Industry News

What is SB 562 all about?

It may be of interest, if not importance, for all Californians to know about current proposed legislation, sponsored by Senator Ricardo Lara of Bell Gardens and Senator Toni Atkins of San Diego. The proposed bill would significantly expand the role of the state government within the healthcare system, by essentially establishing a single-payer system.

It may be of interest, if not importance, for all Californians to know about current proposed legislation, sponsored by Senator Ricardo Lara of Bell Gardens and Senator Toni Atkins of San Diego. The proposed bill would significantly expand the role of the state government within the healthcare system, by essentially establishing a single-payer system.

Under Senate Bill 562 (SB 562), the State would cover all medical services for every resident regardless of income or immigration status, including inpatient, outpatient, emergency, dental, vision, mental health, and nursing home care. Furthermore, insurers would be prohibited from offering benefits that cover the same services, potentially resulting in their choice to exit the marketplace. While the proposed bill touts that the program would eliminate co-pays and deductibles, and the need to obtain referrals, there is no mention of how it would be funded, except through “broad-based revenue.”

Obviously, many people ask me about the direction healthcare is headed in California and the Country; to which, I do my best to eliminate my interest in the subject since I make my living guiding companies through the insurance process. But, I do offer up some food-for- thought in terms of evaluating such a proposal, including citing the increasing shortfall of funding for Medicare, and the VA as examples of government-run healthcare, as it seems to me the former is going to require an eventual increase in payroll taxes, which effects everyone, employers and employees alike, and the latter is a good example of inefficiency and lack of innovation when there is no competition.

Personally, I believe that healthcare is both a right and a responsibility. As out-of-whack as the current system seems, or let’s face it, is, I just don’t know how we go about funding such a proposal without breaking the proverbial bank. The financial and economic realities have to be weighed with the politics, which is why it’s a bit of a relief that Governor Jerry Brown has asked the question in return, “Where do you get the extra money? This is the whole question?”

Whatever my thoughts, it is certainly a complex and vexing economic, social, and political issue for our times, one that will continue to be hotly debated and legislated, so there is much more to come.

Commercial Auto Premiums Are Rising - What’s Driving the Increases?

Author David J. Garcia, C.R.I.S., A.A.I., President Rancho Mesa Insurance Services, Inc.

The insurance industry is experiencing record losses on their commercial auto books of business, which is dramatically driving up insurance premiums for business owners. There are many factors that are contributing to this increase in losses; let’s take a look at six of the most prevalent.

Author David J. Garcia, C.R.I.S., A.A.I., President Rancho Mesa Insurance Services, Inc.

The insurance industry is experiencing record losses on their commercial auto books of business, which is dramatically driving up insurance premiums for business owners. There are many factors that are contributing to this increase in losses; let’s take a look at six of the most prevalent.

1. Distracted Drivers. This one factor is now contributing over 30% of all accidents reported. This is the single most significant issue facing not only the commercial insurance marketplace, but personal auto usage as well. Whether it’s talking on the phone, viewing and answering emails, or texting, these trends are escalating at alarming rates.

2. Higher Auto Repair Costs. This is one of the hidden “new” claim costs that insurance companies are facing. Record auto sales of newer vehicles that include sensors, cameras and other new electronics are bringing the cost of repairs to higher levels than ever before. As an example, minor fender repairs might have been a few hundred dollars in the past, but now with sensors and cameras built into most new vehicle bumpers, this cost has risen into the thousands of dollars.

3. Increase in Miles Driven. Since recovering from the recession, a healthier economy has lead businesses to expand and hire more employees. Now, with an increased need for more company-owned vehicles, more miles are driven which leads directly to an increase in accidents.

4. Rising Medical Costs. The medical costs associated with treating auto accident victims is rising 1.5 times faster than any other cost associated with auto incidents. While this probably comes as no surprise given the state of our health care costs, in general, it plays a major role in driving up commercial auto losses, and thus, premiums.

5. Fatalities and Severe Accidents Increasing. With an increase in miles being driven and the distracted driving epidemic, the severity of accidents has grown proportionately.

6. Less “Skilled Driver” Availability. The growth in business and the need for more drivers has resulted in a shortage of skilled commercial drivers. The lack of availability has also increased the likelihood for more auto accidents to occur.

