Industry News

6 Steps for California SB1159 COVID-19 Reporting

Rancho Mesa Insurance Services, Inc. has developed a six step guide to help employers navigate through the reporting of COVID-19 cases to their insurance carriers per California Senate Bill 1159 (SB 1159). The document will lead you through specific employee scenarios that will determine if you should report the claim.

Rancho Mesa Insurance Services, Inc. has developed a six step guide to help employers navigate through the reporting of COVID-19 cases to their insurance carriers per California Senate Bill 1159 (SB 1159). The document will lead you through specific employee scenarios that will determine if you should report the claim.

California Governor Newsom signed SB 1159 into law September 17, 2020 and it is having several impacts on workers’ compensation and the presumption of the claim. These rules will continue, unless modified, until January 2023.

If the employer has fewer than 100 employees at a specific location and 4 employees test positive at that location, or if the employer has more than 100 employees and 4% of their total employees test positive, during a 14-day period at an employer’s specific location, the COVID-19 case is presumed to be work-related. Thus, the 4/4/14 rule. When in doubt, call your workers’ compensation carrier and discuss the specific situation. They will help you determine whether or not it is a workers’ compensation claim.

To learn more about the elements of SB 1159, please listen to a recent StudioOne™ Safety and Risk Management Network podcast episode, in which President of Rancho Mesa, Dave Garcia, and President of Berkshire Hathaway Homestate Companies, discuss the bill’s impact on the workers’ compensation market.

A Tree Care Company’s Guide to the Annual Workers’ Compensation Audit

Author, Rory Anderson, Account Executive, Tree Care Group, Rancho Mesa Insurance Services, Inc.

The premium for your workers’ compensation policy is based on the type of work you do, and the amount of payroll incurred. By maintaining proper payroll records, segregating the wages earned by your employees, you may reduce the cost of your workers’ compensation insurance. The final audit is the process that calculates the last premium due. It compares the estimated payrolls to actual wages paid during the policy year. The audit may result in a refund or additional premium due. Workers’ compensation audits also determine if the classification codes quoted at inception accurately reflect the scope of work performed during the policy period. Insurance carriers charge more premium for higher risk operations, like tree trimming.

Author, Rory Anderson, Account Executive, Tree Care Group, Rancho Mesa Insurance Services, Inc.

The premium for your workers’ compensation policy is based on the type of work you do, and the amount of payroll incurred. By maintaining proper payroll records, segregating the wages earned by your employees, you may reduce the cost of your workers’ compensation insurance. The final audit is the process that calculates the last premium due. It compares the estimated payrolls to actual wages paid during the policy year. The audit may result in a refund or additional premium due. Workers’ compensation audits also determine if the classification codes quoted at inception accurately reflect the scope of work performed during the policy period. Insurance carriers charge more premium for higher risk operations, like tree trimming.

In my last article, we looked at how it may be possible for a tree care company to use the 0042 landscape classification code at specific times, if they are trimming hedges or trees from the ground. We noted, however, that when any of the tree care company’s operations are off the ground, at any elevation, that payroll would be classified in 0106 tree trimming. Also, any type of work that is associated with the tree trimming (e.g., clean-up, chipping, stump grinding, etc.) would also be included as 0106.

The basis of premium is the payroll earned during the policy period. Payroll includes regular wages, salaries, overtime, bonuses, vacation pay, sick pay, commissions, cash payments, and other substitutes for money. Summarizing and segregating wages allows for the possible reduction of exposures and lower premium charges. Consider the following for potential adjustments at final audit:

If employees are engaged in both landscape construction/maintenance work, and tree trimming, you can segregate wages between operations and utilize both classifications. Earnings can be split by classification if time cards are maintained showing hours worked by activity, and payroll reports summarize hours and wages earned for each class. Segregation is based on records of actual hours worked; you cannot split earnings by percentages or projected bid calculations.

The wages for miscellaneous employees can be split by class if timecards segregate earnings by type of work performed. If no segregation is maintained, payroll will be assigned to the highest rated class.

Premium overtime is excludable if records document the hours and remuneration earned for regular hours and overtime hours. This includes earnings paid over and above the straight time earnings. If overtime is paid at one and one-half times the regular rate of pay, 1/3 of the total overtime pay can be excluded. If double time is paid, ½ of the overtime pay is excludable.

California allows the exclusion of deductions which are part of a Section 125 Cafeteria Plan. This might include medical, dental, and vision premiums. If these deductions are summarized by employee and by classification, they can be excluded from the workers comp wages.

Severance pay and tips are excludable. Maintain severance agreement letters documenting final payment agreements.

Depending on the type of entity insured, the earnings of sole proprietors, partners, and corporate officers may be excludable. Talk with your agent regarding qualifications and endorsements which can be issued as adjustments to your policy.

Workers’ compensation exposures may include costs for additional earnings paid outside of payroll. This could include bonuses, flat auto allowances, cash payments, casual labor, and subcontractors who could be considered employees. If subcontractors are hired, be sure to use licensed contractors who operate their own business. Always obtain and keep copies of the certificates of insurance from subcontractors to confirm independent coverage.

To prepare for final audit, maintain proper payroll records segregating and summarizing wages earned by your employees. The Auditor will:

Advise you on which reports to prepare for final audit. This typically includes payroll records and summaries, quarterly payroll tax reports, general ledger, cash disbursements, and/or 1099 reports.

Assist you in identifying cost saving measures. They will help to recognize and explain how to take advantage of all potential credits, such as premium overtime, severance, Cafeteria 125 plan deductions, etc.

Ask for a description of the business, and the job duties of employees to verify classification assignments.

Review all findings and suggestions, and address any additional questions you may have.

For questions about your annual audit, contact me at (619) 486-6437 or randerson@ranchomesa.com

Safety Programs Can Reduce Workers’ Compensation Premiums

Author, Daniel Frazee, Executive Vice President, Rancho Mesa Insurance Services, Inc.

As California business owners continue incurring costs as they work their way through the maze of ever-changing COVID-19 regulations and protocols, prioritizing critical elements of your internal safety program can directly lower your insurance costs. Refocusing on key areas below will help present an effective, detailed submission to the marketplace that will lead to talking points with an underwriter for schedule credits and ultimately, lower rates and premiums.

Author, Daniel Frazee, Executive Vice President, Rancho Mesa Insurance Services, Inc.

As California business owners continue incurring costs as they work their way through the maze of ever-changing COVID-19 regulations and protocols, prioritizing critical elements of your internal safety program can directly lower your insurance costs. Refocusing on key areas below will help present an effective, detailed submission to the marketplace that will lead to talking points with an underwriter for schedule credits and ultimately, lower rates and premiums.

Employee Benefits

Workers’ compensation underwriters pay close attention to employee benefit plans from a submission they are reviewing to quote. A deeper dive will create inquiries on overall employee participation, employer’s contribution to the plan, and whether established “wellness” plans are made available. High participation and contribution can show underwriters that employees value the benefits being offered and that the employer is investing in their most important asset, the employees. Lastly, industry professionals commonly link reduced fraudulent workers’ compensation claims to more robust, supported employee benefit programs.

Formal Safety Program

Developing a formal, documented Injury and Illness Prevention Program (IIPP) is truly just a baseline for managing risk for any business. The IIPP must be a living, changing document that contemplates random/periodic inspections, regular meeting intervals, safety orientation for new employees, and detailed investigative reports performed by field and management. Your program can be compared to a book that sits on the shelf and develops dust. Or, if you are focused on best practice techniques, it can be used as a tool for education, training, and risk mitigation. It should change as your company changes and incorporate the safety priorities instilled from the top down. Additionally, incorporating safety programs like Rancho Mesa’s RM365 Advantage Safety Star™ training program for foreman and supervisors help make your safety program go to the next level and really stand out in the insurance marketplace. Dynamic IIPPs stand out in a workers’ compensation submission process. They provide much needed detail to simple Yes/No questions on a supplemental application and show just how important safety is to the organization that is being underwritten.

