Industry News

Resources and Tools for Completing Your Workplace Violence Prevention Plan

Author, Megan Lockhart, Client Communications Coordinator, Rancho Mesa Insurance Services, Inc.

As July 1st quickly approaches, California businesses are working hard to prepare their Workplace Violence Prevention plans before the deadline. In our aim to serve the needs of our clients, Rancho Mesa has outlined resources we offer to supplement your specific company’s training and plan.

Author, Megan Lockhart, Client Communications Coordinator, Rancho Mesa Insurance Services, Inc.

As July 1st quickly approaches, California businesses are working hard to prepare their Workplace Violence Prevention plans before the deadline. In our aim to serve the needs of our clients, Rancho Mesa has outlined resources we offer to supplement your specific company’s training and plan.

The SafetyOne™ platform and the RM365 HRAdvantage™ portal has the online training topics and recordkeeping tools available for workplace violence prevention.

HR Portal Course

Preventing Workplace Violence Training for Employees

SafetyOne Courses

Active Shooter: Surviving an Attack

Workplace Security

Workplace Violence

Workplace Violence in Construction Environments

Workplace Violence in Food Processing and Handling Environments

Workplace Violence in Healthcare Facilities

Workplace Violence in Office Environments

Clients can utilize SafetyOne’s incident report forms or create their own custom forms to collect workplace violence incident data on the job. The information collected in these forms are stored in the SafetyOne administrator website. Forms such as Accident Investigation, Incident Investigation, Incident Witness Statement, and Witness Statement can support clients’ Workplace Violence Prevention plan.

Online training can be used as a tool towards creating a complete Workplace Violence Prevention Plan. However, employers must also train their employees on the specific hazards of their company’s location, and address these in their written Workplace Violence Prevention Plan.

For questions regarding accessing Rancho Mesa resources, clients can contact their client technology coordinator.

Subcontractors: The Prime Contract and Its Impact On Your Rights and Responsibilities

Author, Anne Wright, Surety Relationship Executive, Rancho Mesa Insurance Services, Inc.

Reviewing contracts is not everyone’s favorite thing to do. But, I would like to share some quick thoughts on why asking for and reviewing the prime contract (before you sign your subcontract, ideally) can be important for subcontractors. This can help strengthen your position if certain conflicts arise.

Author, Anne Wright, Surety Relationship Executive, Rancho Mesa Insurance Services, Inc.

Reviewing contracts is not everyone’s favorite thing to do. But, I would like to share some quick thoughts on why asking for and reviewing the prime contract (before you sign your subcontract, ideally) can be important for subcontractors. This can help strengthen your position if certain conflicts arise.

I have had the pleasure of knowing Pam Scholefield of Scholefield Construction Law, here in San Diego, for many years. Pam and I are both active and involved in NECA, as well as the Women’s Construction Coalition. Pam has an impressive background not just in her law practice and involvement in the industry, but in her education and prior job experience. Pam was an engineer for General Dynamics when female engineers were quite rare. She gained a valuable skillset that led her into the legal realm, and her passion for construction law and subcontractors, particularly.

I recently attended a class that Pam presented for one of these associations. The topic was contract terms. Diving into the weeds a bit, there were some key points that I’ve found to be relevant for all subcontractors. Each subcontractor can, of course, assess their own risk. I just want to address a few things that might make a difference and help you avoid certain disputes.

A few things to consider:

Does the prime contract always prevail if there are differing provisions in the subcontract?

It may prove in your best interest to incorporate your proposal into the subcontract.

Are things like warranty, payment terms, and liquidated damages negotiable in the subcontract?

When should you request a copy of the prime contract, at bid time or before you sign the subcontract?

Do not sign the subcontract until you are clear about your key issues. Those issues may be different for different jobs, but knowing about key provisions and terms up front may well prevent you from some nasty attempts at negotiations later in the job. Better contracts can translate into more profitable, and certainly more successful, projects.

Understanding Insurance Options for Tree Care Vehicles with Permanently Mounted Equipment

Author, Rory Anderson, Account Executive, Rancho Mesa Insurance Services, Inc.

The vehicles that tree care companies are using today have become more specialized and more mechanized than ever. These specialized vehicles contribute to the overall productivity, profitability, and safety of the tree care industry.

Author, Rory Anderson, Account Executive, Rancho Mesa Insurance Services, Inc.

The vehicles that tree care companies are using today have become more specialized and mechanized than ever. These specialized vehicles contribute to the overall productivity, profitability, and safety of the tree care industry.

Many vehicles in a tree care company’s fleet have permanently mounted equipment. The crane is a great example. Both the knuckleboom and straight boom crane are permanently mounted onto the cab and chassis. Obviously, the value of the vehicle significantly increases the moment the crane is mounted.

When placing insurance coverage for this unit, it is important to understand the options. The liability coverage for specialty vehicles will always be insured on the commercial auto policy. However, when insuring the physical damage to your unit, you may have a couple different options.

The commercial auto policy will value the physical damage on actual cash value, which is a depreciated value. Actual cash value equals the replacement cost minus depreciation. In the event of a physical damage claim, the commercial auto insurance carrier will factor in depreciation when determining the amount to pay out for the claim. If you have an older crane, this may be an acceptable way to provide coverage. Just be certain that your insurance broker and carrier have the total value, including the crane, for the vehicle.

You can also split the physical damage coverage between commercial auto and inland marine. Often times, you can get replacement cost valuation on the inland marine policy, which is a more robust valuation. Replacement cost is the cost of a new one today, without factoring in depreciation. You can cover the physical damage of the vehicle (cab and chassis) on the commercial auto policy, but then you can cover the crane itself on the inland marine policy and get the replacement cost valuation. This strategy might make more sense if you are insuring a new, and expensive, crane. In the event of a total loss, the difference between actual cash value and replacement cost can be staggering.

Properly insuring your assets is a fundamental aspect of your risk management program. It is crucial for protecting your company’s financial stability. It is also important to work with your insurance broker to understand how your current insurance company will handle this.

