Industry News

Four Factors When Developing a Nonprofit Agency's Youth Protection Plan

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services.

When designing youth protection measures, many nonprofit leaders want to understand the industry’s “best practices” and incorporate what already works for others. Unfortunately, it is very difficult to identify one set of “best practices” or a universal checklist all organizations should adopt. As a result, it will benefit nonprofit leaders and their clients to tailor daily practices to the unique exposures and operations of the agency. When doing so, it’s best to consider four important factors when designing a youth protection program.

When designing youth protection measures, many nonprofit leaders want to understand the industry’s “best practices” and incorporate what already works for others. Unfortunately, it is very difficult to identify one set of “best practices” or a universal checklist all organizations should adopt. As a result, it will benefit nonprofit leaders and their clients to tailor daily practices to the unique exposures and operations of the agency. When doing so, it’s best to consider four important factors when designing a youth protection program.

In A Season of Hope, authored by the staff at the Nonprofit Risk Management Center, the authors refer to these interlocking factors as the “Four P’s: Personnel, Participants, Program, and Premises. Let’s explore:

Staffing

The nature of the services offered to youth will dictate the staff’s professional background and education. Those nonprofits offering therapy and counseling will aim to hire employees with advanced degrees; whereas, some programs may feel comfortable hiring responsible teens and young adults. In each case, supervision and background checks are vital to client safety.

Participant Mix

Is the agency serving a pre-school program for kids who are relatively close in age with similar needs? Or, perhaps, it is a group home involving minors who all have differing special needs due to their unique family situations and backgrounds. What unique risks to the organization does each group present? Considering the characteristics of a nonprofit’s youth clientele will shape an organization’s approach to youth protection.

Program and Mission

An organization must consider how its mission and programs will impact youth safety. A nonprofit conducting group outings to encourage social behavior will not have the same concerns as an organization matching children with foster families. Each will present unique exposures.

Environment

Nonprofits serve youth in a wide range of venues and environments, and each present different risks. The variables can include supervision, activities at height, access to emergency care, and sleeping arrangements. Knowing this, it is vital for an organization’s leaders to identify how a venue presents risk to youth safety and then plan accordingly.

“My Risk Assessment” is a very strong tool available through Rancho Mesa Insurance Services. This interactive module allows nonprofit leaders to identify potential gaps in risk management in a number of areas, including client safety, transportation, and facilities.

Keeping young clients safe while in a nonprofit’s care is a core promise of the organization to the community. When nonprofit leaders take a careful look at the four P's, they can reduce the risk of harm while also ensuring the mission endures.

Please contact Rancho Mesa at (619) 937-0164 to learn more about sound risk management practices.

CIGA is “Back in Black” - Employers will receive 2% savings on 2019 workers' comp premium

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

For the first time in 20 years, the California Insurance Guarantee Association (CIGA) will not collect its annual assessment. As a result, California employers in the guaranteed cost workers' compensation insurance market will save 2% on their premium in 2019.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

For the first time in 20 years, the California Insurance Guarantee Association (CIGA) will not collect its annual assessment. As a result, California employers in the guaranteed cost workers' compensation insurance market will save 2% on their premium in 2019.

The CIGA board of directors approved a zero assessment for 2019, as it moved into the black after collecting last year’s 2% assessment on workers' compensation premiums. At one point, CIGA had a workers, compensation deficit of $4 Billion. The 20 years of employer assessments, ranging from 1% to 2.6% of premium, paid off workers' compensation debt and in some years the debt payments on special bonds issued to pay claims from insurance company insolvencies.

Similar to the rest of the Industry, CIGA’s improved fortune results from positive reforms provided in SB 863, as well as the efforts of Department of Industrial Relations Director Christine Baker.

Employers Beware! Ten Red Flags You May Have a Fraudulent Workers’ Comp Claim

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Workers’ Compensation is a form of insurance providing wage replacement and medical benefits to employees injured in the course of employment in exchange for mandatory relinquishment of the employee's right to sue their employer for the tort of negligence.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

Workers’ Compensation is a form of insurance providing wage replacement and medical benefits to employees injured in the course of employment in exchange for mandatory relinquishment of the employee's right to sue their employer for the tort of negligence.

While most people would agree with the idea of a workers' compensation system, unfortunately, there are people who try to defraud it in an effort to earn an extra buck. These individuals include both employers and employees. For this article, I will focus solely on the most common workers’ compensation fraud, claimant fraud (i.e., when an employee commits the fraud).

Claimant fraud includes false claims and exaggerated claims. These claims typically involve soft-tissue symptoms, such as headaches, whiplash, or muscle strain, which are all very difficult to disprove. In order to increase the value of the claim, claimants will also include multiple body parts. The most common types of claimant fraud includes reporting fake claims, injuries not received on the job, exaggerated injuries, and claimants working for another employer while collecting benefits from an injury claim.

Claimant fraud causes extreme frustration, animosity, and can lead business owners to question all claims, including those that are legitimate. Employers can feel helpless, especially when the system gives the benefit of the doubt to fraudsters. There are, however, red flags that both employers and insurance companies can pick up on to fight against these individuals seeking easy money.

Ten Red Flags

The top ten red flags employers can look for on a possible fraudulent claims are: When the claimant;

Hires an attorney the day of the alleged injury.

Has several other family members also receiving workers’ compensation benefits.

Exhibits a strong familiarity with the workers’ comp system.

Has been disciplined several times or is disgruntled and fears termination.

Was engaged in seasonal work that is about to end.

Continues to cancel or fails to keep medical appointments or refuses a diagnostic procedure to confirm an injury.

Changes doctors when the original suggests they return to work.

Is seen working at another job while collecting total temporary disability.

Is reluctant to return to work and shows very little improvement.

Has problems with workplace relationships.

Contact me to learn strategies for combating fraudulent claims before and after it is reported.

Risk Management Center Streamlines Electronic OSHA Reporting

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

The Occupational Health and Safety Administration (OSHA) now require certain employers to electronically submit their completed 2016 Form 300A. OSHA has created a website that allows employers to manually complete the information or upload a formatted CSV (comma-separated values) file

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

Editor's Note: This post was originally published on November 9, 2017 and has been updated to reflect the latest available information.

