Industry News

Matching Contractors with the Right Bond Company

Author, Andy Roberts, Account Executive, Rancho Mesa Insurance Services, Inc.

Like any great match-maker, a surety bond agent needs to fully understand both parties in order to match the contractor with the right bond company.

Author, Andy Roberts, Account Executive, Rancho Mesa Insurance Services, Inc.

Like any great match-maker, a surety bond agent needs to fully understand both parties in order to match the contractor with the right bond company.

In a previous article, we explored key factors that a contractor should consider when hiring a surety bond agent, highlighting experience, some additional value adds, and agent appointments. Agent appointments are an important factor to consider, because one of the most important roles of a surety bond agent is making sure that their clients are paired with the right surety bond company. In order to do this, an agent needs to have an in-depth understanding of both their client’s business and the bond companies that they work with.

In order to properly match a client with a bond company, it is vital that the agent take the time to really understand the client’s business: review financials, review the business plan, and get a firm handle on what the contractor’s goals are for the company. Doing this will allow the agent to get a thorough understanding of the client’s specific bond needs and will help them narrow down the marketplace to a handful of bond companies that would be the right fit. While it is very important to have a good understanding of the client’s business, it is equally important to have a strong understanding of each bond company’s appetite.

There are more than 100 bond companies out there and they are all a little different. They all have different limitations with regard to the size of bonds they can write. They will have different underwriting standards for when a client is required to start providing CPA-reviewed financials. They have different classes of business that they favor. Some bond companies value personal financials more than others. This list goes on, making it vital that agents have a thorough understanding of their markets, and have good relationships with their underwriters so that clients are placed with a bond company that will be a good partner for them as they look to accomplish their goals.

It is important that an agent have appointments with a variety of highly rated bond companies while also possessing a deep understanding of those markets because contractors need to be able to trust that their agent has them placed with the bond company that is the right fit for their business. Rancho Mesa has long-standing appointments with over 20 highly regarded bond companies, in addition to close working relationships with those underwriters.

As you look to build a successful bond program that can help your construction firm grow profitably, contact me at aroberts@ranchomesa.com or by phone at (619) 937-0166.

Pollution Liability for Tree Care Companies

Author, Rory Anderson, Account Executive, Rancho Mesa Insurance Services, Inc.

Most tree care companies use pesticides, herbicides, fungicides, and other chemicals as a part of their operations. Even if the company does not offer plant health care, many tree care professionals still use hydraulic fluids, gasoline, and other fluids to operate or maintain equipment and vehicles. The use of heavy equipment and chemicals, while operating exclusively outdoors, opens the company up to environmental exposure.

Author, Rory Anderson, Account Executive, Rancho Mesa Insurance Services, Inc.

Most tree care companies use pesticides, herbicides, fungicides, and other chemicals as a part of their operations. Even if the company does not offer plant health care, many tree care professionals still use hydraulic fluids, gasoline, and other fluids to operate or maintain equipment and vehicles. The use of heavy equipment and chemicals, while operating exclusively outdoors, opens the company up to environmental exposure.

Pollution coverage is a standard exclusion on any general liability policy, but business owners can cover this exposure with a stand-alone contractor’s pollution liability (CPL) policy. CPL insurance is distinct in that it offers protection for contractors in the event their work, or any work done on their behalf, leads to a pollution or environment-related claim of bodily harm, property damage, cleanup and other remediation expenses. In today’s green and eco-minded society, filling this gap is more important than ever.

If the tree care company offers plant health care as a service, the herbicide/pesticide applicator coverage endorsement is an important part of your insurance program and can offer some coverage to replace damaged or dead plants/trees in the event an arborist mixes a bad batch or over sprays. However, the herbicide/pesticide applicator coverage endorsement may not pick up remediation efforts, or the business interruption losses that result from the clean-up. The best way to transfer your environmental exposure would, again, be putting a contractor’s pollution liability policy in place with at least a $1,000,000 limit.

Pollution liability insurance is an important part of the risk management strategy and can help protect tree care contractors from environmental liabilities by providing coverage for legal fees, cleanup costs, and other expenses associated with environmental pollution.

For a policy review or questions about which policies match your tree care company’s risks, please contact me at (619) 486-6437 or randerson@ranchomesa.com.

Understanding General Liability Forms and Endorsements

Author, Lauren Stumpf, Media Communications & Client Services Specialist, Rancho Mesa Insurance Services, Inc.

Two agency leaders within Rancho Mesa Insurance Services, Inc. made a special appearance in a recent episode of the StudioOne™ Safety & Risk Management Podcast. During episode 293, Executive Vice President Daniel Frazee and Vice President of the Construction Group Sam Clayton discussed the important forms and endorsements in general liability policies.

Author, Lauren Stumpf, Media Communications & Client Services Specialist, Rancho Mesa Insurance Services, Inc.

Two agency leaders within Rancho Mesa Insurance Services, Inc. made a special appearance in a recent episode of the StudioOne™ Safety & Risk Management Podcast. During episode 293, Executive Vice President Daniel Frazee and Vice President of the Construction Group Sam Clayton discussed the important forms and endorsements in general liability policies.

Sam and Daniel highlighted 3 key terms they commonly see within the construction insurance space. Sam started out with explaining residential work, and how it is defined within the scope of general liability underwriting.

Next he explained subcontractor’s warranty endorsement, a term that is recognized by insurance professionals, but may confuse trade and general contractors. Sam dives into the term, explaining the importance of knowing how the warranty on one’s policy actually reads.

Lastly, Sam explains what minimum and earned premium is and how contractors’ can use it to their advantage when negotiating terms through their broker.

The pair wrapped up their conversation educating listeners on first steps contractors can take to learn more about the policies they currently have in place.

Daniel and Sam’s episode, Ep. 293 General Liability Forms and Endorsements, can be listened to below, or via your favorite podcast listening platform.

Plan Your SafetyOne™ App to Best Suit Your Organization’s Needs

Author, Megan Lockhart, Media Communications and Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

Rancho Mesa aims to provide clients with tools that are flexible in order to best fit their individual needs, including our proprietary SafetyOne™ application. SafetyOne’s features are systemized based on “Projects.” However, projects are highly adaptable to the way each individual organization works.