If you have any questions, please reach out to me at (619) 486-6437 or randerson@ranchomesa.com.

WCIRB 2024 Construction Dual Wage Threshold Increases Approved

The California Insurance Commissioner Lara has approved an increase in hourly wage thresholds for all 16 construction dual-wage classifications.

California Insurance Commissioner Ricardo Lara has approved an increase in hourly wage thresholds for all 16 construction dual-wage classifications.

The increases range from $1 to $4 depending on the classification and will go into effect for policyholders on their workers’ compensation policy renewal date on or after September 1, 2024. The chart below outlines the proposed increases for each classification.

| Dual Wage Classifications | Existing Threshold | Proposed Increase |

Proposed Threshold |

| 5027/5028 Masonry | $32 | $3 | $35 |

| 5190/5140 Electrical Wiring | $34 | $2 | $36 |

| 5183/5187 Plumbing | $31 | $1 | $32 |

| 5185/5186 Automatic Sprinkler | $32 | $1 | $33 |

| 5201/5205 Concrete Work | $32 | $1 | $33 |

| 5403/5432 Carpentry | $39 | $2 | $41 |

| 5446/5447 Wallboard Installation | $38 | $3 | $41 |

| 5467/5470 Glaziers | $36 | $3 | $39 |

| 5474/5482 Painting Waterproofing | $31 | $1 | $32 |

| 5484/5485 Plastering or Stucco | $36 | $2 | $38 |

| 5538/5542 Sheet Metal Work | $29 | $4 | $33 |

| 5552/5553 Roofing | $29 | $2 | $31 |

| 5632/5633 Steel Framing | $39 | $2 | $41 |

| 6218/6220 Grading/Land Leveling | $38 | $2 | $40 |

| 6307/6308 Sewer Construction | $38 | $2 | $40 |

| 6315/6316 Water/Gas Mains | $38 | $2 | $40 |

In light of the ongoing labor shortage within the construction industry, employers have been making a concerted effort to retain their workforce. This includes providing more comprehensive benefits packages, including higher wages, and merit-based bonuses when appropriate. As a result, these new wage classification increases may prompt employers to consider extending further salary increases to their employees, with the aim of reducing workers' compensation premiums.

To better understand these changes and plan for the impact this will have on your company, please call us at 619-937-0164 and ask to speak to a member of our construction group.

Four Weeks of Safety: Important Resources for National Safety Month

Author, Megan Lockhart, Client Communications Coordinator, Rancho Mesa Insurance Services, Inc.

As we hit the halfway mark on the 2024 year, we’ve explored plenty of important topics related to health and safety each month. The month of June is National Safety Month by the National Safety Council (NSC), in partnership with the Center for Disease Control and Prevention (CDC).

Author, Megan Lockhart, Client Communications Coordinator, Rancho Mesa Insurance Services, Inc.

As we hit the halfway mark on the 2024 year, we’ve explored plenty of important topics related to health and safety each month. The month of June is National Safety Month by the National Safety Council (NSC), in partnership with the Center for Disease Control and Prevention (CDC).

This month brings attention to safety issues as a whole and highlights important topics each week. So whether our clients are construction leaders or human services professionals, June is an opportunity to evaluate the safety practices of yourself and your workers.

Week 1: Safety Engagement

One of the foundational aspects of cultivating a safe workplace is through intentional participation in safety practices.

“Both employers and employees must be engaged in safety. Working together, employers and employees can develop policies and procedures to identify, monitor, mitigate, and eliminate work-related hazards,” NSC states.

One way Rancho Mesa encourages clients to engage in safety is by offering tools to help best equip them for the task. The SafetyOne™ platform offers weekly toolbox talks that employers can administer to workers on the job. SafetyOne also offers a library of online training courses to encourage safety engagement. The videos and quizzes are taken individually via a web browser.

The more relevant the employer’s lessons are to the current safety hazards and job tasks, the more valuable the training will be to employees.

Week 2: Roadway Safety

The Bureau of Labor Statistics states that the leading cause of work-related deaths in the nation are motor vehicle crashes and either the first or second leading cause of death in each major industry. That’s why the NSC has dedicated this week to driving safety.

Rancho Mesa offers a library of driver trainings, both in the form of toolbox talks and online trainings:

Toolbox Talks

Defensive Driving

Driving in Wet Conditions

Like Oil and Water, Drinking And Driving Do Not Mix

Do Cellular Phones Cause More Vehicle Accidents?

Motor Vehicles – A Form of Locking Out

Motor Vehicles – Seat Belts

No Vehicle Accidents on This Site

Safety While Refueling Vehicles and Equipment

Vehicle and Equipment Parking Safety for Landscape Contractors

Online Training

Driver Safety: The Basics

Driving Safety

Driving Defensively

Distracted Driving

Commercial Drivers License (CDL) Defensive Driver Training

Rancho Mesa also recently hosted its Fleet Safety Workshop, presented by Travelers Insurance. The recording is now available.

Week 3: Risk Reduction

The best ways to keep employees safe and prevent workplace incidents is by identifying the environmental hazards and addressing them immediately.

According to NSC’s Injury Facts, there were a total of 4,695 preventable workplace deaths and 4.53 million medically consulted injuries in 2022.

Foreseeing potential injuries before they happen mitigates risk. A pivotal part of this process for companies is through observing their work environment. The SafetyOne app offers the Observation tool clients can use to perform safety observations or inspections via a phone or tablet. An issue identified in an observation can be assigned to other employees or emailed to third parties. Once completed, they are automatically documented in the platform.

Additionally, employers create and maintain a written Injury and Illness Prevention Program (IIPP) and a copy must be made available in the workplace. This week is a good opportunity to revisit your company’s IIPP and make sure it is up to date and covers all job hazards. The Cal/OSHA website offers a model IIPP for both high hazard and non-high hazard industries.

Week 4: Slips, Trips and Falls

As the final topic of the month, slips, trips, and falls are a prevalent hazard across most industries. Whether missing a step down a slippery ladder, losing balance on an aerial lift, or slipping on wet flooring, falls can happen anywhere in the workplace. The best way to prevent these common incidents is to eliminate the hazard initially and make sure employees are trained in the correct safety procedures.

