer will incur and, consequently, an insurer's rates are typically higher than the pure premium rates.” (WCIRB).

Of note, new pure premium rates were just released in September. Each carrier’s individual experience with all respective class codes also has an impact on these rates. Workers’ compensation has been in a soft market for the past several years with the expectation that rates will gradually start increasing. Following the change in pure premium rates is a great indication of where the marketplace is heading an effective way to better understand future costs that your company may be expecting.

With this in mind, engaging a broker that specializes in your industry and prepares you accordingly for the renewal process is a critical step in controlling workers compensation costs. Part of this process begins with understanding pure premium rates and how they ultimately will impact your MOD, carrier base rates, and your renewal pricing.

To discuss the current market or how your XMOD is affecting your workers’ compensation premium, contact me at (619) 438-6900 or ccraig@ranchomesa.com.

ADR Workers' Compensation Programs Reduce Litigation

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Workers’ compensation rates have fallen steadily over the last ten years, but businesses in California still pay the highest rates in the country. In addition, California has the highest frequency of permanent disability clams, the highest medical cost per claim and the highest litigation rates per claim.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Workers’ compensation rates have fallen steadily over the last ten years, but businesses in California still pay the highest rates in the country. In addition, California has the highest frequency of permanent disability claims, the highest medical cost per claim, and the highest litigation rates per claim.

To mitigate the friction within the workers’ compensation system, California and several other state legislatures in the early 1990s developed legislation that would permit unions and management to jointly develop an Alternative Dispute Resolution (ADR) program or “carve-out” agreement that resolves disputes outside the state workers’ compensation system with benefits that are at least equal to the benefits required by the Labor Code.

ADR is an alternative to the traditional approach to workers’ compensation claims. With ADR, an injured worker will report the injury and then use the services of a neutral ombudsmen hired by the union trust who is knowledgeable in workers’ compensation law to quickly determine if the injury is work related. The ombudsmen will recommend to the injured worker the appropriate treatment and other benefits owed within the carve-out agreement.

Union ADR provides employers with flexibility to manage the overall cost for their workers’ compensation program by promoting voluntary agreement early on with the injured worker on effective medical treatment to reduce litigation over the scope of medical treatment. ADR can also provide an accelerated claims resolution, faster medical treatment and potentially quicker return to work for the injured employee.

This process limits litigation with the services of an ombudsman and, if needed, mediation and arbitration procedures designed to resolve the claim quickly and appropriately. Since this is a very specialized arena, workers’ compensation carriers typically have a separate claims division that are well versed in the nuances of ADR claims.

To find out if your workers’ compensation carrier offers ADR programs or to learn more, I can be reached at 619-937-0167 or sclayton@ranchomesa.com.

Surety Keith Clements from Tokio Marine HCC

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

Rancho Mesa's Director of Surety Matt Gaynor interviewed Vice President of Tokio Marine HCC Surety, Keith Clements on Wednesday, September 15, 2021 to learn about his background, his role with Tokio Marine HCC and how the company fits into the surety marketplace.

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

Rancho Mesa's Director of Surety Matt Gaynor interviewed Vice President of Tokio Marine HCC Surety, Keith Clements on Wednesday, September 15, 2021 to learn about his background, his role with Tokio Marine HCC and how the company fits into the surety marketplace.

As a college student in Iowa, Keith had career options. Companies visited the college looking to recruit new grads. He jokes that he had a choice to either go into surety bonds, or sell Oscar Meyer wieners. He chose surety.

“I started looking around and thought, you know what? I like numbers… I think this bonding thing might sound pretty good,” Keith tells Matt.

After over 20 years in the industry, “I’m still trying to figure out if I like it,” Keith says jokingly.

Matt and Keith reminisced about processing bonds in the early 1980s and compare the old technology to today’s high-tech methods of getting the bonds issued.

Keith explains the types of surety bonds Tokio Marine HCC writes as an A++ XV rated company.

Listen to the full Ep. 135 to learn more about Keith and the Tokio Marine HCC Surety.

Best Practice Controls for Solar Contractors

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

As we continually build broad and competitive insurance programs for solar contractors in southern California, we recently interviewed a Senior Underwriter from a national workers’ compensation carrier in an effort to learn best practice controls for these types of risks. To our delight, this underwriter provided the top five controls their team looks for while reviewing a submission to quote. Having these controls in place can show an underwriter that your company deserves the best possible pricing available in the insurance marketplace…

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

As we continually build broad and competitive insurance programs for solar contractors in southern California, we recently interviewed a Senior Underwriter from a national workers’ compensation carrier in an effort to learn best practice controls for these types of risks. To our delight, this underwriter provided the top five controls their team looks for while reviewing a submission to quote. Having these controls in place can show an underwriter that your company deserves the best possible pricing available in the insurance marketplace:

