Industry News

Six Reasons a Company’s Experience Modification Could be Recalculated

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Workers’ Compensation costs continue to be one of the most costly expenses for business owners in California. With recent reform, California has maintained steady rate decreases in the workers’ compensation marketplace. Unfortunately California still maintains some of the highest rates in the country, often times two to three times the nations average.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Workers’ Compensation costs continue to be one of the most costly expenses for business owners in California. With recent reform, California has maintained steady rate decreases in the workers’ compensation marketplace. Unfortunately, California still maintains some of the highest rates in the country, often times two to three times the nations average.

Controlling insurance costs is vital to staying profitable and often times, staying in business. An important way business owners can control their insurance costs is by controlling their Experience Modification or X-MOD. An X-MOD is a benchmark of an individual employer against others in its industry, based on that employer's historical claim experience. This comparison is expressed as a percentage which is applied to an employer's workers' compensation premium.

The premium impact of a credit X-MOD (less than 1) vs a debit X-MOD (more than 1) can be significant. Business owners budget around their insurance costs. When there are unforeseen changes to their insurance costs it can have a dramatic effect. While it is rare, there are situations when an X-MOD can change in the middle of a policy term. Below are six circumstances when this could happen:

- If a claim that has been used in an X-MOD calculation is subsequently reported as closed mid policy term AND closed for less than 60% of the aggregate of the highest value, then the X-MOD is eligible for recalculation.

- In cases where loss values are included or excluded through mistake other than error of judgement. Basically, this rule takes into consideration the element of human error.

- Where a claim is determined non-compensable. Meaning the injury was determined to be non-work related.

- Where the insurance company has received a subrogation recovery or a portion of the claim cost is declared fraudulent.

- Where a closed death claim has been compromised over the sole issue of applicability of the workers’ compensation laws of California. Basically, if a person passes away at work but it was determined that the person had a pre-existing condition which caused the death, not work itself.

- Where a claim has been determined to be a joint coverage claim. This occurs mainly with cumulative trauma claims where there was no specific incident that caused an injury, but an injury that developed over time (i.e., wear and tear).

If any of the circumstances above have occurred, than a revised reporting shall be filed with the Workers’ Compensation Insurance Rating Bureau (WCIRB) and it shall be used to adjust the current and two immediately preceding experience ratings.

If you would like to discuss this topic in further detail, and learn how Rancho Mesa Insurance can audit your X-MOD worksheet for potential recalculations, please contact us at (619) 937-0164.

Six Proactive Steps to Prevent Heat Illness During a Scorching Summer

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

The National Weather Service has issued heat warnings for many parts of California starting today, and excessive heat warnings for some other areas. Temperatures are expected to rise to 110ºF in some parts of the Sacramento Valley, for instance. In the desert areas of Imperial and San Diego counties, they will soar as high as 114ºF.

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

The National Weather Service has issued heat warnings for many parts of California starting today, and excessive heat warnings for some other areas. Temperatures are expected to rise to 110ºF in some parts of the Sacramento Valley, for instance. In the desert areas of Imperial and San Diego counties, they will soar as high as 114ºF.

Recommendation

If you have employees working outdoors, you should have an effective heat illness prevention plan in place and train your workers on it's content. Elements of the plan include:

- Making sure those toiling outside have plenty of fresh, cool water – workers need to drink at least a quart an hour. Just providing it isn’t enough, according to the heat illness prevention standard (General Industry Safety Orders section 3395). You must encourage employees to drink water.

- Providing shade when the temperature reaches 80ºF, or when employees request it.

- If an employee is in danger of developing heat illness, they must be allowed to take a rest in the shade until their symptoms disappear.

- Having emergency procedures, including effective communication with workers in remote areas.

- Designating employees at each work site to call emergency medical services if someone starts to develop heat illness.

- Keeping a close eye on workers who have been on the job for two weeks or less. They may not have the prior training to be aware of the early signs of heat illness.

In order to prepare our clients, Rancho Mesa recently conducted a Heat Illness Prevention Workshop. For those of you who were not able to attend, the training videos are available in the Risk Management Center or via the Workshop Video Request Form.

Should you have any questions or need further assistance, please contact a member of your Rancho Mesa team. Please be safe!!

Independent Contractor Classification Changes Expected to Impact Construction Industry

Author, David J. Garcia, AAI, CRIS, President, Rancho Mesa Insurance Services, Inc.

With the recent ruling by the California Supreme Court concerning how 1099 employees (independent contractors) are defined, the construction industry's approach to utilizing these workers has changed significantly. The Court adopted a new test to determine whether the worker should be classified as an employee or independent contractor. The previous test to determine if a worker was an employee or independent contractor was whether the employer had the right to direct the manner and means by which the worker performed the services.

Author, David J. Garcia, AAI, CRIS, President, Rancho Mesa Insurance Services, Inc.

With the recent ruling by the California Supreme Court concerning how 1099 employees (independent contractors) are defined, the construction industry's approach to utilizing these workers has changed significantly. The Court adopted a new test to determine whether the worker should be classified as an employee or independent contractor. The previous test to determine if a worker was an employee or independent contractor was whether the employer had the right to direct the manner and means by which the worker performed the services. Under the new test, a worker is considered to be an independent contractor only if all three of the following factors are present:

- The worker must be free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of the work and in fact;

- The worker must perform work that is outside the usual course of the hiring entities business;

- The worker must be customarily engaged in an independently established trade, occupation, or business of the same nature as that involved in the work performed.

These new factors have major implications for contractors, or any business for that matter, where previously they had classified a worker as an independent contractor and now have to classify them as an employee. This will impact several lines of insurance, but most critically workers' compensation, general liability and employee benefits.

Workers' Compensation

Currently, if an employee is classified as an independent contractor, they would not be subject to any workers' compensation premium nor workers' compensation benefits. If their status should change to employee, they now would be entitled to workers' compensation benefits and would have their payroll accounted for in the employer’s premium. In addition, based on the work being performed, this may change the employer’s risk profile, creating negative underwriting consequences in the workers' compensation carrier marketplace, resulting in coverage not being offered or higher premiums.

General Liability

The impact to general liability insurance is very similar to that of workers' compensation. Additional payroll or sales will need to be accounted for as the employer will become directly responsible for the work being performed without the benefit of any hold harmless agreement or other risk transfer methods. This could potentially change the risk profile of the employer’s operations, which could result in the employer needing to provide additional underwriting information.

Employee Benefits

Since 1099 contract workers are not employees and are considered self-employed, they do not show on the Quarterly Wage and Withholding Report (DE9 and DE9C) to the State of California. Because of this status, they typically cannot enroll in a group health insurance plan. Many workers who are now classified as independent contractors will be considered employees in the eyes of the state and will be eligible for group benefit offerings from their employer.