Return to Work Program

Companies of all types will share that they support a return to work program when their injured employee is cleared for modified duty. That support needs to be taken a few steps further to improve your program. Create job descriptions for potential modified positions. Identify and engage with specific doctors within your network and ensure that these job descriptions are on file. This process can often help expedite employees back to the field, warehouse, office, etc. and ultimately lower temporary disability payments which can lower claim reserves. Use Rancho Mesa’s RM365 HRAdvantage™ portal to generate job descriptions and manage employee’s modified duty in the Risk Management Center.

Hiring Practices

Developing “gates” in the hiring process are often overlooked as too expensive or time consuming. But, the costs of bad hiring decisions can linger for years, impacting your bottom line and employee morale. Employers must strongly consider pre-employment physicals and drug testing, typically performed post interview and before an offer is made. As the Compliance Director for Current Consulting Group LLC, Andrew Current said, “The average cost of a pre-employment drug test is $45. The average turnover cost for an entry level employee is $6,600.” There is added benefit with workers’ compensation underwriters who view pre-employment checks as key controls to minimizing claim frequency and severity. Take advantage of the New Employee Onboarding Checklist and other resources in the RM365 HRAdvantage Portal.

Website Development

Most, if not all, workers’ compensation underwriters begin their review process by accessing the company in question’s website to learn more about their operation, exposures, risks, etc. Therefore, seeing your website through this same filter and utilizing your broker as an additional soundboard of information, consider these possible edits and/or redesign of your website:

Add a “Safety” link or tab, allowing space for sharing your company’s philosophy on managing risk.

Include a section on any safety awards or recognition that you may have received.

Remove any pictures on your website that might create confusion or concern about your operation as it relates to safety and risk.

Include examples of safety protocol that are unique to your operation (e.g. proper use of machinery, ladder usage, cleanliness of operating areas, etc).

Like any potential internal investment, companies must always balance whether the time and resource commitment will ultimately benefit their company. Many of the above recommendations require minimal resources and can pay huge dividends in consistently securing the most competitive workers’ compensation pricing, often a significant line item on a profit and loss statement. You may find cost savings in areas you did not know were possible that can help your business survive and remain profitable in these difficult times.

To discuss how your company’s safety program can affect your workers’ compensation premium, contact me at (619) 937-0172 or dfrazee@ranchomesa.com.

Risk Management and the Virtual Workforce

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

As American employers navigate the Coronavirus Pandemic, many business leaders quickly adapted to a virtual office and virtual workforce. While many organizations anxiously wait for the day employees can all safely head into the office Monday through Friday, employers must adjust risk management practices to account for the virtual workforce.

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

As American employers navigate the Coronavirus Pandemic, many business leaders quickly adapted to a virtual office and virtual workforce. While many organizations anxiously wait for the day employees can all safely head into the office Monday through Friday, employers must adjust risk management practices to account for the virtual workforce.

Cyber Crime

Prior to the pandemic, the FBI would routinely receive 1,000 cybersecurity complaints, daily. Since the COVID-19 outbreak began, the number of complaints has increased to 3,000 to 4,000 every day according to Tonya Ugoretz, deputy assistant director of cyber division of the FBI in a webinar hosted earlier this year. The most commonly targeted industries are health care, manufacturing, financial services, and public sector organizations. Stated plainly, cyber criminals are successfully exploiting weak virtual cybersecurity and poor execution on the part of remote employees.

Brett Landry of Landry IT, recently stated that 85% of employees circumvent “acceptable use” policies when using a company owned device, reinforcing the need for increased employee training.

Mr. Landry highly recommends employers update security patches on all devices, adopt a higher standard for password security, utilize two-factor authentication, and train employees how to recognize phishing and social engineering efforts.

How will a cyber liability insurance policy respond to this new threat?

Important questions to ask:

Will my policy cover a remote exposure?

Will my policy cover incidents involving personal devices?

Is Social Engineering covered?

Will my policy respond if an employee does not follow company procedures?

Workers’ Compensation

Allowing employees to work from home has resulted in some employees moving out of state. When this occurs, the employer should report the new working address to the insurance company to ensure the workers’ compensation insurance policy will cover an injury. In some cases, the insurance company can add the new location. If not, then the employer may need to purchase a separate workers’ compensation policy for that employee’s new state.

In an effort to manage the risk of employee injury, employers should design and implement work-from-home policies. Effective policies will clearly define work hours, communicate standards for a home office, train employees on ergonomics, reinforce work and safety rules, and remind employees of the claim reporting process. Establishing the above expectations may help employees avoid injury and legal disputes over compensability.

Directors & Officers Liability

Remember that a Directors & Officers Liability policy protects individuals from personal losses if sued for their role as a director or an officer of a company and not indemnified by the company. While a move to a virtual workforce doesn’t inherently put a board member at risk, big changes to company policy can result in missteps if employees do not receive proper communication and training. Ultimately, directors and officers are held accountable if company policies are not followed, highlighting the need for diligent execution of important company changes.

Rancho Mesa supports clients in developing employee manuals, work-from-home policies, and 2021 changes to labor law. Please contact me at (619) 937-0175 to discuss how Rancho Mesa can support your business or mission.

COVID-19 Workers Comp Surcharge Coming to California

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Adding frustration to the growing concerns for businesses dealing with COVID-19, the Workers’ Compensation Insurance Rating Bureau (WCIRB) has recommended California employers pay a COVID-19 surcharge on their 2021 workers’ compensation policies.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Adding frustration to the growing concerns for businesses dealing with COVID-19, the Workers’ Compensation Insurance Rating Bureau (WCIRB) has recommended California employers pay a COVID-19 surcharge on their 2021 workers’ compensation policies.

If approved, this new COVID-19 surcharge will vary by industry and have a minimum of $0.01 and hit a maximum of $0.24 per $100.00 of payroll. The industries with less of a COVID-19 exposure can expect a lower surcharge. While industries with a higher exposure can expect a greater increase. The additional surcharge my not seem like a lot, but multiplied by a company’s payroll, it can be significant to a company’s bottom line. Additionally, this surcharge will apply to all California employers, regardless if they had any COVID-19 illnesses.

The Workers’ Compensation Insurance Rating Bureau (WCIRB) approved the surcharge after growing concerns that the number of COVID-19-related workers’ compensation claims will continue to increase. It’s been estimated this year that 11% of all workers’ compensation claims in California have been COVID-19 related. The surcharge will help the insurance carriers mitigate the growing cost of the claims that could not have been anticipated when rates were calculated for 2020 policies. Even though COVID-19 claims will not be included in California’s companies’ Experience Modification Rates (i.e., XMOD, EMR), carriers will look to a number of variables in order to adequately price for an individual company’s premium. Those will include:

Overall claims experience

COVID-19 claims experience

The COVID-19 protocols and practices that are in place

Rancho Mesa, California union employer groups, as well as several carriers including the State Compensation Insurance Fund (State Fund), oppose the surcharge idea. Our feeling, as well as many of the others, is that most carriers are now underwriting specifically for COVID-19 by evaluating the businesses’ COVID-19 claim history and safe guards. Thus, there is no need for an additional surcharge.

In the next few weeks, we will release a follow up article that will highlight the best practices employers can implement now to minimize the COVID-19 impact to their organization and 2021 workers’ compensation renewal pricing.

For questions about workers’ compensation and the COVID-19 surcharge, contact me at (619) 937-0167 or sclayton@ranchomesa.com.