Rancho Mesa offers toolbox talks and online training that covers slip, trip, and fall prevention:

Toolbox Talks

Slips, Trips and Falls

Fall Prevention and Guardrails

Slip and Fall Prevention for Landscape Contractors

Watch Your Step! Don't Slip & Fall

Fall Protection

Avoiding Falls

Let's Prevent Slips, Trips and Falls

Online Training

Slips, Trips, and Falls

Slips, Trips and Falls in Construction Environments

Slips, Trips, and Falls in Food Processing and Food Handling Environments

Slips, Trips, and Falls in Healthcare Environments

Slips, Trips, and Falls in Office Environments

Fall Protection in Industrial and Construction Environments

As we continue to make our way through National Safety Month, it's a good idea for clients to evaluate any holes in their safety practices. The opportunities employers take to keep workers trained will impact their hazard prevention, and ultimately their incident rate, the rest of the year.

Rancho Mesa is committed to offering the necessary tools to help.

For questions about accessing resources in SafetyOne, clients can reach out to their client technology coordinator.

Beyond Insurance: Employer Strategies to Prevent Wage and Hour Claims

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

It was June 86 years ago, Congress and President Franklin D. Roosevelt (FDR) signed into law the Fair Labor Standards Act of 1938 (FLSA). In the words of FDR, the FLSA ensured “a fair day’s pay for a fair day’s work.”

Author, Sam Brown, Vice President, Human Services Group, Rancho Mesa Insurance Services, Inc.

It was June, 86 years ago, when Congress and President Franklin D. Roosevelt (FDR) signed into law the Fair Labor Standards Act of 1938 (FLSA). In the words of FDR, the FLSA ensured “a fair day’s pay for a fair day’s work.”

While the FLSA immediately raised wages for hundreds of thousands of workers and improved working conditions, it has also given rise to a specific type of costly allegation, wage and hour claims.

Wage and hour claims arise when non-salaried or non-exempt employees make a formal complaint stating they were unfairly compensated for work performed.

In 2021, about 19,000 California workers filed unpaid wage claims for a total of more than $330 million, according to Cal Matters.

Wage and Hour Liability Allegations include:

Underpayment of overtime

Miscalculation of wages

Refusal to allow employee breaks

Expecting off-the-clock work

Not paying employees regularly

Refusal to pay exempt employees for absences

Not paying for time required to put on or remove protective gear or clothing

Adhering to federal minimum pay guidelines when state guidelines warrant higher pay

Prevention is always the best line of defense against wage and hour claims. Beyond purchasing insurance, which will typically provide $100,000 to $200,000 of defense costs, employers can mitigate risk by:

Assessing the risk within the company, starting with the State and Local Government Self-Assessment Tool available from the U.S. Department of Labor’s Wage and Hour Division.

Review employee classification as to “exempt” and “non-exempt” status to ensure compliance with guidelines under the FLSA and applicable state laws.

Consult with an attorney or consultant regarding job descriptions and how overtime is calculated.

Review and confirm proper classification for independent contractors.

Keep payroll records for all employees and establish a mechanism for tracking non-exempt employees’ hours.

Review practices and procedures to ensure compliance with meal and rest periods as applicable to state law.

Allow an outside HR firm to conduct an external audit of the employer’s wage and hour practices.

Enacting policies that prohibit off-the-clock work

Navigating employment law and the FLSA will help employers earn good favor among workers and help to avoid costly wage and hour lawsuits. Understanding common wage and hour allegations is a critical step in this process, but may not be enough.

If you have questions about how insurance policies may supplement your existing risk management plan, contact me at sbrown@ranchomesa.com or (619) 937-0175.

Building an Effective Renewal Submission in a Hard Market

Author, Jack Marrs, Associate Account Executive, Rancho Mesa Insurance Services, Inc.

Insurance renewals can be challenging for nonprofits, especially in the hard market of 2024, characterized by higher premiums, stricter underwriting, and reduced coverage from insurance carriers. Leaning on your insurance broker as the quarterback, a well-prepared submission can significantly impact the outcome of your insurance renewal, potentially leading to better terms and lower premiums. Nonprofits can work effectively with their insurance broker to build a comprehensive submission using the following strategies.

Author, Jack Marrs, Associate Account Executive, Rancho Mesa Insurance Services, Inc.

Insurance renewals can be challenging for nonprofits, especially in the hard market of 2024, characterized by higher premiums, stricter underwriting, and reduced coverage from insurance carriers. Leaning on your insurance broker as the quarterback, a well-prepared submission can significantly impact the outcome of your insurance renewal, potentially leading to better terms and lower premiums. Nonprofits can work effectively with their insurance broker to build a comprehensive submission using the following strategies.

Pre-Renewal Meeting

Begin the pre-renewal process well in advance by meeting with your insurance broker at least 90 days before your renewal date to update expiring applications and discuss any changes in operations, such as new programs, major grants, changes in leadership, turnover percentage, and employee count, etc. Rancho Mesa meets with clients 120 days prior to the renewal date. This provides plenty of time to gather the necessary documentation, address potential issues, discuss a renewal strategy, and explore alternative options if needed.

Highlight Risk Management Efforts

Insurance carriers are going to favor organizations that proactively manage risk. Demonstrating your commitment to risk management can position your nonprofit as a lower-risk organization, potentially leading to more favorable insurance terms. Risk Management Strategies:

Safety Training

Regularly train staff and volunteers on safety procedures and document these sessions. Rancho Mesa clients have access to our proprietary SafetyOne™ Desktop & Mobile App, which allows you to manage your workplace safety program from anywhere, access important documents, and share job-specific and employee safety data as needed. The SafetyOne platform also includes tailored trainings to ensure proactive risk management.Large Claim Summary

For organizations that have experienced any number of large claims, it is best practice to provide a detailed summary of each claim. This should include exactly what happened and the procedures your organization has put into place to mitigate similar claims from happening in the future. Charity First recommends this approach because it demonstrates to insurance carriers that your organization is proactive about risk management.