Employers may need to reevaluate their group size to ensure that they remain compliant with the Affordable Care Act (ACA). Employers with 50 or more full-time employees working a minimum of 30 hours per week, and/or full-time equivalents (FTEs) must offer health insurance that is affordable and provides minimum value to 95% of their full-time employees and their children up to age 26, or be subject to penalties.

While these changes are new and just beginning to take affect, we believe your best strategy moving forward is to consult with your trusted advisors in legal, accounting and risk management. This will have a significant impact to the construction industry throughout California and we intend to take a leadership role in helping those companies with concerns and questions. So, please reach out to our Rancho Mesa Team to help you navigate these changes. Contact Alyssa Burley at aburley@ranchomesa.com for assistance.

Key Steps to Take Before, During, and After an OSHA Inspection

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

An OSHA officer can show up to your facility or worksite for any number of reasons: employee complaints, accidents, programmed inspections, sweeps, follow-up or a drive-by observation. In order to ensure a smooth inspection, we suggest you prepare before OSHA appears at your door. Here are some key steps to take before, during and after an OSHA inspection.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

An OSHA officer can show up to your facility or worksite for any number of reasons: employee complaints, accidents, programmed inspections, sweeps, follow-up or a drive-by observation. In order to ensure a smooth inspection, we suggest you prepare before OSHA appears at your door. Here are some key steps to take before, during and after an OSHA inspection.

Before the Inspection

Every company should have a formal plan in place detailing what should be done before, during and after an OSHA inspection. This procedure should be site specific and available to all supervisors. Site specific information should include company contacts for the project if OSHA arrives, location of documents like OSHA 300 logs and the Injury and Illness Prevention Program (IIPP).

Upon arrival of the OSHA inspection officer, the company should verify the officer’s credentials and try to determine why they are at the site. Before the opening conference begins, the employer should assign specific individuals to be the note taker and the photographer. It is also extremely important to remind everyone involved to be professional and treat the compliance officer with respect.

During the Inspection

Opening Conference: During the opening conference, you will want to establish the scope of the inspection, the reason for the inspection, and the protocol for any employee interviews or production of documents. If the inspection is triggered by an employee complaint, the employer may request a copy.

Physical Inspection: During the inspection, the OSHA compliance officer will conduct a tour of the worksite or facility in question to inspect for safety hazards. It is likely pictures will be taken by the compliance officer. Instruct your photographer to also take the same pictures and possibly additional pictures from different angels while the note taker should take detailed notes of the findings.

Closing Conference: At the closing conference, the OSHA compliance officer typically will explain any citations, the applicable OSHA standards and potential abatement actions and deadlines. It is important that during this process the company representative takes detailed notes and asks for explanations regarding any violations. If any of the alleged violations have been corrected, you will want to inform the OSHA compliance officer.

After the Inspection

If you are told no citations will be issued, contact the compliance officer and obtain a Notice of No Violation after Inspection (Cal/OSHA 1 AX). If you receive a citation, it is important to take immediate action because a company only has 15 working days after the inspection to notify the Appeals Board, if they choose to appeal the citation. Citations can be issued up to six months after the inspection, so it is important to watch your mail closely during this time.

For a proactive approach to OSHA inspections, contact the Consultation Services Branch for your state (i.e. Cal/OSHA) or Federal OSHA Consultation. They will be able to provide consultative assistance to you through on-site visits, phone support, educational materials and outreach, and partnership programs.

Register for the "How to Survive an OSHA Visit" webinar hosted by KPA on Monday, June 25, 2018 from 11:00 am - 12:00 pm PST to learn about what OSHA looks for during an inspection.

For additional information, please contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164.

WCIRB Proposed Changes Affecting Schools and Disabled Services

Author, Chase Hixson, Account Executive, Rancho Mesa Insurance Services, Inc.

The Workers' Compensation Insurance Rating Bureau of California (WCIRB) recently announced plans to reclassify the 8868 (i.e., professors, teachers or academic professional employees) and 9101 (i.e., all employees other than professors, teachers, or academic professional employees) class codes under the belief that there is significant disparity between the businesses that currently fall under these two classifications. These changes are planned to go into effect January 1, 2019.

The Workers' Compensation Insurance Rating Bureau of California (WCIRB) recently announced plans to reclassify the 8868 (i.e., professors, teachers or academic professional employees) and 9101 (i.e., all employees other than professors, teachers, or academic professional employees) class codes under the belief that there is significant disparity between the businesses that currently fall under these two classifications. These changes are planned to go into effect January 1, 2019.

Currently the 8868 and 9101 classes, titled “schools,” consist of not only kindergarten through college schools, but also vocational schools, special education for disabled children, social services for children, and training programs for the developmentally disabled. While these businesses are similar in many ways, the claims appear to differ uniformly between these specific niches. This has a direct impact on the Experience Modifications (i.e., x-mod) of the organizations. According to the WCIRB, the average x-mod for K-12 schools and colleges is .81, vocational schools are 1.08, programs offering special education services for children are at 1.40 and training programs for developmentally disabled are at 1.30.

Average X-Mod within 8868 and 9101 Class Codes

The proposed changes will continue to include the 8868 and 9101 class codes while adding four new classifications. The theory is that this will create more homogeneous classes for the members while at the same time leveling out the X-mods for all. As the process unfolds, it could create higher insurance costs and you will want to fully understand how these changes could affect your bottom line.

While there are still more details to be worked out, it’s apparent that there are significant changes heading towards those operating with the 8868 and 9101 class codes. Whether or not an employer will be positively or negatively affected will depend on their individual risk profile.

Rancho Mesa’s Human Services Group will be taking a leadership position in understanding these changes and their impacts. To learn more about how these changes will affect your organization, please Rancho Mesa at (619) 937-0164.

Four Factors When Developing a Nonprofit Agency's Youth Protection Plan

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services.

When designing youth protection measures, many nonprofit leaders want to understand the industry’s “best practices” and incorporate what already works for others. Unfortunately, it is very difficult to identify one set of “best practices” or a universal checklist all organizations should adopt. As a result, it will benefit nonprofit leaders and their clients to tailor daily practices to the unique exposures and operations of the agency. When doing so, it’s best to consider four important factors when designing a youth protection program.

When designing youth protection measures, many nonprofit leaders want to understand the industry’s “best practices” and incorporate what already works for others. Unfortunately, it is very difficult to identify one set of “best practices” or a universal checklist all organizations should adopt. As a result, it will benefit nonprofit leaders and their clients to tailor daily practices to the unique exposures and operations of the agency. When doing so, it’s best to consider four important factors when designing a youth protection program.