California’s Workers’ Compensation Landscape May Reach a Valley in Coming Year

Author, Drew Garcia, Vice President of the Landscape Group, Rancho Mesa Insurance Services, Inc.

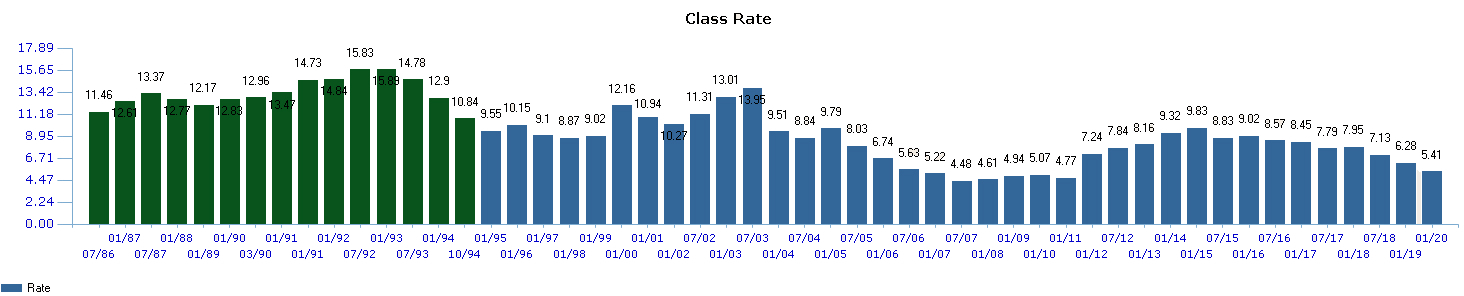

The workers’ compensation market for landscape companies in California has remained in a downward trend since 2015. As a result, landscape business owners have realized lower rates and subsequently aggressive premiums. The following are some key insights to help landscape businesses prepare for their 2021 workers’ compensation insurance renewal.

Author, Drew Garcia, Vice President of the Landscape Group, Rancho Mesa Insurance Services, Inc.

The workers’ compensation market for landscape companies in California has remained in a downward trend since 2015. As a result, landscape business owners have realized lower rates and subsequently aggressive premiums.

The following are some key insights to help landscape businesses prepare for their 2021 workers’ compensation insurance renewal.

For Experience MOD (XMOD) purposes, it’s important to know the Expected Loss Rate (ELR) for the landscape class code (0042) has decreased 8% over last year, $2.38 per $100. With a lower ELR comes an adverse effect for landscape companies’ individual XMOD, as a result of lower expected losses. Lower ELRs also drive down the primary threshold, amplifying each claim’s impact on the XMOD. Have your 2021 XMOD projected early to identify any possible implications.

Pure premium rates are developed by the Workers' Compensation Insurance Rating Bureau of California (WCIRB) and approved by the insurance commissioner to reflect the expected losses and loss adjustment expenses for each class code. Insurance carriers can then use these rates to come up with their own base rates to establish premiums. Pure premium for the landscape industry is down 8% over last year, from $5.61 to $5.14. The WCIRB also added a $.06 surcharge for COVID-19 claim impacts for the landscape industry. The Landscape Industry was labeled under tier 3 of 5, were the $.06 surcharge will be applied. Other tiers such as 4, 5, and 6 saw $.012, $.18, and $.20 surcharges as it was deemed those industries have a larger exposure share to COVID claims. In the end, with the surcharge, Pure Premium is slightly down and theoretically should lower carrier base rates.

Watch a 10-minute webinar where Drew Garcia explains the California Workers' Compensation marketplace for the landscape industry.

Areas like Los Angeles Country, Riverside County, and San Bernardino Country have had higher claims activity and claim outcomes than other parts of the state. Carriers use territory factors to more accurately align their premium for your business, depending on your location. Territory factors can either credit or debit your policy based on the location of your business or surrounding areas where you operate. For example, if you are a landscape company in Riverside County but doing business in San Diego Country, make sure you are breaking out these operations so your underwriter can accurately evaluate the correct percentage of operations in Riverside vs. San Diego.

The average base rate filed by insurance carriers for class code 0042 is $10.63, which is down 7% over last year. Carriers determine base rates based on industry appetite, historical loss experience, pure premium rates, and overhead. Not all carriers have an appetite for landscape business and the lowest base rate does not mean the lowest net rate. Insurance carriers have the ability to apply “schedule rating” which is a list of criteria they file for with the California Department of Insurance to allow underwriters the ability to deviate off the price.

In 2019, the top three carriers writing workers’ compensation insurance in California by premium volume was State Fund (10.56%), Berkshire Hathaway Homestate Companies (7.12%), and Insurance Company of the West (6.94%). Rounding out the top ten were Hartford, Travelers, AmTrust, Zurich, Chubb, Fairfax, and Employers.

Our advice for 2021:

Have your companies 2021 XMOD projected today, if not at least 6 months before your policy is set to renew.

Meet with your insurance professional 120 days before renewal to determine the renewal strategy.

If you are discussing different carrier options with your agent, ask the next level questions:

What other landscape companies does this carrier work with?

What is their rating?

How long have they written workers’ compensation in California?

Are claims handled in house or by a third party?

The numbers above indicate the perpetuation of a soft market, however, we are steadily seeing the delta of decrease shorten. Take this information to help your company formulate your renewal strategy and impact the discussions you have with your insurance agent in 2021.

If you have questions about your workers’ compensation renewal, contact me at (619) 937-0200 or drewgarcia@ranhcomesa.com.

SB 1159 Is Now Workers’ Compensation Law

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

As expected, California Governor Newsom signed Senate Bill 1159 (SB 1159) into law Thursday, September 17, 2020 and it will have several impacts on workers’ compensation and the presumption of the claim. Below is an outline of some of the more important elements of SB 1159. In simple terms, just remember three numbers, 4/4/14 - I’ll explain, later.

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

As expected, California Governor Newsom signed Senate Bill 1159 (SB 1159) into law Thursday, September 17, 2020 and it will have several impacts on workers’ compensation and the presumption of the claim. Below is an outline of some of the more important elements of SB 1159. In simple terms, just remember three numbers, 4/4/14 - I’ll explain, later. Additionally, these rules will continue, unless modified, until January 2023. So, SB 1159 may be around for a while.

If an “outbreak” occurs, for the presumption of the claim to rest with the employer (meaning it will be presumed the person testing positive for COVID-19 contracted it at work and is therefore eligible for workers’ compensation benefits), there are several factors that need to be meet for that to occur.

If the employer has fewer than 100 employees and 4 employees test positive, or if the employer has more than 100 employees and 4% of their total employees test positive, during a 14-day period at an employer’s specific location, the COVID-19 case is presumed to be work-related. Thus, the 4/4/14 rule. When in doubt, call your workers’ compensation carrier and discuss the specific situation. They will help you determine whether or not it is a workers’ compensation claim.

Rob Darby, President of Berkshire Hathaway Homestate Companies, the second largest writer of workers’ compensation insurance in California and I discuss SB 1159 in a recent StudioOne™ Safety and Risk Management Network podcast episode “SB 1159 Impacts Workers' Comp Market.” A week before Governor Newsom signed the bill, Rob and I discussed the impacts of the bill to get an early insight. Take a listen - I think you will find it useful.

Now comes possible confusion with SB 1159. What is considered an outbreak? What is the definition of a specific location?

Outbreaks

The section of the law (Labor Code 3212.88) applies to any employee other than frontline workers and healthcare workers who test positive during an “outbreak” at the employer’s place of business, if the employer has 5 or more employees.

COVID-19 is presumed work-related if an employee worked at the employer’s place of business at the employer’s direction on or after July 6, 2020 and both the following elements are met:

The employee tested positive for COVID-19 within 14 days after working at the employer’s location.

