Industry News

Strengthen Your Risk Profile During COVID-19

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

While the effects of COVID-19 on the workers’ compensation marketplace vary among the different business sectors, the Workers’ Compensation Insurance Rating Bureau (WCIRB) has approved a filing that will increase the 2021 pure premium advisory rates by 2.6%. With impending rate increases on the horizon, it’s more important now than ever to be proactive when it comes to your company’s risk management program. Carriers are already tightening up their underwriting guidelines and limiting schedule credits. In order to earn the most competitive pricing possible, a business must differentiate itself from other businesses. Below are three strategies you can use to strengthen your risk profile during COVID-19.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

COVID-19 continues to have a stronghold on the US economy and it is likely that we will see the impact for many years to come. While the effects of COVID-19 on the workers’ compensation marketplace vary among the different business sectors, the Workers’ Compensation Insurance Rating Bureau (WCIRB) has approved a filing that will increase the 2021 pure premium advisory rates by 2.6%. Understand that this recommended rate increase comes against a backdrop of record profits in workers’ compensation prior to COVID-19. There are also three COVID-19 presumption Bills (AB 196, AB 644, and SB 1159) that could create presumptions that cases of COVID-19 are a compensable consequence of work, which will likely cause additional turmoil in the marketplace.

With impending rate increases on the horizon, it’s more important now than ever to be proactive when it comes to your company’s risk management program. Carriers are already tightening up their underwriting guidelines and limiting schedule credits. In order to earn the most competitive pricing possible, a business must differentiate itself from other businesses. Below are three strategies you can use to strengthen your risk profile during COVID-19.

Improve the Safety Program

Now is not the time to take your focus off of safety in the workplace. In fact, I would argue that there should be even more focus on safety. Some items to focus on relating to a safety program include:

Update your Injury and Illness Protection Program (IIPP) and have it reviewed by a labor attorney.

Establish a safety committee consisting of ownership, supervisors, managers, your insurance broker, and insurance company (i.e., loss control representative). This will assist with identifying workplace hazards, discussing claims or near misses that have occurred and creating safety meeting topics that can be discussed at future employee safety meetings.

Ensure that safety meetings are occurring at least every 10 working days, but preferably weekly. Using safety topics identified by the safety committee, managers can pinpoint proper trainings for employees.

Update Employee Handbook

With employment requirements, policies and procedures continually changing, it’s easy to fall behind on new regulations like adding an Emergency Paid Sick Leave Policy or Expanded Family and Medical Leave Policy, in your employee handbook. Rancho Mesa offers access to a living handbook builder through the RM365 HRAdvantage™ portal. By creating a living employee handbook through the portal, updating the document with new policies is as easy as reviewing and approving the suggested changes provided by experienced human resources professionals.

Continue Your Risk Management Education and Certifications

With many businesses slowing during COVID-19, consider filling that down time with required accreditations and continued education courses. Some examples include:

Anti-harassment Training: By the end of 2020, businesses with 5 or more employees are required to provide Anti-harassment training to all employees. Owners, supervisors, and management are required to complete the two-hour course, while all other employees must complete a one-hour course. Rancho Mesa offers free online Anti-harassment training for both supervisors/managers and employees. The courses can be accessed by computer, tablet, and a smart phone.

Continued education or achieving professional designations: It’s also a good time to consider working on continued education courses such as renewing forklift certifications, OSHA trainings, as well as any professional designations. To reinvest your efforts in continued education, now, while business is still slow due to COVID-19, could position your business to hit the ground running when the economy opens up again.

Safety Star Certification – With underwriting guidelines tightening and worker’s compensation premiums expected to increase due to COVID-19, Rancho Mesa’s RM365 Advantage Safety Star Program™ can build your risk profile and differentiate your business from others. The program is designed for supervisors, foreman, safety coordinators, upper management, administrators, and directors of human resources. To earn the Safety Star certification in Construction Safety, you must complete the required Incident Investigation and Analysis online module plus at least two other modules of your choice from the approved list. This certification is also a marketing tool your broker can use to show your commitment to safety.

Proactively improving your safety program, employee handbook, and continuing education during the pandemic will allow you to hit the ground running once COVID-19 restrictions are lifted. It can also position your business to mitigate increasing premiums with the ever tightening workers’ compensation marketplace.

If you need any assistance in implementing a sound risk management program, please reach out to me at (619) 937-0174.

Choosing the Right Classcode: A Guide to Distinguishing Tree Trimming from Landscape Work

Author, Rory Anderson, Account Executive, Rancho Mesa Insurance Services, Inc.

Many tree care companies perform work that could be classified as “landscape gardening.” The risk and exposure associated with this class code is minimal compared to those associated with tree trimming. Without the additional tree care exposure, landscape gardening workers’ compensation insurance rates are significantly lower than tree trimming rates. Common questions we receive from our tree care clients are…

Author, Rory Anderson, Account Executive, Rancho Mesa Insurance Services, Inc.

Many tree care companies perform work that could be classified as “landscape gardening.” The risk and exposure associated with this class code is minimal compared to those associated with tree trimming. Without the additional tree care exposure, landscape gardening workers’ compensation insurance rates are significantly lower than tree trimming rates. Common questions we receive from our tree care clients are:

What is the difference between the two class codes?

I’ve always only used 0106-Tree Trimming, is it possible for me to use 0042-Landscape Gardening as well?

How can I differentiate which specific operations are considered landscape gardening and which are considered tree trimming?

When more than one classification applies to operations that are closely related, it is important to understand the boundaries of each classification. Let’s take a look at how the California Workers’ Compensation Insurance Rating Board (WCIRB) defines both class codes:

0106 Tree Pruning, Repairing or Trimming

This classification applies to pruning, repairing or trimming trees or hedges when any portion of the operations requires elevation, including but not limited to using ladders, lifts or by climbing. This classification includes clean-up, chipping or removal of debris; stump grinding or removal; and tree spraying or fumigating that are performed in connection with tree pruning, repairing or trimming. This classification also applies to the removal of trees that retain no timber value.

0042 Landscape Gardening

This classification applies to the construction, maintenance, repair or installation of landscape systems or facilities designed for public or private gardens or other areas in order to aesthetically, architecturally, horticulturally or functionally improve the grounds within or surrounding a structure or a tract or plot of land. This classification includes the preparation and grading of plots or areas of land for the installation of landscaping; pruning, repairing or trimming trees or hedges when none of the operations at a particular job or location require elevation, including but not limited to using ladders, lifts or by climbing; or chipping operations performed in connection with landscape gardening. This classification also applies to spraying or spreading lawn fertilizers or herbicides, or weed abatement for fire hazard control purposes.

According to these definitions, a tree company may be able to use the 0042 landscape class code at specific times. However, when any of the operations are off the ground, that payroll would be classified in tree trimming 0106. Also, any type of work that is associated with the tree trimming (e.g., clean-up, chipping, stump grinding, etc.) will also be included as 0106. Here is a quick real-world example that will help to clarify.