1. Fall Protection

A written fall protection plan is in place and available for review

Employee training is documented

A competent person is able to assess fall hazards through a written hazard assessment prior to installation

There is familiarity with all fall arrest systems (e.g., yo-yos, ropes, lanyards, harnesses, and guardrails)

Rescue procedures and training on rescuing is in place

Assembly, maintenance, inspection, handling and storage of fall protection equipment is documented and organized

2. Responsive and Thorough Claim Reporting

Claims are reported same day

Claims are documented for future training opportunities

Witness statements from co-workers are documented

3. Outsourcing Delivery of Solar Panels to a Third Party

Minimizes the driving exposure to and from the jobsite

Lowers the material handling exposure

Reduces any potential lifting exposure while on a jobsite

4. Create a Smaller Radius of Work

Lessening of your company’s driving exposure, which in turn can lower the probability of any car accident leading to a claim

Company vehicles to return the same day which reduces any after-hours driving by employees

Allows for vehicles to be monitored more easily

5. Health Benefits are Provided

Lowers the probability of employees filing fraudulent claims

Increases overall employee wellness.

Some of these controls may be difficult or unrealistic to implement with your current business model. With workers’ compensation representing such a large line item on so many solar contractor’s profit and loss statements, engaging a forward-thinking insurance broker who can provide you additional resources and a clear renewal strategy is critical. At Rancho Mesa, we bring both of those tools to our relationships, utilizing our Risk Management Center to properly implement controls and our 20+ year history as leaders in the construction insurance marketplace.

To start a conversation about how we can assist your company, contact me at (619) 438-6874 or khoward@ranchomesa.com.

Performance-Based Workers’ Compensation Programs – Are Retros In Your Future?

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

In the past, we explored performance-based workers’ compensation programs. These plans can create a competitive advantage and an opportunity to monetize your company’s insurance program.

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

In the past, we explored performance based workers’ compensation programs. These plans can create a competitive advantage and an opportunity to monetize your company’s insurance program.

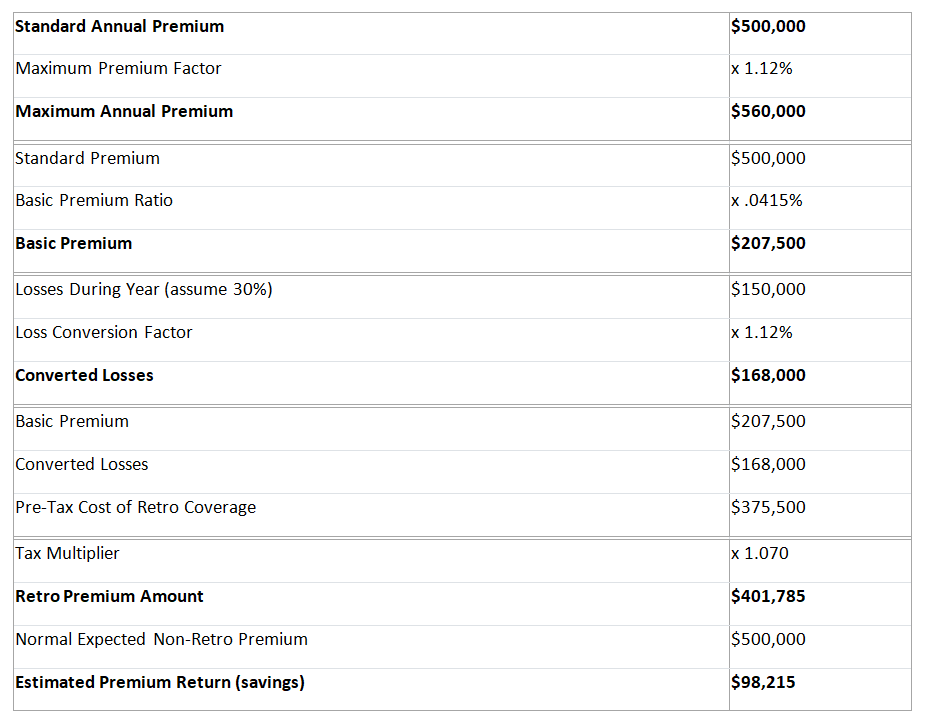

While we have previously discussed several of these programs in detail (i.e., captives and deductibles), another option that is often overlooked; Retrospective Rating Plan (retros), could possibly be the right next step for many businesses to explore.

Typically, these plans begin to make sense once a company’s annualized premiums exceed $500,000. They contain many elements and variables that must be analyzed and understood before inception, including:

maximum, basic, and minimum premiums

required letters of credit (LOC)

loss cost factor (LCF)

losses based on incurred or paid

potential return of premium

number and frequency of recalculation of the premium/losses

recapture of premium in future calculation if claims develop

claim buyouts

Are you a candidate for a performance based program?