The Occupational Health and Safety Administration (OSHA) now requires certain employers to electronically submit their completed Form 300A. OSHA has created a website that allows employers to manually complete the information or upload a formatted CSV (comma-separated values) file. Users of Rancho Mesa’s Risk Management Center have the ability to track incidents and generate the export file, making the electronic reporting process quick and simple.

Check federal OSHA or your state's OSHA website for specific filing date deadlines.

Prepare and Submit

Once an incident occurs, Risk Management Center users track the details within the online system. All of the required information is stored and made available through reports and an export.

Request a Risk Management Center Account.

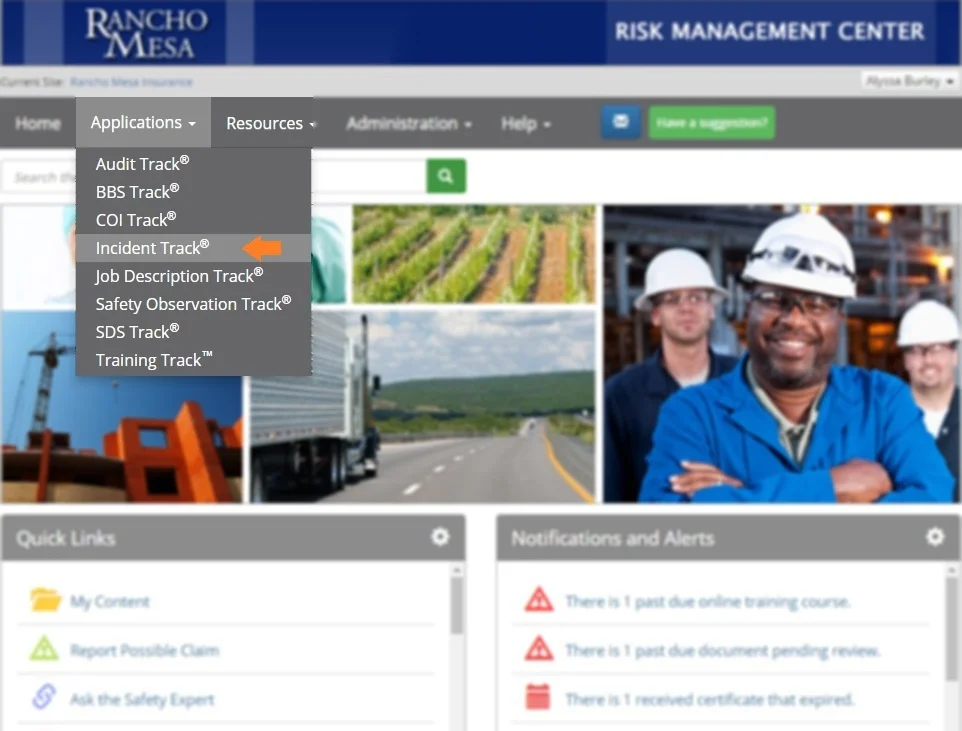

To export the OSHA 300A Report data, login to the Risk Management Center. Then, navigate to the Applications list and click on Incident Track®.

From this screen, click on the Reports menu and click the Export Data option.

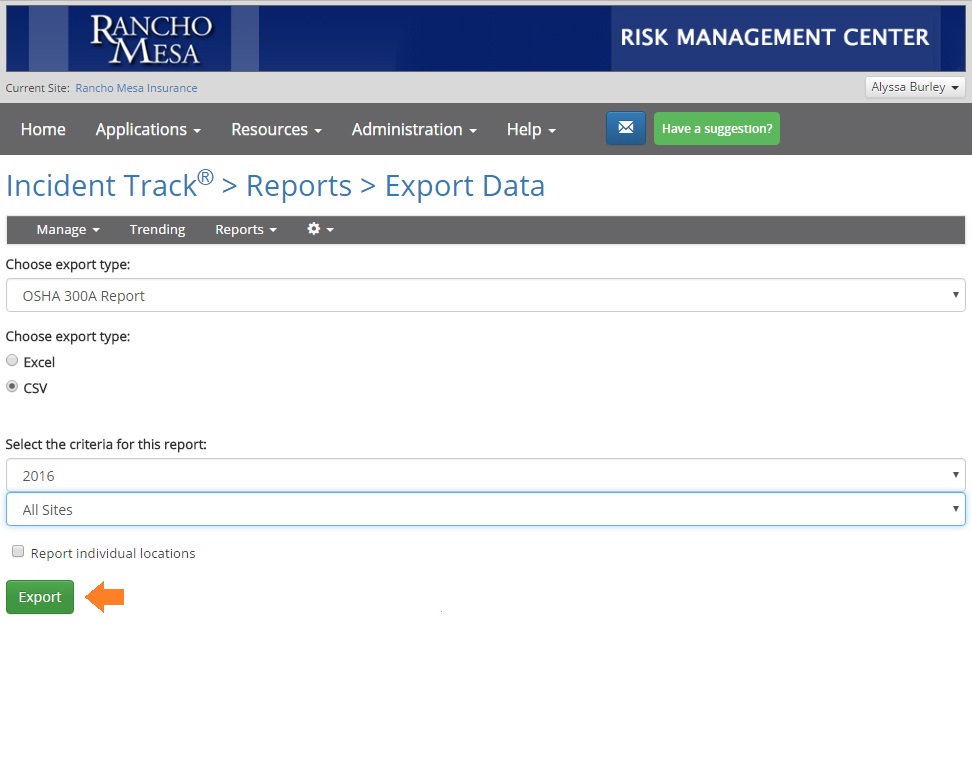

Choose the report, “OSHA 300A Report” and select the export type a CSV. Choose the year and either all your sites or just one. Click the Export button and enter your email address.

The .CSV file will be generated and emailed to you. Save the file on your computer so it can be uploaded to OSHA’s Injury Tracking Application (ITA).

To upload the .CSV file, login to OSHA’s ITA and follow the instructions on the screen.

Who is Required to Submit?

According to OSHA, “establishments with 250 or more employees are currently required to keep OSHA injury and illness records and establishments that are classified in certain industries with historically high rates of occupational injuries and illnesses.” Some of those industries include construction, manufacturing, health and residential care facilities, and building services.