A tree company has 10 employees that worked on a specific job to trim a large Eucalyptus tree. There were only two workers that actually climbed and trimmed the tree, and all the rest of the employees worked on the ground to clean up the limbs and branches that were being cut and fell from the tree. All 10 employees must be classified into the 0106 class code because the ground crew operations were in connection with the tree trimming, where the climbers were operating off of the ground.

The next day, on a completely different job site, the same tree company with 10 employees worked on a new job to trim a handful of 8 ft Japanese maple trees. For this job, all of the work was performed from the ground and there was never a point where any of the workers operated from elevation (e.g., ladders, lifts, climbing, etc.). Three of the workers trimmed with pole saws from the ground, while the other seven employees cleaned-up the debris and used the chipper. All 10 of the employees could be classified into the 0042 landscape class code because there was never a time where a worker left the ground to trim.

Properly documenting and maintaining valid records is critical in order for your company to utilize both class codes properly. Without proper documentation, you could be setting your company up for a large additional premium owed at audit.

Stay tuned to my follow up article and podcast as I share how to prepare for and execute a successful audit when both of these two class codes are applicable to your operations.

Employers Enlist Assistance from HR Experts while Navigating Perils of COVID-19

Author, Chase Hixson, Account Executive, Rancho Mesa Insurance Services, Inc.

The COVID-19 pandemic has brought a slew of unknowns to employers across the country, especially as it relates to human resources questions and Employment Practices Liability (EPLI). Rancho Mesa’s RM365 HRAdvantage™ Portal has been a favorite of our clients ever since its release in 2019. The portal continues to grow in popularity as employers face new challenges as workplace standards and employee interaction changes, almost daily.

The COVID-19 pandemic has brought a slew of unknowns to employers across the country, especially as it relates to human resources questions and Employment Practices Liability (EPLI). Rancho Mesa’s RM365 HRAdvantage™ Portal has been a favorite of our clients ever since its release in 2019. The portal continues to grow in popularity as employers face new challenges as workplace standards and employee interaction changes, almost daily.

The most popular tool in the portal gives clients access to live certified Senior Professionals in Human Resources (SPHR) and Professionals in Human Resources (PHR) advisors via phone or through the portal’s messaging tool. Not only will the HR experts answer human resources questions, they will also follow-up with written documentation of the advice so you can refer back to their recommendations.

If an effort to ensure compliance and reduce the chance of an EPLI claim, Rancho Mesa clients are reaching out to our experts for advice on how to navigate human resource issues before they turn into a legal nightmare.

A recent client inquiry included a question about: “required postings and notifications regarding COVID-19 and how to deliver them to remote employees.” The HR experts provided guidance on how to address the client’s specific situation like getting state notices to employees who are working from home.

Another client asked “what to do if an employee refuses to come to work when restrictions are lifted.” The advice pointed to the federal Families First Coronavirus Response Act (FFCRA) and possible city ordinances or state law that may dictate how to handle the specific situation. In addition, other factors were highlighted that take into account the employee’s personal risk factors and the Occupational Safety and Health Administration (OSHA) rules for safe workplaces.

Additionally, our team is answering questions like “Can employers require employees to get tested for COVID?” or “What accommodations am I required to make for employees working from home?”

Getting reliable answers to important human resources questions quickly can mean the difference between a happy and healthy workforce, and a possible EPLI claim.

With so much uncertainty facing our clients, many have found comfort and confidence in knowing they have reliable human resources experts available to advise them as they navigate these uncharted waters.

If you have any further questions about EPLI coverage, please contact Rancho Mesa Insurance Services at (619) 937-0164.

Common Sense Strategies for Lowering Risk and Managing Liability

Author, Daniel Frazee, Executive Vice President, Rancho Mesa Insurance Services, Inc.

While business owners spend thousands of hours becoming experts in their own field, most know very little about the intricacies of purchasing commercial insurance. Consider exploring these topics further as you prepare for your upcoming renewal cycle.

Author, Daniel Frazee, Executive Vice President, Rancho Mesa Insurance Services, Inc.

While business owners spend thousands of hours becoming experts in their own field, most know very little about the intricacies of purchasing commercial insurance. Consider exploring these topics further as you prepare for your upcoming renewal cycle.

Buying Too Little Property Insurance

Property coverage can often be the least expensive piece of a comprehensive insurance program. Yet the impact financially to a business or property owner can be devastating if you are under-insured. Take time to understand any coinsurance clause that may exist within your policy and the real world impacts that could occur if any penalty is imposed by the carrier if you have failed to maintain a minimum amount of insurance. Ensuring that your property limits are more than adequate can truly be a cost-effective approach when there is a significant loss.

Overlooking Potential Savings of Higher Deductibles

In layman terms, purchasing insurance simply transfers risk from one party to the other in exchange for premium dollars. Deductibles are a form of self-insurance that represents the costs you are responsible for before your coverage starts. Typically, the higher your policy’s deductible, the lower annual premium because you are absorbing more financial risk if and when a claim occurs. With this in mind, discussing your risk tolerance with your leadership team and your broker can allow for healthy dialogue leading into rate negotiation.

Not Buying Enough Liability Limits

A common term circling around the insurance industry is Social Inflation. This generally refers to the rising costs of insurance claims that are a result of societal trends and views toward increased litigation, plaintiff friendly legal decisions, and large jury awards. As W. Robert Berkley Jr., chief executive officer of commercial property and casualty insurer W.R. Berkley Corp told analysts, “Social inflation is real. It is here and the industry is beginning to pay attention.” This is a waving red flag that insurance buyers should begin considering higher liability limits by adding an Umbrella policy or increasing existing limits. Businesses can implement plans to mitigate risk. But, lawsuits and the amount of damages plaintiffs will seek remain unpredictable.

The Impacts of “Carrier Jumping”

Building a strong, viable business is centered on relationships. It is those relationships that you lean on most when you need an insurance carrier to come through for you, a consultant to solve a problem, or a key partner to deliver when times are difficult. That philosophy applies more than business owners might realize in the insurance industry. Jumping from carrier to carrier, year to year, to get the cheapest policy might save on the short-term, but this approach can negatively impact your marketability in the long-term.

First, it is important to understand that underwriters see your carrier and claim history as a part of their risk profile review. In determining their real opportunity to win your trust, they’ll look closely at your willingness to create a longer term partnership and your historical trends with carriers will provide immediate answers.

Secondly, remember the phrase “when you need an insurance carrier to come through for you.” A critical part of building a relationship with your carrier is developing relationships with their loss control and claims teams. When claims occur, which are inevitable, you want and need that comfort level to know that your vendor will handle it properly and timely.

Start simple when it comes to your approach with buying commercial insurance. The topics above are only the beginning of this process but can have meaningful impact on appropriate coverage and limit levels, pricing, and claims handling.

For more information, contact me at (619) 937-0172 or dfrazee@ranchomesa.com.

Post COVID-19 XMODs Threaten a Double Whammy

Author, Kevin Howard, C.R.I.S., Account Executive, Rancho Mesa Insurance Services, Inc.

COVID-19 has created a multitude of challenges for California business owners in the first half of 2020. A concerning trend is the potential combination of lower payrolls and the California Workers’ Compensation Insurance Rating Bureau’s (WCIRB) recommendation to lower expected loss rates, creating what very likely could be significant Experience Modification Rate (XMOD) increases for numerous California businesses.