As a business owner, what can you do to minimize this exposure and help control your present and future auto premiums? The process starts with having a formal written “Vehicle Safety Program” in place that is specific to your company’s needs and exposures. The following will outline major areas that the Vehicle Safety Program should address.

- Management Commitment – strong management involvement and concern must be evident

- Vehicle Operator Responsibilities – distracted driving guidelines and consequences, a description on how the vehicle may and may not be used, etc.

- Driver Selection - established criteria in order to be eligible to drive, should include age, MVR history, etc.

- Accident Investigation – formal written process for documenting, reporting and the resulting training to prevent similar accidents

- Vehicle Maintenance – establish a process for regular and consistent care of the vehicles tires, brakes, oil, etc.

In addition to the above, there are other areas that need to be addressed in more detail in order for you to build your own comprehensive Fleet Safety Program. In order to get started, you may want to reach out to your existing auto insurance carrier, as many carriers will offer assistance to their policyholders for creating a safety program.

Furthermore, Rancho Mesa has a proprietary template for our clients, as they design new and re-design existing Fleet Safety Programs. We also offer Fleet Safety Training workshops twice a year to assist in this process. Our workshops are free of charge and offered to current and prospective clients.

Should Union Janitorial Employers have a lower Workers’ Compensation rate than Non-Union Employers?

Author Jeremy Hoolihan, CRIS, Janitorial Group Leader Rancho Mesa Insurance Services, Inc.

A recent study by the Commission on Health, Safety and Workers’ Compensation made an argument that the janitorial industry should be split into two workers’ compensation class codes. This change would be similar to how many construction operations field class codes are separated between an over and under dollar amount per hourly wage. As an example, an electrical contractor’s field wages are split at over and under $30/hour.

Author Jeremy Hoolihan, CRIS, Janitorial Group Leader Rancho Mesa Insurance Services, Inc.

A recent study by the Commission on Health, Safety and Workers’ Compensation made an argument that the janitorial industry should be split into two workers’ compensation class codes. This change would be similar to how many construction operations field class codes are separated between an over and under dollar amount per hourly wage. As an example, an electrical contractor’s field wages are split at over and under $30/hour. Why does this matter? It matters, because the workers’ compensation marketplace perceives the higher-wage-earner to be a safer risk (the thinking being - a higher-wage-earner is more experienced and less likely to sustain injury), thus, the workers' compensation premium rates are less for those in the “above” threshold category. However, the BIG difference between this rationale and the study is that rather than basing the split rates on pay scale, the study proposes the split be between Union and Non-Union companies.

The study’s line of reasoning is that Union firms have fewer injuries and as a whole have a much lower loss ratio than Non-Union firms. However, many industry experts disagree and believe that the figures are skewed and not representative of the true industry experience. Clearly with the varying opinions and so much at stake, much more research and discussion needs to take place before anything is implemented.

With that said, in order to remain relevant and competitive, all janitorial companies need to stay well informed and be prepared for any changes should they occur. Rancho Mesa’s janitorial department will keep a close eye on any new developments and continue to help improve your company's risk profile, so you will be well informed and prepared for any changes. If you have any questions please feel free to contact us

Help Control Your Workers’ Compensation Claim Costs through Accident Investigation

Authors, Dave Garcia, AAI, CRIS, President and CEO, and Drew Garcia, NALP Program Director from Rancho Mesa Insurance Services, Inc.