The positive test occurred during an “outbreak” at the employer’s specific location.

An “outbreak” is defined as a COVID-19 occurrence at a specific employment location within a 14-day period AND meets one of the following:

If an employer has 100 employees or less at a specific location and 4 or more employees test positive for COVID-19;

If an employer has more than 100 employees at a specific location and 4% of the employees test positive for COVID-19;

The local public health department, State California Department of Public Health or Occupational Safety and Health Administration (Cal/OSHA) or school superintendent orders the specific place of employment to close due to risk of COVID-19 infection.

A specific location or place of employment is a building, store, facility or agricultural field where an employee performs work at the employer’s direction. An employee’s home is not considered a specific place of employment unless the employee provides home health care services to a client at the employee’s home. An employee may have more than one specific place of employment, if they worked in multiple locations within the 14-day period before their positive test.

There is a 45-day timeframe to determine if a positive COVID-19 case meets the above standard.

Outbreak Reporting Requirements

When an employer knows or reasonably should know that an employee has tested positive for COVID-19, they must report the incident to their workers’ compensation carrier. They should be prepared with the following information to give the carrier.

The fact that an employee has tested positive, regardless if work-related or not.

Employers should not include any personal information regarding the employee who tested positive for COVID-19 unless the employee asserts it is work-related or files a claim form.

The date the specimen was collected for the employee’s COVID-19 test.

The specific address or location of the employee’s place(s) of employment during the 14-day period preceding the date the test specimen was collected.

The highest number of employees who reported to work at the specific location(s) in the 45-day period before the last day the COVID-19 positive employee worked there.

It best practices to follow all local, state and federal guidelines for safe workplaces. However, even with the best intentions and precautions, COVID-19 may accidentally spread to employees. Again, when in doubt, report an employee COVID-19 case to your workers’ compensation carrier and allow them to determine how to proceed.

For questions about SB 1159 and how it with affect your organization’s workers’ compensation, contact your broker or reach out to Rancho Mesa at (619) 937-0164.

The Importance of Timely Workers’ Compensation Claims Reporting

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

Injuries, accidents, and mistakes happen. When a work-related injury occurs, a common reaction from many business owners is an instinct to NOT report the injury to their workers’ compensation carrier for fear of increasing their company’s Experience Modification (EMR). However, they couldn’t be more wrong. Timely reporting of all claims is the first step in controlling claim costs and lowering their EMR.

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

Injuries, accidents, and mistakes happen. When a work-related injury occurs, a common reaction from many business owners is an instinct to NOT report the injury to their workers’ compensation carrier for fear of increasing their company’s Experience Modification (EMR). However, they couldn’t be more wrong. Timely reporting of all claims is the first step in controlling claim costs and lowering their EMR.

Best Practices would demand that all claims get reported within 24 hours, if at all possible. By doing this, it provides the best possible outcome and will impact the claim in several positive ways:

Reducing Fraudulent Claims

One of the biggest frustrations in the workers’ compensation industry for most employers are the number of fraudulent claims that find their way into the system. Immediate accident investigation, witness statements and pictures followed by reporting the claim to the carrier within 24 hours of the injury, will give the employer and the carrier the best opportunity to deny a claim. The insurance carrier only has 90 days from the date of injury (not from the date reported) to deny a claim. This shortens that time-frame and allows more fraudulent claims into the system.

Lowering Litigation Rates

Another area employers find both frustrating and costly are the number of litigated claims that occur within the workers’ compensation system. Litigated claims on average will add 30% to 35% to the ultimate cost of a claim. While there are many ways employers can impact this area, perhaps the most controllable is the timely reporting of any injury. To further support this, it has been proven that the litigation rate for claims goes up 300% if the claim is reported 5 or more days after the injury occurred.

Identifying Claim Trends Early

By not reporting all claims or by reporting them late, employers can develop unreliable data in their effort to identify claim trends and root causes. Without this information, businesses in all sectors run the risk of a severe injury occurring from an area that could have been addressed if all claim data was accurate and analyzed.

When an injury occurs, do a thorough accident investigation that details all events that caused the injury and immediately call your workers’ compensation carrier. This one habit alone will help you lower claim costs and manage your EMR.

To learn more about this process, including benchmarking and analytics that can help control your loss ratio and lower premiums, please reach out to me, Casey Craig at (619) 438-6900 or ccraig@ranchomesa.com.

California Workers' Comp Carriers React to Commissioner's COVID-19 Amendment Approval

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

With California Insurance Commissioner Lara’s recent approval of a special regulatory filing introduced to alleviate the burden COVID-19 workers’ compensation (WC) claims threaten to have on California employers, we reached out to several prominent carrier executives to share their thoughts.

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

With California Insurance Commissioner Lara’s recent approval of a special regulatory filing introduced to alleviate the burden COVID-19 workers’ compensation (WC) claims threaten to have on California employers, we reached out to several prominent carrier executives to share their thoughts.

The amendments address accounting for employees whose job duties have changed to clerical work, which is typically a less expensive workers’ compensation insurance classification than the jobs they were performing prior to Governor Newsom’s March 19, 2020 Stay-at-Home Executive Order. It also excludes payroll for furloughed employees who are not working, but collecting a paycheck. It creates a way to identify COVID-19 cases within the California workers’ compensation system and excludes the cases from the Experience Modification Rate (XMOD) calculation.

When asked about the amendments scheduled to take effect July 1, 2020, Margaret Hartmann, Senior Vice President and Chief Marketing Officer at Berkshire Hathaway Homestate Companies, California’s second largest workers’ compensation insurance carrier, said “Lara’s approval of the WCIRB [Workers’ Compensation Insurance Rating Bureau] proposal was not surprising. These are not unreasonable, at least from the perspective of ratemaking and predicting future experience of employers once COVID passes.”

Bryan Anderson, Senior Vice President at The Zenith explained the WCIRB’s amendments to the California Unit Statistical Reporting Plan and XMOD calculation were “not likely to change under any normal circumstances but the Bureau made these recommendations to address the unique pandemic situation that California (and the world’s) businesses find themselves in."

Another industry leader Paul Zamora, ICW Group’s Senior Vice President for Workers’ Compensation Underwriting said, “We support Commissioner Lara’s decision to approve the recommended changes by the WCIRB. We believe the rule modifications accurately reflect changes in exposures created by COVID-19 and will provide the appropriate relief needed by California businesses.”

The changes were expected by California’s workers’ compensation insurance carriers as a mechanism to adjust employers’ insurance rates, since COVID-19 claims aren’t necessarily an indicator of a company’s safety record.

“Under normal situations,” Anderson explained, “workers’ compensation covers only those occupational illnesses that are created from the work environment. In this instance, that understanding changed with the Governor’s Executive Order requiring employers to accept compensability for Covid-19 claims unless they can prove they are not work-related.”

Hartmann added, “This is clear cost-shifting to the industry, which we expected. The combination of a broad WC presumption, possible additional legislation extending these presumptions past July 5th, excluding COVID from ratemaking and XMODs, means that the insurance industry will absorb the lion’s share of COVID costs that can be assigned to WC.”

Zamora points out “it’s imperative that business owners understand the rule changes and adopt new practices, particularly with respect to the record keeping criteria associated with two of the changes. By adopting new record keeping procedures to apply to the new rules, policyholders will have the necessary audit documentation to realize the full value of Commissioner Lara’s decision.”

This means employers should start documenting employees’ hours worked under each class code, now, and not wait until a final audit.

“Hopefully, these measures will play a small part in helping California employers as they try to recover from the devastating impacts of this pandemic,” Hartmann concluded.

“I think this solution is a testament to the strength and objectivity of the Bureau, the companies it represents and to the integrity of the Workers’ Compensation Industry in California,” said Anderson.