Description of Operations

Providing a detailed description of your operations is crucial. This includes explaining how your nonprofit executes its mission, the specific activities and programs you run, and how these activities align with your organizational goals. A comprehensive description helps insurance carriers understand the nature and scope of your work, assess the associated risks accurately, and provide appropriate coverage.

Broker Expertise

Your insurance broker is a valuable resource and should have a deep knowledge of your organization’s insurance market and the specific needs of nonprofits. The broker should be ensuring that the submission is as strong as possible. The broker should be leading you throughout this entire process, informing you exactly what is needed and educating you on what is happening in the marketplace. The broker's role is not only to provide nonprofits with adequate coverage but also to ensure clients feel well-informed about what to expect for their renewal.

Importance for 2024 Renewals in a Hard Market

The insurance market in 2024 is particularly challenging for nonprofits due to an uptick in frequency and severity of claims across all lines of insurance. A hard market typically translates into insurance carriers engaging in more conservative underwriting, more restrictive coverage, elevated retentions/deductibles, and higher premiums. This makes it even more critical for nonprofits to present a strong, well-documented submission.

Building a strong submission for your insurance renewal in 2024 requires a proactive and collaborative approach. By starting early, maintaining open communication with your broker, compiling comprehensive documentation, highlighting risk management efforts, leveraging your broker’s expertise, and exploring alternative options, your nonprofit can secure the best possible terms for its insurance coverage. This strategic approach not only helps in managing costs but also ensures that your organization is properly insured.

To discuss your organization’s insurance renewal, contact me at (619)486-6569 or jmarrs@ranchomesa.com.

Surety Bonding: Understanding the Client-Broker-Carrier Relationship

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

People from outside the surety bond industry will sometimes ask if we work for 1) the carrier (bond company) or 2) the contractor client. This is an easy one. While we are approved to issue bonds by the 20+ carriers we are appointed with, make no mistake that we work 100% for our clients.

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

People from outside the surety bond industry will sometimes ask if we work for 1) the carrier (bond company) or 2) the contractor client. This is an easy one. While we are approved to issue bonds by the 20+ carriers we are appointed with, make no mistake that we work 100% for our clients.

The thought for this article came about when a potential new client mentioned to me that he felt his broker was not working very hard on his behalf to increase his aggregate bond program. During a phone call where the client was providing the broker with a narrative of information to pass along to the bond company, the broker mentioned that he didn’t want to, “push too hard” because he had a number of accounts with the bond company and did not want to negatively affect that relationship.

Whether a broker has 1 or 10 accounts placed with a particular carrier, you should ethically treat each account individually, working as hard as possible to create the best program for your client. Our industry promotes very high standards regarding the servicing of our accounts, and the State of California requires agents to complete three hours of ethics training every two years. I am certain this is covered during the training.

Looking at this from the carrier viewpoint, if the bond company supported an account mainly because a broker placed numerous accounts with that company (yet the underwriting of the account did not meet the bond company requirements) that would open the door for them to accept undue risk of future losses. At some point, one of these accommodation-type accounts will fail and cause a loss that the bond carrier could have avoided.

If you would like to discuss the client-broker-carrier relationship, please contact me at (619) 937-0165 or mgaynor@ranchomesa.com.

Return to Work Programs: Best Practices for Handling Workers’ Comp Claims

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

How do you handle the situation when a great employee is injured but not quite ready to return to full duty? We do all that we can to prevent injuries and make sure once they do happen our employees are taken care of quickly and properly. The one true variable we have in our control, after a claim has been filed, is how to accommodate employees that are injured but not able to return to normal duties until deemed fully recovered.

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

How do you handle the situation when a great employee is injured but not quite ready to return to full duty? We do all that we can to prevent injuries and make sure once they do happen our employees are taken care of quickly and properly. The one true variable we have in our control, after a claim has been filed, is how to accommodate employees that are injured but not able to return to normal duties until deemed fully recovered.

Your experience modification rate (X-MOD) is a very important component in your premiums and potentially securing bids in states like California. Every company has a primary threshold that is unique to the company. This is a dollar amount per claim that, once the medical, permanent disability, and temporary disability surpasses this threshold, has no further impact to your X-MOD. Carriers have medical review teams set in place to ensure that the medical portion of each claim is as low as possible, permanent disability is dictated by the treating doctor, so the only portion of each claim we have control over is how the temporary disability will be handled. Sometimes, even that is out of our control if an injured employee is not able to work in any capacity.

Ideally, your workers’ compensation doctor will quickly give you work restrictions and you will be able to determine if you have any available work within those restrictions. The bigger question is what to do with these employees if they are not fit for regular duty? Is it best to let the carrier handle the temporary disability portion of the claim, have the employee come back and work in your office doing odd jobs, or utilize companies like ReEmployAbility or carrier programs where they can work at any number of nonprofit organizations? Temporary disability mismanagement can add up very quickly and lead to a small claim turning into a claim that heavily impacts your X-MOD.

Making sure your employee feels valued and that they have a job to come back to is a great way to keep claims cost down and employee morale high. When employees sit at home waiting to recover, they may feel helpless and uncertain about their future, are exposed to countless commercials about injured workers and lawyers that claim they can make them rich. Keeping them at work, in some capacity, where progress can be seen and communication continues is beneficial for both the employee and the employer.

The intricacies of how to handle claims is something you hope to never need to be good at as an employer, which is why it is so important to have a broker and claims advocate on your side to help navigate the process with you.

This is a complex topic and if you would like to discuss further or talk about any other insurance needs, I can be reached at (619)438-6900 or you can email me at ccraig@ranchomesa.com.

Focus on Frequency with a Small Work Comp Deductible

Author, Drew Garcia, Vice President of the Landscape Group, Rancho Mesa Insurance Services, Inc.