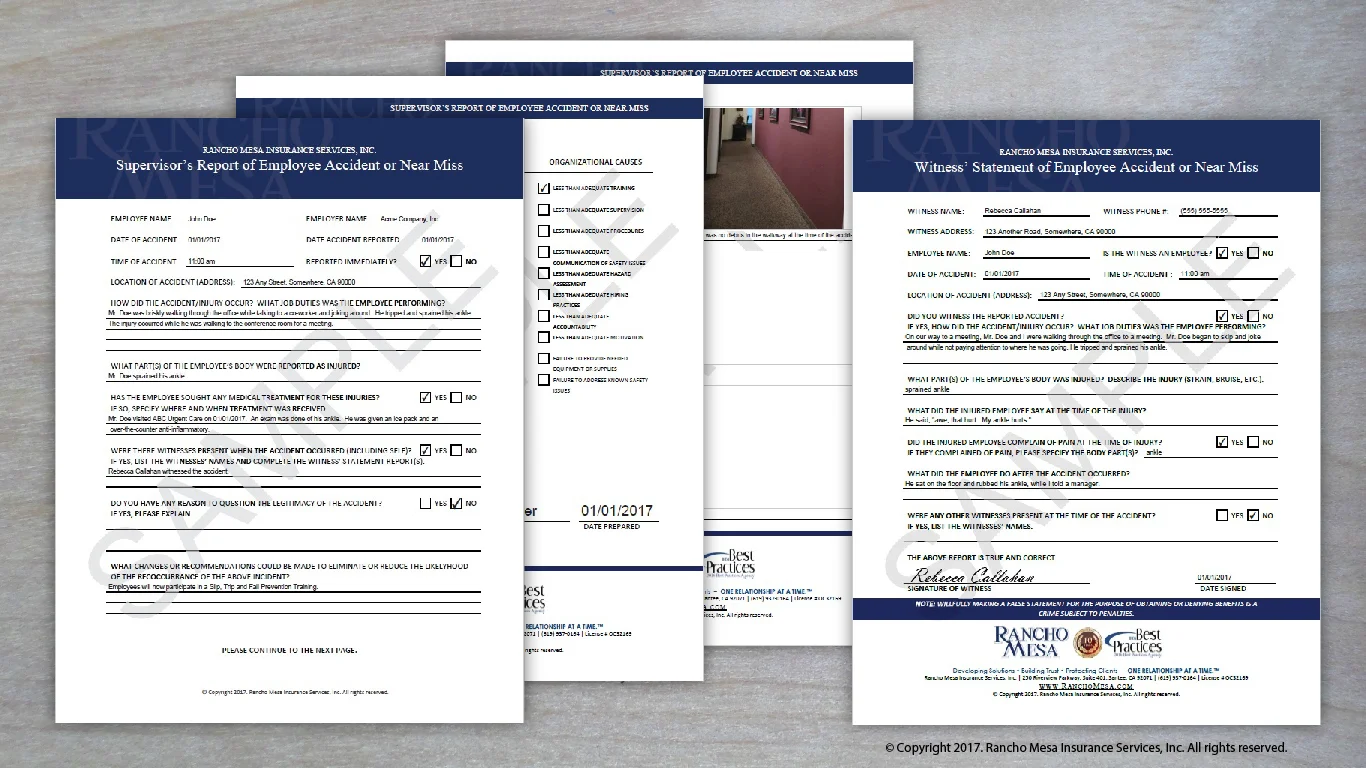

When a workers’ compensation claims occurs, in order to both control the costs of the claim and look for preventive measures to reduce or eliminate similar claims from reoccurring, it is vital that a thorough accident investigation report is completed.

Authors, Dave Garcia, AAI, CRIS, President and CEO, and Drew Garcia, NALP Program Director from Rancho Mesa Insurance Services, Inc.

When a workers’ compensation claims occurs, in order to both control the costs of the claim and look for preventive measures to reduce or eliminate similar claims from reoccurring, it is vital that a thorough accident investigation report is completed. The accident investigation report should be completed at the time of the accident, by the supervisor overseeing the injured employee, and contain the following information:

- Employee name, date, time and location of the accident,

- A description of how the injury occurred and the job duties the employee was performing when they were injured,

- The employee’s body part(s) that were reported as injured,

- If witnesses were present when the accident occurred, document their names and statements using the Witness’ Statement of Employee Accident or Near Miss Report,

- Pictures of the injury and accident area,

- Recommendations or changes that could be made to eliminate or reduce the potential for a similar claim in the future.

The goals of this process are:

- To have a timely and accurate record of the accident or incident that allows the claim to be reported to the insurance carrier in a timely manner.

- To help you to reduce the chance of fraudulent claims through documentation, pictures and witness statements.

- To analyze the root cause of the accident or near miss and implement the needed recommendations to reduce or eliminate the likelihood of future claims.

As a 10-time National Best Practices Agency, Rancho Mesa Insurance Services, Inc. understands the importance of implementing the highest standards of Risk Management practices for our clients. So, as part of our RM365 Advantage™ program, we have developed our own proprietary Employee Accident Report and Witness Statement to assist our clients with documentation of their accidents or near misses.

How to Prevent Back Injuries in the Landscape Industry

Author, Drew Garcia, with Rancho Mesa Insurance Services, is the program director for NALP’s Worker’s Compensation Program.