Author, Megan Lockhart, Media Communications and Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

Rancho Mesa aims to provide clients with tools that are flexible in order to best fit their individual needs, including our proprietary SafetyOne™ application. SafetyOne’s features are systemized based on “Projects.” However, projects are highly adaptable to the way each individual organization works.

Below are best practices for utilizing projects depending on your organization’s industry and structure.

Construction (Project or Job)

As the name suggests, construction companies will most likely assign their policies, mobile forms and users to their individual construction projects or job sites. Project managers and foremen can access job-specific content based on the projects they are assigned.

This system works well for both short-term and long-term projects that need to manage safety within unique worksites.

Landscape, Tree Care and Janitorial (Service Crew)

Many landscape, tree care and janitorial companies organize their employees in the SafetyOne application into crews. These crews are employees who stay grouped together from one worksite to the next. Companies can name their projects based on a crew number, truck, or team name and assign content, such as toolbox talks to individual crews.

This system works well for companies providing on-going services to multiple accounts that aren’t necessarily tied to one worksite.

Human Services (Client or Program)

Human services organizations like non-profits, home healthcare, and schools can use projects for their different office locations, facilities, programs, or campuses. These organizations may choose to make policies and forms available to employees based on their office, clients, facility, program or campus.

There may be different ways to utilize the projects organization structure in the SafetyOne application. Through the dynamicity of the platform, Rancho Mesa is happy to help clients best meet their organization’s risk management needs.

For more information about how to set up projects in SafetyOne™, please contact your client services coordinator or watch our Administrator Website Overview Training.

Directors & Officers Liability Series: Side A Defense Costs & Settlements

Author, Jack Marrs, Associate Account Executive, Rancho Mesa Insurance Services, Inc.

While an insurance agent must continually stay abreast of industry trends and market conditions, it’s equally important to educate clients on the enforce insurance policies. As a non-profit focused insurance agency, Rancho Mesa is accustomed to having important conversations with clients regarding Directors & Officers Liability insurance (D&O).

Author, Jack Marrs, Associate Account Executive, Rancho Mesa Insurance Services, Inc.

While an insurance agent must continually stay abreast of industry trends and market conditions, it’s equally as important to educate clients on the enforce insurance policies. As a non-profit focused insurance agency, Rancho Mesa is accustomed to having important conversations with clients regarding Directors & Officers Liability Insurance (D&O).

This article is the first installment in a 3-part series explaining the most common insurance agreements in a D&O policy: Side A, Side B, and Side C.

Side A addresses defense costs and settlements.

Why Organizations Have D&O Policies

Most non-profit board members understand they may be held personally liable for financial damages they cause while serving the organization.

This scenario might occur if a director or officer unintentionally misappropriates funds, isn’t transparent about a conflict of interest, or unknowingly violates workplace laws. As such, personal assets can be exposed without a D&O policy in place.

Fortunately, the D&O policy’s Side A insuring agreement addresses this concern and protects the personal assets of the organization’s directors.

Having a D&O policy allows organizations to attract qualified board members who do not want to risk their personal assets in order to serve on the organization’s board.

D&O Policy Coverage

Side A covers the cost of claims not indemnified by the organization.

A claim made against an officer during a bankruptcy is one such example. Without this coverage, the officer will be liable for defense costs.

Fortunately, Side A insuring agreements typically do not have a self-insured retention, which acts similar to a deductible.

Our next installment in this Directors & Officers liability series will address the Side B insuring agreement.

To learn more about D&O insurance or to address your organization’s risk, contact me at (619)486-6569 or jmarrs@ranchomesa.com.

Best Practices for Growing Your Surety Program

Author, Anne Wright, Surety Relationship Executive, Rancho Mesa Insurance Services, Inc.

You may know that the surety client/agent/underwriter relationship is different from other lines of insurance.

Whether you are new to the bonding process, or have been doing bonded work for years, there are a handful of important items that can assist with securing the best relationship for your bonding needs. It really boils down to a few key areas: timely information, accurate information, and regular communication.

Author, Anne Wright, Surety Relationship Executive, Rancho Mesa Insurance Services, Inc.

You may know that the surety client/agent/underwriter relationship is different from other lines of insurance.

Whether you are new to the bonding process, or have been doing bonded work for years, there is a handful of important items that can assist with securing the best relationship for your bonding needs. It boils down to a few key areas: timely information, accurate information, and regular communication.

For contractors who only need small or infrequent bonds, communication may be very basic and minimal. For example, if we establish your support with a surety who has an “express program,” these programs are based on clean, personal credit and perhaps some track record of completed projects. So, there may not be a need for as much communication as there would be if an account is in a more “standard” or “preferred” program. We always want to understand and share details on the jobs you are looking to do, and have completed, but there’s generally no need for a personal relationship with the underwriter in these types of programs.

Once you are established with a more standard surety relationship, the timely information the surety expects to receive is key. However, with regular and clear communication, we also hope to add value to the relationship between our clients and the underwriter in support of the contractor’s needs.

Communication about financial information will ensure that proper attention is given to the accurate details that confirm important benchmarks. Questions like: does equity track? is the operation profitable? how is the cash looking? are percentage of completion entries noted and match what’s on the work in progress report (WIP)?

Regular communication will not only include this financial information, but also conversations about the work you have completed and the work you will complete. Be prepared to provide trends from year to year, profitability year-to-date, and specific information on current or completed jobs noted on the WIP (whether certain jobs are bonded or not). All of this information is designed to better understand your operational processes and goals, thus presenting the most complete information to the surety.

Being proactive in this relationship is always our goal. We will do our best to facilitate the information that is needed, and work to share the information that will facilitate the best support for you.

We are your advocate with the surety underwriter – and happy to facilitate these conversations and/or meetings to ensure that your surety needs are adequately addressed and met.

Regular and open communication with your surety agent and underwriter, like any relationship, is a Best Practice that will serve us all well.

To discuss your surety program, contact me at awright@ranchomesa.com or (619) 486-6570.

Insurance Benefits of GPS Systems in Commercial Vehicles

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

For businesses that rely on a fleet of commercial vehicles, insurance costs can be a significant expense. Insurance carriers calculate premiums based on a variety of factors, including the age and condition of the vehicles, driver experience and record, and the frequency and distance of trips. One factor that can positively impact insurance costs is the use of global positioning systems (GPS) in commercial vehicles. Below, we will explore some of the insurance benefits of installing GPS systems in commercial vehicles.

Author, Kevin Howard, Account Executive, Rancho Mesa Insurance Services, Inc.