Example of a Retro Workers’ Compensation Program

Assumes a $500,000 premium with a 30% incurred loss ratio

If you would like us to create a performance model for you and your team members to evaluate, contact Rancho Mesa at (619) 937-0164 or via our website. Or, complete our performance based insurance spreadsheet and submit to Alyssa Burley at aburley@ranchomesa.com

Risk Bow Tie Exercise

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

Rancho Mesa’s non-profit clients successfully serve their communities in changing economic and political climates. In part, their success is due to managing risk for an organization’s employees, clients, finances, and mission. Just as important, but less discussed than risk management, is risk analysis. This article offers one helpful tool non-profit leaders can use to facilitate risk analysis, the Risk Bow Tie Exercise.

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

Rancho Mesa’s non-profit clients successfully serve their communities in changing economic and political climates. In part, their success is due to managing risk for an organization’s employees, clients, finances, and mission. Just as important, but less discussed than risk management, is risk analysis. This article offers one helpful tool non-profit leaders can use to facilitate risk analysis, the Risk Bow Tie Exercise.

Introduced to Rancho Mesa by the Nonprofit Risk Management Center’s book World-Class Risk Management for Nonprofits, the Risk Bow Tie technique helps nonprofit leaders consider an event’s positive and negative consequences in a group setting. Following the exercise, participants may feel empowered to utilize the technique in multiple departments to analyze both expected and unexpected events.

The five steps of the bow tie exercise include:

Identify a potential event.

Identify some of the underlying conditions that make the event more or less likely, more or less impactful, and more or less urgent.

Identify some of the consequences or ripple effects, both positive and negative, should the risk materialize.

Identify preventative risk management steps or controls that could make the event less likely or less detrimental.

Identify risk management steps or controls that could be planned now, but implemented after the event has occurred, to reduce the potential negative consequences.

The image below, from page 152 of World-Class Risk Management for Nonprofits, is a sample Bow Tie Worksheet.

Risk Bow Ties Worksheet image provided by World-Class Risk Management for Nonprofits.

Performing the exercise in a workshop or group setting will usually provide one or more of the following insights:

The group uncovers details of an event that had not previously been discussed or observed.

Both positive and negative consequences can result from one event.

The exercise brings to light unique perspectives and experiences from multiple participants.

Identifying important underlying conditions and consequences better informs the creation of relevant controls.

Team members can perform a risk analysis in a fun, accessible and informal way.

Nonprofit leaders can use a diverse set of tools to analyze and manage risk. Rancho Mesa encourages clients to ask about various tools we have available to prepare for both the expected and unexpected.

To learn more about the Risk Bow Tie technique contact me at sbrown@ranchomesa.com or (619) 937-0175.

Mitigate Janitorial Industry’s Employee Theft Exposure

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Employee theft can be detrimental to any business and can come in many forms. Janitorial businesses, in particular, have an inherent risk of employee theft as employees often work alone at the client’s property with little to no supervision and access to valuables. Employee theft can start with smaller items that are easily overlooked and can quickly escalate. These types of losses are not only a financial burden, but can also tarnish the business’ reputation.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Employee theft can be detrimental to any business and can come in many forms. Janitorial businesses, in particular, have an inherent risk of employee theft as employees often work alone at the client’s property with little to no supervision and access to valuables. Employee theft can start with smaller items that are easily overlooked and can quickly escalate. These types of losses are not only a financial burden, but can also tarnish the business’ reputation.

Insurance companies typically break employee theft into two categories: 1st party and 3rd party theft or crime. When an employee steals directly from the employer, it is called 1st party crime. Examples of this include embezzlement, inventory theft, theft of supplies, and more. Third party crime occurs when an employee steals property from the employer’s client or vendor. Examples of this would include stealing property from a client’s premises such as laptops, cash, etc.

It is important to note that most insurance policies do not automatically cover employee theft. Those that extend coverage typically only offer 1st party crime via an endorsement and provide lower limits than stand-alone policies.

Janitorial companies can protect themselves from theft exposure by securing a fidelity bond or business services bond, a commercial crime policy, or through obtaining a specialty enhancement endorsement which adds 1st and 3rd party crime coverage to a package policy.

A fidelity bond protects a company if employees commit theft, fraud, or other dishonest acts. Most insurance policies exclude dishonest and malicious acts which includes employee theft.

A commercial crime policy and fidelity bond are similar in some respects, but they differ in that commercial crime insurance covers a wider range of threats, while fidelity bonds offer more targeted coverage. In addition to the offerings listed above, a commercial crime policy could cover crimes by people outside of the company, including burglary, theft, and forgery.