In A Season of Hope, authored by the staff at the Nonprofit Risk Management Center, the authors refer to these interlocking factors as the “Four P’s: Personnel, Participants, Program, and Premises. Let’s explore:

Staffing

The nature of the services offered to youth will dictate the staff’s professional background and education. Those nonprofits offering therapy and counseling will aim to hire employees with advanced degrees; whereas, some programs may feel comfortable hiring responsible teens and young adults. In each case, supervision and background checks are vital to client safety.

Participant Mix

Is the agency serving a pre-school program for kids who are relatively close in age with similar needs? Or, perhaps, it is a group home involving minors who all have differing special needs due to their unique family situations and backgrounds. What unique risks to the organization does each group present? Considering the characteristics of a nonprofit’s youth clientele will shape an organization’s approach to youth protection.

Program and Mission

An organization must consider how its mission and programs will impact youth safety. A nonprofit conducting group outings to encourage social behavior will not have the same concerns as an organization matching children with foster families. Each will present unique exposures.

Environment

Nonprofits serve youth in a wide range of venues and environments, and each present different risks. The variables can include supervision, activities at height, access to emergency care, and sleeping arrangements. Knowing this, it is vital for an organization’s leaders to identify how a venue presents risk to youth safety and then plan accordingly.

“My Risk Assessment” is a very strong tool available through Rancho Mesa Insurance Services. This interactive module allows nonprofit leaders to identify potential gaps in risk management in a number of areas, including client safety, transportation, and facilities.

Keeping young clients safe while in a nonprofit’s care is a core promise of the organization to the community. When nonprofit leaders take a careful look at the four P's, they can reduce the risk of harm while also ensuring the mission endures.

Please contact Rancho Mesa at (619) 937-0164 to learn more about sound risk management practices.

CIGA is “Back in Black” - Employers will receive 2% savings on 2019 workers' comp premium

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

For the first time in 20 years, the California Insurance Guarantee Association (CIGA) will not collect its annual assessment. As a result, California employers in the guaranteed cost workers' compensation insurance market will save 2% on their premium in 2019.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

For the first time in 20 years, the California Insurance Guarantee Association (CIGA) will not collect its annual assessment. As a result, California employers in the guaranteed cost workers' compensation insurance market will save 2% on their premium in 2019.

The CIGA board of directors approved a zero assessment for 2019, as it moved into the black after collecting last year’s 2% assessment on workers' compensation premiums. At one point, CIGA had a workers, compensation deficit of $4 Billion. The 20 years of employer assessments, ranging from 1% to 2.6% of premium, paid off workers' compensation debt and in some years the debt payments on special bonds issued to pay claims from insurance company insolvencies.

Similar to the rest of the Industry, CIGA’s improved fortune results from positive reforms provided in SB 863, as well as the efforts of Department of Industrial Relations Director Christine Baker.

Employers Beware! Ten Red Flags You May Have a Fraudulent Workers’ Comp Claim

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Workers’ Compensation is a form of insurance providing wage replacement and medical benefits to employees injured in the course of employment in exchange for mandatory relinquishment of the employee's right to sue their employer for the tort of negligence.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Workers’ Compensation is a form of insurance providing wage replacement and medical benefits to employees injured in the course of employment in exchange for mandatory relinquishment of the employee's right to sue their employer for the tort of negligence.

While most people would agree with the idea of a workers' compensation system, unfortunately, there are people who try to defraud it in an effort to earn an extra buck. These individuals include both employers and employees. For this article, I will focus solely on the most common workers’ compensation fraud, claimant fraud (i.e., when an employee commits the fraud).

Claimant fraud includes false claims and exaggerated claims. These claims typically involve soft-tissue symptoms, such as headaches, whiplash, or muscle strain, which are all very difficult to disprove. In order to increase the value of the claim, claimants will also include multiple body parts. The most common types of claimant fraud includes reporting fake claims, injuries not received on the job, exaggerated injuries, and claimants working for another employer while collecting benefits from an injury claim.

Claimant fraud causes extreme frustration, animosity, and can lead business owners to question all claims, including those that are legitimate. Employers can feel helpless, especially when the system gives the benefit of the doubt to fraudsters. There are, however, red flags that both employers and insurance companies can pick up on to fight against these individuals seeking easy money.

Ten Red Flags

The top ten red flags employers can look for on a possible fraudulent claims are: When the claimant;

Hires an attorney the day of the alleged injury.

Has several other family members also receiving workers’ compensation benefits.

Exhibits a strong familiarity with the workers’ comp system.

Has been disciplined several times or is disgruntled and fears termination.

Was engaged in seasonal work that is about to end.

Continues to cancel or fails to keep medical appointments or refuses a diagnostic procedure to confirm an injury.

Changes doctors when the original suggests they return to work.

Is seen working at another job while collecting total temporary disability.

Is reluctant to return to work and shows very little improvement.

Has problems with workplace relationships.

Contact me to learn strategies for combating fraudulent claims before and after it is reported.

Risk Management Center Streamlines Electronic OSHA Reporting

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

The Occupational Health and Safety Administration (OSHA) now require certain employers to electronically submit their completed 2016 Form 300A. OSHA has created a website that allows employers to manually complete the information or upload a formatted CSV (comma-separated values) file

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

Editor's Note: This post was originally published on November 9, 2017 and has been updated to reflect the latest available information.

The Occupational Health and Safety Administration (OSHA) now requires certain employers to electronically submit their completed Form 300A. OSHA has created a website that allows employers to manually complete the information or upload a formatted CSV (comma-separated values) file. Users of Rancho Mesa’s Risk Management Center have the ability to track incidents and generate the export file, making the electronic reporting process quick and simple.

Check federal OSHA or your state's OSHA website for specific filing date deadlines.

Prepare and Submit

Once an incident occurs, Risk Management Center users track the details within the online system. All of the required information is stored and made available through reports and an export.

Request a Risk Management Center Account.