Economies of scale create leverage for landscape businesses as they grow. The Bureau of Labor Statistics (BLS) 2022 table of incident rates notes that the landscape industry has an incident rate of 3.4 per 100 full time employees. Landscape is classified by BLS under Administrative and Support and Waste Management and Remediation Services; this sub class has an incident rate of 1.9. The average for all other industries is 3.0.

Author, Drew Garcia, Vice President of the Landscape Group, Rancho Mesa Insurance Services, Inc.

Economies of scale create leverage for landscape businesses as they grow. The Bureau of Labor Statistics (BLS) 2022 table of incident rates notes that the landscape industry has an incident rate of 3.4 per 100 full time employees. Landscape is classified by BLS under Administrative and Support and Waste Management and Remediation Services; this sub class has an incident rate of 1.9. The average for all other industries is 3.0.

With frequency typically being high for the landscape industry, it’s important to continue to focus on ways to minimize injury, prevent severity and focus on return to work opportunities when an injury does arise.

While commercial auto, general liability, and umbrella have been stuck in a hard market, workers’ compensation has relatively been in a soft market. Combined ratios for private insurance carriers on workers’ compensation was published at 87% in 2021 and 84% in 2022, according to the National Council on Compensation Insurance (NCCI) State of the Line Report. This impact on carrier profitability has led to decreased pressure on rates for landscape employers across the country.

Like all things cyclical, it is expected that the workers’ compensation market will reverse and begin to harden.

As the market hardens, landscape employers operating in the middle market (i.e., businesses with an annual workers’ compensation premium between $300,000 and $1,500,00) should consider a small workers’ compensation deductible to tackle the high likelihood of frequency.

Small deductibles vary by carrier from $1,000 to $25,000. Collateral might be required and the ability to apply an aggregate to the policy will also vary by carrier.

A small deductible allows the landscape company an opportunity to take the predicable layer of injury cost while still transferring severity to the insurance carrier.

As your company grows and/or market conditions change, consider a small workers’ compensation deductible to maximize your insurance program.

To discuss implementing this strategy for your business, contact me at (619) 937-0200 or drewgarcia@ranchomesa.com.

National Electrical Safety Month: Preventing Hazards in the Construction Industry

Author, Megan Lockhart, Client Communications Coordinator, Rancho Mesa Insurance Services, Inc.

We’ve just started the month of May, National Electrical Safety month. The Electrical Safety Foundation International (ESFI) dedicates this month annually to help reduce electrical-related fatalities, injuries, and property loss.

Author, Megan Lockhart, Client Communications Coordinator, Rancho Mesa Insurance Services, Inc.

We’ve just started the month of May, National Electrical Safety month. The Electrical Safety Foundation International (ESFI) dedicates this month annually to help reduce electrical-related fatalities, injuries, and property loss.

Many Rancho Mesa construction clients not only work with electricity, but specialize in some form of it. So, it's a great opportunity to reevaluate workplace safety and ensure any hazards to shock or fire are addressed.

One of ESFI’s missions is to spread awareness to specific industries that work with and around electricity. Accidents involving electricity can lead to electrocution and flash fire, and the construction industry stands the most risk. The Center for Construction Research and Training found that construction workers account for almost half of all workplace electrocution deaths in the nation.

As we continue through the month of May, it's a good idea to make sure your workers are handling electrical tools and hazards safely. Rancho Mesa offers training resources in the SafetyOne™ app with several online courses relating to electrical safety as well as various toolbox talks.

For more information about the resources Rancho Mesa offers, clients can reach out to their Client Technology Coordinator.

WCIRB Files for Workers’ Comp Rate Increase

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Earlier this month, the Workers’ Compensation Insurance Rating Bureau (WCIRB) recommended a nominal .9% increase in the advisory pure premium rates. The reason given, increased loss development for medical costs and higher claims adjustment expenses. This recommendation is now sent to the California’s Insurance Commissioner Ricardo Lara for approval. If approved, the increase in rates then take effect September 1, 2024.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Earlier this month, the Workers’ Compensation Insurance Rating Bureau (WCIRB) recommended a nominal .9% increase in the advisory pure premium rates. The reason given, increased loss development for medical costs and higher claims adjustment expenses. This recommendation is now sent to the California’s Insurance Commissioner Ricardo Lara for approval. If approved, the increase in rates then take effect September 1, 2024.

Recognizing that a .9% increase is not very significant and in 2023 the WCIRB requested a similar increase which ultimately was denied by Commissioner Lara, the message remains clear that workers’ compensation rates have probably bottomed out.

This does not mean every business will see an increase. There will still be reductions in some class codes pure premium rates and pricing will be more tied to Experience Modification Rate (EMR) decreases and an individual company’s claims experience. For distressed accounts, companies whose EMR is increasing and have had poor claim experience, will likely see an increase in their rates.

In order to stay ahead of this, we recommend companies review their key performance indicators (KPIs) that measure and compare a company’s frequency and severity of claims to their peers within the same governing class code. These metrics allow a company to identify trends, design programs that will address specific training needs, and project claims costs that will ultimately impact their EMR.

In addition, we recommend working closely with your claim advocate to assist in monitoring open workers’ compensation claims, and identify any open claims under your company’s primary threshold that could be closed prior to your unit stat filing that can impact your EMR.

If you would like to learn more about the pure premium rate’s impact by class code or evaluate your specific KPIs, I can be reached at (619) 937-0167 or via email at sclayton@ranchomesa.com.

Property Insurance in California Continues to be a Ticking Time Bomb

Author, Jeremy Hoolihan, Partner, Rancho Mesa Insurance Services, Inc.

Insurance industry experts and legislators continue to work with Insurance Commissioner Ricardo Lara and the California Department of Insurance (CDI) to address the overwhelming crisis in the insurance property market. On March 26th, 2024, there was a public hearing to address the crisis.

Author, Jeremy Hoolihan, Partner, Rancho Mesa Insurance Services, Inc.

Insurance industry experts and legislators continue to work with Insurance Commissioner Ricardo Lara and the California Department of Insurance (CDI) to address the overwhelming crisis in the insurance property market. On March 26th, 2024, there was a public hearing to address the crisis.