As mentioned, a third option is purchasing a 1st and 3rd party crime enhancement endorsement to the package policy. This is typically the most cost effective; however, these endorsements are usually only available through specialty programs specific to niche industries like janitorial and typically have limited access. Rancho Mesa’s MaintenanceOne™ Janitorial Program has access to markets that provide these specific endorsements.

To discuss these options in further detail, please reach out to me at 619-937-0174 or at jhoolihan@ranchomesa.com.

Top Five OSHA Citations the Tree Care Industry Should Avoid

Author, Rory Anderson, Account Executive, Rancho Mesa Insurance Services, Inc.

Every year, Federal OSHA conducts hundreds of inspections and issues costly citations to tree care companies. Although the Occupational Health OSHA citations can be issued for many reasons, there are five specific citations that continually plague the tree care industry every year.

Author, Rory Anderson, Account Executive, Rancho Mesa Insurance Services, Inc.

Every year, Federal OSHA conducts hundreds of inspections and issues costly citations to tree care companies. Although the Occupational Health OSHA citations can be issued for many reasons, there are five specific citations that continually plague the tree care industry every year.

1. Violation of standard 1910.132, PPE General Requirements

Employers of tree care companies can be cited for a violation if they fail to assess the workplace hazards, don’t provide personal protective equipment and fail to train employees on when and how to use it.

Average penalty: $1,300

2. Violation of standard 1910.1200, Hazard Communication

This citation is served if the employer lacks a hazard communication program for hazardous substances such as gas or hydraulic fluid periodically encountered in the tree care workplace.

Average penalty: $454

3. Violation of standard 5(a)(1), OSHA General Duty Paragraph

This is when an employer fails to provide a workplace free of recognized hazards. OSHA did not have a standard to describe the hazards specifically encountered in the tree care industry, but general duty citations usually cite passages from the ANSI Z133 standard.

Average penalty: $2,992

4.Violation of standard 1910.67, Vehicle-mounted Elevating and Rotating Work Platforms (e.g., bucket trucks and aerial lifts).

This citation can be issued if the employer fails to provide fall protection for the lift operator or fails to properly inspect the lift.

Average penalty: $3,325

5. Violation of standard 1910.135, Head Protection

This citation occurs when the employer fails to ensure that employees wear hard hats when required.

Average penalty: $1,262

As a tree care company, it is important that employee trainings routinely cover these five topics. While the standard safety training topics for the tree care industry are impactful (e.g., fall protection, chainsaw safety, etc.) and vital to your company’s safety success, these top five OSHA citations should be considered a high priority for regular review.

Access these specific trainings from our Risk Management Center library. If you’re not a Rancho Mesa client, please contact me at (619) 486-6437 or randerson@ranchomesa.com for a free Risk Management Center trial.

How Improving Equity Impacts Your Bond Program

Author, Andy Roberts, Account Executive, Surety Group, Rancho Mesa Insurance Services, Inc.

In our current series of articles, we are taking a deeper look into the properties of a balance sheet that will affect a contractor’s bonding capacity. We have previously discussed bonding capacity and summarized working capital in regards to the impact it can have on a contractor’s capacity. However, another very important component on the balance sheet that surety underwriters will consider is net worth, also referred to as equity.

Author, Andy Roberts, Account Executive, Surety Group, Rancho Mesa Insurance Services, Inc.

In our current series of articles, we are taking a deeper look into the properties of a balance sheet that will affect a contractor’s bonding capacity. We have previously discussed bonding capacity and summarized working capital in regards to the impact it can have on a contractor’s capacity. However, another very important component on the balance sheet that surety underwriters will consider is net worth, also referred to as equity.

Equity is calculated by subtracting a company’s total liabilities from their total assets on the balance sheet, and is a measurement that is used to determine their long term liquidity. From a bonding standpoint, surety underwriters love to see equity increase year after year. They analyze each item in the equity section of the balance sheet such as common stock, additional paid in capital, and shareholders’ loans. One item that carries a particularly large amount of weight is retained earnings.

Retained earnings represents the net income or profit that a company reinvests in its business after distributions are paid to the shareholders. This is important because as a general guideline we say a contractor can qualify for an aggregate bonding capacity that is ten times their company’s equity. Thus, their retained earnings heavily influence the overall equity of the company. Contractors looking to maintain a strong bond program, or increase their bond program, will want to retain as much profit in the company as they can. This allows their retained earnings and their equity to continue to grow through the years, making it even more important to have a knowledgeable and proactive bonding agent on your side. This should be someone who understands your business and overall goals, can analyze your balance sheet, and will discuss strategies with you to reach optimal capacity.

For many contractors, building a strong bonding capacity can create opportunities for significant revenue growth. Perhaps one of the more critical elements to note as you review your balance sheet is being educated on the importance of having strong retained earnings inside your financials. You can start this process and leapfrog your competitors when you request a quick capacity analysis from our surety team. They’ll provide you with a detailed evaluation.