On April 30, 2018, OSHA announced State Plans have been informed “that for Calendar Year 2017 all employers covered by State Plans will be expected to comply. An employer covered by a State Plan that has not completed adoption of a state rule must provide Form 300A data for Calendar Year 2017. Employers are required to submit their data by July 1, 2018. There will be no retroactive requirement for employers covered by State Plans that have not completed adoption of their own state rule.

Cal/OSHA released a statement explaining that "even though California has not yet adopted its own state rule, employers are advised to comply with federal OSHA's directive to provide Form 300A data covering calendar year 2017." In addition, other states like Maryland, Minnesota, South Carolina, Utah, Washington and Wyoming may follow California's lead.

For questions about tracking and exporting OSHA reports with the Risk Management Center, contact Rancho Mesa at (619) 937-0164

Federal OSHA Asserts Electronic Data Reporting Requirement Applies to Employers Across All States

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

The federal Occupational Safety and Health Administration (OSHA) announced Monday, April 30, 2018 it has “taken action to correct an error that was made with regard to implementing the final rule” which required some employers to electronically submit their injuring and illness reports via the Injury Tracking Application (ITA) online.

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

The federal Occupational Safety and Health Administration (OSHA) announced Monday, April 30, 2018 it has “taken action to correct an error that was made with regard to implementing the final rule” which required some employers to electronically submit their injuring and illness reports via the Injury Tracking Application (ITA) online.

Federal OSHA has determined that Section 18(c)(7) of the Occupational Safety and Health Act requires employers in State-administered OSHA plans “to make reports to the Secretary in the same manner and to the same extent as if the plan were not in effect.” Therefore, federal OSHA’s statement asserts “employers must submit injury and illness data in the Injury Tracking Application (ITA) online portal, even if the employer is covered by a State Plan that has not completed adoption of their own state rule.”

According to the announcement, State Plans have been informed “that for Calendar Year 2017 all employers covered by State Plans will be expected to comply. An employer covered by a State Plan that has not completed adoption of a state rule must provide Form 300A data for Calendar Year 2017. Employers are required to submit their data by July 1, 2018. There will be no retroactive requirement for employers covered by State Plans that have not completed adoption of their own state rule.”

“Even though California has not yet adopted its own state rule, employers are advised to comply with federal OSHA’s directive to provide Form 300A data covering calendar year 2017.”

This announcement comes on the heels of a March 2018 report by Bloomberg Environment that indicated federal OSHA anticipated more than 350,000 worksites to submit Form 300A reports via the online portal, yet nearly 200,000 weren’t submitted by the December 31, 2017 deadline. That means only 153,653 Form 300A reports were submitted and another 60,992 worksites submitted reports that were not required.

In May 2017, Cal/OSHA published a statement indicating “California employers are not required to follow the new requirements and will not be required to do so until ‘substantially similar’ regulations go through formal rulemaking, which would culminate in adoption by the Director of the Department of Industrial Relations and approval by the Office of Administrative Law." However, with the recent announcement from federal OSHA, Cal/OSHA released a statement explaining that "even though California has not yet adopted its own state rule, employers are advised to comply with federal OSHA's directive to provide Form 300A data covering calendar year 2017." In addition, other states like Maryland, Minnesota, South Carolina, Utah, Washington and Wyoming may follow California's lead.

Rancho Mesa’s Incident Track® is an effective way to manage incidents and maintain required OSHA logs. As just one of the many “tracks” inside the Agency’s “Risk Management Center,” Incident Track can also generate electronic report files that can be uploaded into the Federal OSHA’s ITA online portal.

Contact Alyssa Burley with follow up questions about these OSHA requirements and/or an interest in learning more about tracking incidents through our client based portal.

Benefits of a Student/Volunteer Accident Policy

Author, Chase Hixson, Account Executive, Human Services Group, Rancho Mesa Insurance Services, Inc.

Organizations like nonprofits, schools, home health care facilities and other entities that rely on volunteers or frequently interact with the public, may be vulnerable to accidents not covered by workers' compensation insurance. These accidents can cause an unexpected financial burden on the organization if they don't have an accident policy.

Organizations like nonprofits, schools, home health care facilities and other entities that rely on volunteers or frequently interact with the public, may be vulnerable to accidents not covered by workers' compensation insurance. These accidents can cause an unexpected financial burden on the organization if they don't have an accident policy.

What is an Accident Policy?

An accident policy offers a specified dollar amount, typically between $10,000 and $50,000, to cover medical costs to qualified participants in the event of an injury. They are fairly inexpensive and offer an added layer of defense, should an accident occur. Typically, these policies cover volunteers and/or students (for schools), and they are written on a no-fault basis. While most general liability policies require a liable party in order to pay out, accident policies pay out quickly and efficiently.

It’s important to note that these policies only cover medical costs. If the injured party were to seek legal action against your organization, your liability policy would respond.

Example of a Covered Event

If a student falls down on the playground, breaking an arm, the school has an accident policy that covers all students, providing $15,000 for each incident. The student's medical bills total $12,000. Neither the school nor the child’s parents would end up paying any money out of pocket for the accident.

Advantages of an Accident Policy

Accidents, by nature, are sudden and unexpected, as are the associated medical costs. An accident policy can reduce those financial burdens and give peace of mind knowing there is a set amount of money readily available should something go wrong.

In addition, an accident policy can help reduce the likelihood of future lawsuits. While any accident can result in subsequent legal action, there’s a greater likelihood of litigation if the injured party receives a large medical bill.

Mitigate the Financial Burden

Accident policies are a great option for those who have volunteers or students in their care. They are inexpensive and offer an added layer of financial protection that can provide significant financial relief in the wake of an accident.

Please feel free to reach out if you have any questions, and we can determine if an accident policy is the right fit for you.

The Changing Definition of Employee: What you need to know about SB 189

Author, Yvonne Gallagher, Landscape Division Account Manager, Rancho Mesa Insurance Services, Inc.

California State Capital Building.

State Bill 189 (SB 189) (Bradford) was recently enacted by the California State Legislature. It is intended to correct issues resulting from the passage of Assembly Bill 2883 (AB 2883) (Daly et. al) in 2017, which changed the requirements for business owners to exclude themselves from workers' compensation coverage.