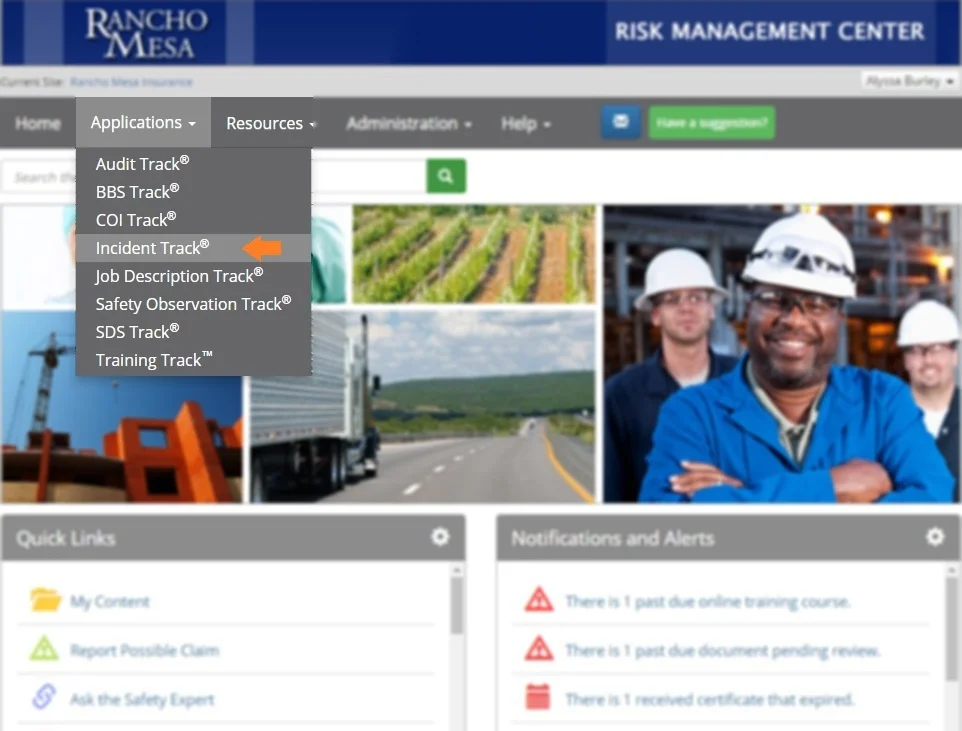

To export the OSHA 300A Report data, login to the Risk Management Center. Then, navigate to the Applications list and click on Incident Track®.

From this screen, click on the Reports menu and click the Export Data option.

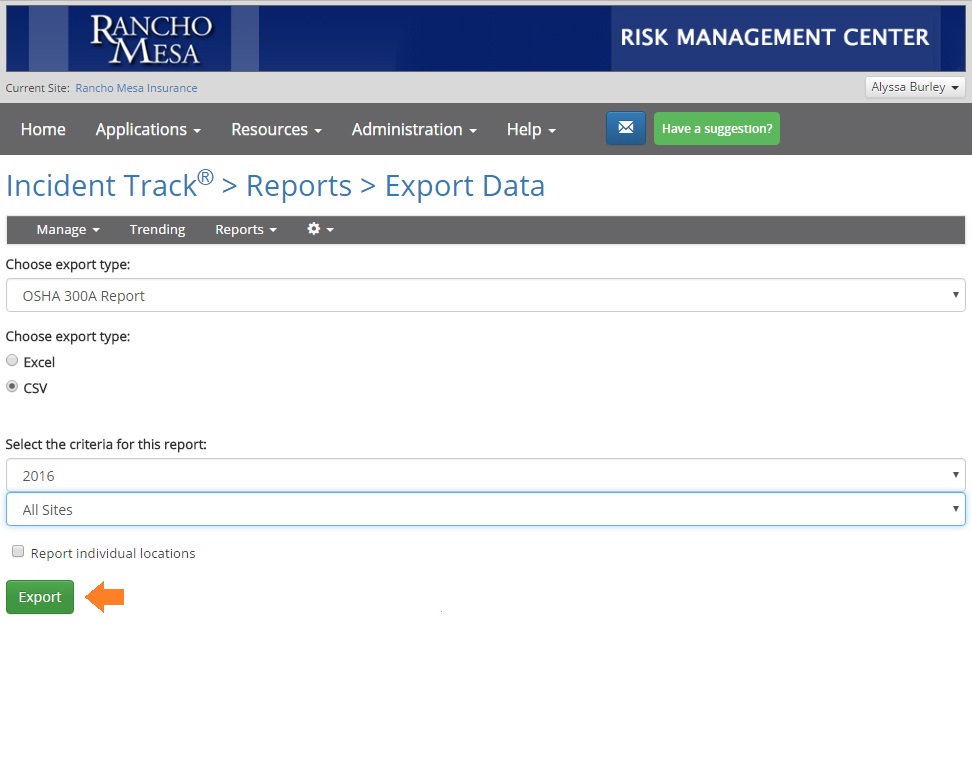

Choose the report, “OSHA 300A Report” and select the export type a CSV. Choose the year and either all your sites or just one. Click the Export button and enter your email address.

The .CSV file will be generated and emailed to you. Save the file on your computer so it can be uploaded to OSHA’s Injury Tracking Application (ITA).

To upload the .CSV file, login to OSHA’s ITA and follow the instructions on the screen.

Who is Required to Submit?

According to OSHA, “establishments with 250 or more employees are currently required to keep OSHA injury and illness records and establishments that are classified in certain industries with historically high rates of occupational injuries and illnesses.” Some of those industries include construction, manufacturing, health and residential care facilities, and building services.

On April 30, 2018, OSHA announced State Plans have been informed “that for Calendar Year 2017 all employers covered by State Plans will be expected to comply. An employer covered by a State Plan that has not completed adoption of a state rule must provide Form 300A data for Calendar Year 2017. Employers are required to submit their data by July 1, 2018. There will be no retroactive requirement for employers covered by State Plans that have not completed adoption of their own state rule.

Cal/OSHA released a statement explaining that "even though California has not yet adopted its own state rule, employers are advised to comply with federal OSHA's directive to provide Form 300A data covering calendar year 2017." In addition, other states like Maryland, Minnesota, South Carolina, Utah, Washington and Wyoming may follow California's lead.

For questions about tracking and exporting OSHA reports with the Risk Management Center, contact Rancho Mesa at (619) 937-0164

Federal OSHA Asserts Electronic Data Reporting Requirement Applies to Employers Across All States

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

The federal Occupational Safety and Health Administration (OSHA) announced Monday, April 30, 2018 it has “taken action to correct an error that was made with regard to implementing the final rule” which required some employers to electronically submit their injuring and illness reports via the Injury Tracking Application (ITA) online.

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

The federal Occupational Safety and Health Administration (OSHA) announced Monday, April 30, 2018 it has “taken action to correct an error that was made with regard to implementing the final rule” which required some employers to electronically submit their injuring and illness reports via the Injury Tracking Application (ITA) online.

Federal OSHA has determined that Section 18(c)(7) of the Occupational Safety and Health Act requires employers in State-administered OSHA plans “to make reports to the Secretary in the same manner and to the same extent as if the plan were not in effect.” Therefore, federal OSHA’s statement asserts “employers must submit injury and illness data in the Injury Tracking Application (ITA) online portal, even if the employer is covered by a State Plan that has not completed adoption of their own state rule.”