The hearing appeared to be a step in the right direction in adopting Lara’s Sustainable Insurance Strategy which is designed to restore insurance markets to competitive health by making it easier for insurers to get adequate rates and timely rate decisions.

The hearing also brought expert commentary from Sheri Scott, a Principal and Consulting Actuary at Milliman, one of the nation’s leading actuarial firms. Scott urged the CDI to amend its regulations to include a more comprehensive reconciliation checklist. The idea is to streamline the process and ensure that insurance company filings were complete, and also to limit its evaluations to issues that could impact potential rates. Scott suggests the CDI only focus on underwriting material that has a clear impact on rates they utilize and all other non-rate related items be evaluated separately.

While this hearing had some positive points, there is still a lot of work to be done. On April 23rd, 2024, the CDI hosted a public workshop on a proposal that would allow insurers to use catastrophic loss modeling in their rate making applications. As it currently stands, California is the only state that requires insurers to base rate requests solely on their own individual losses over the last 20 years rather than projecting future losses based on analysis.

The CDI and Commissioner Lara are clearly feeling the pressure to improve and streamline the rate approval process. With the FAIR Plan exposure now at $366 billion across California ($25 billion just added in January and February), it is ill equipped to handle any major disasters. The FAIR Plan has just $700,000 in cash on hand, $200 million in surplus and about $2 billion dollars in reinsurance available. The Plan also has nearly 400,000 policy holders and are fielding over 2,000 calls a day. The CDI and Lara seem to agree that California and the FAIR Plan are a major wildfire away from needing emergency help.

Obviously, the inability for insurance companies to have rates approved in a timely fashion has caused several insurance companies to leave California. The result is fewer insurance carrier options and in many cases having to rely on the FAIR Plan. Stay tuned for updates on the progress being made with Commissioner Lara’s Sustained Insurance Strategy.

If you have any questions about your commercial property insurance, please feel free to contact me at (619) 937-0174 or jhoolihan@ranchomesa.com.

Rising Reconstruction Costs and the Impact on Building Owners

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

The continuing trend of catastrophic claim activity over the last several years, rising number of nuclear settlements due to increased litigation funding, and hyperinflation are impacting all economic sectors. One of those sectors is the commercial property insurance market and the rapid increase in reconstruction costs.

Author, Kevin Howard, Partner, Rancho Mesa Insurance Services, Inc.

The continuing trend of catastrophic claim activity over the last several years, rising number of nuclear settlements due to increased litigation funding, and hyperinflation are impacting all economic sectors. One of those sectors is the commercial property insurance market and the rapid increase in reconstruction costs. Per Verisks’s recently released Reconstruction Costs Analysis, from January of 2023 to January of 2024 the total reconstruction costs have increased by 4.1%. Since the 2020 pandemic, reconstruction costs have increased over 25% nationwide. For commercial property owners, these statistics require additional due diligence with their broker when evaluating the replacement cost of their respective portfolios during the pre-renewal process.

With interest rates still elevated and the demand for quality tenants still present, the last thing a property management group or single building owner needs is an underinsured claim that compromises cash flow.

Factors that have driven up reconstruction costs include:

Demolition and debris removal

Removing existing landscaping, debris and existing buildings add costs to a project. Balancing this work within the bounds of other occupants/tenants can also compromise timelines.

Site

New construction starts with a clean foundation. Reconstruction does not have a clean site, it may have foundations that need to be removed in order to add/replace plumbing, sewer, underground pipelines, etc.

Labor

The cost of labor has skyrocketed with higher wages, cost of living, medical benefits, etc. Those costs translate directly to contractor margins and have increased reconstruction project estimates.

Hyperinflation

Gas, rental equipment, and building materials have all been directly impacted by inflationary trends, further elevating reconstruction costs.

The above examples represent only some of reasons why property owners must re-evaluate and most likely increase property limits on their statement of values (SOV). Working with a broker who can utilize data analytics while also providing comparative models can help to identify appropriate coverage that complements the changing world of reconstruction.

To learn more about our detailed process for evaluating your risk exposure, contact me at khoward@ranchomesa.com or (619) 729-5173.

Distracted Driving Awareness Month: Prevent Fleet Accidents Through Training

Author, Megan Lockhart, Client Communications Coordinator, Rancho Mesa Insurance Services, Inc.

April is Distracted Driving Awareness Month across the nation. The month is dedicated to preventing distractions while driving as well as spreading awareness of these dangers on the road.

Author, Megan Lockhart, Client Communications Coordinator, Rancho Mesa Insurance Services, Inc.

April is Distracted Driving Awareness Month across the nation. The month is dedicated to preventing distractions while driving as well as spreading awareness of these dangers on the road.

The National Highway Traffic Safety Administration reports more than 3,500 people in the United States were killed due to distracted driving in 2021. The most common forms of distraction are phone use such as texting, scrolling apps, or phone calls. When it comes to fleet and construction vehicles, it's important to make sure your employees are driving safely.

One vital way to prevent accidents on the road is through driver training. The SafetyOne™ platform offers a library of online driver training topics to ensure your drivers are safe on the road.

Driver Safety: The Basics

Driving Safety

Driving Defensively

Distracted Driving

Commercial Driver’s License (CDL) Defensive Driver Training

Additionally, clients can register for Rancho Mesa’s in-person Fleet Safety workshop on Friday, May 17, 2024 at the Mission Valley Library.

To learn more about the training offered in SafetyOne, contact your client technology coordinator.

Navigating Contractor Challenges in 2024: Insights from the Surety Association of San Diego

Author, Andy Roberts, Surety Account Executive, Rancho Mesa Insurance Services, Inc.

In a recent special StudioOne™ Podcast episode, I’m joined by my three fellow board members of the Surety Association of San Diego as we explore some of the biggest challenges facing contractors in 2024 and beyond.

Author, Andy Roberts, Surety Account Executive, Rancho Mesa Insurance Services, Inc.