Author, Yvonne Gallagher, Landscape Division Account Manager, Rancho Mesa Insurance Services, Inc.

California State Capital Building.

State Bill 189 (SB 189) (Bradford) was recently enacted by the California State Legislature. It is intended to correct issues resulting from the passage of Assembly Bill 2883 (AB 2883) (Daly et. al) in 2017, which changed the requirements for business owners to exclude themselves from workers' compensation coverage.

SB 189 is written to expand:

The scope of the exception from the definition of an employee to apply to an officer or member of the board of directors of a quasi-public or private corporation, except as specified, who owns at least 10% of the issued and outstanding stock, or 1% of the issued and outstanding stock of the corporation if that officer’s or member’s parent, grandparent, sibling, spouse, or child owns at least 10% of the issued and outstanding stock of the corporation and that officer or member is covered by a health care service plan or a health insurance policy, and executes a written waiver, as described above. The bill would expand the scope of the exception to apply to an owner of a professional corporation, as defined, who is a practitioner rendering the professional services for which the professional corporation is organized, and who executes a document, in writing and under penalty of perjury, both waiving his or her rights under the laws governing workers’ compensation, and stating that he or she is covered by a health insurance policy or a health care service plan. The bill would expand the scope of the exception to include an officer or member of the board of directors of a cooperative corporation, as specified. The bill would also expand the definition of an employee to specifically include a person who holds the power to revoke a trust, with respect to shares of a private corporation held in trust or general partnership or limited liability company interests held in trust, and would authorize that person to also elect to be excluded from the requirement to obtain workers’ compensation coverage, as specified. The bill would provide that an insurance carrier, insurance agent, or insurance broker is not required to investigate, verify, or confirm the accuracy of the facts contained in the waiver. (Legislative Counsel, 2018)

Once a waiver is signed and on file with the insurance carrier it will remain in effect until there is a written withdrawal. When changing insurance carriers a new waiver must be signed with the new carrier.

Effective 1/1/18

- Carriers were able to accept waivers up until 12/31/17 for policies issued in 2017 that weren't turned in on time and the officer exclusion is being honored from the inception of the policy and is being applied at final audit.

Effective 7/1/18

- Trusts will be eligible for officer exclusion.

- To be excluded, the required ownership percentage will change from 15% to 10%.

- An officer with 1%-9% ownership that is related to an excluded officer that owns 10% or more may also be excluded as long as they have health insurance.

- Waivers currently are required at the policy effective date. SB 189 provides a 15-day grace period from the effective date to turn in the waiver. The waiver may only be backdated 15 days.

Examples: With a 1/1/18 effective date, if the waiver is turned in and accepted by 1/15/18, the officer exclusion will be effective 1/1/18. With a 1/1/18 effective date, if the waiver is turned in and accepted by 2/15/18, the officer exclusion will be effective 2/1/18.

For specific questions about your workers' compensation policy, contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164.

Workplace Violence Insurance Surges in Aftermath of Shootings

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

In response to the hundreds of mass shootings taking place each year, the insurance marketplace has produced new workplace violence products to help employers and employees recover from a crisis.

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

In response to the hundreds of mass shootings taking place each year, the insurance marketplace has produced new workplace violence products to help employers and employees recover from a crisis.

U.S. employers have an obligation for duty of care for the safety, health, and security of employees (see Occupational Safety and Health Administration (OSHA) Act of 1970). Duty of care requires protection against workplace violence hazards.

A mass shooting is an attack resulting in 4 or more.

| Year | # of Incidents |

|---|---|

| 2017 | 327 |

| 2016 | 385 |

| 2015 | 333 |

It is the employer's obligation to protect its employees from violence. Homeland Security defines an active shooter as “an individual actively engaged in killing or attempting to kill people in a confined and populated area.” While OSHA describes workplace violence as “any act or threat of physical violence, harassment, intimidation, or other threatening disruptive behavior that occurs at the work site.” What is your organization doing to protect its people from these types of events?

Over the last three years, the United States recorded an average of 348 mass shootings per year.

| Description | Cost |

|---|---|

| Support for survivors and families of victims | $2.7 million |

| Cleanup, renovations, and other facility changes | $6.4 million |

| Settlement payments and other legal costs | $4.8 million |

Costs to Consider

As victims, families, and co-workers struggle to heal after losing friends and loved ones, the costs continue to mount.

Aside from treating survivors, consider some of the costs from the Virginia Tech University shooting: survivor support, cleanup, renovations, facility changes, settlement payouts and legal costs.

How would your organization absorb the cost of such an event?

Workplace Violence Policy Coverage

In addition to providing a consultant to guide businesses through an emergency event, a covered event will trigger legal liability coverage to address legal expenses. These expenses may be related to the following:

- Business interruption expense

- Defense and indemnity expenses

- Public relations counsel

- Psychiatric care

- Medical or dental care

- Employee counseling

- Temporary security measures

- Rehabilitation expenses

- Limits start at $1,000,000 with $0 deductible

Among other underwriting considerations, when pricing workplace violence policies, carriers factor in operations like exchanging money with the public, working with volatile or unstable people, providing services and care to the public, and working where alcohol is served. Take a look at your organization's operations to see if there is a risk.

Please contact Rancho Mesa Insurance Services to discuss whether this insurance is right for your organization.

Information sourced from McGowan Program Administrators.

3 Practical Reasons for Timely Claims Reporting

Author, Jim Malone, Claims Advocate, Rancho Mesa Insurance Services, Inc.

When a work-related accident occurs, as a business owner or manager, it is our nature to want to analyze the situation in order to learn how to avoid it in the future. However, the reporting of the incident is equally as important. With the recent requirement to report first aid claims, timely reporting for all claims is recognized as being critical for a number of reasons.

Author, Jim Malone, Claims Advocate, Rancho Mesa Insurance Services, Inc.

When a work-related accident occurs, as a business owner or manager, it is our nature to want to analyze the situation in order to learn how to avoid it in the future. However, the reporting of the incident is equally as important. With the recent requirement to report first aid claims, timely reporting for all claims is recognized as being critical for a number of reasons.

Employee Morale

First and foremost, timely reporting allows for immediate care of any injuries that may have occurred as a result of the incident. It promotes prompt referral for medical evaluation, documentation of the bodily areas affected, and provides recommendations for treatment.