According to the announcement, State Plans have been informed “that for Calendar Year 2017 all employers covered by State Plans will be expected to comply. An employer covered by a State Plan that has not completed adoption of a state rule must provide Form 300A data for Calendar Year 2017. Employers are required to submit their data by July 1, 2018. There will be no retroactive requirement for employers covered by State Plans that have not completed adoption of their own state rule.”

“Even though California has not yet adopted its own state rule, employers are advised to comply with federal OSHA’s directive to provide Form 300A data covering calendar year 2017.”

This announcement comes on the heels of a March 2018 report by Bloomberg Environment that indicated federal OSHA anticipated more than 350,000 worksites to submit Form 300A reports via the online portal, yet nearly 200,000 weren’t submitted by the December 31, 2017 deadline. That means only 153,653 Form 300A reports were submitted and another 60,992 worksites submitted reports that were not required.

In May 2017, Cal/OSHA published a statement indicating “California employers are not required to follow the new requirements and will not be required to do so until ‘substantially similar’ regulations go through formal rulemaking, which would culminate in adoption by the Director of the Department of Industrial Relations and approval by the Office of Administrative Law." However, with the recent announcement from federal OSHA, Cal/OSHA released a statement explaining that "even though California has not yet adopted its own state rule, employers are advised to comply with federal OSHA's directive to provide Form 300A data covering calendar year 2017." In addition, other states like Maryland, Minnesota, South Carolina, Utah, Washington and Wyoming may follow California's lead.

Rancho Mesa’s Incident Track® is an effective way to manage incidents and maintain required OSHA logs. As just one of the many “tracks” inside the Agency’s “Risk Management Center,” Incident Track can also generate electronic report files that can be uploaded into the Federal OSHA’s ITA online portal.

Contact Alyssa Burley with follow up questions about these OSHA requirements and/or an interest in learning more about tracking incidents through our client based portal.

Benefits of a Student/Volunteer Accident Policy

Author, Chase Hixson, Account Executive, Human Services Group, Rancho Mesa Insurance Services, Inc.

Organizations like nonprofits, schools, home health care facilities and other entities that rely on volunteers or frequently interact with the public, may be vulnerable to accidents not covered by workers' compensation insurance. These accidents can cause an unexpected financial burden on the organization if they don't have an accident policy.

Organizations like nonprofits, schools, home health care facilities and other entities that rely on volunteers or frequently interact with the public, may be vulnerable to accidents not covered by workers' compensation insurance. These accidents can cause an unexpected financial burden on the organization if they don't have an accident policy.

What is an Accident Policy?

An accident policy offers a specified dollar amount, typically between $10,000 and $50,000, to cover medical costs to qualified participants in the event of an injury. They are fairly inexpensive and offer an added layer of defense, should an accident occur. Typically, these policies cover volunteers and/or students (for schools), and they are written on a no-fault basis. While most general liability policies require a liable party in order to pay out, accident policies pay out quickly and efficiently.

It’s important to note that these policies only cover medical costs. If the injured party were to seek legal action against your organization, your liability policy would respond.

Example of a Covered Event

If a student falls down on the playground, breaking an arm, the school has an accident policy that covers all students, providing $15,000 for each incident. The student's medical bills total $12,000. Neither the school nor the child’s parents would end up paying any money out of pocket for the accident.

Advantages of an Accident Policy

Accidents, by nature, are sudden and unexpected, as are the associated medical costs. An accident policy can reduce those financial burdens and give peace of mind knowing there is a set amount of money readily available should something go wrong.

In addition, an accident policy can help reduce the likelihood of future lawsuits. While any accident can result in subsequent legal action, there’s a greater likelihood of litigation if the injured party receives a large medical bill.

Mitigate the Financial Burden

Accident policies are a great option for those who have volunteers or students in their care. They are inexpensive and offer an added layer of financial protection that can provide significant financial relief in the wake of an accident.

Please feel free to reach out if you have any questions, and we can determine if an accident policy is the right fit for you.

The Changing Definition of Employee: What you need to know about SB 189

Author, Yvonne Gallagher, Landscape Division Account Manager, Rancho Mesa Insurance Services, Inc.

California State Capital Building.

State Bill 189 (SB 189) (Bradford) was recently enacted by the California State Legislature. It is intended to correct issues resulting from the passage of Assembly Bill 2883 (AB 2883) (Daly et. al) in 2017, which changed the requirements for business owners to exclude themselves from workers' compensation coverage.

Author, Yvonne Gallagher, Landscape Division Account Manager, Rancho Mesa Insurance Services, Inc.

California State Capital Building.

State Bill 189 (SB 189) (Bradford) was recently enacted by the California State Legislature. It is intended to correct issues resulting from the passage of Assembly Bill 2883 (AB 2883) (Daly et. al) in 2017, which changed the requirements for business owners to exclude themselves from workers' compensation coverage.

SB 189 is written to expand:

The scope of the exception from the definition of an employee to apply to an officer or member of the board of directors of a quasi-public or private corporation, except as specified, who owns at least 10% of the issued and outstanding stock, or 1% of the issued and outstanding stock of the corporation if that officer’s or member’s parent, grandparent, sibling, spouse, or child owns at least 10% of the issued and outstanding stock of the corporation and that officer or member is covered by a health care service plan or a health insurance policy, and executes a written waiver, as described above. The bill would expand the scope of the exception to apply to an owner of a professional corporation, as defined, who is a practitioner rendering the professional services for which the professional corporation is organized, and who executes a document, in writing and under penalty of perjury, both waiving his or her rights under the laws governing workers’ compensation, and stating that he or she is covered by a health insurance policy or a health care service plan. The bill would expand the scope of the exception to include an officer or member of the board of directors of a cooperative corporation, as specified. The bill would also expand the definition of an employee to specifically include a person who holds the power to revoke a trust, with respect to shares of a private corporation held in trust or general partnership or limited liability company interests held in trust, and would authorize that person to also elect to be excluded from the requirement to obtain workers’ compensation coverage, as specified. The bill would provide that an insurance carrier, insurance agent, or insurance broker is not required to investigate, verify, or confirm the accuracy of the facts contained in the waiver. (Legislative Counsel, 2018)

Once a waiver is signed and on file with the insurance carrier it will remain in effect until there is a written withdrawal. When changing insurance carriers a new waiver must be signed with the new carrier.

Effective 1/1/18

- Carriers were able to accept waivers up until 12/31/17 for policies issued in 2017 that weren't turned in on time and the officer exclusion is being honored from the inception of the policy and is being applied at final audit.

Effective 7/1/18

- Trusts will be eligible for officer exclusion.

- To be excluded, the required ownership percentage will change from 15% to 10%.

- An officer with 1%-9% ownership that is related to an excluded officer that owns 10% or more may also be excluded as long as they have health insurance.