Gene Simpson, CompWest’s Vice President of Underwriting and Marketing, added, “To confront the challenges presented by the COVID-19 pandemic to California employers, regulatory authorities, insurance carriers and employers must work together on effective solutions.”

While the amendments should reduce workers’ compensation premium costs for California businesses in the short-term, only time will tell how lower revenues and higher costs due to COVID-19 claims will impact California’s workers’ compensation insurance premiums in the future.

For a greater understanding of these changes and how they will impact your company, please contact our team at (619) 937-0164.

Workers’ Compensation Claim Advocacy: Distinguishing Good from Great

Author, Jim Malone, Workers’ Compensation Claims Advocate, Rancho Mesa Insurance Services, Inc.

As the new normal continues evolving through this pandemic, advocates are needed across all industries and sectors. Businesses and their employees exposed to the risk of workers’ compensation injuries and illnesses need the highest level of advocacy now, more than ever.

Author, Jim Malone, Workers’ Compensation Claims Advocate, Rancho Mesa Insurance Services, Inc.

As the new normal continues evolving through this pandemic, advocates are needed across all industries and sectors. Businesses and their employees exposed to the risk of workers’ compensation injuries and illnesses need the highest level of advocacy now, more than ever.

Like so much of what we experience in our daily interactions, establishing a baseline of competence in any field has varying levels of effectiveness. That is, there are good claim advocates and then there are great ones; high-level claim liaisons that can make organizations more knowledgeable and stronger.

What are the characteristics that make up the great ones? And, what should you expect with their involvement in your workers’ compensation program?

The first pre-requisite for any workers’ compensation claim advocate is experience. Ideally, having multiple years working as a claim adjuster and managing a case load for an insurance company is vital. While this creates a solid base, stopping here can limit the effectiveness for employers in other critical areas. In order to begin to go from good to great you should expect your advocate to have one or more of the following experiences to offer the broadest perspective possible for your team:

Background with return-to-work programs, in development, implementation and management.

Experience from being a workers’ compensation administrator for a self-insured employer with the State of California and Department of Industrial Relations

Obtaining years of training in diagnosing and treating industrial injuries from occupational medicine, orthopedic surgical, spinal surgical and pain management physicians.

Providing years of training to workers compensation physicians on treatment and disability management of work injuries and preparing med-legal reports and addressing permanent impairment ratings, causation, apportionment, contribution and all other issues.

Or the very rare experience of suffering a work injury, requiring surgeries and rehab, concern for losing one career and starting over in another, and going through the entire workers compensation process through settlement

Secondly, using these technical experiences in review and oversight of claims is both tangible and measurable. That includes:

Ensuring the accuracy of claim statuses and plan of actions.

Recognizing when claim reserves are adequate or inflated.

Pushing for claim closures in the most efficient and cost-effective resolutions.

Forming a deep, consultative bond that elevates a claim advocate to that of a trusted partner.

The final component in establishing a superior workers’ compensation advocate is building strong, respectful relationships with adjusters and employers. This requires the most experienced advocate creating a “partnership environment” that allows for continual open dialogue, which very often expedites the entire claim process. The most effective of these professionals build this environment through direct communication with the adjuster(s), supervisors, and even claim department managers. That information is then thoroughly and simply shared with employers in regular intervals through formal claim reviews, safety committee meetings, and/or pre-renewal meetings involving the broker.

As a 35-year industry veteran of the claims management field, I proudly serve the Rancho Mesa team with a core commitment to providing great contributions to the claims management process. These contributions are predicated on bringing my extensive knowledge and experiences from all sides of the workers’ compensation claim process, to my advocacy role for you, my client… the employer.

Commissioner Lara Approves WCIRB Proposed Amendments Addressing COVID-19

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

California Insurance Commissioner Lara has approved, as filed, the proposed special regulatory filing submitted by the Workers’ Compensation Insurance Rating Bureau (WCIRB) concerning proposed amendments addressing the Coronavirus Disease (COVID-19). The special regulatory filing is effective July 1, 2020 and will apply retroactively starting March 19, 2020, the day California Governor Newsom issued the Stay-at-Home Executive Order N-33-20. Those amendments are as follow…

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

California Insurance Commissioner Lara has approved, as filed, the proposed special regulatory filing submitted by the Workers’ Compensation Insurance Rating Bureau (WCIRB) concerning proposed amendments addressing the Coronavirus Disease (COVID-19). The special regulatory filing is effective July 1, 2020 and will apply retroactively starting March 19, 2020, the day California Governor Newsom issued the Stay-at-Home Executive Order N-33-20. Those amendments are as follows:

New COVID-19 Rule: Clerical Office Employees

Part 3, Section III, General Classification Procedures, was amended to add Rule 7, Coronavirus Disease 2019 (COVID-19), to permit during a statewide California COVID-19 stay-at-home order the following: The division of an employee’s payroll between Classification 8810, Clerical Office Employees, and a non-standard exception classification when the employee’s work is exclusively clerical in nature and the non-standard exception classification does not include Clerical Office Employees. This amendment will conclude 60 days after the Stay-at-Home Executive Order N-33-20 is lifted.

New COVID-19 Rule: Basis of Payroll

Part 4, Section IV, Exposure Information, Rule 1, Classification Code, and Rule 4, Exposure Amount, were amended to report payments excluded from remuneration pursuant to new Rule 7, Coronavirus Disease 2019 (COVID-19). Payments made to an employee while the employee is performing no duties of any kind in service of the employer are to be excluded from payroll when the payments are equal to or less than the employee’s regular rate of pay. This amendment will conclude 30 days after the Stay-at-Home Executive Order N-33-20 is lifted.

New COVID-19 Rules: Claims Reporting

Part 4, Section V, Loss Information, Rule B, Loss Data Elements, Sub rule 4, Catastrophe Number, was amended to add Catastrophe Number 12 for the reporting of COVID-19 claims. Appendix III, Injury Description Codes, Section B, Nature of Injury (Positions 3-4), and Section C, Cause of Injury (Positions 5-6), were amended to add a Nature of Injury code and a Cause of Injury code for COVID-19 claims. This amendment includes claims with an accident date after December 1, 2019, reported on a Unit Statistical Report due on or after August 1, 2020, and reported with a Catastrophe Number 12.

Exclusion of COVID-19 Claims from Experience Modification

Section VI, Rating Procedure, Rule 2, Actual Losses and Actual Primary (Ap) Losses, was amended to specify that all claims directly arising from a diagnosis of Coronavirus Disease 2019 (COVID-19) shall not be reflected in the computation of an experience modification.

For a greater understanding of these changes and how they will impact your company please contact our team at (619) 937-0164.

CA Governor Issues Executive Order Making Workers’ Compensation Benefits More Readily Available to Essential Workers

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

On Wednesday, May 6 2020, California Governor Gavin Newsom issued an Executive Order making workers’ compensation benefits more readily available to essential workers.

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

On Wednesday, May 6 2020, California Governor Gavin Newsom issued an Executive Order making workers’ compensation benefits more readily available to essential workers.

The Executive Order states “any COVID-19-related illness of an employee shall be presumed to arise out of and in the course of employment for purposes of awarding workers’ compensation benefits if all of the following requirements are satisfied:

a. The employee tested positive for or was diagnosed with COVID-19 within 14 days after a day that the employee performed labor or services at the employee’s place of employment at the employer’s direction;

b. The day referenced in subparagraph (a) on which the employee performed labor or services at the employee’s place of employment at the employer’s direction was on or after March 19, 2020;

c. The employee’s place of employment referenced in subparagraphs (a) and (b) was not the employee’s home or residence; and;

d. Where subparagraph (a) is satisfied through a diagnosis of COVID-19, the diagnosis was done by a physician who holds a physician and surgeon license issued by the California Medical Board and that diagnosis is confirmed by further testing within 30 days of the date of the diagnosis.”