To answer more questions about your bonding program, contact me at aroberts@ranchomesa.com or call my direct line at (619) 937-0166 and we can get started.

One Easy Step Can Improve Your Equipment Theft Prevention Program

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

A piece of heavy equipment like a skid steer, backhoe, or excavator can be a vital tool for a landscape company and is expensive to replace, if stolen. According to the National Equipment Register (NER), heavy equipment is nine-times more likely to be stolen than vandalized and five-times more likely to be stolen than encounter fire damage. These statistics are alarming and prove theft of heavy equipment has now become a billion dollar illegal industry.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

A piece of heavy equipment like a skid steer, backhoe, or excavator can be a vital tool for a landscape company and is expensive to replace, if stolen. According to the National Equipment Register (NER), heavy equipment is nine-times more likely to be stolen than vandalized and five-times more likely to be stolen than encounter fire damage. These statistics are alarming and prove theft of heavy equipment has now become a billion dollar illegal industry.

When confronted with these realities, business owners are comforted that they’ve purchased an inland marine insurance policy to cover the loss of a piece of heavy equipment. But, there is another step companies can take to reduce the likelihood that a piece of their equipment will be stolen or increase the chance that stolen equipment will be recovered.

HELPtech (i.e., heavy equipment loss prevention technology), is an online database that tracks heavy equipment. Law enforcement officials are able to utilize the information from the database to track and recover stolen equipment. Decals on the equipment alert would-be thieves that stealing this equipment and trying to sell it will be more trouble than it’s worth.

In some cases, insurance carriers are willing to waive the policy theft deductible, if the equipment that was stolen is actively registered through the NER - HELPtech database.

The NER also provides updated theft trends and security tips for best practices to help companies stay informed and up to date on activity across the country.

In partnership with the NER, Rancho Mesa can offer clients a 20% discount when utilizing HELPtech. Register your equipment, today.

To learn more about your heavy equipment exposure, contact me at (619) 937-0200 or drewgarcia@ranchomesa.com.

How Increased Material Costs Leave Contractors Underinsured

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Over the last 15 months, COVID-19 has brought numerous challenges to the construction industry. Second to only the labor shortage, the most pressing challenge faced by contractors is the spike in material costs which can leave them underinsured if a proper installation floater is not updated.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Over the last 15 months, COVID-19 has brought numerous challenges to the construction industry. Second to only the labor shortage, the most pressing challenge faced by contractors is the spike in material costs which can leave them underinsured if a proper installation floater is not updated.

Lumber, steel, copper, and other building material costs rose anywhere from 100% to 500% between April 2020 and May 2021, depending on the material. Since most projects are bid 6 to 18 months prior to the start of construction, many suppliers and subcontractors were caught off guard and did not reflect these increases in their initial bids.

Most contractors will purchase an inland marine policy that provides coverage for their miscellaneous tools, scheduled equipment, rented or leased equipment as well as an installation floater. It is important for contractors to understand the installation floater and how the increase in material costs could leave a contractor underinsured in the event of a loss.

An installation floater policy provides protection for direct physical loss or damage to materials, as well as supplies and labor costs for property being installed at jobsites. Materials are also covered while in transit and stored at temporary locations. The floater also extends coverage to the property until the installation work is accepted by the purchaser or when the insured's interest in the installed property ceases.

So, in the event of a covered loss, which includes fire, theft, explosions, transit-related damage and vandalism, a contractor’s installation floater will respond with coverage.

Proactive contractors should rely on their insurance advisor to discuss and design a program that addresses these unforeseen material and labor increases. In advance, consider the amount of product stored at any jobsite at one time, the amount of product that can be at risk in transit, the value of product stored offsite (i.e., storage units) and the protections in place that secure your product.

To discuss how an installation floater can protect your company, contact me at (619) 937-0167 or sclayton@ranchomesa.com.

ANSI Releases New Mobile Elevating Work Platforms Standards

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

Last year, the American National Standards Institute (ANSI) updated their aerial lift standard, starting with renaming it Mobile Elevating Work Platforms (MEWP). This has been in the works since 2018 and is designed to align training, certifications, and equipment used on a more universal standard. According to the Center for Construction Research and Training (CPWR), roughly 26 people die from MEWP each year. This prompted the Occupational Safety and Health Administration (OSHA) to increase training requirements to keep accidents to a minimum. Obviously, MEWP are essential for completing a wide variety of construction jobs. So, what should you, as a business owner, be doing to ensure your employees are safe and in compliance when OSHA comes by your jobsites?