- Waivers currently are required at the policy effective date. SB 189 provides a 15-day grace period from the effective date to turn in the waiver. The waiver may only be backdated 15 days.

Examples: With a 1/1/18 effective date, if the waiver is turned in and accepted by 1/15/18, the officer exclusion will be effective 1/1/18. With a 1/1/18 effective date, if the waiver is turned in and accepted by 2/15/18, the officer exclusion will be effective 2/1/18.

For specific questions about your workers' compensation policy, contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164.

Workplace Violence Insurance Surges in Aftermath of Shootings

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

In response to the hundreds of mass shootings taking place each year, the insurance marketplace has produced new workplace violence products to help employers and employees recover from a crisis.

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

In response to the hundreds of mass shootings taking place each year, the insurance marketplace has produced new workplace violence products to help employers and employees recover from a crisis.

U.S. employers have an obligation for duty of care for the safety, health, and security of employees (see Occupational Safety and Health Administration (OSHA) Act of 1970). Duty of care requires protection against workplace violence hazards.

A mass shooting is an attack resulting in 4 or more.

| Year | # of Incidents |

|---|---|

| 2017 | 327 |

| 2016 | 385 |

| 2015 | 333 |

It is the employer's obligation to protect its employees from violence. Homeland Security defines an active shooter as “an individual actively engaged in killing or attempting to kill people in a confined and populated area.” While OSHA describes workplace violence as “any act or threat of physical violence, harassment, intimidation, or other threatening disruptive behavior that occurs at the work site.” What is your organization doing to protect its people from these types of events?

Over the last three years, the United States recorded an average of 348 mass shootings per year.

| Description | Cost |

|---|---|

| Support for survivors and families of victims | $2.7 million |

| Cleanup, renovations, and other facility changes | $6.4 million |

| Settlement payments and other legal costs | $4.8 million |

Costs to Consider

As victims, families, and co-workers struggle to heal after losing friends and loved ones, the costs continue to mount.

Aside from treating survivors, consider some of the costs from the Virginia Tech University shooting: survivor support, cleanup, renovations, facility changes, settlement payouts and legal costs.

How would your organization absorb the cost of such an event?

Workplace Violence Policy Coverage

In addition to providing a consultant to guide businesses through an emergency event, a covered event will trigger legal liability coverage to address legal expenses. These expenses may be related to the following:

- Business interruption expense

- Defense and indemnity expenses

- Public relations counsel

- Psychiatric care

- Medical or dental care

- Employee counseling

- Temporary security measures

- Rehabilitation expenses

- Limits start at $1,000,000 with $0 deductible

Among other underwriting considerations, when pricing workplace violence policies, carriers factor in operations like exchanging money with the public, working with volatile or unstable people, providing services and care to the public, and working where alcohol is served. Take a look at your organization's operations to see if there is a risk.

Please contact Rancho Mesa Insurance Services to discuss whether this insurance is right for your organization.

Information sourced from McGowan Program Administrators.

3 Practical Reasons for Timely Claims Reporting

Author, Jim Malone, Claims Advocate, Rancho Mesa Insurance Services, Inc.

When a work-related accident occurs, as a business owner or manager, it is our nature to want to analyze the situation in order to learn how to avoid it in the future. However, the reporting of the incident is equally as important. With the recent requirement to report first aid claims, timely reporting for all claims is recognized as being critical for a number of reasons.

Author, Jim Malone, Claims Advocate, Rancho Mesa Insurance Services, Inc.

When a work-related accident occurs, as a business owner or manager, it is our nature to want to analyze the situation in order to learn how to avoid it in the future. However, the reporting of the incident is equally as important. With the recent requirement to report first aid claims, timely reporting for all claims is recognized as being critical for a number of reasons.

Employee Morale

First and foremost, timely reporting allows for immediate care of any injuries that may have occurred as a result of the incident. It promotes prompt referral for medical evaluation, documentation of the bodily areas affected, and provides recommendations for treatment.

Promptly reporting an injury shows the injured employee, and their coworkers, that the company cares about them. When an employee knows the employer cares, they are less likely to litigate the claim, which can significantly reduce the overall cost to the employer.

Elimination of Hazards

Timely reporting can trigger the immediate assessment of the scene and cause of the accident. The initial focus is to document the area and determine if there is still an injurious exposure or condition present that may need to be addressed to prevent further incidents or injuries. Timely reporting also allows for prompt investigation of the accident and the scene of the accident, identify witnesses, secure faulty tools or equipment for safety and subrogation purposes, and to convey a sense of responsibility and concern for the employee that their safety is of extreme importance.

Prompt investigations into the cause of a near miss, accidents, and injuries can lead to an understanding of the factors that lead up to the incident. Thus, the employer has the opportunity to make changes in processes and improvements in safety in order to prevent future near miss events or accidents from occurring.

Cost Savings

Timely reporting can directly affect the overall costs of a claim. Decreased medical costs are realized when injuries are promptly assessed, allowing for treatment to start immediately. Injured employees tend to recover quickly when treatment is provided right away. Swift recoveries usually result in shorter periods of temporary total and/or temporary partial disability, fewer diagnostic studies, physical therapy visits, injections, surgeries, permanent physical limitations, work restrictions or permanent disability percentages, and lower future medical care needs. This translates into lower financial resources allocated to these claims.

The timely reporting of a claim promotes positive morale among employees; helps remove potential future hazards from the workplace and can significantly reduce overall the cost of incidents.

For more information about claims reporting, contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164.

Top Three Benefits of Conducting an In-Home Health Care Safety Inspection

Author, Chase Hixson, Account Executive, Human Services, Rancho Mesa Insurance Services, Inc.

For many Home Health Care companies, conducting an in-home inspection on all new cases is standard practice. The intent of these inspections is to improve the quality of services offered; however, there is also an additional opportunity to improve the risk profile for those health care companies and thereby help them reduce their insurance costs.

For many Home Health Care companies, conducting an in-home inspection on all new cases is standard practice. The intent of these inspections is to improve the quality of services offered; however, there is also an additional opportunity to improve the risk profile for those health care companies and thereby help them reduce their insurance costs.

Best practices suggest that Home Health Care companies conduct safety inspections in the home for all new clients prior to having a caregiver work the case. If possible, have the caregiver(s) that will be in the home, conduct the inspection with you. Following are 3 ways inspections with an eye toward safety can help improve your risk profile.

Providing An Opportunity to Point out Safety Hazards

The most obvious outcome is the opportunity to point out safety hazards. Having two sets of eyes on the home will help to identify potential hazards such as a poorly lit staircase, an over stocked bookshelf where the caregiver might obtain supplies, a crowded kitchen, or loose carpet or rug.