Author, Kevin Howard, C.R.I.S., Account Executive, Rancho Mesa Insurance Services, Inc.

COVID-19 has created a multitude of challenges for California business owners in the first half of 2020. A concerning trend is the potential combination of lower payrolls and the California Workers’ Compensation Insurance Rating Bureau’s (WCIRB) recommendation to lower expected loss rates, creating what very likely could be significant Experience Modification Rate (XMOD) increases for numerous California businesses.

Whammy #1 - Lower Payrolls

With the economy screeching to a halt in March of this year due to the shelter in place restrictions, payrolls and employee counts have been dramatically reduced. Since the XMOD calculation is based on a rolling three years of payroll and claims, should the year dropping out of the calculation have larger payrolls than the year entering and assuming the same claim amounts for each year, the XMOD would increase.

Whammy #2 – Lower Expected Loss Rates (ELR)

ELRs are the factors used to anticipate a class code’s claim cost per $100 for the experience rating period. Stated simply, it’s a rate per, $100 of payroll by class code that projects the claim amounts the WCIRB believes should occur for that class code. Thus, should ELRs decrease; it would have the effect, given no change in the claims, of raising the XMOD.

California businesses should pay close attention to their individual ELRs as the WCIRB annually recommends updated rates during their June regulatory filing period. The 2021 rates were recently proposed on June 25, 2020 by the WCIRB and will be waiting approval in September by Insurance Commissioner Ricardo Lara.

Below is a breakdown of the 2021 proposed ELRs by class code with notable double digit increases highlighted:

2021 Proposed ELRs

| Class Code | 2020 ELRs | 2021 Proposed ELRs | Increase/Decrease % |

|---|---|---|---|

| 3724 Solar/Millwright | 1.74 | 1.81 | 4% |

| 5187 Plumbing > $28 | 1.18 | 1.13 | -4% |

| 5183 Plumbing < $28 | 2.6 | 2.6 | 0% |

| 5542 Sheet Metal > $27 | 1.4 | 1.35 | -3% |

| 5538 Sheet Metal < $27 | 2.3 | 2.39 | -12% |

| 6258 Foundation Prep | 2.65 | 2.48 | 2% |

| 0042 Landscape Gardening | 2.59 | 2.38 | -8% |

| 0106 Tree Pruning | 3.91 | 4.11 | 5% |

| 5140 Electrical Wiring > $23 | 0.81 | 0.73 | -10% |

| 5190 Electrical Wiring < $23 | 1.89 | 1.82 | -4% |

| 5470 Glaziers > $33 | 1.63 | 1.81 | 11% |

| 5467 Glaziers < $33 | 4.3 | 3.81 | -11% |

| 5028 Masonry > $28 | 2.17 | 2.13 | -1.8% |

| 5027 Masonry < $28 | 4.73 | 4.03 | -14% |

| 5482 Painting/ Waterproofing > $28 | 1.42 | 1.57 | 10% |

| 5474 Painting/ Waterproofing < $28 | 3.68 | 4.08 | 10% |

| 5186 Automatic Sprinkler Install > $29 | 1.11 | 1.14 | 3% |

| 5185 Automatic Sprinkler Install < $29 | 2.45 | 2.2 | -10% |

| 5205 Concrete/Cement work > $28 | 1.95 | 1.71 | -12% |

| 5201 Concrete/Cement work < $28 | 3.95 | 3.45 | -12% |

| 5432 Carpentry > $35 | 2.01 | 2.05 | 2% |

| 5403 Carpentry < $35 | 5.27 | 4.91 | -7% |

| 5447 Wallboard Application > $36 | 1.34 | 1.14 | -14% |

| 5446 Wallboard Application < $36 | 2.76 | 2.67 | -3% |

| 5485 Plastering or Stucco >$32 | 2.66 | 2.55 | -4% |

| 5484 Plastering or Stucco < $32 | 4.78 | 4.41 | -8% |

| 5443 Lathing | 2.37 | 2.23 | -6% |

| 5553 Roofing > $27 | 3.9 | 3.89 | -2% |

| 5552 Roofing < $27 | 9.85 | 9.23 | -6% |

| 6220 Excavation/Grading > $34 | 1.24 | 1.08 | -12% |

| 6218 Excavation/Grading < $34 | 2.34 | 2.59 | 10% |

| 5436 Hardwood Flooring | 2.03 | 2.01 | -1% |

| 3066 Sheet Metal Prod Mfg. | 1.94 | 2.00 | 3% |

| 8018 Stores - Wholesale | 2.67 | 2.81 | 5% |

| 8804 Shelter/Social Rehab | 1.25 | 1.30 | 4% |

| 8827 Hospice and Homecare | 1.72 | 1.54 | -10% |

| 9059 Childcare | 0.99 | 1.07 | 8% |

| 8834 Physicians | 0.34 | 0.34 | 0% |

| 8868 Colleges/ Professors Private-Teachers | 0.36 | 0.37 | 3% |

| 9101 Colleges/Schools Private-Other | 2.50 | 2.13 | -14% |

Should Commissioner Lara approve the ELR changes in September, a majority of class codes will be seeing a decrease which can lead to higher XMOD’s in many cases. That possibility, combined with lower incoming payrolls, requires proactive risk mitigation, claim management and detailed planning with your broker.

If you are seeking a partner with the tools to address these needs, please reach out to Kevin Howard at Rancho Mesa Insurance Services, Inc. at (619) 438-6874.

Managing Working Capital is Key as Markets Tighten

Author, Andy Roberts, Account Executive, Surety Department, Rancho Mesa Insurance Services, Inc.

Contractors often ask us what bond companies are looking for when they are reviewing balance sheets and income statements. The answer isn’t a simple one, because there are many items that underwriters look at when determining if they will write a bond for a contractor. Typically, the first thing an underwriter will do is calculate a contractor’s working capital.

Author, Andy Roberts, Account Executive, Surety Department, Rancho Mesa Insurance Services, Inc.

Contractors often ask us what bond companies are looking for when they are reviewing balance sheets and income statements. The answer isn’t a simple one, because there are many items that underwriters look at when determining if they will write a bond for a contractor. Typically, the first thing an underwriter will do is calculate a contractor’s working capital.

Simply put, working capital is calculated by subtracting a contractor’s current liabilities from their current assets on the balance sheet. Current liabilities are any obligations due within one year, while current assets are the most liquid like cash, accounts receivable, and items that can be converted to cash within a fiscal year. This calculation measures what is available for a company to pay its current debts, finance its current operations, and provides an indication of a company’s overall health.

With bond companies placing an emphasis on working capital and tightening their underwriting guidelines through these uncertain times, it is critical that contractors pay close attention to their balance sheet. Managing their working capital can ensure a contractor receives the bond credit that they need. One specific area a company can focus on to accomplish this is being more diligent with collecting receivables.

Accounts receivable are listed as a current asset. However, bond companies will review the aging of a company’s accounts receivable and likely deduct any that are 90 days or more past due from the amount listed on the balance sheet. These are viewed as not likely to be received and will lower a company’s total current assets, which lowers working capital. This can directly affect the amount of credit that a bond company is willing to offer and possibly lead to bond requests being denied.