Promptly reporting an injury shows the injured employee, and their coworkers, that the company cares about them. When an employee knows the employer cares, they are less likely to litigate the claim, which can significantly reduce the overall cost to the employer.

Elimination of Hazards

Timely reporting can trigger the immediate assessment of the scene and cause of the accident. The initial focus is to document the area and determine if there is still an injurious exposure or condition present that may need to be addressed to prevent further incidents or injuries. Timely reporting also allows for prompt investigation of the accident and the scene of the accident, identify witnesses, secure faulty tools or equipment for safety and subrogation purposes, and to convey a sense of responsibility and concern for the employee that their safety is of extreme importance.

Prompt investigations into the cause of a near miss, accidents, and injuries can lead to an understanding of the factors that lead up to the incident. Thus, the employer has the opportunity to make changes in processes and improvements in safety in order to prevent future near miss events or accidents from occurring.

Cost Savings

Timely reporting can directly affect the overall costs of a claim. Decreased medical costs are realized when injuries are promptly assessed, allowing for treatment to start immediately. Injured employees tend to recover quickly when treatment is provided right away. Swift recoveries usually result in shorter periods of temporary total and/or temporary partial disability, fewer diagnostic studies, physical therapy visits, injections, surgeries, permanent physical limitations, work restrictions or permanent disability percentages, and lower future medical care needs. This translates into lower financial resources allocated to these claims.

The timely reporting of a claim promotes positive morale among employees; helps remove potential future hazards from the workplace and can significantly reduce overall the cost of incidents.

For more information about claims reporting, contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164.

Top Three Benefits of Conducting an In-Home Health Care Safety Inspection

Author, Chase Hixson, Account Executive, Human Services, Rancho Mesa Insurance Services, Inc.

For many Home Health Care companies, conducting an in-home inspection on all new cases is standard practice. The intent of these inspections is to improve the quality of services offered; however, there is also an additional opportunity to improve the risk profile for those health care companies and thereby help them reduce their insurance costs.

For many Home Health Care companies, conducting an in-home inspection on all new cases is standard practice. The intent of these inspections is to improve the quality of services offered; however, there is also an additional opportunity to improve the risk profile for those health care companies and thereby help them reduce their insurance costs.

Best practices suggest that Home Health Care companies conduct safety inspections in the home for all new clients prior to having a caregiver work the case. If possible, have the caregiver(s) that will be in the home, conduct the inspection with you. Following are 3 ways inspections with an eye toward safety can help improve your risk profile.

Providing An Opportunity to Point out Safety Hazards

The most obvious outcome is the opportunity to point out safety hazards. Having two sets of eyes on the home will help to identify potential hazards such as a poorly lit staircase, an over stocked bookshelf where the caregiver might obtain supplies, a crowded kitchen, or loose carpet or rug.

Engaging the Employee as an Equal Partner in Safety

Studies show claims are less likely to occur when the employee is engaged in the safety process. For example, if the employee is involved with assessing their own hazards and determining their own safety, they are more likely follow the guidelines.

Improving your Frequency Rate

Conducting pre-case safety inspections is known to reduce the frequency of claims. It’s no surprise taking this step will positively impact the employer’s insurance premium. Not only is the likelihood of a claim reduced, the ability to react to a claim with proper corrective action increases, as well. If an accident were to occur, prior inspections will speed up the discovery process and allow the proper changes to be made, in theory, reducing the likelihood of the incident occurring again.

Conducting safety inspections in the home prior to assigning a case workers is a great way to not only benefit pricing immediately, reduce the likelihood of a claim in the future, thereby helping you to sustain favorable pricing in the future.

If you would like to learn more, or have any questions, please contact Rancho Mesa at (619) 937-0164.

Reminder: 2017 OSHA Summary of Work-Related Injuries and Illness Must Be Posted

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

According to a recent memo, the State of California Department of Industrial Relations would like to remind employers that they are required to physically post their 2017 annual summaries of work-related injuries from February 1, 2018 through April 30, 2018.

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

According to a recent memo, the State of California Department of Industrial Relations would like to remind employers that they are required to physically post their 2017 annual summaries of work-related injuries from February 1, 2018 through April 30, 2018.

OSHA’s Summary of Work-Related Injuries and Illness, also known as Form 300A, must be completed and posted for employees to view.

If you are tracking work-related injuries in the Rancho Mesa Risk Management Center, the Form 300A can be generated from the system. From the Incident Track screen, click on "Reports," then "OSHA Reports," select "OSHA 300A Summary," the "2017." Complete any missing information and "Download."

To manually complete the Form 300A, review the instructions found on the Cal/OSHA or OSHA websites.

If you are unsure if you are required to maintain OSHA logs, visit the OSHA website.

Why Would a Contractor Purchase Employment Practices Liability Insurance?

Author, Kevin Howard, CRIS, Account Executive, Construction Gorup, Rancho Mesa Insurance Services, Inc.

Insurance is often considered a necessary evil by business owners. It can represent a significant line item on a profit & loss statement rivaling the cost in some cases of payroll, material costs and rent. With deductibles that can range from $15,000-$25,000 per claim, why then would a business spend dollars on an insurance policy that is not required by either state law or part of any General Contractor’s insurance specifications?

Author, Kevin Howard, CRIS, Account Executive, Construction Group, Rancho Mesa Insurance Services, Inc.

Insurance is often considered a necessary evil by business owners. It can represent a significant line item on a profit & loss statement rivaling the cost in some cases of payroll, material costs and rent. With deductibles that can range from $15,000-$25,000 per claim, why then would a business spend dollars on an insurance policy that is not required by either state law or part of any general contractor’s insurance specifications?

What does an EPLI policy cover?

Employment Practices Liability Insurance (EPLI) policies typically extend coverage to the following:

Wrongful termination of an employee who alleges violation of their contract;

Sexual harassment claims by one employee against another;

Wage related claims by employees who allege denial of overtime pay or tips, or working “off the books." Note: Most carriers offer a defense only sub limit for this type of claim;

Claims of unequal or unfair pay between employees performing the same job and having similar skills, education, seniority and responsibility;

Discrimination claims based on age, race, gender or sexual orientation;

Third Party. Example: Your employee out in the field of work upsets another subcontractor’s employee, a customer at their home, a student at a school enough to where they file a lawsuit against you.