Engaging the Employee as an Equal Partner in Safety

Studies show claims are less likely to occur when the employee is engaged in the safety process. For example, if the employee is involved with assessing their own hazards and determining their own safety, they are more likely follow the guidelines.

Improving your Frequency Rate

Conducting pre-case safety inspections is known to reduce the frequency of claims. It’s no surprise taking this step will positively impact the employer’s insurance premium. Not only is the likelihood of a claim reduced, the ability to react to a claim with proper corrective action increases, as well. If an accident were to occur, prior inspections will speed up the discovery process and allow the proper changes to be made, in theory, reducing the likelihood of the incident occurring again.

Conducting safety inspections in the home prior to assigning a case workers is a great way to not only benefit pricing immediately, reduce the likelihood of a claim in the future, thereby helping you to sustain favorable pricing in the future.

If you would like to learn more, or have any questions, please contact Rancho Mesa at (619) 937-0164.

Reminder: 2017 OSHA Summary of Work-Related Injuries and Illness Must Be Posted

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

According to a recent memo, the State of California Department of Industrial Relations would like to remind employers that they are required to physically post their 2017 annual summaries of work-related injuries from February 1, 2018 through April 30, 2018.

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

According to a recent memo, the State of California Department of Industrial Relations would like to remind employers that they are required to physically post their 2017 annual summaries of work-related injuries from February 1, 2018 through April 30, 2018.

OSHA’s Summary of Work-Related Injuries and Illness, also known as Form 300A, must be completed and posted for employees to view.

If you are tracking work-related injuries in the Rancho Mesa Risk Management Center, the Form 300A can be generated from the system. From the Incident Track screen, click on "Reports," then "OSHA Reports," select "OSHA 300A Summary," the "2017." Complete any missing information and "Download."

To manually complete the Form 300A, review the instructions found on the Cal/OSHA or OSHA websites.

If you are unsure if you are required to maintain OSHA logs, visit the OSHA website.

Why Would a Contractor Purchase Employment Practices Liability Insurance?

Author, Kevin Howard, CRIS, Account Executive, Construction Gorup, Rancho Mesa Insurance Services, Inc.

Insurance is often considered a necessary evil by business owners. It can represent a significant line item on a profit & loss statement rivaling the cost in some cases of payroll, material costs and rent. With deductibles that can range from $15,000-$25,000 per claim, why then would a business spend dollars on an insurance policy that is not required by either state law or part of any General Contractor’s insurance specifications?

Author, Kevin Howard, CRIS, Account Executive, Construction Group, Rancho Mesa Insurance Services, Inc.

Insurance is often considered a necessary evil by business owners. It can represent a significant line item on a profit & loss statement rivaling the cost in some cases of payroll, material costs and rent. With deductibles that can range from $15,000-$25,000 per claim, why then would a business spend dollars on an insurance policy that is not required by either state law or part of any general contractor’s insurance specifications?

What does an EPLI policy cover?

Employment Practices Liability Insurance (EPLI) policies typically extend coverage to the following:

Wrongful termination of an employee who alleges violation of their contract;

Sexual harassment claims by one employee against another;

Wage related claims by employees who allege denial of overtime pay or tips, or working “off the books." Note: Most carriers offer a defense only sub limit for this type of claim;

Claims of unequal or unfair pay between employees performing the same job and having similar skills, education, seniority and responsibility;

Discrimination claims based on age, race, gender or sexual orientation;

Third Party. Example: Your employee out in the field of work upsets another subcontractor’s employee, a customer at their home, a student at a school enough to where they file a lawsuit against you.

Why do businesses resist purchasing EPLI?

Declining to purchase EPLI can stem from businesses feeling that they are not large enough for this type of claim to occur. Many owners have close relationships with their employees and never believe any of the above scenarios could occur within their organization. And yet, many more can assume that a General Liability policy would cover these types of potential claims when, in fact, most have specific EPLI exclusions. This type of thinking could result in losses that have severe financial consequences for your company. Let’s take a quick look at three common EPLI exposures facing the construction industry.

Common EPLI Claims in the Construction Industry

Rapid growth and layoffs are unique aspects of the construction industry that can cause the elimination of a specific position and/or termination. With these ebbs and flows, contractors unintentionally open themselves up to wrongful termination cases which can carry into discrimination charges, as well. It can also be common to see employees bring post-employment wage & hour claims, which center around improper overtime, breaks, etc. Lastly, contractors' work very often involves interaction and exposure to the public. This interaction can lead to comments, inferences, or specific actions that non-employees find offensive. Claims brought by these third parties are difficult to prove when the employer is unable to witness the events first-hand.

Light Bulb Moment

In these and other potential claim scenarios, employers without EPLI must outlay their own funds to find legal representation and fight the charges. Legal costs add up quickly regardless of the documentation an employer has kept on file and the conviction they have that an employee’s claim is frivolous. Defending yourself in today’s environment can become cost ineffective very quickly. Light bulb moments can occur when EPLI limits are unavailable because coverage is not in force and an owner is staring at a “balance sheet loss,” resulting in a six figure settlement.

Consult Your Broker for EPLI Options

At Rancho Mesa, as it relates to coverage for our clients, we often say "you would rather be looking at it than for it”. That is, you want to be looking at a policy that will respond to coverage than for one at the time of a loss. Take time to explore the nuances of employment practices liability insurance with a knowledgeable broker. Allow an expert to educate you on the real exposure to your company, ask to spreadsheet different policy forms, deductibles and limits in an effort to balance the annual premium with the potential impact of a large loss.

For more information about Employment Practices Liability Insurance, contact Rancho Mesa Insurance at (619) 937-0164.

4 Simple Steps for Passenger Van Safety

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

Many of our agency's social service and nonprofit clients serve an important function for individuals and families...transportation! Whether helping a physically challenged child get to school or embarking on a day trip to the mall with a group of adults with intellectual and developmental disabilities, it's vital to manage all risks associated with transporting clients.

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

Many of our agency's social service and nonprofit clients serve an important function for individuals and families...transportation! Whether helping a physically challenged child get to school or embarking on a day trip to the mall with a group of adults with intellectual and developmental disabilities, it's vital to manage all risks associated with transporting clients.

This article outlines important driver safety guidelines. You will also learn safety tips and the factors contributing to rollovers with large passenger vans.

Start from Day 1

Ensure all new hires receive a driver safety orientation. Make sure they understand the organization's safety policies as well as processes tied to safety. This must include volunteers who may perform driving duties for the organization.

Employee Screening and Incident Reports

Require new hire candidates to submit a Motor Vehicle Record (MVR) with the employment application, while also checking MVRs periodically. Candidates and employees who don't meet your insurance company's driver guidelines, or pose a liability to the organization, can be restricted from driving or be required to complete additional driver training. It is also a best practice to formalize an accident reporting and investigation process.