With so much remaining uncertainty in the economy, it is more important than ever for contractors to re-visit their balance sheets and take an aggressive stance with collecting receivables. These techniques can quickly build or re-build a strong risk profile to secure the level of surety credit a contractor may need for their bond program.

As you develop your financial strategy and look to strengthen bonding options, consider Rancho Mesa’s Surety team of advisors. Contact Andy Robert at (619) 937-0166 or email him directly at aroberts@ranchomesa.com.

The Importance of Timely Workers’ Compensation Claims Reporting

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

Injuries, accidents, and mistakes happen. When a work-related injury occurs, a common reaction from many business owners is an instinct to NOT report the injury to their workers’ compensation carrier for fear of increasing their company’s Experience Modification (EMR). However, they couldn’t be more wrong. Timely reporting of all claims is the first step in controlling claim costs and lowering their EMR.

Author, Casey Craig, Account Executive, Rancho Mesa Insurance Services, Inc.

Injuries, accidents, and mistakes happen. When a work-related injury occurs, a common reaction from many business owners is an instinct to NOT report the injury to their workers’ compensation carrier for fear of increasing their company’s Experience Modification (EMR). However, they couldn’t be more wrong. Timely reporting of all claims is the first step in controlling claim costs and lowering their EMR.

Best Practices would demand that all claims get reported within 24 hours, if at all possible. By doing this, it provides the best possible outcome and will impact the claim in several positive ways:

Reducing Fraudulent Claims

One of the biggest frustrations in the workers’ compensation industry for most employers are the number of fraudulent claims that find their way into the system. Immediate accident investigation, witness statements and pictures followed by reporting the claim to the carrier within 24 hours of the injury, will give the employer and the carrier the best opportunity to deny a claim. The insurance carrier only has 90 days from the date of injury (not from the date reported) to deny a claim. This shortens that time-frame and allows more fraudulent claims into the system.

Lowering Litigation Rates

Another area employers find both frustrating and costly are the number of litigated claims that occur within the workers’ compensation system. Litigated claims on average will add 30% to 35% to the ultimate cost of a claim. While there are many ways employers can impact this area, perhaps the most controllable is the timely reporting of any injury. To further support this, it has been proven that the litigation rate for claims goes up 300% if the claim is reported 5 or more days after the injury occurred.

Identifying Claim Trends Early

By not reporting all claims or by reporting them late, employers can develop unreliable data in their effort to identify claim trends and root causes. Without this information, businesses in all sectors run the risk of a severe injury occurring from an area that could have been addressed if all claim data was accurate and analyzed.

When an injury occurs, do a thorough accident investigation that details all events that caused the injury and immediately call your workers’ compensation carrier. This one habit alone will help you lower claim costs and manage your EMR.

To learn more about this process, including benchmarking and analytics that can help control your loss ratio and lower premiums, please reach out to me, Casey Craig at (619) 438-6900 or ccraig@ranchomesa.com.

Court Agrees Temporary COVID-19 Standards Are Not Needed

Author, Emily Marasso, Media Communications Assistant, Rancho Mesa Insurance Services, Inc.

On June 11th, 2020, the D.C. Circuit Court denied the American Federation of Labor and Congress of Industrial Organizations’ (AFL-CIO) lawsuit against the Occupational Safety and Health Administration (OSHA) for not issuing an emergency temporary worker safety standard due to COVID-19.

Author, Emily Marasso, Media Communications Assistant, Rancho Mesa Insurance Services, Inc.

On June 11th, 2020, the D.C. Circuit Court denied the American Federation of Labor and Congress of Industrial Organizations’ (AFL-CIO) lawsuit against the Occupational Safety and Health Administration (OSHA) for not issuing an emergency temporary worker safety standard due to COVID-19.

As a volunteer labor union group that works to improve the lives of the U.S. workforce, the AFL-CIO wants OSHA to issue a temporary worker safety standard addressing the risks of COVID-19 in the workplace. However, an Emergency Temporary Standard is authorized by OSHA under certain limited conditions. It must be determined that workers are in danger of exposure to toxic substances or agents that can be physically harmful. Plus, a temporary standard then serves as a proposed permanent standard.

The D.C. Circuit Court denied the lawsuit against OSHA due to the fact that government officials are learning new information about COVID-19 weekly, if not daily. An appropriate response to the union’s concern is not a fixed rule, at this time. And, a standard specific to COVID-19 would likely not need to become a permanent standard in the future.

Furthermore, the U.S. Department of Labor states, "We are pleased with the decision from the D.C. Circuit, which agreed that OSHA reasonably determined that its existing statutory and regulatory tools are protecting America's workers and that an emergency temporary standard is not necessary at this time.”

While a new standard to combat COVID-19 isn’t necessary because of existing standards, OSHA has provided many resources for employers to assist in maintaining worker safety. Their “Guidance on Preparing Workplaces for COVID-19” provides information on the virus, how it could affect a workplace, steps employers can take to reduce the risk to employees, and additional services and programs available to employers. The “Guidance on Returning to Work” offers steps for reopening, applicable OSHA Standards, and a frequently asked questions section. In addition, employers can find news updates and resources on OSHA’s COVID-19 webpage.

Landscape Companies with Low Experience MODs Do These 5 Things

Author, Drew Garcia, Vice President of the Landscape Group, Rancho Mesa Insurance Services, Inc.

Landscape companies with a low Experience Modification Rating (XMOD/EMR) typically exhibit similar best practices when dealing with work-related injuries. Their proactive approach helps close claims faster and return employees to work sooner than their counterparts.

Author, Drew Garcia, Vice President of the Landscape Group, Rancho Mesa Insurance Services, Inc.

Landscape companies with a low Experience Modification Rating (XMOD/EMR) typically exhibit similar best practices when dealing with work-related injuries. Their proactive approach helps close claims faster and return employees to work sooner than their counterparts.

The XMOD/EMR is a unique number assigned to a business that is made up of their historical loss figures and audited payroll information vs. the same information for companies involved in the company’s same industry. Generally, if your business has experienced more claim activity than the industry average, you will have a XMOD/EMR above 1.00. The opposite is true; if you have had less claim activity, your XMOD/EMR will be below 1.00. The XMOD/EMR impacts the rates you pay for workers’ compensation by crediting (XMOD/EMR below 1.00) or applying a surcharge (XMOD/EMR above 1.00).

Here are the 5 best practices used by landscape companies who have an XMOD/EMR) below 1.00.

1. An Aggressive Return to Work Program

If you heard our podcast episode with Roscoe Klausing of Klausing Group, you will hear him coin the phrase an “aggressive return to work program” which was a key component to his company, of more than 70 employees, going 3 years without a lost time accident.

Aggressively finding a way to help bring an injured employee back on modified work restrictions has long been proven to provide positive outcomes for everyone involved. Benefits of bringing an employee back on modified duties include:

Eliminating temporary disability payments from the claim cost.

Lower the dollar amount of medical treatments.

Reduce the overall cost of the claim.