For businesses that rely on a fleet of commercial vehicles, insurance costs can be a significant expense. Insurance carriers calculate premiums based on a variety of factors, including the age and condition of the vehicles, driver experience and record, and the frequency and distance of trips. One factor that can positively impact insurance costs is the use of global positioning systems (GPS) in commercial vehicles. Below, we will explore some of the insurance benefits of installing GPS systems in commercial vehicles.

Improved Safety

GPS systems in commercial vehicles can help improve safety by providing real-time tracking of vehicles and drivers. This can help businesses identify and address unsafe driving behaviors such as speeding, sudden braking, and hard cornering. By addressing these behaviors, businesses can reduce the risk of accidents and insurance claims which can result in lower insurance premiums.

Reduced Theft Risk

GPS systems can also help reduce the risk of vehicle theft. If a commercial vehicle is stolen, GPS tracking can help businesses locate the vehicle quickly and notify law enforcement. This can help reduce the risk of property loss and insurance claims related to vehicle theft.

Faster Claims Processing

In the event of an accident or other incidents involving a commercial vehicle, GPS systems can provide valuable data to insurance carriers. This can include information on the location, speed, and direction of travel of the vehicle at the time of the incident. This data can help insurance carriers process claims more quickly and accurately, which can help reduce costs and improve the overall claims experience for businesses.

Lower Insurance Premiums

GPS in vehicles can lower the loss ratio which is a key factor that underwriters use. Furthermore, the disclosure to insurance underwriters that GPS is installed and properly utilized could help insurance brokers negotiate lower premiums based on this added safety feature.

Improved Business Operations

In addition to insurance benefits, GPS systems can also help businesses improve their operations. Real-time tracking and reporting can help businesses optimize their routes, reduce fuel costs, and improve overall efficiency. By improving operations, businesses can reduce costs and improve profitability, which can have a positive impact on insurance costs and premiums.

GPS Systems have a multitude of benefits. These systems can save lives because drivers pay more attention to detail when GPS is on the vehicle. They can lower insurance premiums which can improve the return on investment. Lastly, the ability to track a stolen vehicle is a control that creates major benefits knowing that the cost of vehicles and the time needed to locate a replacement is at an all-time high.

To learn more about how GPS on your commercial vehicles can be implemented as part of your risk management plan, contact me at (619)438-6874 or khoward@ranchomesa.com.

Properly Utilizing Tailgate Meetings

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

For many foremen and superintendents, weekly tailgate meetings can feel like a task that just needs to be checked off the list. However, while the purpose of these meetings is critical for the health and well-being of fellow field employees, the time required and repetitive nature of them can create challenges. To maximize the benefits of these meetings, construction firms must be proactive and thoughtful as they develop an inventory of topics.

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

For many foremen and superintendents, weekly tailgate meetings can feel like a task that just needs to be checked off the list. However, while the purpose of these meetings is critical for the health and well-being of fellow field employees, the time required and repetitive nature of them can create challenges. To maximize the benefits of these meetings, construction firms must be proactive and thoughtful as they develop an inventory of topics.

Identifying Tailgate Meeting Topics

Take ample time with your sales team to understand the scope of your backlog to see where hazards may appear within these projects. Plan training topics with an eye on the weather, paying close attention to historically warm or cold months. Consider connecting with your insurance broker as well on recent injury trends that you can address with the crew.

This will be pertinent as your company approaches their renewal window with underwriters looking at claims history. They commonly ask, “what has the insured done to make sure these claims don’t happen again?” Learning from your past is key to being proactive. Knowing you will have certain exposures coming up and addressing those with preventative training topics begins to build a Best Practice Safety Program.

Accessing Content for Training

Locating “Toolbox” trainings can be time consuming and, in some cases, costly. And very often, the trainings may not be applicable to your operation and/or the trends you may need to focus on. With an eye to the future, Rancho Mesa has recently introduced a proprietary SafetyOne™ App. Safety managers will be able to document safety inspections from their mobile device and assign required fixes to employees, while also tracking when they have been completed. Meeting content can also be distributed to supervisors through their mobile device all with a focus of making safety meetings more efficient and effective. These same supervisors can now access a vast library that can be customized to their operation.

Reach out to me to learn more about the SafetyOne™ App and how Rancho Mesa can partner with you and your team moving forward. You can reach me at (619) 438-6900 or email me at ccraig@ranchomesa.com

Take Advantage of Contractor Express Bond Programs

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

Several years ago, I put together an article on various credit driven surety bond offerings that require a one-page application to qualify for bonding. Quick and simple! At that time, the maximum limits offered by various carriers was $350,000 for a single bond.

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

Several years ago, I put together an article on various credit driven surety bond offerings that require a one-page application to qualify for bonding. Quick and simple! At that time, the maximum limits offered by various carriers was $350,000 for a single bond.

Last week, I received separate emails from two of our partner surety carriers offering single bond programs of $600,000 and $750,000, respectfully. Again, these quick and easy bond offers are solely based on personal credit scoring. In other words, if the owner of a construction company pays their personal bills, then they most likely will have the ability to qualify for a decent-sized bond.

There is no need for company financial statements to qualify for bonding in these programs. Instead, the contractor completes a “fast” application requesting personal financial information about the owner(s). The bond company will run the personal credit of the owner(s). If the personal credit is decent, the bond will be approved. A response is provided within 24 hours of submission.

The program responds to requests for bid bonds, performance and payment bonds, and letters of bondability. Several carriers provide a “pre-qualification” feature so you can determine if you will qualify for the bond before you bid or negotiate a project that will require a bond. This pre-qualification feature is helpful for owners that are concerned they may have low credit scores.

The standard premium rate for these programs is 3% of the contract amount. Based on the strength of your personal credit, and the type of work you are looking to bond, we have seen this lowered to 2%.

Therefore, if you are considering a project that requires a bond and you are not a big fan of collecting a lot of paperwork for one project – don’t fret. We may have a solution to help you win that job.

If you would like more information on how to qualify for these programs, please contact me at (619)937-0165 or mgaynor@ranchomesa.com.