Establish a Written Driver Safety Policy

Document the organization's culture of safety and the need to protect clients, employees, and volunteers while on the road. Include a code of conduct with regards to seat belt use, driving while under the influence, distracted driving, incident reporting, and vehicle maintenance.

Understand the Risks of Passenger Vans

Large passenger vans, such as 15-passenger vans, are at a high risk of rollover.

Contributing factors

- Number of occupants: vehicles with less than 10 passengers are three times less likely to rollover

- Speed: The odds of rollover are 5x greater when traveling on high speed roads (+50mph)

- Road curvature: The odds of rolling over double on curved roads vs. straight roads

- Tire inflation: An NHTSA study found that 74% of 15-passenger vans have at least one tire underinflated by 25% or more. Underinflated tires are at a higher risk of blowout.

Safety Tips

- Never allow more passengers than allotted seats. Fill seats from front to back of the vehicle if you have open seats.

- Only allow experienced and trained drivers to operate 15-passenger vans.

- Load cargo forward of the rear axle to enhance stability and control.

- Inspect vehicles for wear and tire pressure. Maintain an accurate log.

- Replace tires on a regular basis

- Keep the vehicle within the Gross Vehicle Weight Rating (GVWR).

The risk associated with transporting clients is important to recognize and manage. With close attention to safety and written procedures any social service or nonprofit organization can successfully help move around town. Be safe out there.

For more information about transportation safety, contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164.

Resources:

Safety is Not a Luxury: Understanding the Risks of Passenger Vans, https://www.nonprofitrisk.org/app/uploads/2016/12/1222-NRM-16-Summer-Newsletter-D3

Before You Hit the Road: Stepping Stones of Driver Safety, https://www.nonprofitrisk.org/resources/articles/before-you-hit-the-road-stepping-stones-of-driver-safety/

Highlights of the New Tax Reform Law

Article provided by, Kevin Brown, Managing Partner, RBTK, LLP.

The new tax reform law, commonly called the “Tax Cuts and Jobs Act” (TCJA), is the biggest federal tax law overhaul in 31 years, and it includes both good and bad news for taxpayers.

Below are highlights of some of the most significant changes affecting individual and business taxpayers. (Except where noted, these changes are effective for tax years beginning after December 31, 2017.)

Article provided by, Kevin Brown, Managing Partner, RBTK, LLP.

The new tax reform law, commonly called the “Tax Cuts and Jobs Act” (TCJA), is the biggest federal tax law overhaul in 31 years, and it includes both good and bad news for taxpayers.

Below are highlights of some of the most significant changes affecting individual and business taxpayers. (Except where noted, these changes are effective for tax years beginning after December 31, 2017.)

Individuals

Drops of individual income tax rates ranging from 0 to 4 percentage points (depending on the bracket) to 10%, 12%, 22%, 24%, 32%, 35% and 37% — through 2025

Near doubling of the standard deduction — through 2025

Elimination of personal exemptions — through 2025

Doubling of the child tax credit to $2,000 — through 2025

Elimination of the individual mandate under the Affordable Care Act — effective for months beginning after December 31, 2018

Reduction of the adjusted gross income (AGI) threshold for the medical expense deduction to 7.5% for regular and AMT purposes — for 2017 and 2018

New $10,000 limit on the deduction for state and local taxes (on a combined basis for property and income taxes; $5,000 for separate filers) — through 2025

Reduction of the mortgage debt limit for the home mortgage interest deduction to $750,000 ($375,000 for separate filers), with certain exceptions — through 2025

Elimination of the deduction for interest on home equity debt — through 2025

Elimination of miscellaneous itemized deductions subject to the 2% — through 2025

Elimination of the AGI-based reduction of certain itemized deductions — through 2025

Expansion of tax-free Section 529 plan distributions to include those used to pay qualifying elementary and secondary school expenses, up to $10,000 per student per tax year

AMT exemption increase — through 2025

Doubling of the gift and estate tax exemptions to $10 million (expected to be $11.2 million for 2018 with inflation indexing) — through 2025

Businesses

Replacement of graduated corporate tax rates ranging from 15% to 35% with a flat corporate rate of 21%

Repeal of the 20% corporate AMT

New 20% qualified business income deduction for owners of flow-through entities (such as partnerships, limited liability companies and S corporations) and sole proprietorships — through 2025

Doubling of bonus depreciation to 100% — effective for assets acquired and placed in service after September 27, 2017, and before January 1, 2023

Doubling of the Section 179 expensing limit to $1 million

New disallowance of deductions for net interest expense in excess of 30% of the business’s adjusted taxable income (exceptions apply)

New limits on net operating loss (NOL) deductions

Elimination of the Section 199 deduction, also commonly referred to as the domestic production activities deduction or manufacturers’ deduction — effective for tax years beginning after December 31, 2017, for noncorporate taxpayers and for tax years beginning after December 31, 2018, for C corporation taxpayers

New rule limiting like-kind exchanges to real property that is not held primarily for sale

New tax credit for employer-paid family and medical leave — through 2019

New limitations on excessive employee compensation

New limitations on deductions for employee fringe benefits, such as entertainment and, in certain circumstances, meals and transportation

More to Consider

This is just a brief overview of some of the most significant TCJA provisions. There are additional rules and limits that apply, and the law includes many additional provisions. Contact your tax advisor to learn more about how these and other tax law changes will affect you in 2018 and beyond.

OSHA Accepting Electronic Form 300A Data Submissions Through End of Year

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

In a recent news release from the U.S. Department of Labor (DOL), the Occupational Safety and Health Administration (OSHA) will be accepting electronically submitted 2016 OSHA Form 300A data through midnight on December 31, 2017. The previous deadline had been December 15, 2017.

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

In a recent news release from the U.S. Department of Labor (DOL), the Occupational Safety and Health Administration (OSHA) will be accepting electronically submitted 2016 OSHA Form 300A data through midnight on December 31, 2017. The previous deadline had been December 15, 2017.

According to a statement released by the DOL, as of January 1, 2018, the Injury Tracking System "will no longer accept the 2016 data."

Employers in California, Maryland, Minnesota, South Carolina, Utah, Washington and Wyoming are currently not required to submit their OSHA reports electronically. However, it is likely it will be a requirement in the future.

Update: 5/3/18 For updated information on State requirements, read "Federal OSHA Asserts Electronic Data Reporting Requirement Applies to Employers across All States."

For additional information about the OSHA electronic reporting, read "Risk Management Center Streamlines Electronic OSHA Reporting," "DHS Alerts OSHA of Possible Electronic Reporting Security Breach," "OSHA Launched Electronic Reporting System."