According to the Workers Compensation Insurance Rating Bureau (WCIRB), in the last 5 years, over a quarter of a billion dollars in back injury claims, on behalf of the landscape industry, have been paid out by carriers in California. The back claim is by far the most costly injury at $22,000 over the last five years and the second highest in terms of frequency (behind hand, wrist and finger injuries), and the leading claim resulting in an employee's time away from work.

Author, Drew Garcia, with Rancho Mesa Insurance Services, is the program director for NALP’s Worker’s Compensation Program.

According to the Workers Compensation Insurance Rating Bureau (WCIRB), in the last 5 years, over a quarter of a billion dollars in back injury claims, on behalf of the landscape industry, have been paid out by carriers in California. The back claim is by far the most costly injury at $22,000 over the last five years and the second highest in terms of frequency (behind hand, wrist and finger injuries), and the leading claim resulting in an employee's time away from work.

Consider

- Back claims are most costly.

- They are the second most frequent claim reported.

- They are the leading claim resulting in an employee losing time away from work.

Reflect

- Has your company had a back injury in the past?

- What are you doing to protect the backs of your employees?

- Would it be worth your time to consider ways to mitigate this exposure?

Solution

Implementing a pre-work stretch, when done properly, is a quick and effective solution to reduce the likelihood of back injuries. The following stretch program was designed to stretch the back with Professional Landscapers in mind. The program can be executed in minimal time, at any location (yard or on-site) and will not only help employees warm up for the day, but also strengthen their back to help maintain a healthy career.

Benefits

By implementing a stretch you are:

- Showing your employees that you care about their health and have explored an option to help keep them safe.

- Differentiating your companies risk profile against the industry to help enforce aggressive underwriting.

- Looking for a way to improve employee productivity while potentially decreasing insurance cost directly related to claims.

4 Factors That Shape Your Insurance Risk Profile

Author, Drew Garcia, with Rancho Mesa Insurance Services, is the program director for NALP’s Worker’s Compensation Program.

Ever wonder why your insurance rates high when your competitors are low? There are reasons for that including, frequency of claims, severity of claims, experience rating, average claim cost incurred, operations, trends, loss ratio etc. If you evaluate your risk profile you can take action to lower your premiums.

Author, Drew Garcia, with Rancho Mesa Insurance Services, is the program director for NALP’s Worker’s Compensation Program.

Ever wonder why your insurance rates high when your competitors are low? There are reasons for that including, frequency of claims, severity of claims, experience rating, average claim cost incurred, operations, trends, loss ratio etc. If you evaluate your risk profile you can take action to lower your premiums.

Here are 4 factors that help shape your risk profile.

Frequency of Claim

The number of workers’ compensation claims you average per million dollars in payroll.

Calculation = # of claims / (annual payroll/$1,000,000)

Evaluate – How often are you having workers’ compensation claims and how does that compare to other landscape companies in your region or state? You can expect your insurance premiums to be higher if your frequency rate of claim is higher than the average.

Action – If you are having a frequency issue, you need to assess;

- Trends (back, hand, wrist, knee…)

- Cause (lifting, punctures, slips…)

- Implement corrective actions to help mitigate the risks associated with your claims.

Take it to the next level and evaluate “near misses.” Treat a “near miss” as if it were a claim and strategize a corrective action to prevent it from happening in the future.

Lost Time Claims (Indemnity)

The number of “lost time” claims your company has per million dollars in payroll. These are the claims in which your employee loses time away from work.

Calculation = # of lost time claims / (annual payroll/$1,000,000)

Evaluate – How often are you having workers’ compensation claims that result in lost time and how does that compare to other landscape companies in your region or state? You can expect your insurance premiums to be higher if your Indemnity rate of claim is higher than the average.

Action – If you are having an indemnity issue, you need to assess;

– Trends (back, hand, wrist, knee…)

– Cause (lifting, punctures, slips…)

– Implement corrective actions to help mitigate the risks associated with your claims.

Establish a “return to work program” which allows your injured employees an opportunity to come back to work on limited duty. This will help you monitor your employee’s progress and keep them feeling a part of the team.

Experience Rating

Your experience rating is a combination of your loss data and total payroll when compared to your industry typically but not always, over a three year period. Your experience rating has the ability to credit or debit pricing accordingly based on your history.