The Importance of a Job Hazard Analysis in the Janitorial Industry

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

The janitorial industry faces job hazards on a daily basis. The key to running a successful and safe business is identifying hazards within the workplace well before injuries or liabilities can occur. One way to keep track and address hazards in the workplace is by creating a Job Hazard Analysis (JHA). A JHA can be used to identify individual exposures to each specific jobsite and create a plan or solution to minimize these risks.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

The janitorial industry faces job hazards on a daily basis. The key to running a successful and safe business is identifying hazards within the workplace well before injuries or liabilities can occur. One way to keep track and address hazards in the workplace is by creating a Job Hazard Analysis (JHA). A JHA can be used to identify individual exposures to each specific jobsite and create a plan or solution to minimize these risks.

For the janitorial industry, there are several common exposures and solutions JHAs should be used to address.

Bloodborne Pathogens

While this exposure is more prevalent in a medical or healthcare setting, it is important to train employees on OSHA’s bloodborne pathogen standards. Whether an employee works within a healthcare setting or not, there is always the possibility that they will have to face a situation where blood is present. Proper education on how to address this exposure can help minimize and prevent the transmission of any infectious disease.

Chemical Hazards

Examples of chemical hazards janitors could face in the workplace include carbon monoxide poisoning, lead poisoning, asbestos, and mold to name a few. Identifying these hazards in advance and putting a plan in place to avoid these exposures will lead to fewer injuries.

Cleaning Chemicals

Within the JHA, identifying which chemicals are going to be used is critical to job safety. Training employees on the proper use of these chemicals can avoid mistakes made such as improper dilution, improper mixing of products causing a chemical reaction, and improper ventilation.

Slip & Falls

Slip and fall injuries are very common in the janitorial industry for both employees and the general public. A properly used JHA can help identify high hazard areas within the jobsite and put together a plan to help minimize and avoid future injuries. Examples of areas of concern include high traffic areas, areas with slippery surfaces, areas where water tends to settle (i.e., bathroom floors, kitchens, etc.), and entrances to buildings. Once these areas are identified, it’s critical to address the issue by using caution cones, cleaning during off hours when possible, using floor mats whenever possible, and regularly monitoring these areas if a clean-up is necessary.

Personal Protective Equipment

While surveying a jobsite to determine which cleaning products and equipment will be used, it’s also important to identify what type of personal protective equipment (PPE) will be needed. Examples include proper eye, face, and hand protection while using certain chemicals and equipment. A well-executed JHA can identify which PPE is appropriate for the jobsite. However, the key is making sure that the employees are all properly trained in the use of the PPE and that implementation is mandatory.

Equipment

A JHA can assist with identifying equipment appropriate for a jobsite. Once the equipment has been chosen, proper training is vital to ensure proper use and maintenance.

Janitor’s face a number of jobsite hazards throughout their work day which is cause for concern. By developing a job hazard analysis, employers can develop techniques and procedures for avoiding hazards and injuries.

If you would like to discuss the resources Rancho Mesa Insurance has in assisting with developing a JHA, please reach out to me at (619) 937-0174 or jhoolhan@ranchomesa.com.

Focusing on ONE Industry: The Landscape Industry

Author, Greg Garcia, Account Executive, Rancho Mesa Insurance Services, Inc.

When my baseball career ended in 2021, it was time for me to do something new with my life. For me the decision was easy and one that I am very grateful for. My dad, Dave Garcia started Rancho Mesa 25 years ago and throughout the years he and many others have contributed into what Rancho Mesa is today, a 16-time National Best Practices Agency. I was fortunate enough to get an opportunity to join such an amazing organization.

Author, Greg Garcia, Account Executive, Rancho Mesa Insurance Services, Inc.

When my baseball career ended in 2021, it was time for me to do something new with my life. For me the decision was easy and one that I am very grateful for. My dad, Dave Garcia started Rancho Mesa 25 years ago and throughout the years he and many others have contributed into what Rancho Mesa is today, a 16-time National Best Practices Agency. I was fortunate enough to get an opportunity to join such an amazing organization.

One of the main priorities for Rancho Mesa brokers is to find your “niche.” My brother Drew Garcia who has been a broker here at Rancho Mesa for 7 plus years, found the importance of focusing on one industry and how it can be a benefit for not only his personal success but more importantly for the businesses he serves within his specialty. He decided to focus on the landscape industry, which turns out to be my focus as well.

We found that by focusing on just one industry, we can better understand the issues and needs of our clients, and provide quicker more accurate solutions than if we were a generalist broker. We not only see the common issues that landscape contractors face, but through this expertise are able to develop the right risk management solutions for them. We push ourselves to be constantly searching for better ways to help our clients and future prospects. We are an integral part of the NALP and attend all their events. We are active participants in landscaping peer groups events all over the country to try to gain additional insights and knowledge about the landscape industry.

My family background is in baseball, so needless to say we are all very competitive, and in insurance it is no different. We are looking for an honest way to create a competitive advantage for our clients within the insurance marketplace. Focusing on one industry, the landscape industry, gives us a big advantage over other brokers that are not niched to landscape, because it is all we think about, talk about, and research. Our clients see the advantage in having their broker focus solely on their industry.

If you have never thought about partnering with a specialized broker or did not think that was possible, consider exploring that option before your next insurance renewal. To begin the process, sit down with your current broker and ask how many other clients he or she works with in your same industry.

For all the landscape companies listening who want to learn more about why having a specialized broker is important, please contact me at 619-438-6905 or ggarcia@ranchomesa.com.

Inflation Increases Cost of Workers’ Compensation Claims

Author, Sam Brown, Account Executive, Rancho Mesa Insurance Services, Inc.

As non-profits and leaders of human service organizations navigate important business decisions in the face of inflation, it’s important to consider measures that can reduce inflation’s impact to an organization’s operating budget. Today, we look at inflation’s effect on workers’ compensation insurance and strategies to reduce future costs.

Author, Sam Brown, Account Executive, Rancho Mesa Insurance Services, Inc.

As non-profits and leaders of human service organizations navigate important business decisions in the face of inflation, it’s important to consider measures that can reduce inflation’s impact to an organization’s operating budget. Today, we look at inflation’s effect on workers’ compensation insurance and strategies to reduce future costs.

In August 2022, the U.S. Bureau of Labor Statistics published data reflecting an 8.3% increase to the Consumer Price Index for All Urban Consumers over the previous 12 months. If medical costs are the largest expenditure in workers’ compensation claims, how is the recent inflationary trends affecting worker’s compensation medical and claim costs?