Why do businesses resist purchasing EPLI?

Declining to purchase EPLI can stem from businesses feeling that they are not large enough for this type of claim to occur. Many owners have close relationships with their employees and never believe any of the above scenarios could occur within their organization. And yet, many more can assume that a General Liability policy would cover these types of potential claims when, in fact, most have specific EPLI exclusions. This type of thinking could result in losses that have severe financial consequences for your company. Let’s take a quick look at three common EPLI exposures facing the construction industry.

Common EPLI Claims in the Construction Industry

Rapid growth and layoffs are unique aspects of the construction industry that can cause the elimination of a specific position and/or termination. With these ebbs and flows, contractors unintentionally open themselves up to wrongful termination cases which can carry into discrimination charges, as well. It can also be common to see employees bring post-employment wage & hour claims, which center around improper overtime, breaks, etc. Lastly, contractors' work very often involves interaction and exposure to the public. This interaction can lead to comments, inferences, or specific actions that non-employees find offensive. Claims brought by these third parties are difficult to prove when the employer is unable to witness the events first-hand.

Light Bulb Moment

In these and other potential claim scenarios, employers without EPLI must outlay their own funds to find legal representation and fight the charges. Legal costs add up quickly regardless of the documentation an employer has kept on file and the conviction they have that an employee’s claim is frivolous. Defending yourself in today’s environment can become cost ineffective very quickly. Light bulb moments can occur when EPLI limits are unavailable because coverage is not in force and an owner is staring at a “balance sheet loss,” resulting in a six figure settlement.

Consult Your Broker for EPLI Options

At Rancho Mesa, as it relates to coverage for our clients, we often say "you would rather be looking at it than for it”. That is, you want to be looking at a policy that will respond to coverage than for one at the time of a loss. Take time to explore the nuances of employment practices liability insurance with a knowledgeable broker. Allow an expert to educate you on the real exposure to your company, ask to spreadsheet different policy forms, deductibles and limits in an effort to balance the annual premium with the potential impact of a large loss.

For more information about Employment Practices Liability Insurance, contact Rancho Mesa Insurance at (619) 937-0164.

4 Simple Steps for Passenger Van Safety

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

Many of our agency's social service and nonprofit clients serve an important function for individuals and families...transportation! Whether helping a physically challenged child get to school or embarking on a day trip to the mall with a group of adults with intellectual and developmental disabilities, it's vital to manage all risks associated with transporting clients.

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

Many of our agency's social service and nonprofit clients serve an important function for individuals and families...transportation! Whether helping a physically challenged child get to school or embarking on a day trip to the mall with a group of adults with intellectual and developmental disabilities, it's vital to manage all risks associated with transporting clients.

This article outlines important driver safety guidelines. You will also learn safety tips and the factors contributing to rollovers with large passenger vans.

Start from Day 1

Ensure all new hires receive a driver safety orientation. Make sure they understand the organization's safety policies as well as processes tied to safety. This must include volunteers who may perform driving duties for the organization.

Employee Screening and Incident Reports

Require new hire candidates to submit a Motor Vehicle Record (MVR) with the employment application, while also checking MVRs periodically. Candidates and employees who don't meet your insurance company's driver guidelines, or pose a liability to the organization, can be restricted from driving or be required to complete additional driver training. It is also a best practice to formalize an accident reporting and investigation process.

Establish a Written Driver Safety Policy

Document the organization's culture of safety and the need to protect clients, employees, and volunteers while on the road. Include a code of conduct with regards to seat belt use, driving while under the influence, distracted driving, incident reporting, and vehicle maintenance.

Understand the Risks of Passenger Vans

Large passenger vans, such as 15-passenger vans, are at a high risk of rollover.

Contributing factors

- Number of occupants: vehicles with less than 10 passengers are three times less likely to rollover

- Speed: The odds of rollover are 5x greater when traveling on high speed roads (+50mph)

- Road curvature: The odds of rolling over double on curved roads vs. straight roads

- Tire inflation: An NHTSA study found that 74% of 15-passenger vans have at least one tire underinflated by 25% or more. Underinflated tires are at a higher risk of blowout.

Safety Tips

- Never allow more passengers than allotted seats. Fill seats from front to back of the vehicle if you have open seats.

- Only allow experienced and trained drivers to operate 15-passenger vans.

- Load cargo forward of the rear axle to enhance stability and control.

- Inspect vehicles for wear and tire pressure. Maintain an accurate log.

- Replace tires on a regular basis

- Keep the vehicle within the Gross Vehicle Weight Rating (GVWR).

The risk associated with transporting clients is important to recognize and manage. With close attention to safety and written procedures any social service or nonprofit organization can successfully help move around town. Be safe out there.

For more information about transportation safety, contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164.

Resources:

Safety is Not a Luxury: Understanding the Risks of Passenger Vans, https://www.nonprofitrisk.org/app/uploads/2016/12/1222-NRM-16-Summer-Newsletter-D3

Before You Hit the Road: Stepping Stones of Driver Safety, https://www.nonprofitrisk.org/resources/articles/before-you-hit-the-road-stepping-stones-of-driver-safety/

Highlights of the New Tax Reform Law

Article provided by, Kevin Brown, Managing Partner, RBTK, LLP.

The new tax reform law, commonly called the “Tax Cuts and Jobs Act” (TCJA), is the biggest federal tax law overhaul in 31 years, and it includes both good and bad news for taxpayers.

Below are highlights of some of the most significant changes affecting individual and business taxpayers. (Except where noted, these changes are effective for tax years beginning after December 31, 2017.)

Article provided by, Kevin Brown, Managing Partner, RBTK, LLP.

The new tax reform law, commonly called the “Tax Cuts and Jobs Act” (TCJA), is the biggest federal tax law overhaul in 31 years, and it includes both good and bad news for taxpayers.

Below are highlights of some of the most significant changes affecting individual and business taxpayers. (Except where noted, these changes are effective for tax years beginning after December 31, 2017.)