Action – Controlling your frequency and indemnity claims will ultimately be reflected in your experience rating.

Operations

Heavier operations would include hardscape construction, tree trimming, and snow removal in which generally heavier machinery and product is used thus a higher exposure to injury. Compare these types of landscape operations to a lighter exposure such as landscape maintenance; mowing, edging and pruning.

Action – Identifying the exposures that are unique to your operations and then implementing safety programs catered to your exposures will help protect your employees. Although your operations might consist of heavier exposures, you have the ability to implement tactics to mitigate the claims from happening and subjectively making your risk profile more appealing. Don’t wait for the injury to occur, be proactive and stop the claim before it transpires.

Your risk profile has already been created whether you know it or not. The opportunity for you to own it and improve it is always available. To look at lowering your workers compensation insurance, take a look at NALP’s new program.

For more information, there will be a free webinar on March 22. Sign up here.

New First Aid Reporting Requirements Take Effect January 1st, 2017

Effective January 1, 2017, employers and insurers will be required to report first aid all claims, according to a recent bulletin from the Workers' Compensation Insurance Rating Bureau (WCIRB).

Effective January 1, 2017, employers and insurers will be required to report first aid all claims, according to a recent bulletin from the Workers' Compensation Insurance Rating Bureau (WCIRB).

To learn more about the changes, visit WCRIB's Bulletin.

W-2 Phishing Scam – New Potential Risk to Nonprofits – Be Aware!!

There has been a recent increase in attempts of a phishing scams involving W2s in nonprofit, schools and other human services organizations. We caution any business, but particularity organizations in these sectors to be very cautious if they receive any emails requesting information regarding W2’s, earning summaries or any other employee sensitive information. In many cases these emails look like they originate from a high level employee and are sent to other high level, human resources or payroll department employees.

It has come to our attention that there has been a recent increase in attempts of phishing scams involving W-2 forms in nonprofit, schools and other human services organizations.

Rancho Mesa cautions any business, but particularity organizations in these sectors, to be very cautious if they receive any emails requesting information regarding W-2 forms, earning summaries or any other employee sensitive information. In many cases these emails look like they originated from a high level employee and are sent to other high level, human resources or payroll department employees.

We have included a link to the most recent release from the IRS concerning this issue. Please review it and call us if you have any questions.

Dangerous W-2 Phishing Scam Evolving; Targeting Schools, Restaurants, Hospitals, Tribal Groups and Others

Published February 2, 2017

www.irs.gov/uac/dangerous-w-2-phishing-scam-evolving-targeting-schools-restaurants-hospitals-tribal-groups-and-others

Court Case Endangers State Workers' Comp System

The California Chamber of Commerce recently filed a friend-of-the-court brief in a California Supreme Court case that will determine whether doctors who review workers' comp cases can be sued for certain medical decisions.

Seal of the Supreme Court of California

The Independent Insurance Agents & Brokers of California's (IIABCal) Legislative Update, a compilation of reports produced by IIABCal Lobbyist John Norwood of Norwood & Associates, recently published an update on the possible effects of a court case on the Workers' Compensation System.

Below is an excerpt from the February 6, 2017 Legislative Update article:

The California Chamber of Commerce recently filed a friend-of-the-court brief in a California Supreme Court case that will determine whether doctors who review workers' comp cases can be sued for certain medical decisions.

The brief in King v. CompPartners, Inc argues that the appellate court incorrectly found that utilization review doctors - those who look at records to decide whether a worker's treatment was appropriate, but do not examine the patient personally - have established a physician-patient relationship and therefore owe a duty of care to the injured workers.

Major Implications

If allowed to stand, the decision will create extensive future litigation and can be expected to increase costs that will put upward pressure on malpractice premium rates for all physicians, and have a chilling effect on utilization review physicians, according to the CalChamber.

Establishing potentially unlimited liability for utilization review physicians will potentially lead to higher premiums for employers and could drive future and existing business away from California.

The case also will determine whether medical malpractice claims against utilization review doctors are barred, because all workers' compensation claims are under the purview of the state Division of Workers Compensation. National and statewide insurer groups joined the CalChamber on the brief.