Medical costs per workers’ compensation claim increased almost 18% between 2012 and 2021 according to a study by the National Council on Compensation Insurance (NCCI). Moving forward, the Office of the Actuary at the Centers for Medicare and Medicaid Services projects an index closely related to medical costs in worker’s compensation will increase 2.5% to 3% beyond 2022. Inflation has impacted many segments of the economy, including workers’ compensation insurance.

Strategies to reduce inflation’s impact to workers’ compensation insurance premiums, include:

Offer modified duty to all injured workers.

Offering modified duty to employees with work restrictions is widely known to reduce the likelihood of workers’ compensation litigation and reduces the overall cost and duration of the claim. In addition, if an injured employee rejects the offer, then the individual can no longer receive temporary disability benefits. These positive outcomes may help explain why at least one insurance company offers a 10% rate discount to employers that offer modified duty to all injured workers.

Consider on-call medical technician and telephonic nurse triage services.

Rancho Mesa has published articles about the benefits of on-site medical evaluations and nurse-triage services, but they deserve a fresh look. Both services can advise the injured workers on proper self-care, thereby providing the employee with helpful treatment options while avoiding a costly workers’ compensation claim. The employer will also avoid paying the injured worker’s wages while they travel to and wait inside a medical provider’s office.

The nurse-triage service will continue to manage the injury and help the employee determine if further medical care is necessary. Of course, employers should always report the incident to the workers’ compensation carrier.

Consider an alternative workers’ compensation plan to gain more control over claim and insurance premiums.

It’s true that self-insured worker’s compensation plans are typically reserved for very large organizations, but options exist that replicate some of the most beneficial features. The available options depend on the size of the employer.

Small to medium sized employers can explore self-insured groups (SIG) to potentially split payroll between class codes and receive dividends. SIGs are very motivated to help members avoid workers’ compensation claims, but also closely manage open claims. A member vote is typically required after a review of an applicant’s safety plan, safety record, and operations.

Medium to large organizations may consider loss-sensitive plans. The policy will typically offer reduced annual premium if the employer can control claim frequency and claim costs. There may also be an opportunity to share in the underwriting profit following a plan year. Of course, the insured may also need to share in the claim costs in a poor performing year.

Another alternative, workers’ compensation deductible plans, can also offer a premium savings if the employer is willing to pay a deductible on each claim. Deductibles can range from $10,000 to $100,000 or more, depending on the employer’s risk tolerance.

Looking at alternative workers’ compensation strategies and plans can help employers navigate the current pattern of inflation. The information above can reduce claim frequency, claim cost, and also inform nonprofit and human service leaders about potential insurance premium savings available.

To discuss your organization’s options, contact me at (619) 937-0175 or sbrown@ranchomesa.com.

Mitigating Pollution Liability Exposure

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

No matter what trade, contractors face environmental risks from their operations. Contactors pollution liability (CPL) insurance has now become an integral part of a contractor’s insurance program. The industry is seeing contractual requirements for this coverage from a combination of owners, developers and general contractors for projects of all sizes.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

No matter what trade, contractors face environmental risks from their operations. Contactors pollution liability (CPL) insurance has now become an integral part of a contractor’s insurance program. The industry is seeing contractual requirements for this coverage from a combination of owners, developers and general contractors for projects of all sizes.

While many contactors assume their commercial general liability (CGL) policy would cover a pollution claim; the unfortunate reality is that most CGL policies have pollution exclusions that leave contractors uninsured in the case of a pollution incident.

Pollution incidents are causing some type of contamination on a job site. And, contamination is the operative word in all pollution exclusions. With such a broad definition extending to so many types of construction, it is important to understand how a pollution incident can happen on the jobsite.

Pollution incidents can happen to contractors in many trades. Real-world examples include:

An HVAC system is installed improperly, which over time, causes moisture and ultimately mold to spread throughout a residential building, causing bodily injury and property damage.

A painting contractor does not properly ventilate a residential facility causing exposure to fumes which lead one or more residents to hospitalization.

Dirt being excavated from one area of a job site to another is contaminated with arsenic and lead. The chemicals are then spread to a larger area which is later found by a soils expert.

Construction equipment on a project site has hydraulic fuel lines cut by vandals, causing fuel to leak out and contaminate the soil.

A contractor punctures an underground storage tank during excavation, causing the product to spill into the soil and groundwater.

In addition to implementing an effective plan to reduce the likelihood of pollution incidents on the jobsite, a best practices approach to protecting contractors from this type of exposure is to transfer the risk to a CPL policy.

Contractors pollution liability insurance provides coverage for third party bodily injury, property damage and pollution clean-up costs as a result of pollution conditions for which the contractor may be responsible.

A pollution incident can include the discharge of pollutants brought to the job site, a release of pre-existing pollutants at the site or other pollution conditions due to the performance of the contractor’s or a lower tier subcontractor’s operations. In addition to the potential loss of reputation, often overlooked expenses that can negatively impact a profit and loss statement are the costs incurred to defend a company involved in a pollution claim.

Contact me at (619) 937-0167 or sclayton@ranchomesa.com if you would like to discuss your pollution liability risk.

Important Updates to Minimum Wage Policies for 2023

Author, Megan Lockhart, Media Communications and Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

As businesses ring in the New Year, it is important for owners to note some key changes to state and local wage policies taking effect January 1, 2023.

Author, Megan Lockhart, Media Communications and Client Services Coordinator, Rancho Mesa Insurance Services, Inc.

As businesses ring in the New Year, it is important for owners to note some key changes to state and local wage policies taking effect January 1, 2023.

Established by the Fair Labor Standards Act (FLSA), the federal minimum wage rate stands at $7.25. However, changes to minimum and tipped wages will impact individual states and local areas. In California, the State minimum wage as of January 1, 2023 is $15.50 regardless of tips. Be sure to check the updates to your specific location to ensure your company is best prepared for the New Year.