Lower the potential impact the claim would have on your XMOD/EMR.

Improve injured employee morale.

2. Timely Reporting and Accident Detail

It is critical to constantly remind your front line supervisors and employees that they must report all injuries no matter the severity as soon as possible. Studies have shown that work related injuries reported with the first 5 days have a dramatically lower average claim cost and litigation rates than those reported after 5 days.

Two measurable statistics for you to keep an eye on are:

The lag time between when an injury is reported to you from an employee.

The amount of time it takes you to report this information to your insurance carrier.

By conducting a thorough accident investigation at the time of injury and providing a report to your insurance claim professional, you will speed up the claims process and lower costs. Eliminating the time delays caused by the claim professional waiting for details or additional information is critical in making sure your injured employee is on the fast track to recovery. To assist the landscape industry in completing this necessary step, Rancho Mesa has created a free, fillable, carrier approved accident investigation report for use by the landscape industry.

3. Communication

Keeping in constant communication with employees who are injured is vital to a positive outcome. At times, the workers’ compensation process can seem slow. Some injuries will take longer than others. This can lead injured employees to feel frustrated and uncertain. Make sure you are addressing their concerns and checking in on them, frequently.

4. Know the Basic Principles Behind the XMOD/EMR

You do not need to know the XMOD/EMR formula, but you should have an understanding of the basic concepts that leads to XMOD/EMR inflation.

You should know when your claim information will be sent to your rating bureau for next year’s XMOD/EMR calculation and make sure you are familiar with the status of each claim before the information is locked.

If your rating bureau uses a Primary Threshold or Split Point, it is good to understand how this number impacts claim cost and each claim’s impact on the XMOD/EMR.

Know your lowest possible XMOD/EMR, this would be all your payroll with zero claims. The points between your lowest possible XMOD/EMR and your current XMOD/EMR are the controllable points.

Know the policy years that are used to calculate the XMOD/EMR.

5. Relationship With Your Carrier and Claims Professional

The carrier claims professional who handles your injuries can have a huge impact on the outcome of the claim. If you are fortunate enough to have a dedicated claim adjuster assigned to your company, make it a point to call and introduce yourself before the first claim occurs. The adjuster should have a very good understanding of:

Your attitude and policy regarding return to work programs.

The level of accident information they will receive from you.

Who will be your company’s main contact throughout the claim process?

Consider these five best practices when handling your workers’ compensation claims to keep your XMOD/EMR under control and your workers’ compensation costs low.

Top 5 Cyber Threats for Contractors

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Equipment and material theft as well as jobsite vandalism are exposures that unfortunately contractors have become accustomed to over the years. Over the last decade, however, the construction industry has seen a new threat arise and its name is Cybercrime.

Author, Sam Clayton, Vice President, Construction Group, Rancho Mesa Insurance Services, Inc.

Equipment and material theft as well as jobsite vandalism are exposures that unfortunately contractors have become accustomed to over the years. Over the last decade, however, the construction industry has seen a new threat arise and its name is Cybercrime. While the contracting community is likely familiar with this term, many mistakenly feel as though they are immune to this threat. With minimal personal identifiable information on hand, few, if any, payments accepted through credit card and storage of data in the cloud, what is their true exposure? Below are five REAL cyber threats contractors are facing on a daily basis:

Ransomware entails encrypting company data so that it cannot be used or accessed, and then forcing the company to pay a ransom, typically in Bitcoin, to unlock the data. This type of cyber threat has grown tremendously in the last few years and is one of the most lucrative types of attacks.

Phishing involves the attempt to obtain sensitive information by getting employees to click a hyperlink or open an attachment in a phishing email. This could allow malware to install on a system, or take an employee to a fake website where they could enter sensitive personal or business information. Phishing scams can ultimately lead to employees being tricked into sending money via wire transfer to a bank account controlled by a cyber-criminal.

Malware Attacks encompasses a variety of cyber threats such as viruses and worms that are created to gain access to networks, steal data, or destroy data on computers. Malware usually comes from spam e-mails or malicious website links.

Password Attacks are big threats facing businesses with employees who use weak or easily guessed passwords. Using weak passwords for multiple logins can allow unauthorized users to access information through your company’s secured network.

Insider Threats is a risk to an organization that is caused by current and/or former employees and business associates. These people can access critical information and/or data through your company which can cause harmful effects through greed, carelessness, or ignorance.

Now, more than ever, companies need a strong Cyber Prevention Plan in place. This would include:

Identifying your company’s most valuable information and where this information is located on your network.

Establishing Best Practice controls and procedures that consider both internal and external threats.

Communicating cyber security measures to the entire company and help your employees understand the threats your organization faces, and their role in protecting the company’s assets.

Adding a strong Cyber Liability Policy to your Risk Management Portfolio

To learn more about implementing a strong Cyber Prevention Plan and our CyberOne program, reach out to Sam Clayton at sclayton@ranchomesa.com or call 619-937-0164.

Edited 4/19/2021.

Why Am I Now Required to Bond Such Small Construction Projects?

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

I received an email from a large Subcontractor client last week requesting performance and payment bonds in the amounts of $87,000 and $133,000, respectively. This client has completed projects in excess of $5,000,000 in the past and was surprised that the general contractor they were working with was requiring such a small amount to be bonded back.

Author, Matt Gaynor, Director of Surety, Rancho Mesa Insurance Services, Inc.

I received an email from a large Subcontractor client last week requesting performance and payment bonds in the amounts of $87,000 and $133,000, respectively. This client has completed projects in excess of $5,000,000 in the past and was surprised that the general contractor they were working with was requiring such a small amount to be bonded back.

I explained the potential reasons for why the general contractor may require such a small bond.

One reason might be with the financial uncertainty created by the COVID-19 pandemic, the prime contractor/general contractors’ bond company is looking to transfer some of the risk from the bond they provide to their prime contractor. They may set a certain limit (for example, all subcontracts over $100,000) to require the subcontractor to bond back to the prime contractor.

A second reason might be that the prime contractor has not used a certain subcontractor in the past and wants the protection of a bond to help offset the risk. The general contractor might have selected this subcontractor based on “price” and wants the third party prequalification that the performance and payment bond provides.

A third example could be that the trade this subcontractor supports is critical to the success of the project and the general contractor is using every tool they can to manage the risk.

Overall in 2020, we have seen an increase in the number of prime contractors requiring a bond for a small subcontract.

The good news for the subcontractor that rarely requires bonding is that the qualification process for a small subcontractor bond is relatively easy. A number of highly rated bond companies provide programs for bonding projects up to $400,000 (sometimes higher) based on the credit scoring of the subcontract company owner.

If you would like more information on how a professional bonding agent can assist in putting a single bond or a bond program in place for your company, feel free to reach out to me at (619) 937-0165 to ensure your company is getting the proper attention.

California Workers' Comp Carriers React to Commissioner's COVID-19 Amendment Approval

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

With California Insurance Commissioner Lara’s recent approval of a special regulatory filing introduced to alleviate the burden COVID-19 workers’ compensation (WC) claims threaten to have on California employers, we reached out to several prominent carrier executives to share their thoughts.