Individuals

Drops of individual income tax rates ranging from 0 to 4 percentage points (depending on the bracket) to 10%, 12%, 22%, 24%, 32%, 35% and 37% — through 2025

Near doubling of the standard deduction — through 2025

Elimination of personal exemptions — through 2025

Doubling of the child tax credit to $2,000 — through 2025

Elimination of the individual mandate under the Affordable Care Act — effective for months beginning after December 31, 2018

Reduction of the adjusted gross income (AGI) threshold for the medical expense deduction to 7.5% for regular and AMT purposes — for 2017 and 2018

New $10,000 limit on the deduction for state and local taxes (on a combined basis for property and income taxes; $5,000 for separate filers) — through 2025

Reduction of the mortgage debt limit for the home mortgage interest deduction to $750,000 ($375,000 for separate filers), with certain exceptions — through 2025

Elimination of the deduction for interest on home equity debt — through 2025

Elimination of miscellaneous itemized deductions subject to the 2% — through 2025

Elimination of the AGI-based reduction of certain itemized deductions — through 2025

Expansion of tax-free Section 529 plan distributions to include those used to pay qualifying elementary and secondary school expenses, up to $10,000 per student per tax year

AMT exemption increase — through 2025

Doubling of the gift and estate tax exemptions to $10 million (expected to be $11.2 million for 2018 with inflation indexing) — through 2025

Businesses

Replacement of graduated corporate tax rates ranging from 15% to 35% with a flat corporate rate of 21%

Repeal of the 20% corporate AMT

New 20% qualified business income deduction for owners of flow-through entities (such as partnerships, limited liability companies and S corporations) and sole proprietorships — through 2025

Doubling of bonus depreciation to 100% — effective for assets acquired and placed in service after September 27, 2017, and before January 1, 2023

Doubling of the Section 179 expensing limit to $1 million

New disallowance of deductions for net interest expense in excess of 30% of the business’s adjusted taxable income (exceptions apply)

New limits on net operating loss (NOL) deductions

Elimination of the Section 199 deduction, also commonly referred to as the domestic production activities deduction or manufacturers’ deduction — effective for tax years beginning after December 31, 2017, for noncorporate taxpayers and for tax years beginning after December 31, 2018, for C corporation taxpayers

New rule limiting like-kind exchanges to real property that is not held primarily for sale

New tax credit for employer-paid family and medical leave — through 2019

New limitations on excessive employee compensation

New limitations on deductions for employee fringe benefits, such as entertainment and, in certain circumstances, meals and transportation

More to Consider

This is just a brief overview of some of the most significant TCJA provisions. There are additional rules and limits that apply, and the law includes many additional provisions. Contact your tax advisor to learn more about how these and other tax law changes will affect you in 2018 and beyond.

OSHA Accepting Electronic Form 300A Data Submissions Through End of Year

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

In a recent news release from the U.S. Department of Labor (DOL), the Occupational Safety and Health Administration (OSHA) will be accepting electronically submitted 2016 OSHA Form 300A data through midnight on December 31, 2017. The previous deadline had been December 15, 2017.

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

In a recent news release from the U.S. Department of Labor (DOL), the Occupational Safety and Health Administration (OSHA) will be accepting electronically submitted 2016 OSHA Form 300A data through midnight on December 31, 2017. The previous deadline had been December 15, 2017.

According to a statement released by the DOL, as of January 1, 2018, the Injury Tracking System "will no longer accept the 2016 data."

Employers in California, Maryland, Minnesota, South Carolina, Utah, Washington and Wyoming are currently not required to submit their OSHA reports electronically. However, it is likely it will be a requirement in the future.

Update: 5/3/18 For updated information on State requirements, read "Federal OSHA Asserts Electronic Data Reporting Requirement Applies to Employers across All States."

For additional information about the OSHA electronic reporting, read "Risk Management Center Streamlines Electronic OSHA Reporting," "DHS Alerts OSHA of Possible Electronic Reporting Security Breach," "OSHA Launched Electronic Reporting System."

California Workers Compensation 2018 Annual Officer Payrolls Minimums and Maximums, Assessment Rates, and Dual Wage Thresholds Announced by WCIRB

ICW Group Insurance Company, the largest group of privately held insurance companies domiciled in California, recently released an announcement that outlines the details and is attached for your review.

ICW Group Insurance Company, the largest group of privately held insurance companies domiciled in California, recently released an announcement that outlines the details of California Workers Compensation 2018 Annual Officer Payrolls Minimums and Maximums, Assessment Rates, and Dual Wage Thresholds. The document is available for your review.

For any questions concerning the changes, please contact your Rancho Mesa service team.

3 Steps to Developing Your 2018 Safety Training Calendar

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

The end of the year is the perfect time to evaluate your company’s overall safety program. One important element in a successful safety program is the weekly safety meetings (aka training shorts, tailgate talks, or toolbox talks).

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

Example of a construction training short calendar.

The end of the year is the perfect time to evaluate your company’s overall safety program. One important element in a successful safety program is the weekly safety meetings (aka training shorts, tailgate talks, or toolbox talks).

Rancho Mesa’s Risk Management Library provides the content employers need to educate their employees on how to be safe in the workplace.

The library includes hundreds of English and Spanish training shorts designed to educate employees on various safety topics in a quick and concise manner. Each training short typically includes 1-2 pages of easy to follow content and a sign-in sheet.

Rancho Mesa recommends choosing 52 topics that are relevant to your industry. This will serve as your training short calendar for 2018.

Step 1: Review the Training Shorts Library

To access the training shorts within the library, login to the Risk Management Center, click “Resources,” then click “Risk Management Library. Click on “Training Shorts,” then click “Safety.”

Review the list to determine which topics are appropriate for your industry.

Step 2: Save the Training Topics

It is recommended that you save your selected Training Shorts to your “My Content” folder. This will make it easily to find them later.

From the list of training shorts, check the box to the left of the title(s) you would like to save to the “My Content” folder. Then, click “Add to My Content” in the upper right corner. Choose the subfolder to save the training shorts. Now, you can refer back to the list of topics, later.

Step 3: Schedule the Trainings

Now, that you have picked your 52 training topics from the library, we recommend putting them on a calendar. Pick a day during the week when you’ll have your safety meeting and include the topic for each week. Training may also be scheduled within the Risk Management Center.