Local Minimum Wage Rates for California

| Locality | Coverage | Minimum Wage as of January 1, 2023 Increase |

| Alameda City | $15.75 | |

| Belmont | $16.75 | |

| Berkeley | $16.99 | |

| Burlingame | $16.47 | |

| Cupertino | $17.20 | |

| Daly City | $16.07 | |

| East Palo Alto | $16.50 | |

| El Cerrito | $17.35 | |

| Emeryville | $17.68 | |

| Foster City | Employers that have a business license from Foster City | $16.50 |

| Fremont | $16.00 | |

| Half Moon Bay | $16.45 | |

| Hayward | Employers with 25 or fewer employees | $15.50 (state rate) |

| Hayward | Employers with 26 or more employees | $16.34 |

| Long Beach | Hotel employers (100 or more guest rooms) | $16.73 |

| Long Beach | Employers of concessionaires at the Long Beach Airport and Long Beach Convention Center | $16.55 |

| Los Altos | $17.20 | |

| Los Angeles City | General | $16.04 |

| Los Angeles City | Hotel employers with 150 or more guest rooms | $18.17 |

| Los Angeles County (unincorporated areas) | $15.96 | |

| Malibu | $15.96 | |

| Menlo Park | $16.20 | |

| Milpitas | $16.40 | |

| Mountain View | Employers that are subject to the Mountain View Business License Tax or that maintain a facility in Mountain View | $18.15 |

| Novato | Business with 1 – 25 employees | $15.53 |

| Novato | Business with 26 – 99 employees | $16.07 |

| Novato | Business with 100+ employees | $16.32 |

| Oakland | General | $15.97 |

| Oakland | Hotel employers (50 or more rooms) with qualifying health benefits | $17.37 |

| Oakland | Hotel employers (50 or more rooms) without qualifying health benefits | $23.15 |

| Palo Alto | $17.25 | |

| Pasadena | $16.11 | |

| Petaluma | $17.06 | |

| Redwood City | $17.00 | |

| Richmond | Employers that offer qualifying health benefits | $15.50 (state rate) |

| Richmond | Employers that don’t offer qualifying health benefits | $16.17 |

| San Carlos | $16.32 | |

| San Diego | $16.30 | |

| San Francisco | $16.99 | |

| San Jose | $17.00 | |

| San Mateo City | $16.75 | |

| Santa Clara City | $17.20 | |

| Santa Monica | General | $15.96 |

| Santa Monica | Hotel employers | $18.17 |

| Santa Rosa | $17.06 | |

| Sonoma City | Employers with 25 or fewer employees | $16.00 |

| Sonoma City | Employers with 26 or more employees | $17.00 |

| South San Francisco | $16.70 | |

| Sunnyvale | $17.95 | |

| West Hollywood | Employers with 49 or fewer employees | $17.00 |

| West Hollywood | Employers with 50 or more employees | $17.50 |

| West Hollywood | Hotel employers | $18.35 |

Clients can login to the RM365 HRAdvantage™ portal to review the full local minimum and tipped wages for all states and counties under the New Chart: 2023 State and Local Minimum and Tipped Wages.

Managing Your Surety Relationship for 2023 and Beyond

Author, Andy Roberts, Account Executive, Rancho Mesa Insurance Services, Inc.

Over the past two years, there has been a lot of talk about a looming recession. If a recession happens, its severity remains to be seen, but regardless, it is important for contractors to be taking an active approach in building their relationship with their bond company and utilizing the services of a surety specific agent.

Author, Andy Roberts, Account Executive, Rancho Mesa Insurance Services, Inc.

Over the past two years, there has been a lot of talk about a looming recession. If a recession happens, its severity remains to be seen, but regardless, it is important for contractors to be taking an active approach in building their relationship with their bond company and utilizing the services of a surety specific agent.

Surety companies are conservative and err on the side of caution when it comes to providing bonds, which makes it imperative that the contractor build a strong relationship with their management and underwriting teams. Annual meetings should be conducted, as this provides the underwriter valuable insight into the company while also allowing them to build a more personal relationship with the contractor. Additionally, it is important that there is regular communication between all parties throughout the year regarding the contractor’s financials and performance on jobs, as this type of discussion can help build trust between both parties. This may seem pretty standard, but it is not easily accomplished unless a contractor is working with a surety broker that specializes in the bonding industry.

The surety industry is specialized and relationship driven, which makes partnering with the right broker even more critical as the country moves into unprecedented financial times. Effective brokers know each carriers’ appetite; they have relationships with those underwriters and should be able to easily determine which surety will be able to provide a program to match the contractor’s needs. This type of knowledge and experience can greatly benefit a contractor in the event the economy begins to turn and surety markets begin to limit capacity and/or pull back from offering bond programs.

In this most uncertain time, contractors should begin building and, in some cases, re-building their surety relationships. With considerable work lined up in Southern California over the next few years, strengthening these bond programs can allow for maximum capacity and potentially profitable growth.

For any questions about managing your surety relationships or to discuss if we can assist with any bond-related needs, contact me at aroberts@ranchomesa.com or call my direct line at (619) 937-0166.

Employers Adapt to New Pay Transparency Requirements

Author, Lauren Stumpf, Media Communications & Client Services Specialist, Rancho Mesa Insurance Services, Inc.

Pay transparency is becoming more common for companies, especially as laws are being passed making variations of it a requirement. Pay transparency is the idea that employers should be open, or transparent, about what they pay their employees, and how they decide on compensation for specific roles.

Author, Lauren Stumpf, Media Communications & Client Services Specialist, Rancho Mesa Insurance Services, Inc.

Pay transparency is becoming more common for companies, especially as laws are being passed making variations of it a requirement. Pay transparency is the idea that employers should be open, or transparent, about what they pay their employees, and how they decide on compensation for specific roles.

More employees are wanting clarity about their own pay and how it compares to their peers. According to HR and recruiting experts, employees may leave or give less effort at work if they feel they’re not being paid fairly.

Job recruiters are also finding that people searching for job opportunities want to see pay ranges on job postings, and some will not apply if that information is not available.

As of January 1, 2023, California employers with 15 or more employees must include base pay ranges in job postings and ads. Colorado, Washington, and soon to be New York, are among other states to pass similar laws.

Employers should be aware that employees already have a legal right to discuss their pay. Under federal law, employers may not keep their non-supervisory employees from discussing their wages with each other. In addition to rights under federal law, many employees and including supervisors have protections under state laws that allow them to freely discuss their wages. It is recommended that employers eliminate any policy telling employees that discussion of wages is discouraged or prohibited, or that wages are confidential.

Utilizing Rancho Mesa’s RM365 HRAdvantage™ Smart Employee Handbook Builder is a great way to ensure that your company policies are compliant.

Being open with salary expectation up front can save companies time and money on recruiting. Hiring managers can waste a lot of time on interviews if they wait until after they have conducted multiple interviews to finally reveal the salary, only to learn that it does not meet the expectations of the candidate.