Insurance companies have 30 days from the date of a COVID-19 diagnosis to rebut with evidence.

According to the Executive Order, the presumption pertains only “to dates of injury occurring through 60 days following the date of this Order.”

The order establishes a rebuttable presumption that any essential workers infected with COVID-19 contracted the virus on the job. It is important to understand the order shifts the burden of proof from the injured worker and now requires employers or insurance companies to prove the employee didn’t get sick at the place of work.

Prior to the change, it was difficult to prove workers’ compensation claims related to a COVID-19 infection.

Rancho Mesa’s Response

In response to the Executive Order and other proposed rule changes, Rancho Mesa President David Garcia interviewed Berkshire Hathaway Homestate Companies President Rob Darby on the impact to California businesses and the workers’ compensation market. Berkshire Hathaway is one of the largest workers’ compensation insurance companies in California.

Read Governor Newsom’s Executive Order on Cal/Gov website.

Please contact your Rancho Mesa broker with questions specific to your business.

Special COVID-19 Workers' Compensation Filing and Executive Order Imminent

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

The Workers Compensation Insurance Rating Bureau (WCIRB) voted unanimously this past Friday, April 17, 2020, on a special filing and sent it to the Insurance Commissioner for signature. If approved, this order would…

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

The Workers’ Compensation Insurance Rating Bureau (WCIRB) voted unanimously this past Friday, April 17, 2020, on a special filing and sent it to the Insurance Commissioner for signature. If approved, this order would:

Exclude COVID-19 claims from the experience rating formula.

Exclude from premium calculations payroll paid to employees who are continuing to be paid while not working.

Allow the assignment of Classification 8810 on a temporary basis to employees who are now working from home whose temporary duties meet the definition of a clerical office employee.

Each of these changes will have their own nuances and it remains to be seen how exactly their implementation, auditing and tracking will be put into practice.

Separately, but equally important, Governor Newsom is considering an executive order that would create a “conclusive presumption” that COVID-19 illnesses and deaths sustained by “essential workers” are work related and therefore covered under workers’ compensation policies. The potential scope and impact of the order are not yet known, but on April 20, 2020, the WCIRB released a projection that the annual cost of COVID-19 claims on “essential critical infrastructure” workers, under a conclusive presumption, ranges from $2.2 billion to $33.6 billion.

These decisions, should they be implemented, will create significant disruption in the workers’ compensation marketplace and to all insurable businesses in California. As these decisions are rendered, Rancho Mesa will continue to provide resources and implementation strategies to help businesses adjust through these uncertain times. If you have questions or want to discuss this in greater detail please reach out to your broker or account manager.

Potential Workers’ Compensation Changes Due to COVID-19 Claims

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

Last week the Workers’ Compensation Insurance Rating Bureau (WCIRB) began developing emergency regulations resulting from the COVID-19 crisis that will be presented to the Insurance Commissioner in the coming weeks. The major areas to be addressed are…

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

Last week the Workers’ Compensation Insurance Rating Bureau (WCIRB) began developing emergency regulations resulting from the COVID-19 crisis that will be presented to the Insurance Commissioner in the coming weeks. The major areas to be addressed are:

Experience Rating Calculations

Dave Bellusci, Chief Actuary at the WCIRB, indicated that they are “leaning toward excluding COVID-19 claims from the calculation.” This would entail setting up new nature of injury and cause of injury codes that would identify these claims.

They are also leaning towards excluding the payrolls for workers who are not working because of the pandemic and shelter-in-place orders but who are still receiving all or a portion of their salaries or are being paid through sick leave benefits.

Class Code Classifications

Those sheltered-in-place workers who are being paid and either not working their customary jobs or not working at all has created a question about how that payroll should be classified for premium purposes. Should that payroll be classified in its usual class code or be adjusted into another class code such as clerical or a code specific to COVID-19. These are all questions being considered.

Any potential changes like these in question would be temporary and require that employers document how the employees in question were not working their customary jobs during this time and were performing clerical functions.

Our Answer

Rancho Mesa is collaborating with several regional and national workers’ compensation carriers on a form that will be able to capture this information for businesses affected by these new work restrictions. Accurate and accessible documentation will help both businesses and their workers’ compensation carrier make the necessary adjustments at audit.

At this point, these are only preliminary responses that are being discussed. While nothing has been passed into law, it seems highly likely that the WCIRB and the Insurance Commissioner will agree on some type of new legislation. When and if this occurs, we will provide full details and specific strategies to assist.

If you want to be kept informed of any changes and are not currently on our weekly newsletter list, please subscribe to our email distribution list.

What Employers Need to Know Before a Serious Injury Occurs in the Workplace

Author, Jim Malone, Workers’ Compensation Claims Advocate, Rancho Mesa Insurance Services, Inc.

Timely reporting of an employee’s work-related serious injury, illness or death can pose a challenge to the employer. As of January 1, 2020, these incidents (including any hospitalizations, unless the injured worker is admitted for medical observation or diagnostic testing) must be reported immediately to Cal/OSHA. Immediately means as soon as practically possible but not longer than 8 hours after the employer knows or, with diligent inquiry, would have known of the serious injury, illness or death.

Author, Jim Malone, Workers’ Compensation Claims Advocate, Rancho Mesa Insurance Services, Inc.

Timely reporting of an employee’s work-related serious injury, illness or death can pose a challenge to the employer. As of January 1, 2020, these incidents (including any hospitalizations, unless the injured worker is admitted for medical observation or diagnostic testing) must be reported immediately to Cal/OSHA. Immediately means as soon as practically possible but not longer than 8 hours after the employer knows or, with diligent inquiry, would have known of the serious injury, illness or death.

Monitoring the employee’s status at a hospital can be difficult if the employer has not put in place procedures and policies that will authorize a healthcare provider to disclose information that is covered by the Health Insurance Portability and Accountability Act (HIPAA). For example, the employer must follow-up with the hospital providing care to the injured employee to determine if the incident must be reported to Cal/OSHA. The employer will need to know if the employee has been moved from the emergency room and admitted to the hospital for in-patient treatment.

Ensuring policies and procedures are developed and implemented to restrict the use and disclosure of protected health information (PHI), are important elements of HIPAA compliance. If health information is used for purposes not permitted by the HIPAA Privacy Rule, or is deliberately disclosed to individuals not authorized to receive the information, there are possible penalties for the covered entity or individual responsible.

HIPAA permits PHI to be used for healthcare operations, treatment purposes, and in connection with payment for healthcare services. It can be argued that employers need this information to comply with State and Federal OSHA laws. Information may be disclosed to third parties for said purposes, provided an appropriate relationship exists between the disclosing covered entity (i.e., the hospital) and the recipient’s covered entity or business associate (i.e., the employee or employer). A covered entity can only share PHI with another covered entity if the recipient had previously or currently has a treatment relationship with the patient. The PHI has to relate to that relationship. In the case of a disclosure to a business associate, a Business Associate Agreement must have been obtained. Disclosures must be restricted to the minimum necessary information that will allow the recipient to accomplish the intended purpose of use.

Prior to any use or disclosure of health information that is not expressly permitted by the HIPAA Privacy Rule, one of two steps must be taken:

A HIPAA authorization must be obtained from a patient, in writing, permitting the covered entity or business associate to use the data for a specific purpose not otherwise permitted under HIPAA.

The health information must be stripped of all information that allows a patient to be identified.

Employers may consider obtaining signed business associate agreements or HIPAA authorizations from their employees before any injury or accident occurs. This will ensure they are able to get the appropriate protected medical information from the hospitals so they can report “serious injury or illness” accurately and timely to Cal/OSHA.