Cal/OSHA 300A Posting Begins February 1st

Rancho Mesa Insurance Services, Inc. would like to remind its clients that February 1, 2017 marks the start of the Cal/OSHA Form 300A posting period. The Cal/OSHA 300A Form is a summary of the company's annual work-related injury and illnesses. It must be posted from February 1, 2017 through April 30, 2017.

Rancho Mesa Insurance Services, Inc. would like to remind its clients that February 1, 2017 marks the start of the Cal/OSHA Form 300A posting period. The Cal/OSHA Form 300A is a summary of the company's annual work-related injuries and illnesses. It must be posted from February 1, 2017 to April 30, 2017.

Who is required to post the Cal/OSHA 300A Form?

Employers with at least 11 employees must post the Cal/OSHA 300A form (though, there are some exemptions for low-hazard industries).

Where must the Cal/OSHA Form 300A be posted?

The Cal/OSHA Form 300A Form must be posted in a conspicuous place within the workplace that is readily available to employees. Employers must also send copies to employees who do not regularly visit the workplace, at least on a weekly basis, where the Cal/OSHA Form 300A form is posted.

Do I need to post the Cal/OSHA Form 300A if we have no work-related injuries or illnesses?

Yes, employers must complete and post the Cal/OSHA Form 300A form even if they have no work-related injuries or illnesses to report.

How do I complete the OSHA Form 300A?

Through Rancho Mesa's Risk Management Center, clients can generate the Cal/OSHA Form 300A using the incident tracking feature, within the system. The form may also be printed and manually completed.

View the Cal/OSHA Form 300A.

Visit www.dir.ca.giv/dosh/etools/recordkeeping/index.html for more information.

California Workers Compensation 2017 Annual Officer Payrolls Minimums and Maximums, Assessment Rates, and Dual Wage Thresholds Announced by WCIRB

ICW Group Insurance Company, the largest group of privately held insurance companies domiciled in California, recently released an announcement that outlines the details and is attached for your review.

ICW Group Insurance Company, the largest group of privately held insurance companies domiciled in California, recently released an announcement that outlines the details of

California Workers Compensation 2017 Annual Officer Payrolls Minimums and Maximums, Assessment Rates, and Dual Wage Thresholds. The document is available for your review.

For any questions concerning the changes, please contact your Rancho Mesa service team.

AB 2883: Change in California Workers Compensation Law

Earlier this year, we reached out regarding California Assembly Bill 2883 (AB 2883), which drastically changed the legal requirements that allow an employer to exclude its corporate officers and the members of its board of directors from workers' compensation insurance coverage. As a result, this change will now affect ALL policies inforce as of January 1, 2017.

AB 2883 Change in California Workers Compensation Law- Officer, Director, Partner, LLC Member Exclusions Effective January 1, 2017

Earlier this year, we reached out regarding California Assembly Bill 2883 (AB 2883), which drastically changed the legal requirements that allow an employer to exclude its corporate officers and the members of its board of directors from workers' compensation insurance coverage. As a result, this change will now affect ALL policies inforce as of January 1, 2017.

Below are key details to note:

- A Corporate Officer/Director must own 15% or more of the corporation’s issued and outstanding stock to be eligible to elect exclusion from WC coverage.

- A General Partner of a Partnership, or a Managing-Member of a LLC, is eligible to elect exclusion from the WC policy (Note – the 15% ownership requirement does not apply to General Partners and Managing Members).

- Grantors of Revocable Trusts are no longer deemed shareholders and are no longer eligible for exclusion.

- Each eligible Corporate Officer/Corporate Director/General Partner/Managing-Member must sign a new waiver attesting to his/her qualification to be excluded, under penalty of perjury. The new waiver(s) will replace any current Exclusion Letter.

- AB 2883 has eliminated the requirement that 100% of the stock must be held by titled Officers/Directors in order for a Corporate Officer/Director to be eligible for exclusion.

What next?

You will receive notification from your current workers compensation carrier explaining these changes. Keep in mind that in order to exclude a Corporate Officer, Member of a Board of Directors, General Partner, or Managing Member of an LLC, each individual to be excluded must sign a written waiver of workers’ compensation benefits certifying under penalty of perjury that he/she is a qualifying Officer, Director, General Partner, or Managing Member of an LLC.

Once a waiver is accepted, new waivers will only be required if there is a change in status or individual wishes to change their status.

If you have any questions please don’t hesitate to call us at (619) 937-0164.