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

With California Insurance Commissioner Lara’s recent approval of a special regulatory filing introduced to alleviate the burden COVID-19 workers’ compensation (WC) claims threaten to have on California employers, we reached out to several prominent carrier executives to share their thoughts.

The amendments address accounting for employees whose job duties have changed to clerical work, which is typically a less expensive workers’ compensation insurance classification than the jobs they were performing prior to Governor Newsom’s March 19, 2020 Stay-at-Home Executive Order. It also excludes payroll for furloughed employees who are not working, but collecting a paycheck. It creates a way to identify COVID-19 cases within the California workers’ compensation system and excludes the cases from the Experience Modification Rate (XMOD) calculation.

When asked about the amendments scheduled to take effect July 1, 2020, Margaret Hartmann, Senior Vice President and Chief Marketing Officer at Berkshire Hathaway Homestate Companies, California’s second largest workers’ compensation insurance carrier, said “Lara’s approval of the WCIRB [Workers’ Compensation Insurance Rating Bureau] proposal was not surprising. These are not unreasonable, at least from the perspective of ratemaking and predicting future experience of employers once COVID passes.”

Bryan Anderson, Senior Vice President at The Zenith explained the WCIRB’s amendments to the California Unit Statistical Reporting Plan and XMOD calculation were “not likely to change under any normal circumstances but the Bureau made these recommendations to address the unique pandemic situation that California (and the world’s) businesses find themselves in."

Another industry leader Paul Zamora, ICW Group’s Senior Vice President for Workers’ Compensation Underwriting said, “We support Commissioner Lara’s decision to approve the recommended changes by the WCIRB. We believe the rule modifications accurately reflect changes in exposures created by COVID-19 and will provide the appropriate relief needed by California businesses.”

The changes were expected by California’s workers’ compensation insurance carriers as a mechanism to adjust employers’ insurance rates, since COVID-19 claims aren’t necessarily an indicator of a company’s safety record.

“Under normal situations,” Anderson explained, “workers’ compensation covers only those occupational illnesses that are created from the work environment. In this instance, that understanding changed with the Governor’s Executive Order requiring employers to accept compensability for Covid-19 claims unless they can prove they are not work-related.”

Hartmann added, “This is clear cost-shifting to the industry, which we expected. The combination of a broad WC presumption, possible additional legislation extending these presumptions past July 5th, excluding COVID from ratemaking and XMODs, means that the insurance industry will absorb the lion’s share of COVID costs that can be assigned to WC.”

Zamora points out “it’s imperative that business owners understand the rule changes and adopt new practices, particularly with respect to the record keeping criteria associated with two of the changes. By adopting new record keeping procedures to apply to the new rules, policyholders will have the necessary audit documentation to realize the full value of Commissioner Lara’s decision.”

This means employers should start documenting employees’ hours worked under each class code, now, and not wait until a final audit.

“Hopefully, these measures will play a small part in helping California employers as they try to recover from the devastating impacts of this pandemic,” Hartmann concluded.

“I think this solution is a testament to the strength and objectivity of the Bureau, the companies it represents and to the integrity of the Workers’ Compensation Industry in California,” said Anderson.

Gene Simpson, CompWest’s Vice President of Underwriting and Marketing, added, “To confront the challenges presented by the COVID-19 pandemic to California employers, regulatory authorities, insurance carriers and employers must work together on effective solutions.”

While the amendments should reduce workers’ compensation premium costs for California businesses in the short-term, only time will tell how lower revenues and higher costs due to COVID-19 claims will impact California’s workers’ compensation insurance premiums in the future.

For a greater understanding of these changes and how they will impact your company, please contact our team at (619) 937-0164.

Workers’ Compensation Claim Advocacy: Distinguishing Good from Great

Author, Jim Malone, Workers’ Compensation Claims Advocate, Rancho Mesa Insurance Services, Inc.

As the new normal continues evolving through this pandemic, advocates are needed across all industries and sectors. Businesses and their employees exposed to the risk of workers’ compensation injuries and illnesses need the highest level of advocacy now, more than ever.

Author, Jim Malone, Workers’ Compensation Claims Advocate, Rancho Mesa Insurance Services, Inc.

As the new normal continues evolving through this pandemic, advocates are needed across all industries and sectors. Businesses and their employees exposed to the risk of workers’ compensation injuries and illnesses need the highest level of advocacy now, more than ever.

Like so much of what we experience in our daily interactions, establishing a baseline of competence in any field has varying levels of effectiveness. That is, there are good claim advocates and then there are great ones; high-level claim liaisons that can make organizations more knowledgeable and stronger.

What are the characteristics that make up the great ones? And, what should you expect with their involvement in your workers’ compensation program?

The first pre-requisite for any workers’ compensation claim advocate is experience. Ideally, having multiple years working as a claim adjuster and managing a case load for an insurance company is vital. While this creates a solid base, stopping here can limit the effectiveness for employers in other critical areas. In order to begin to go from good to great you should expect your advocate to have one or more of the following experiences to offer the broadest perspective possible for your team:

Background with return-to-work programs, in development, implementation and management.

Experience from being a workers’ compensation administrator for a self-insured employer with the State of California and Department of Industrial Relations

Obtaining years of training in diagnosing and treating industrial injuries from occupational medicine, orthopedic surgical, spinal surgical and pain management physicians.

Providing years of training to workers compensation physicians on treatment and disability management of work injuries and preparing med-legal reports and addressing permanent impairment ratings, causation, apportionment, contribution and all other issues.

Or the very rare experience of suffering a work injury, requiring surgeries and rehab, concern for losing one career and starting over in another, and going through the entire workers compensation process through settlement

Secondly, using these technical experiences in review and oversight of claims is both tangible and measurable. That includes:

Ensuring the accuracy of claim statuses and plan of actions.

Recognizing when claim reserves are adequate or inflated.

Pushing for claim closures in the most efficient and cost-effective resolutions.

Forming a deep, consultative bond that elevates a claim advocate to that of a trusted partner.

The final component in establishing a superior workers’ compensation advocate is building strong, respectful relationships with adjusters and employers. This requires the most experienced advocate creating a “partnership environment” that allows for continual open dialogue, which very often expedites the entire claim process. The most effective of these professionals build this environment through direct communication with the adjuster(s), supervisors, and even claim department managers. That information is then thoroughly and simply shared with employers in regular intervals through formal claim reviews, safety committee meetings, and/or pre-renewal meetings involving the broker.

As a 35-year industry veteran of the claims management field, I proudly serve the Rancho Mesa team with a core commitment to providing great contributions to the claims management process. These contributions are predicated on bringing my extensive knowledge and experiences from all sides of the workers’ compensation claim process, to my advocacy role for you, my client… the employer.