For recommendations for your training calendar, contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164.

OSHA Pushes Back Electronic Reporting Deadline

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

In a recent news release from the U.S. Department of Labor (DOL), the Occupational Safety and Health Administration (OSHA) announced it has extended its electronic reporting deadline from December 1, 2017 to December 15, 2017.

Author, Alyssa Burley, Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

In a recent news release from the U.S. Department of Labor (DOL), the Occupational Safety and Health Administration (OSHA) announced it has extended its electronic reporting deadline from December 1, 2017 to December 15, 2017.

The extension was made "to allow affected employers additional time to become familiar with the new electronic reporting system launched on August 1, 2017," according to the statement issed by the DOL's OSHA.

Employers in California, Maryland, Minnesota, South Carolina, Utah, Washington and Wyoming are currently not required to submit their OSHA reports electronically. However, it is likely it will be a requirement in the future.

Update: 5/3/18 For updated information on State requirements, read "Federal OSHA Asserts Electronic Data Reporting Requirement Applies to Employers across All States."

For additional information about the OSHA electronic reporting, read "Risk Management Center Streamlines Electronic OSHA Reporting," "DHS Alerts OSHA of Possible Electronic Reporting Security Breach," "OSHA Launched Electronic Reporting System."

7 Tips for Managing Risk at Nonprofit Special Events

Author, Sam Brown, Vice President, Human Services, Rancho Mesa Insurance Services, Inc.

Nonprofit organizations often conduct special events throughout the year. These events can successfully increase awareness of the nonprofit’s mission, generate important unrestricted revenue, and offer all stakeholders a nice opportunity to have fun. Unfortunately, important risk management steps are often overlooked before the day of the event. Let’s look at a few that can limit exposure to risk.

Author, Sam Brown, Vice President, Human Services, Rancho Mesa Insurance Services, Inc.

Nonprofit organizations often conduct special events throughout the year. These events can successfully increase awareness of the nonprofit’s mission, generate important unrestricted revenue, and offer all stakeholders a nice opportunity to have fun. Unfortunately, important risk management steps are often overlooked before the day of the event. Let’s look at a few that can limit exposure to risk.

1. Documenting Risk Management Activities

In addition to helping train and supervise personnel, a written plan can help to ensure important actions take place. Documenting activities also helps an organization defend its actions if an accident occurs.

2. Safety Officer

Consider assigning risk management oversight specifically to one person. The “safety officer” should receive the proper training and resources to safeguard the event, the organization, the participants, and others.

3. Crisis Response Team

To prevent a crisis from draining valuable resources, develop a crisis response team of three to five people. This team should handle any emergency quickly and effectively while working with all stakeholders.

4. Pre-Event Inspections

This important step helps you identify and correct unsafe conditions before an event as well as identify pre-existing damage to the property. During the inspection, note any damages prior to the event and give a copy to the facility manager. It is also a good idea to inspect the premises during and after the event.

5. Emergency Plans

A host of things can go wrong at a special event, so an organization must know how to address these when they occur. Consider the following: evacuations, medical emergencies, crowd control, and limiting alcohol consumption.

6. Volunteers

Ensuring that your “day of” volunteers are properly trained and supervised is a very important risk management challenge. Without such precautions, great harm can come to the organization. Allow time to screen and select the best candidates.

7. Food and Beverages

Will your organization provide and serve food, or, is a vendor performing these functions? You can transfer risk to vendors in most situations, but if your organization is providing food and beverage then consider the following:

Facilities: Is there adequate preparation, storage, and refrigeration facilities for the type of food?

Health Regulations: Do you need a health department permit? What other health department regulations should you consider?

Food Spoilage and Contamination: Do your food handlers have the proper training for handling the food being served?

These are only a few of the very important risk management practices a nonprofit organization should consider before a special event. Ignoring these exposures in the planning phase can turn a fun day into a costly event. For a full risk assessment of your special event and other activities, please contact Rancho Mesa Insurance Services, Inc.s at (619) 937-1064.

Sources: The Nonprofit Risk Management Center’s “My Assessment“ module (www.nonprofitrisk.org).

OSHA Announces Top 10 Cited Violations for FY 2017

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

The Occupational Safety and Health Administration (OSHA) released its preliminary top 10 citation list for fiscal year 2017 at the annual National Safety Council (NSC) Congress and Expo, held in late September 2017.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

The Occupational Safety and Health Administration (OSHA) released its preliminary top 10 citation list for fiscal year 2017 at the annual National Safety Council (NSC) Congress and Expo, held in late September 2017.

“One thing I’ve said before in the past on this is, this list doesn’t change too much from year to year,” said Patrick Kapust, deputy director of OSHA’s Directorate of Enforcement and Programs, during the expo presentation. “These things are readily fixable. I encourage folks to use this list and look at your own workplace.”

OSHA compiled the list using data collected from incidents occurring from October 2016 through September 2017.

- Fall Protection in Construction: 6,072 violations.

Frequently violated requirements include unprotected edges and open sides in residential construction and failure to provide fall protection on low-slope roofs - Hazard Communication: 4,176 violations.

Not having a hazard communication program topped the violations, followed by not having or providing access to safety data sheets - Scaffolding: 3,288 violations.

Frequent violations include improper access to surfaces and lack of guardrails - Respiratory Protection: 3,097 violations.

Failure to establish a respiratory protections program topped these violations, followed by failure to provide medical evaluations - Lockout/Tagout: 2,877 violations.

Frequent violations were inadequate worker training and inspections not completed. - Ladders in Construction: 2,241 violations.

Frequent violations include improper use of ladders, damaged ladders and using the top step. - Powered Industrial Trucks: 2,162 violations.

Violations include inadequate worker training and refresher training. - Machine Guarding: 1,933 violations.

Exposure points of operation topped these violations. - Fall Protection-training requirements: 1,523 violations.

Common violations include failure to train workers in identifying fall hazards and proper use of fall protection equipment. - Electrical-wiring methods: 1,405 violations.

Violations of this standard were found in most general industry sectors, including food and beverage, retail and manufacturing

Training materials for each of the items on the OSHA list are available within the Risk Management Center. Contact Rancho Mesa Insurance Services, Inc. at (619) 937-0164, for more information.