Therefore, it is extremely important for employers to learn the existing laws and new changes to these laws and have a plan of action in place to address these concerns before the next serious injury, illness, or death occurs.

Currently, reporting to Cal/OSHA can be made by telephone or e-mail. With these reporting changes, Cal/OSHA has also been directed to establish an on-line mechanism for reporting these injuries. It is always important to document when these incidents are reported to Cal/OSHA. Until an online mechanism is established, use of e-mail would be such method for documentation. Monitoring of the Cal/OSHA website for implementation of the on-line mechanism of reporting is also suggested.

For more information on how to report serious injuries and illnesses to Cal/OSHA, please reference “Cal/OSHA Updates: AB 1804 Changes How Injuries and Illnesses Are Reported.”

For more information about what is considered a serious injury or illness under Cal/OSHA, please reference “Cal/OSHA Updates: AB 1805 Changes Definition of Serious Injury or Illness.”

Work Comp Unit Stat: The Meeting That Saves You Money

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

California business owners are aware that their experience modifier (XMOD) is published annually, roughly three to four months before the expiration of their current workers compensation policy term. However, more often than not, companies are missing an incredible opportunity to make an impact on the calculation of their XMOD by strategically evaluating their work comp claims prior to the most critical month in the XMOD calendar known as Unit Stat.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

California business owners are aware that their experience modifier (XMOD) is published annually, roughly three to four months before the expiration of their current workers compensation policy term. However, more often than not, companies are missing an incredible opportunity to make an impact on the calculation of their XMOD by strategically evaluating their work comp claims prior to the most critical month in the XMOD calendar known as Unit Stat.

The Workers’ Compensation Insurance Rating Bureau (WCIRB) defines the process of receiving loss and payroll information by classification as the Unit Statistical Report. The information is reported to the WCIRB by insurance carriers at specific intervals based on your company’s policy effective date. The information is valued for the first time 18 months after the inception of your policy and every 12 months thereafter.

A policy that incepts in January 2020 will be valued for the first time in July of 2021 (18 month mark). This information will remain in your XMOD calculation for the valuations at 30 months and 42 months.

Once this information has been received by the WCIRB, from the respective carriers, it cannot be altered or changed until the following year’s unit stat. Thus, you may have a positive outcome on an existing open claim (reserve reduction or closure) but not see the benefit until the following year. Revisions to the XMOD once published are limited to a few circumstances; more information about revisions can be found here.

The loss information, sent to the WCIRB from the insurance carriers, will be evaluated at the paid (closed claim) or reserved (open claim) amounts. Typically, a claim that has been open for longer than 18 months signifies severity, litigation, lost time, permanent disability, or a combination of the group. For this reason it is absolutely critical that as a part of your risk management process you execute a

pre-unit stat meeting.

When should I schedule my Unit Stat meeting?

What should I do at this meeting?

Who needs to be involved?

How will this meeting save me money?

As a client of Rancho Mesa, we build this meeting into your annual service plan and take care of engaging the parties who need to be involved for the betterment of your XMOD.

Ready to learn more about Unit Stat? Join us for a complimentary 25-minute webinar where we will discuss the process in greater detail and take time for Q&A.

Still not sure if further learning is necessary, ask yourself these questions:

Have you ever been surprised by your XMOD being higher than you would have thought?

Have you ever had an XMOD above 1.00?

Has your XMOD ever caused your premium to increase?

The webinar can be viewed on-demand by clicking the link below.

Don't Let Your Communications with Employees Hurt as Much as Their Injuries

Author, Jim Malone, Workers’ Compensation Claims Advocate, Rancho Mesa Insurance Services, Inc.

A work-related injury is a traumatic event for your employee and their family. Even though your employees are trained and educated to immediately report work injuries, it is sometimes difficult for them to do so.

Author, Jim Malone, Workers’ Compensation Claims Advocate, Rancho Mesa Insurance Services, Inc.

A work-related injury is a traumatic event for your employee and their family. Even though your employees are trained and educated to immediately report work injuries, it is sometimes difficult for them to do so. Employees can be similar to athletes in that they do not want to do anything that might disrupt the team. There are a lot of emotions that can come into play when a work injury occurs. One of the strongest emotions may be guilt or embarrassment after sustaining an injury. There may also be misperceptions of what others are really thinking after an injury occurs. These feelings and misperceptions are usually the main reasons why communication with an injured worker can decline after an injury.

The injured worker may feel as though they have let down their employer after sustaining an injury. They may feel guilty for missing time from work, disrupting the work shifts and schedules of their co-workers, being physically challenged, putting their careers in jeopardy, being able to provide for their families and for causing the company increased premiums associated with a work related injury claim. They realize the cost of these claims are difficult for their company to absorb and may decrease funds for other employee benefits.

It is quite common for injured workers to not want to speak with their employers after an injury. They usually have misconceptions of what their supervisors and co-workers, are thinking about their injury and lost time for medical treatment. Some injured workers feel as though the employer is upset with them for filing a claim. The employer is obviously upset a claim has been reported, but is more concerned with the well-being of the employee and their recovery from the work injury.

Workers oftentimes assume the employer won’t believe them, even thinking they are exaggerating or faking their injuries. The employee may believe the employer thinks they are trying to get away with something by getting out of work or placed on modified duties, or trying to get medical treatment for injuries or conditions that are not actually related to a work injury.

All these beliefs, misconceptions and even paranoia usually leads to a breakdown in communication. So, what do you do if this occurs?

Keep reaching out to the employee. Inquire how they’re feeling, how much they like and trust their doctors and therapists, and communications with the claim adjuster. Continue to reinforce your concern for their injury and recovery. Remind them of how important they are to the company and how much you need/want them back. Reinforce you are not “mad at them” for getting injured, filing the workers’ compensation claim or missing work. Let them know you’re more focused on helping them get through a sometimes complicated workers’ compensation injury and understand the claim process. Promise them you will do everything you can to help them with answers to their questions. Help them express their concerns or problems with the claim adjuster and assist in their recovery and progression through the claim process. Be an advocate for your employee. Help them get the very best in medical treatment possible and assist with the claim.

Lack of communication and not addressing these misperceptions with your injured worker is one of the biggest factors leading to legal representation. They often do not know the workers’ compensation system and don’t know the questions to ask. You can maintain a dialogue with them by providing insight on what to expect next with their claim, provide options or even just listen to their concerns and decisions they may have to make during their recovery.

Lack of communication can result in the injury not being reported timely by the employee, not reported timely to the insurance company or not responding quickly to a request for treatment, which can lead to litigation. A litigated claim increases the cost of the claim by 100, 200 or 300%! Litigation usually increases the life of the claim by several months and even years. It results in further, if not complete breakdown, of communication with the employee. Litigation can oftentimes results in the loss of your employee, possibly increasing the cost of the claim.

Injured workers retain attorneys for a wide variety of reasons. Interruption of communication with the employer is one reason. Another is they have nowhere else to turn. Occasionally, employees may retain an attorney and does not realize they actually hired them. Reassure them you will maintain your communication with them even though they’re being represented. You are still their employer and you still want to help them through the claim and return to work. Oftentimes they realize retaining an attorney was not the best avenue to take. If that is the case, you can reassure them they can terminate their relationship with the attorney with a single sheet of paper. Their representation can be undone as easy, if not easier, than their retaining of counsel.

Maintain communications with your injured employee. Prevent or break down the barriers that can interrupt your employee’s normal recovery and return to work after an injury.

Workers’ Compensation Fraud Is Not a Victimless Crime

Author, Jim Malone, Workers’ Compensation Claims Advocate, Rancho Mesa Insurance Services, Inc.