OSHA Recording Requirements for COVID-19 Cases

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

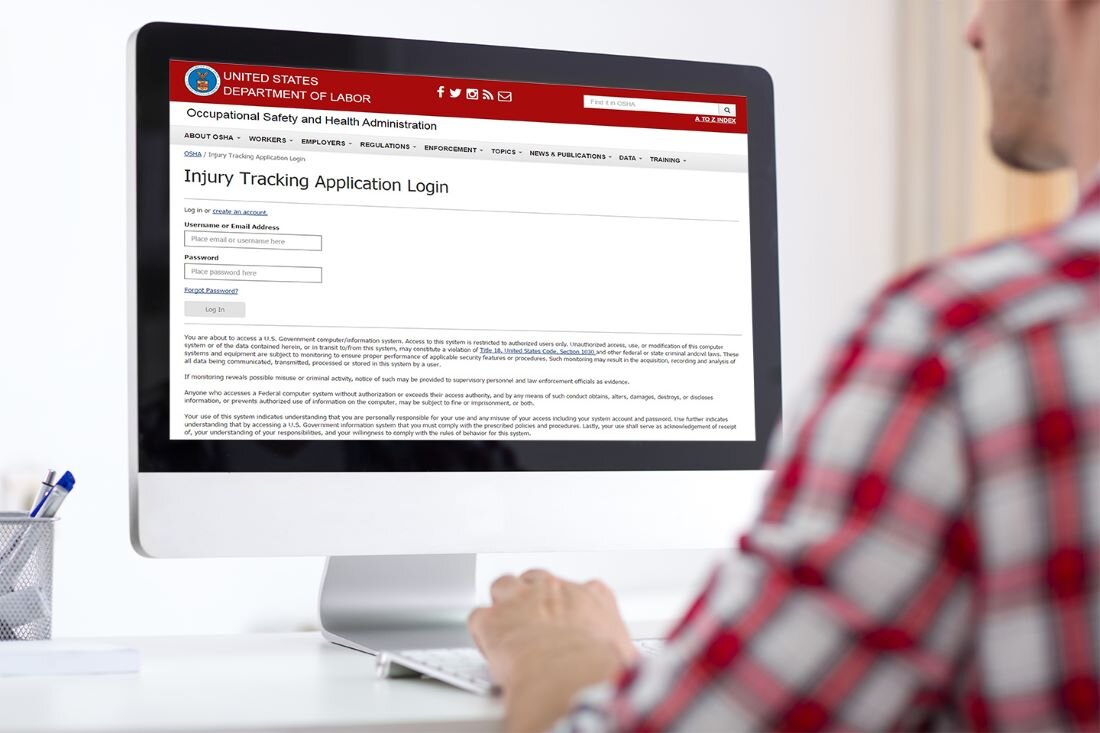

As businesses begin to reopen across the country, employers are now faced with the real possibility that one or more of their employees may be diagnosed with COVID-19. Those who are familiar with the U.S. Department of Labor’s Occupational Safety and Health Administration (OSHA) recording requirements may be wondering how to handle an employee COVID-19 case on their OSHA logs.

Author, Alyssa Burley, Media Communications and Client Services Manager, Rancho Mesa Insurance Services, Inc.

As businesses begin to reopen across the country, employers are now faced with the real possibility that one or more of their employees may be diagnosed with COVID-19. Those who are familiar with the U.S. Department of Labor’s Occupational Safety and Health Administration (OSHA) recording requirements may be wondering how to handle an employee COVID-19 case on their OSHA logs.

California’s Division of Occupational Safety and Health (better known as Cal/OSHA) has released information for employers on the subject and it appears they are using their existing criteria for determining the recordability of an employee COVID-19 case.

According to Cal/OSHA, “California employers that are required to record work-related fatalities, injuries and illnesses must record a work-related COVID-19 fatality or illness like any other illness.” To be recordable on the 300, 300A and 301 forms, the COVID-19 case must be work-related and result in one of the following:

Death.

Days away from work or transfer to another job.

Medical treatment beyond first aid.

Loss of consciousness.

A significant injury or illness diagnosed by a physician or other licensed health care professional.

The criteria that most employers may have a hard time determining is if the COVID-19 illness is actually work-related. Cal/OSHA addresses this in its Frequently Asked Questions webpage. First, the employer must determine if there was “an event or exposure in the work environment [that] either caused or contributed to” the COVID-19 case.

In order to determine if a case is work-related, employers should consider factors like:

The type and duration of contact the employee had at work with other people including co-workers and the general public.

With the implementation of physical distancing and other controls within the workplace, what is the likelihood of exposure?

Did the employee come in contact with anyone showing signs and symptoms of COVID-19, while working?

These considerations will help an employer determine whether or not the COVID-19 case is work-related and thus recordable. According to Cal/OSHA, it is best practices to err on the side of recordability when in doubt about how an employee was exposed to COVID-19.

If it is determined that an employee’s illness was work-related, yet, for a variety of reasons testing or the results from a test is unavailable and the employee has been determined to have COVID-19, “an employer must make a recordability determination” as to whether or not to record the case. While a positive COVID-19 test result would trigger recordability by the employer, a positive test is not always necessary to record the case in the OSHA logs.

Keep in mind, the above information is for OSHA recording of work-related COVID-19 cases only, which may be different from guidance for workers’ compensation claims.

Cal/OSHA states that “Governor Newsom’s Executive Order N-62-20 addresses eligibility for workers’ compensation benefits... The Order does not alter employers’ reporting and recording obligations under Cal/OSHA regulations.”

Rancho Mesa’s Risk Management Center offers employers the ability to track their COVID-19 cases electronically and generate the applicable OSHA 300, 300A and 301 forms along with an incident report and First Report of Jury (Form 5020).

To learn more about the Risk Management Center, contact our Clients Services Department at (619) 438-6869.

Commissioner Lara Approves WCIRB Proposed Amendments Addressing COVID-19

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

California Insurance Commissioner Lara has approved, as filed, the proposed special regulatory filing submitted by the Workers’ Compensation Insurance Rating Bureau (WCIRB) concerning proposed amendments addressing the Coronavirus Disease (COVID-19). The special regulatory filing is effective July 1, 2020 and will apply retroactively starting March 19, 2020, the day California Governor Newsom issued the Stay-at-Home Executive Order N-33-20. Those amendments are as follow…

Author, Dave Garcia, President, Rancho Mesa Insurance Services, Inc.

California Insurance Commissioner Lara has approved, as filed, the proposed special regulatory filing submitted by the Workers’ Compensation Insurance Rating Bureau (WCIRB) concerning proposed amendments addressing the Coronavirus Disease (COVID-19). The special regulatory filing is effective July 1, 2020 and will apply retroactively starting March 19, 2020, the day California Governor Newsom issued the Stay-at-Home Executive Order N-33-20. Those amendments are as follows:

New COVID-19 Rule: Clerical Office Employees

Part 3, Section III, General Classification Procedures, was amended to add Rule 7, Coronavirus Disease 2019 (COVID-19), to permit during a statewide California COVID-19 stay-at-home order the following: The division of an employee’s payroll between Classification 8810, Clerical Office Employees, and a non-standard exception classification when the employee’s work is exclusively clerical in nature and the non-standard exception classification does not include Clerical Office Employees. This amendment will conclude 60 days after the Stay-at-Home Executive Order N-33-20 is lifted.