In a recent special StudioOne™ Podcast episode, I’m joined by my three fellow board members of the Surety Association of San Diego as we explore some of the biggest challenges facing contractors in 2024 and beyond.

Challenges Ahead

As we look ahead, contractors are bracing for significant hurdles, including:

Inflation and Material Costs

Supply Chain Disruptions

Labor Shortages

Bonding Capacity Constraints

All of these issues can have a direct effect on a contractor’s bonding capacity, making it important that they get the most out of their surety relationship.

Maximizing Your Bond Program

To navigate these challenges effectively, contractors can take proactive steps to maximize their bond program:

Work with Experienced Surety Agents

Financial Preparation and Accounting Processes

Transparency about Financials and Backlog

Regular Meetings with Underwriters

By taking a proactive approach to identifying and addressing current and potential future challenges, contractors can maximize their bond program and position themselves for success in 2024 and beyond. By working closely with experienced surety agents, optimizing financial management practices, and fostering open communication with underwriters, contractors can navigate the complexities of the construction industry with confidence.

Empower Your Crew: The Importance of Heat Illness Training and Preparedness

Author, Greg Garcia, Account Executive, Rancho Mesa Insurance Services, Inc.

As the calendar turns to April and warmer weather into spring time, now is a great time to take a look at your current Heat Illness Prevention Plan (HIPP), as well as make sure all crew members are up to date on their heat illness training.

Author, Greg Garcia, Account Executive, Rancho Mesa Insurance Services, Inc.

As the calendar turns to April and warmer weather into spring time, now is a great time to take a look at your current Heat Illness Prevention Plan (HIPP), as well as make sure all crew members are up to date on their heat illness training.

As the months get hotter, it is important to remember three things: water, rest and shade. It is crucial that crews have access to all three. Adequate water for all crew members, regular rest periods, and identified shade areas around the jobsite or a portable canopy are all considered best practices, and when temperatures heat up, are often a requirement.

With rising temperatures, we anticipate, as has been the case in the past, there will also be a rise in heat-related injuries within the landscape industry. Having an HIPP not only will keep you compliant with state regulations, but more importantly keep your employees safe.

There are certain criteria and templates that all HIPP need to follow. For example, they need to be written, they need to be available in English as well as any other languages that are used at the company. And finally, it needs to be available at the worksite. The HIPP should include:

Procedures supplying and accessing water

High heat procedures

Emergency response

Acclimatization methods and procedures.

It is also important that leaders including foreman keep a regular eye on the crew, looking for signs of heat stress. The signs could be as minor as rashes or cramping to as severe as fainting. Any signs of this with a crew member should be reported immediately.

Knowing the hotter months are coming, now is a great time to dive into your company’s HIPP, make any updates to it, and begin to stress the importance of heat illness prevention.

Rancho Mesa clients can train their employees on heat stress and heat illness prevention with both online courses in English and Spanish, and a variety of toolbox talks in the SafetyOne™ website and mobile app. Clients can distribute their HIPP through the mobile app ensuring foreman and crews have access to the document along with any other related resources when they’re at the jobsite.

Every year, Rancho Mesa hosts Heat Illness Prevention workshops and webinars to assist in educating clients and their employees. A recorded version of the workshop can be accessed online.

Contact me at ggarcia@ranchomesa.com or (619) 438-6905 to discuss how to mitigate heat illness and other potential risks.

SafetyOne™ Updates Company News: New Recipient Role Added for Users

Author, Megan Lockhart, Client Communications Coordinator, Rancho Mesa Insurance Services, Inc.

Recently, SafetyOne™ released new updates to the Company News feature of the platform. These updates include a new company news recipient user and added email notifications for all users.

Author, Megan Lockhart, Client Communications Coordinator, Rancho Mesa Insurance Services, Inc.

Recently, SafetyOne™ released new updates to the Company News feature of the platform. These updates include a new company news recipient user and added email notifications for all users.

A new “Recipient” role is now available specifically for receiving company notifications. Users who are assigned to this role do not need access to the mobile app or website, so they won't need to set up a password, and will receive all company news alerts they are assigned via email.

If the user with a Recipient role is switched to a different role in the future, they will be sent an email to create their login information.

Administrators can assign recipient users to their designated projects and when they send out Company News to that project, recipient users will receive it as an email. All users assigned to that project with the mobile app will also get both a notification on their phone immediately and an email.

These new features contribute to the flexibility of SafetyOne and our effort to continually improve user experience.

For questions on how to use these new additions, clients can contact their client technology coordinator, or view our Frequently Asked Questions on the Rancho Mesa website.