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

Last year, the American National Standards Institute (ANSI) updated their aerial lift standard, starting with renaming it Mobile Elevating Work Platforms (MEWP). This has been in the works since 2018 and is designed to align training, certifications, and equipment used on a more universal standard. According to the Center for Construction Research and Training (CPWR), roughly 26 people die from MEWP each year. This prompted the Occupational Safety and Health Administration (OSHA) to increase training requirements to keep accidents to a minimum. Obviously, MEWP are essential for completing a wide variety of construction jobs. So, what should you, as a business owner, be doing to ensure your employees are safe and in compliance when OSHA comes by your jobsites?

MEWP are prone to tipping over on uneven ground and in inclement weather conditions, if equipment is extended out. The most common cause of the MEWP tipping over is driving it over uneven surfaces. Understandably, many contractors rush to complete projects but moving extended lifts can be the easiest way to have a serious accident. Alternatively, taking proper time to lower a lift before moving it leads to fewer serious accidents.

Identifying exposures and objects that conflict with a lift’s surroundings is also of great concern for lift operators. A very common occurrence involves employees being pinned between the lift and an object. It is easy to become fixated on either the ground or the direction the lift is moving and ”miss” objects that could be hazardous as you are raising and lowering the lift. Allowing for time to plan ahead and move the machinery safely is immensely important.

Many of these new requirements are focused on teaching proper equipment use and creating an awareness of the changes to new equipment in the marketplace. Inherently, these machines are dangerous but necessary. So, maintaining a respect for them and understanding how to properly use them is vital. Lift use trainings, techniques, and protocol are available through our Risk Management Center and are compliant with the new ANSI/SAIA A92.20, A92.22, and A92.24 standards that were just released, last year.

Please reach out to me at ccraig@ranchomesa.com or call at 619-937-0164 for more information, or for help assigning the trainings.

The Importance of Properly Classifying Stump Grinding Operations

Author, Rory Anderson, Account Executive, Rancho Mesa Insurance Services, Inc.

Because stump grinding is done from the ground, it can create some confusion for tree care companies on how to properly classify this exposure for workers’ compensation insurance. It’s important to understand how and where to classify this exposure, so you’re not setting yourself up for an issue at the audit. The Workers’ Compensation Insurance Rating Bureau defines all class codes to help companies classify specific operations. Let’s look at how they define 0106 Tree Pruning, Repairing or Trimming.

Author, Rory Anderson, Account Executive, Rancho Mesa Insurance Services, Inc.

Almost all tree care companies’ operations include stump grinding. Stump grinders are powerful machines that are designed to chew away and grind a tree stump down into little pieces, after a tree has been cut down. The operator guides the blade over the stump to take it down below ground level. Because stump grinding is done from the ground, it can create some confusion for tree care companies on how to properly classify this exposure for workers’ compensation insurance. A lot of tree care companies assume that because the employee operating the stump grinder is on the ground, it should be classified in 0042 – Landscape Gardening, which is more cost effective than classifying them in 0106 – Tree Pruning. However, this assumption is incorrect. It’s important to understand how and where to classify this exposure, so you’re not setting yourself up for an issue at the audit.

The Workers’ Compensation Insurance Rating Bureau defines all class codes to help companies classify specific operations. Let’s look at how they define 0106 Tree Pruning, Repairing or Trimming.

0106 Tree Pruning, Repairing or Trimming

This classification applies to pruning, repairing or trimming trees or hedges when any portion of the operations requires elevation, including but not limited to using ladders, lifts or by climbing. This classification includes clean-up, chipping or removal of debris; stump grinding or removal; and tree spraying or fumigating that are performed in connection with tree pruning, repairing or trimming. This classification also applies to the removal of trees that retain no timber value.

According to this definition, a tree care company must report stump grinding in 0106 if the stump grinding is in connection to the 0106 tree work that they performed. Even though the stump grinding operator is working from the ground, they must be classified as 0106 because the stump grinding is performed in connection with the 0106 tree work that they performed.

For example, a specific job calls for the removal of four valley oak trees. The arborists from a tree care company spend the morning climbing, trimming, and removing the four trees. A few hours later, the ground crew grinds all four stumps down using the stump grinder. Per the WCIRB classification definition, the ground crew who are operating the stump grinder must be classified in 0106 because it was in connection to the 0106 tree work that they (the company) performed.

The WCIRB also states that “stump grinding performed for other concerns on a fee basis and not in connection with tree pruning, repairing or trimming at a particular job or location shall be classified as 3724 – Millwright Work.”

To clarify, a tree care company may report stump grinding in the 3724 Millwright Work class code if it has no connection to 0106 tree work. So, in other words, you may only report stump grinding in 3724 if the job calls for only stump grinding.

For example, a homeowner has a stump in their backyard and calls a tree care company out to grind the stump down. This work may be classified in 3724 Millwright Work only if the tree care company did not trim or remove the tree first; they simply showed up and grinded the stump.