Fraud can happen in every industry, including workers’ compensation. Within workers’ compensation claims, fraud is a term that can be overused by employers who may not agree with a claim, or a condition that has been considered work-related/work-aggravated. Many times, instead of fraud, there is simply a difference of opinion as to whether a specific work incident caused an injury.

Author, Jim Malone, Workers’ Compensation Claims Advocate, Rancho Mesa Insurance Services, Inc.

Fraud can happen in every industry, including workers’ compensation. According to standard definitions, “in law, fraud is intentional deception to secure unfair or unlawful gain, or to deprive a victim of a legal right. Fraud can violate civil law, a criminal law, or it may cause no loss of money, property or legal right but still be an element of another civil or criminal wrong. The purpose of fraud may be monetary gain or other benefits, for example by obtaining a passport, travel document, or driver's license, or mortgage fraud, where the perpetrator may attempt to qualify for a mortgage by way of false statements.”

Within workers’ compensation claims, fraud is a term that can be overused by employers who may not agree with a claim, or a condition that has been considered work-related/work-aggravated. Many times, instead of fraud, there is simply a difference of opinion as to whether a specific work incident caused an injury. For these disputes, it usually comes down to a medical opinion addressing whether something is work-related or work-aggravated.

Examples of Workers’ Compensation Fraud

A claim can become fraudulent when the employee lies about how the injury occurred or about their ability to work. The treating physician may be asked to provide their opinion as to whether the injured worker mislead them about how their injury occurred, and the significance of their complaints or physical capabilities. The doctor is provided records or sub rosa videotape contradicting information previously provided by the injured worker. Fraud can also occur when the injured worker lies under oath during a deposition, thus becoming a felony.

Workers’ compensation fraud is not limited to employees, but others within the system can also knowingly participate in the fraud. Physicians can be fraudulent in their billing for services not rendered, for accepting kick-backs, or realizing financial benefit for referrals to and from other physicians, vendors or other entities. Employers can commit insurance fraud by understating their number of employees, under-reporting payroll or misclassifying employees into cheaper job/class codes in order to secure cheaper insurance policy rates and premiums. Vendors can commit fraud by billing insurance carriers for products or services never provided. Attorneys can use illegal capping schemes to retain injured workers for clients.

Combating Workers’ Compensation Fraud

Each insurance company is now required to have a Special Investigative Unit (SIU) that provides ongoing monitoring and investigation of questionable activities related to claims. Fraud continues to cost tax-payers millions of dollars (some estimates are up to $80,000,000) per year. The money and resources the employers and insurance carriers are spending to combat fraud are also increasing each year.

In the event of a fraud conviction, fines or assessments, prison sentences, or restitution can be ordered. Workers’ compensation fraud is not a victimless crime; from the losses caused by fraudulent activities, to the money used to combat and prosecute fraud. The money lost to workers’ compensation fraud can never be replaced, but we are all responsible to do our part in remaining vigilant and reporting suspected fraud to the appropriate person or agency.

California Workers’ Compensation Dual Wage Thresholds Increases Approved for Construction Classes in 2020 – Bottom Line Hit Hard

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

In an effort to keep you informed, so that you can begin to budget for 2020, we wanted to let you know of the approved changes in the dual wage classifications effective January 1, 2020.

Originally published May 23, 2019.

Updated September 19, 2019.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

In an effort to keep you informed, so you can begin budgeting for 2020, we want to let you know of the approved changes in the dual wage classifications effective January 1, 2020.

The increases range from $1.00 to $3.00 per hour, to keep the thresholds in line with inflation. However these changes will have an immediate effect on your bottom line.

In the classes of business that are facing a $3 increase, this equates to a low of 9.3% to a high of 10.3%. See the chart below for the actual approved changes. Not only does this have an impact on wages, payroll taxes, and your bottom line, it may also have an impact on your workers compensation premiums. If you find yourself in a situation where the wage increase is not practical, this will push those employees into the under classification which will have a substantially higher workers compensation rate. In either case, proactive planning will be required so you’re not caught unprepared.

Following are the individual classes and approved changes:

Dual Wage Thresholds

| Classification | Current Threshold | 2020 Threshold | Threshold Difference | Last Changed |

|---|---|---|---|---|

| 5027/5028 Masonry | $27 | $28 | $1 | 2013 |

| 5190/5140 Electrical | $32 | $32 | $0 | 2018 |

| 5183/5187 Plumbing/Heating/Refrigeration | $26 | $28 | $2 | 2014 |

| 5185-5186 Fire Sprinkler | $27 | $29 | $2 | 2009 |

| 5201-5205 Concrete or Cement Work | $25 | $28 | $3 | 2018 |

| 5403/5432 Carpentry | $32 | $35 | $3 | 2018 |

| 5446/5447 Wallboard Application | $34 | $36 | $2 | 2018 |

| 5467/5470 Glaizers | $32 | $33 | $1 | 2019 |

| 5474/5482 Painting/Waterproofing | $26 | $28 | $2 | 2018 |

| 5484/5485 Plastering or Stucco Work | $29 | $32 | $3 | 2018 |

| 5538/5542 Sheet Metal Work | $27 | $27 | $0 | 2014 |

| 5552/5553 Roofing | $25 | $27 | $2 | 2018 |

| 5632/5633 Steel Framing | $32 | $35 | $3 | 2018 |

| 6218/6220 Excavation/Grading | $31 | $34 | $3 | 2018 |

| 6307/6308 Sewer Construction | $31 | $34 | $3 | 2018 |

| 6315/6316 Water/Gas Mains | $31 | $34 | $3 | 2018 |

In an effort to help control workers compensation costs, we have developed several proprietary programs including the RM365 Advantage Safety Star Program™ and RM365 StatTrac™ that can help control these increases. Please reach out to me at sclayton@ranchomesa.com to ask any questions about the above or to learn more about our proprietary programs.

Steps to Understanding and Managing Subrogation

Author, Daniel Frazee, Executive Vice President, Rancho Mesa Insurance Services, Inc.

Author, Jim Malone, Workers’ Compensation Claims Advocate, Rancho Mesa Insurance Services, Inc.

Subrogation crosses into many areas of the insurance world including workers compensation, general liability, property, and auto. As an employer, developing an effective Incident Investigation Plan is a key first step to managing the potential impacts of subrogation on your organization.

Author, Daniel Frazee, Executive Vice President, Rancho Mesa Insurance Services, Inc.

Author, Jim Malone, Workers’ Compensation Claims Advocate, Rancho Mesa Insurance Services, Inc.

Definition

Subrogation is defined as the substitution of one person or group by another in respect of a debt or insurance claim, accompanied by a transfer of any associated rights and duties. It occurs in property/casualty insurance when a company pays one of its insured’s for damages, then makes its own claim against others who may have caused the loss or contributed to it. Subrogation crosses into many areas of the insurance world including workers compensation, general liability, property, and auto. As an employer, developing an effective Incident Investigation Plan is a key first step to managing the potential impacts of subrogation on your organization.

Employer Level Investigation

Identifying the potential for subrogation should occur immediately after an injury or accident occurs with an employer-level investigation. This includes visiting and securing the scene of the accident. If there are hazards or dangerous conditions still present, address them by taping off the area or removing the hazardous element. All potential witnesses need to be identified with securing their name, employer, telephone number, address, copy of their driver’s license, etc. These witnesses should be provided a witness statement for their completion.

It is also imperative that the employer preserve the evidence by taking possession of the tool or equipment that caused the injury. If a ladder broke causing a fall and injuries, take possession of the ladder and keep it secure until needed later. If a tool malfunction is the cause of injury, take possession of that tool until it is needed for the next step of the investigation. Removing the injury-causing item prevents the chance of additional injuries or accidents.