Job postings that include pay transparency are shown to have significantly more applicants than those that do not. In the tight labor market that we are currently facing, especially in the construction industries, employers should be willing to try anything that will set them above the rest.

For additional resources on pay transparency, our clients can visit the RM365 HRAdvantage™ portal.

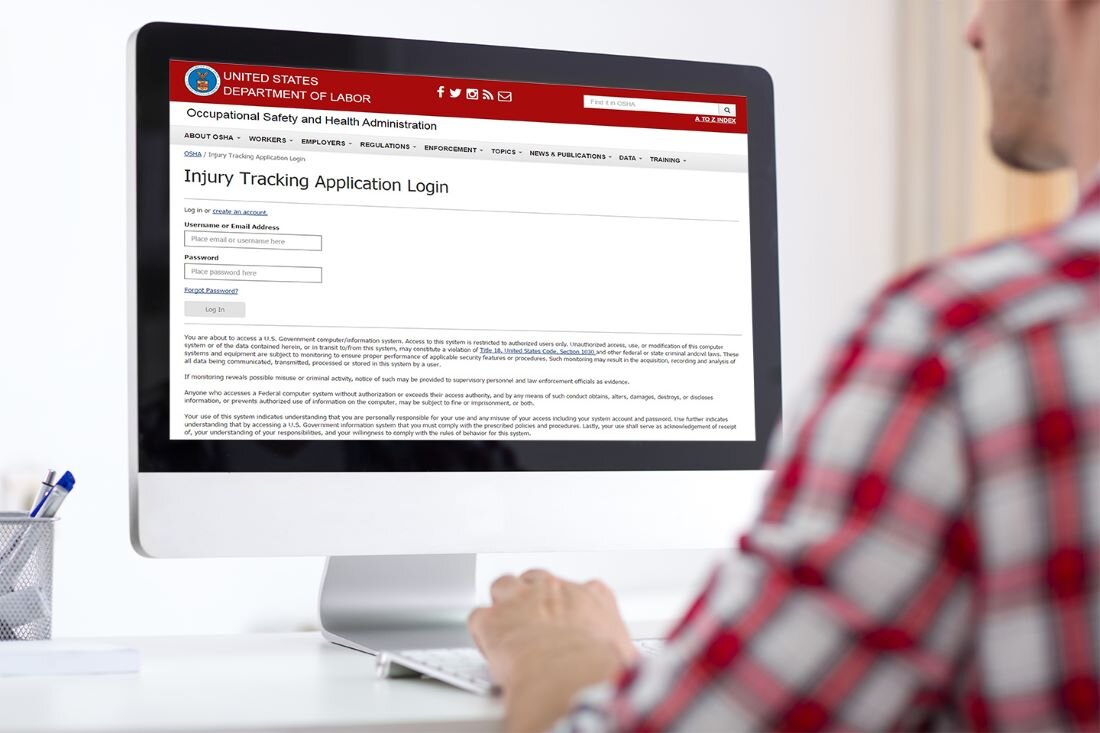

Employers Prepare to Submit OSHA Form 300A

Author, Lauren Stumpf, Media Communications & Client Services Specialist, Rancho Mesa Insurance Services, Inc.

The time is here for you submit your company’s OSHA 300A Form. The OSHA 300A Form is a company’s summary of work-related injuries and illnesses within a given year. Employers must electronically submit their 2022 OSHA Form 300A data to Federal OSHA by March 2, 2023.

Author, Lauren Stumpf, Media Communications & Client Services Specialist, Rancho Mesa Insurance Services, Inc.

The time is here for you to submit your company’s OSHA 300A Form. The OSHA 300A Form is a company’s summary of work-related injuries and illnesses within a given year. Employers must electronically submit their 2022 OSHA Form 300A data to Federal OSHA by March 2, 2023.

Along with electronically submitting the data, the form must also be posted in the workplace, in a place visible to employees from February 1st to April 30th. To ensure employee confidentiality, the Form 300A does not include personal information such as employee names.

According to OSHA, establishments with 20 to 249 employees in designated industries are required to submit the 300A data. Establishments with 250 or more employees that are required to keep OSHA injury and illness records must also submit the data.

Companies under Federal OSHA jurisdiction can use the ITA Coverage Application to determine if they are required to electronically report their injury and illness information to OSHA. Establishments under State Plan jurisdiction should contact their State Plan.

There are three options for injury and illness data submissions. You can manually enter your data, upload a CSV file to add multiple establishments at the same time, or transmit data electronically via an API (application programming interface).

OSHA’s Injury Tracking Application (ITA) is using a new login format for submitting the Form 300A data. Those who have used the old login in previous years will need to make a new Login.gov account using their same email address in order to access the application for the 2023 collection of Calendar Year 2022 Form 300A data.

For additional information and detailed instructions on creating a new account, please visit OSHA’s Injury and Reporting webpage.

If Rancho Mesa clients have entered their 2022 incidents in the Risk Management Center, they will be able to generate their 300A Summary along with the .CSV file to upload to the Federal OSHA’s Injury Tracking Application website. Please refer to our video for instructions on how to do this.

Closing the Installation Floater Coverage Gap for Landscape Contractors

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

Landscape contractors have varying levels of exposure when it comes to installation projects. However, they virtually all share the same common coverage gap for trees, plants, shrubs, and lawns.

Author, Drew Garcia, Vice President, Landscape Group, Rancho Mesa Insurance Services, Inc.

Landscape contractors have varying levels of exposure when it comes to installation projects. However, they virtually all share the same common coverage gap for trees, plants, shrubs, and lawns.

An installation floater covers property being installed by a contractor. For landscapers, this could be a number of different items depending on the scope of work: irrigation systems, hardscape, low voltage lighting, and plant material to name a few. Most installation floaters will exclude plants, trees, shrubs, and lawns within the policy under “property not covered.”

The property being installed is generally insured under a few different scenarios. Temporary storage at the yard, at the jobsite, in transit, and installation at the jobsite. Common losses include fire, theft, and accidental damage.

The obvious concern is a scenario in which plant material is damaged or stolen and the insurance policy denies the claim due to the common exclusion.