Having an insurance agent who specializes in the tree care industry is instrumental in building trust so that this critical information is communicated to you properly. With this information, you can have the confidence that you are reporting payroll correctly and avoid classification issues that can potentially arise at the final audit.

For questions about your operations and corresponding tree care classification codes, contact me at (619) 486-6437 or randerson@ranchomesa.com.

Historic Wildfire Losses Alter Risk Assessments for Many Buildings

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

The 2017 historic wildfire losses and ever-changing atmospheric conditions continue to alter the commercial property insurance marketplace in 2021.

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

The 2017 historic wildfire losses and ever-changing atmospheric conditions continue to alter the commercial property insurance marketplace in 2021.

Insurance carriers have used the CoreLogic® Wildfire Risk Score to evaluate risk and pricing since 2003 without significant changes to the Risk Score’s calculation. However, 2017’s wildfire season put change in motion.

According to CoreLogic, 2017’s fire activity increased in scope and occurred in areas that previously had not been considered high risk areas. Analysis of the fires’ impact noted the surprising intensity with which the fire spread and how the fires burned deep into urban residential neighborhoods without the traditional fuel sources one would expect to see. The analysis also determined that both wind and drought played a major role in the fires’ spread and severity.

Since 2017, California has experienced its most destructive fire in its history, the Camp Fire which burned in 2018 and its most destructive fire season on record in 2020. Analysis of the destruction and pre-fire conditions confirmed the relationship between drought and wind with the size and scope of the fires.

In response to the growing data set and changing conditions, CoreLogic now incorporates wind risk data and the drought factor into the 2021 Wildfire Risk Score. While some structures will see no change in risk score, other areas will be negatively impacted. The bottom line is the wildfire risk score will make some structure very difficult and costly to insure properly.

Rancho Mesa clients and brokers will continue to discuss the changing property insurance landscape as more information and underwriter feedback is gathered.

To discuss how to best insure your commercial property, please contact me at (619) 937-0175 or sbrown@ranchomesa.com.

Closing Your Bond Liability – Understanding the Consent of Surety Document

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

The project our contractor client was required to bond has been completed and they are looking to get their final payment and collect their retention. But the owner or general contractor is requiring a Consent of Surety document from our contractor. What is a consent of surety and why is this document required?

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

The project our contractor client was required to bond has been completed and they are looking to get their final payment and collect their retention. But the owner or general contractor is requiring a Consent of Surety document from our contractor. What is a consent of surety and why is this document required?

The Consent of Surety document is used by the owner to check with the bond company to determine if any claims or notices have been filed with the bond company that the owner may not be aware of. The form states:

The surety hereby approves of the final payment to the contractor, and agrees that final payment to the contractor shall not relieve the surety of any of its obligations to the owner.

Essentially, the bond company agrees that they still have responsibility for the contract even after final payment has been made.

Prior to approval of this document, the bond company will typically request the final contract amount of the bonded project. They may also request that the owner complete a bond status form to determine if any problems/complaints might have occurred on the project.

Once they are satisfied that the project has completed in good standing, they will authorize the bonding agent to issue the Consent of Surety document. They will also invoice for any additional bond premium if the contract increased in size.

For more information on the requirements for a Consent of Surety document and how it pertains to your contract, please contact me at (619) 937-0165 or mgaynor@ranchomesa.com.

Three Signs You’re Ready for Captive Insurance

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

As a business owner, you might hear about group captive insurance but are unsure whether or not it would be a fit for your business model. With auto rates rising dramatically and property and casualty premiums poised to shift upwards over the next 5 years, exploring a group captive could benefit your business. A group captive could help you potentially recover more than 60% of your premiums, generating substantial returns on your investment in safety.

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

As a business owner, you might hear about group captive insurance but are unsure whether or not it would be a fit for your business model. With auto rates rising dramatically and property and casualty premiums poised to shift upwards over the next 5 years, exploring a group captive could benefit your business. A group captive could help you potentially recover more than 60% of your premiums, generating substantial returns on your investment in safety.

So, how do you know if a group captive would be the right fit for your business? Below are three signs it is time to consider a captive option.

1 . Combined Premiums – Your annual premiums for workers’ compensation and commercial auto combined exceeds $100,000.

Many group captives have minimum premiums in the $250,000 to $500,000 range; however, Rancho Mesa represents group captives with minimums as low as $100,000.

2. Risk Controls – You have invested in risk controls in order to prevent or reduce losses and you would like to maximize your return on that investment.

Some examples of controls could be fulltime safety coordinators, GPS/telematic systems installed in all owned autos, pre-employment physicals and/or drug testing, and mandatory stretching or ergonomics, to name a few.

3. Performance – Your business continues to operate as a profitable risk for your insurance company partners.

If the business’ loss ratio is lower than its peers in your industry and your track record looks great, a group captive may be the right fit.