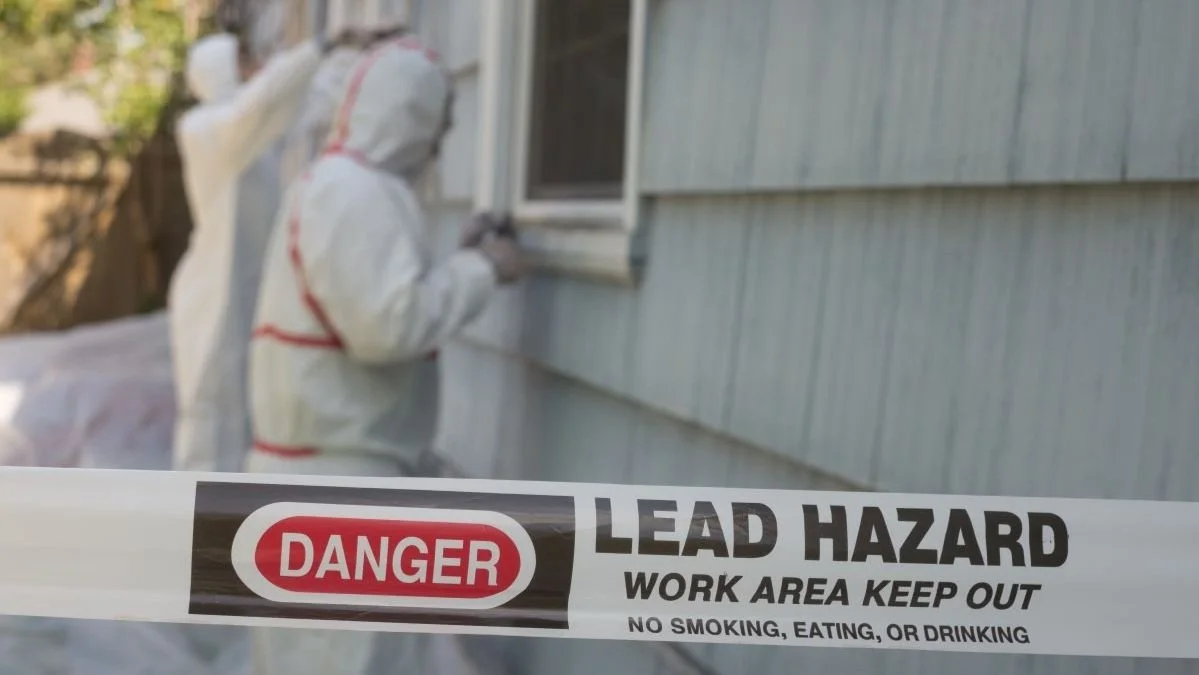

California Enacts Strict Updates to Lead Exposure Regulations

Author, Megan Lockhart, Client Communications Coordinator, Rancho Mesa Insurance Services, Inc.

Recently, the Cal/OSHA Standards board approved stricter standards for occupational lead exposure in both the construction industry and general industry.

Author, Megan Lockhart, Client Communications Coordinator, Rancho Mesa Insurance Services, Inc.

Recently, the Cal/OSHA Standards board approved stricter standards for occupational lead exposure in both the construction industry and general industry.

Effective January 1, 2025, the standards lowered the Permissible Exposure Limit (PEL) by 80% and the Action Limit (AL) by 93%, a vastly stringent policy compared to previous regulations.

The Permissible Exposure Limit is the legal limit that an employee can be exposed to a chemical substance or physical agent. The previous PEL for lead was 50 micrograms per cubic meter of air, and has now been reduced to 10 micrograms per cubic meter of air.

The Action Limit is the maximum value that can be reached before an action is needed to correct the issue. The previous lead level AL was 30 micrograms per cubic meter of air and is now only 2 micrograms per cubic meter of air.

With these limits reduced, employers must make changes in order to comply, such as updating their written program, conducting further exposure monitoring, and providing medical surveillance.

Employers must give workers exposure assessments to determine lead exposure in the blood. If employers do not perform these assessments, they are required to provide respiratory protection, protective work clothing and equipment, medical surveillance, training and posted warning signs.

If employee exposure reaches the new Action Limit, companies are required to implement a medical surveillance program. This includes medical examinations and procedures at no cost to the employees.

Employees who have been exposed to lead levels at or above the Action Level must be temporarily removed from work. These employees will have “medical removal protection benefits,” and will not lose earnings, seniority and other employment rights.

In addition to these requirements, exceeding Action Levels of exposure requires employers to provide employees respirators and protective work clothing and equipment, enact hygiene and housekeeping practices, offer lead exposure prevention training, and maintain monitoring and medical records of exposed employees for a minimum of 40 years.

To prepare for these new standards effective next year, clients should conduct new air monitoring tests and exposure assessments soon to ensure they are still compliant with the new exposure limits. If results exceed the new PEL and AL, they have until the end of the year to reduce exposure and remain in compliance.

For more information regarding these changes, clients can visit the Cal/OSHA website.

Dual Wage Thresholds Set to Increase Again

Author, Matt Gorham, Account executive, Rancho Mesa Insurance Services, Inc.

In an effort to keep up with wage inflation, California’s Workers’ Compensation Insurance Rating Bureau (WCIRB) has recommended increases to all 16 construction dual wage thresholds, which, if approved, would impact policies beginning on September 1, 2024 and could drive up insurance premiums for those unaware.

Author, Matt Gorham, Account executive, Rancho Mesa Insurance Services, Inc.

In an effort to keep up with wage inflation, California’s Workers’ Compensation Insurance Rating Bureau (WCIRB) has recommended increases to all 16 construction dual wage thresholds, which, if approved, would impact policies beginning on September 1, 2024 and could drive up insurance premiums for those unaware.

Dual wage thresholds help carriers evaluate risk of employee injury by correlating average hourly wage with experience on the job. The general notion is that employees with more experience command higher wages and are less likely to get injured at work, while employees with less experience are paid a lower wage, are less familiar with safety and jobsite protocols, and therefore more likely to be injured at work. This difference in risk leads to a difference in cost for insurance premiums, with higher paid employees costing their employers comparatively less in premium.

Using the base rate of $31 or more per hour from one carrier, consider the example of a plumber: a plumber earning $30 per hour will cost their employer $9.31 per $100 of payroll, while a plumber earning $31 per hour will cost their employer $4.35 per $100 of payroll. That is roughly a 47% higher cost in premium per $100 for an employee earning 3% less per hour.

Since the last time the WCIRB suggested an increase to the dual wage thresholds in December 2021, inflation and labor shortages have continued to drive up wages in the construction industry. According to the St. Louis Fed, average hourly earnings in construction have increased from $33.60 to $37.53 – more than 11% in that time. While wages are going up, the experience of employees is not keeping pace, leaving insurance carriers exposed. To address this disparity, the proposed threshold increases from the WCIRB range from $1 for plumbing, automatic sprinkler, concrete work, and painting/waterproofing to $4 for sheet metal/HVAC work.

To get ahead of this proposed change, business owners should consider whether it is more beneficial to award employees with raises or to pay more in insurance premiums. With increased overhead costs likely coming either way and quality employees already in short supply, not only could strategic raises offer relative savings, they could strengthen the loyalty from your team.

While this proposed change still needs final approval by the insurance commissioner, it is expected to have a major impact on wages and potentially premiums within the construction industry.

To evaluate the impact of the proposed dual wage threshold increase on your business, contact me at (619) 486-6554 or mgorham@ranchomesa.com.