When considering the limit for your installation floater, you will want to estimate your average job value for material cost and labor cost to install the product. You will also need to know if the policy is written on blanket coverage or scheduled location. If a project comes up that is out of the ordinary, you can always increase the limit for that specific project by engaging your insurance provider in advance of take-off.

The cost of plant material and labor changes each year. The broker price index for the nursery, garden, and farm supply stores has increased by about 43% since 2019. Wage inflation has continued to drive payroll cost. Be sure to re-evaluate your exposure and ensure that plants, trees, shrubs, and lawns are covered for your installation exposure by working with your insurance professional and carrier to remove the exclusion completely, or amend the limit to provide a max dollar amount per tree, plant, shrub, or lawn being installed.

To discuss this coverage or review your current policy, contact Drew Garcia at (619) 0200 or drewgarcia@ranchomesa.com.

Cal/OSHA Adopts New Non-Emergency COVID-19 Regulations

Author, Lauren Stumpf, Media Communications & Client Services Specialist, Rancho Mesa Insurance Services, Inc.

On Thursday, December 15, 2022 the California Occupational Safety & Health Standards Board (Cal/OSHA) voted on newly proposed COVID-19 regulations during a public forum meeting. With a 6 to 1 vote, the Non-Emergency COVID-19 Prevention Regulations were passed and adopted.

Author, Lauren Stumpf, Media Communications & Client Services Specialist, Rancho Mesa Insurance Services, Inc.

On Thursday, December 15, 2022 the California Occupational Safety & Health Standards Board (Cal/OSHA) voted on newly proposed COVID-19 regulations during a public forum meeting. With a 6 to 1 vote, the Non-Emergency COVID-19 Prevention Regulations were passed and adopted. The regulations will take effect once they are approved by the Office of Administrative Law in January 2023. They remain in effect for 2 years thereafter. However, the recordkeeping subsections will remain in effect for 3 years.

Previously, the proposed standards had the word “permanent” in the title despite it having the two and three year expiration dates. Cal/OSHA is now referring to the regulations as the “COVID-19 Prevention Non-Emergency Regulations.”

These new regulations include some of the same requirements found in the current COVID-19 Prevention Emergency Temporary Standards (ETS), but there are some new provisions.

First, let’s begin with pointing out some key requirements that are staying the same.

With the new regulations employers will still need to make COVID-19 testing available at no cost to the employee and during paid time to employees after a close contact.

Employers will still need to provide their employees with face coverings and respirators upon request.

Employers must still report information about employee deaths, serious injuries, and serious occupational illnesses to Cal/OSHA.

Some key difference between the current ETS and the new regulations include:

Employers are no longer required to maintain a standalone COVID-19 Prevention Plan, as long as COVID-19 requirements are addressed within a section of their Injury and Illness Prevention Program (IIPP).

Employers must now report major outbreaks to Cal/OSHA.

Exclusion pay for employees has been removed from the new regulations. This means employers will no longer be required to pay employees while they are excluded from work due to COVID-19. Instead the employer would only need to provide employees with information on the benefits they would be entitled to under state, federal, and local laws.

There are also some definition changes to what is considered “close contact” and “exposed group.” “Close contact” is now defined by looking at the size of the workplace in which the exposure took place. For indoor airspaces of 400,000 or fewer cubic feet, “close contact” is now defined as sharing the same indoor airspace with a COVID-19 case for a cumulative total of 15 minutes or more over a 24-hour period during the COVID-19 case’s infectious period. For indoor airspaces of greater than 400,000 cubic feet, “close contact” is defined as being within six feet of a COVID-19 case for a cumulative total of 15 minutes or more over a 24-hour period during the COVID-19 case’s infectious period. The term “exposed group” was clarified to include employer-provided transportation and employees residing within employer-provided housing that are covered by the COVID-19 Prevention standards.

Information provided by Cal/OSHA. For a full and detailed list of regulations please refer to Cal/OSHA’s Title 8 Proposed State Standard.

In order to be best prepared for these changes, it is recommended employers review the California Department of Public Health (CDHP) and Cal/OSHA guidance on requirements for things such as the use of face masks. Employers must also develop, implement, and maintain effective methods to prevent COVID-19 transmission by improving ventilation. It’s important to review CDPH and Cal/OSHA Interim Guidance for Ventilation, Filtration, and Air Quality in Indoor Environments.

NIAC Reimbursing for Damage to Employees Personal Vehicles

Author, Jack Marrs, Associate Account Executive, Rancho Mesa Insurance Services, Inc.

Many employees of non-profit organizations use their personal vehicles while performing work-related duties. Following an auto accident, the employee’s personal auto insurance will respond to a third party liability claim. Only once those policy limits are exhausted will the organization’s non-owned auto liability coverage respond.

Author, Jack Marrs, Associate Account Executive, Rancho Mesa Insurance Services, Inc.

Many employees of non-profit organizations use their personal vehicles while performing work-related duties. Following an auto accident, the employee’s personal auto insurance will respond to a third party liability claim. Only once those policy limits are exhausted will the organization’s non-owned auto liability coverage respond.

But who is responsible for physical damage to the employee’s vehicle?

Below, we discuss the impact of California Labor Code 2802 and one insurer’s response.

If an employee’s vehicle is damaged while performing work-related duties, the responsibility of the repair cost falls to the other driver or the employee’s auto insurance. An issue arises, however, when a personal auto lines carrier adopts exclusions that eliminate coverage for an employee involved in a business-related activity.

Complicating matters, California Labor Code 2802 states that “an employer must indemnify an employee for all necessary expenditures or losses that the employee incurs in direct consequence of performing work-related duties.” Non-profit leaders must understand the organization’s obligation to reimburse the employee for the cost to repair a personal vehicle.

This unexpected expense can be challenging, especially for smaller organizations with employees driving personal vehicles to help fulfill the mission.

Fortunately, Nonprofit Insurance Alliance of California (NIAC), an insurance risk sharing pool for 501(c)3 organizations, has developed a useful coverage to address this issue. If coverage is elected, NIAC will reimburse the employer’s expense for physical damages to a California-based employee’s personal vehicle. Coverage offers $5,000 per claim with a $25,000 policy aggregate limit, thereby easing the financial burden created by Labor Code 2802.

Understanding these types of coverages and their exclusions are key for non-profit organizations. If you’re unsure how your policy would respond to this scenario, contact me at (619) 486-6569 jmarrs@ranchomesa.com for a policy audit to see if your organization is covered.