If the above list describes your business, a group captive could be a great long term solution.

To learn more about a group captive option, listen to our StudioOne™ Podcast Episode 86 where Rancho Mesa’s President Dave Garcia discusses captive insurance with Doug Hayden, Senior Vice President of Captive Resources.

If you have questions about if group captive insurance is right for your business, please do not hesitate to contact me at (619) 438-6874 or khoward@ranchomesa.com.

Californians Wait for Revised COVID-19 Prevention Emergency Temporary Standards

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

Over the past few weeks, Californians have eagerly awaited news from the State’s Occupational Safety and Health Standards Board (Standards Board) on revisions to Cal/OSHA’s COVID-19 Prevention Emergency Temporary Standards after the Centers for Disease Control (CDC) released its latest guidance that ease mask wearing for those who are fully vaccinated.

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

Over the past few weeks, Californians have eagerly awaited news from the State’s Occupational Safety and Health Standards Board (Standards Board) on revisions to Cal/OSHA’s COVID-19 Prevention Emergency Temporary Standards after the Centers for Disease Control (CDC) released its latest guidance that ease mask wearing for those who are fully vaccinated.

On June 3, 2021, the seven-member Standards Board first voted to deny a revised set of standards that would place additional requirements on business owners and most notably prevent fully vaccinated employees from being able to take off their masks in the workplace if everyone in the room was not vaccinated. However, in the same meeting, the Standards Board voted a second time which led to the approval of the revised standards which were set to go into effect no later than June 15, 2021 when the State is scheduled to fully reopen.

With pressure from businesses, community groups and California Governor Gavin Newsom, the Standards Board held an emergency meeting on June 9, 2021, where they unanimously voted to rescind the proposed standards previously approved on June 3, 2021.

If all of this sounds confusing, you are not alone.

As of the publication of this article on June 15, 2021, business owners should be following the COVID-19 Prevention Emergency Temporary Standards that were adopted in November 2020 and May 3, 2021’s Executive Order N-84-20 which allows for fully vaccinated people who have been exposed to a COVID-19 case, but show no symptoms, to remain in the workplace. Rancho Mesa has created a COVID-19 Prevention Plan template based on those requirements. It is available for download.

The Standards Board is scheduled to meet on June 17, 2021 where it is expected they will propose new standards that are more in line with the CDC’s masking recommendations. The agenda provides information on how to attend the virtual meeting.

When changes are made to the COVID-19 Prevention Emergency Temporary Standards, Rancho Mesa will update its COVID-19 Prevention Plan template and make it available to the public.

Stay up to date on this issue and others that affect California businesses by subscribing to our weekly Risk Management Newsletter and podcast.

Cyber Attacks Threaten One-in-Six Firms’ Survival

Author, Sam Brown, Vice President of the Human Services Group, Rancho Mesa Insurance Services, Inc.

The dramatic increase in cyber-attacks since 2020 has resulted in employer pain and made headlines as the economic cost skyrockets. The recent Hiscox Cyber Readiness Report 2021 states that the number of firms attacked rose from 38% to 43%. Not surprisingly, more than 28% of those employers suffered multiple cyber-attacks.

Author, Sam Brown, Vice President of the Human Services Group, Rancho Mesa Insurance Services, Inc.

The dramatic increase in cyber-attacks since 2020 has resulted in employer pain and made headlines as the economic cost skyrockets. The recent Hiscox Cyber Readiness Report 2021 states that the number of firms attacked rose from 38% to 43%. Not surprisingly, more than 28% of those employers suffered multiple cyber-attacks.

Determining the cost of a breach can be difficult, but the report states that one-in-six firms’ survival was threatened. Over 58% of firms hit with a ransom paid the threat-actors to regain access to the computer system and vital information. In 2020, the standalone cyber loss ratio increased to 73%, its highest level since separate cyber data were included in financial reporting, six years ago.

The increase in cyber-attacks and claim payouts is causing alarm in both insurance companies and businesses. According to the Insurance Journal, insurance companies are quoting significant premium rate increases and tighter coverage terms to improve underwriting performance and profitability. The average cyber renewal premium rate increased 11%. Meanwhile, written premiums for standalone cyber coverage increased 29% in 2020, a sign of growing demand.

The shift to a remote workforce and an increase in phishing email has tested network security systems. Fortunately, many insurance carriers now offer a cyber readiness assessment to help policyholders address vulnerabilities and avoid cyber-attacks.

As cyber-attacks continue, it is important for all employers to learn more about the specific exposures that cyber insurance coverage can cover along with ways to improve cyber security.

We will be offering a Cyber Liability workshop in the coming weeks, so be sure to look for that information on our workshops and webinars webpage.

Please contact me at (619) 937-0175 or sbrown@ranchomesa.com to discuss our process of developing competitive quote options.