New COVID-19 Rule: Basis of Payroll

Part 4, Section IV, Exposure Information, Rule 1, Classification Code, and Rule 4, Exposure Amount, were amended to report payments excluded from remuneration pursuant to new Rule 7, Coronavirus Disease 2019 (COVID-19). Payments made to an employee while the employee is performing no duties of any kind in service of the employer are to be excluded from payroll when the payments are equal to or less than the employee’s regular rate of pay. This amendment will conclude 30 days after the Stay-at-Home Executive Order N-33-20 is lifted.

New COVID-19 Rules: Claims Reporting

Part 4, Section V, Loss Information, Rule B, Loss Data Elements, Sub rule 4, Catastrophe Number, was amended to add Catastrophe Number 12 for the reporting of COVID-19 claims. Appendix III, Injury Description Codes, Section B, Nature of Injury (Positions 3-4), and Section C, Cause of Injury (Positions 5-6), were amended to add a Nature of Injury code and a Cause of Injury code for COVID-19 claims. This amendment includes claims with an accident date after December 1, 2019, reported on a Unit Statistical Report due on or after August 1, 2020, and reported with a Catastrophe Number 12.

Exclusion of COVID-19 Claims from Experience Modification

Section VI, Rating Procedure, Rule 2, Actual Losses and Actual Primary (Ap) Losses, was amended to specify that all claims directly arising from a diagnosis of Coronavirus Disease 2019 (COVID-19) shall not be reflected in the computation of an experience modification.

For a greater understanding of these changes and how they will impact your company please contact our team at (619) 937-0164.

Topics Your COVID-19 Training Should Cover

Author, Lauren Stumpf, Media Communications Coordinator, Rancho Mesa Insurance Services, Inc.

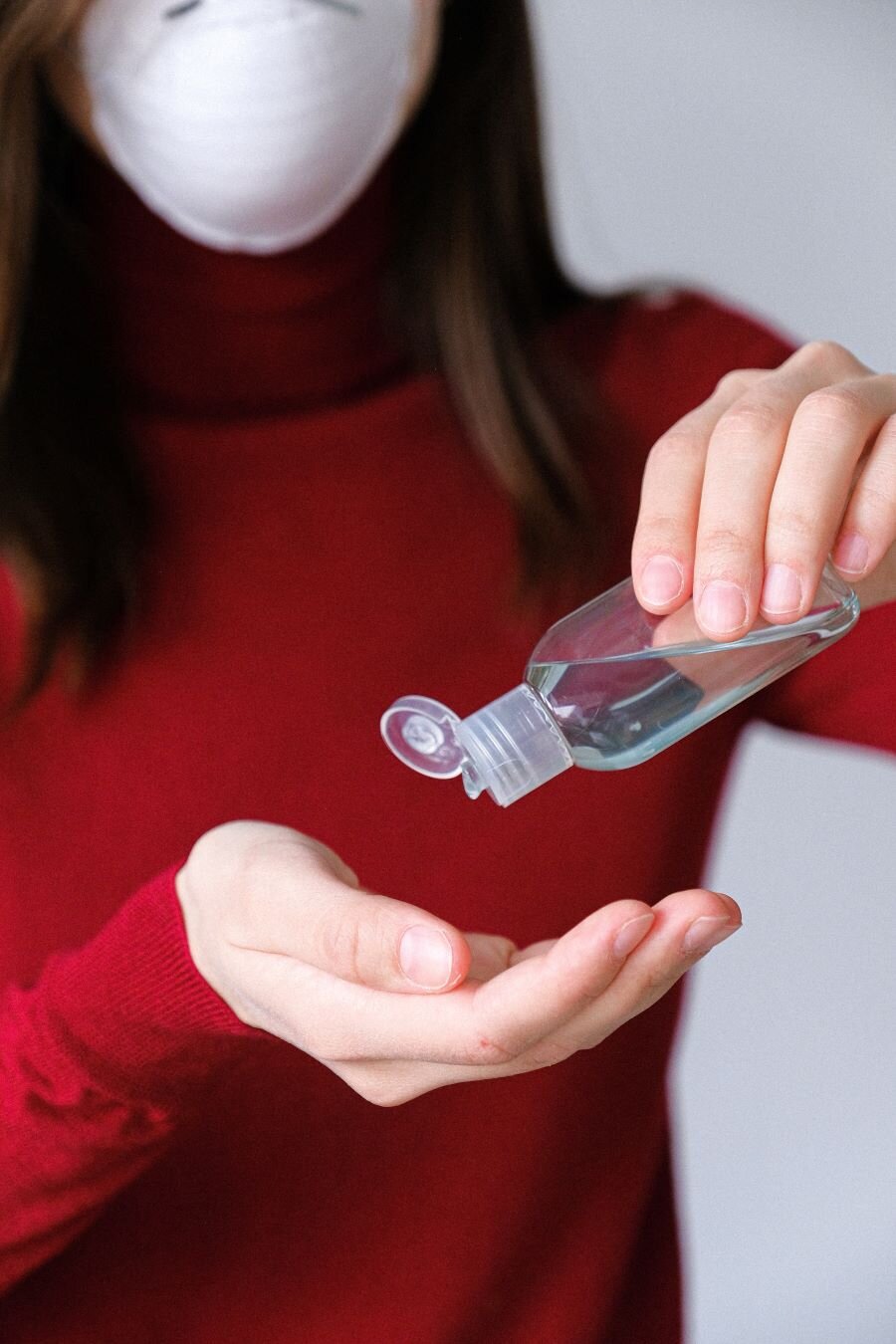

As states begin to lift COVID-19 restrictions and move into later phases of reopening plans, and companies begin to bring back their employees, it is important to take the necessary health and safety precautions in the workplace. Your staff should be well informed about safety precautions and resources to keep one another safe. When choosing a COVID-19 employee training, make sure it is comprehensive and includes all the necessary topics recommended by local, state and federal agencies.

Author, Lauren Stumpf, Media Communications Coordinator, Rancho Mesa Insurance Services, Inc.

As states begin to lift COVID-19 restrictions and move into later phases of reopening plans, and companies begin to bring back their employees, it is important to take the necessary health and safety precautions in the workplace. Your staff should be well informed about safety precautions and resources to keep one another safe. When choosing a COVID-19 employee training, make sure it is comprehensive and includes all the necessary topics recommended by local, state and federal agencies.

The Risk Management Center offers a 10-15 minute training designed to ensure compliance with COVID-19 safety guidelines. This general awareness course on COVID-19 covers tips on how to reduce the risk of contracting the virus by using best practices. In addition, the course covers COVID-19 characteristics and related health and safety concerns.

The COVID-19 General Awareness Online Training topics include:

COVID-19 Characteristics

CDC-Recommended Basic Precautions

Tips for Limiting Exposure

Proper Hand Washing

Social Distancing

Personal Protective Equipment (PPE)

Cross Contamination

Employer Responsibilities

Employee Temperature Checks

Face Masks

Importance of proper disinfecting and sanitation

Recommended Chemicals

What to Clean and Disinfect

Working-from-Home Ergonomics

Federal Assistance for COVID-19 Related Leave

Families First Coronavirus Response Act (FFCRA)

Paid Sick Leave

Family and Medical Leave Act (FMLA)

This online training is offered for free to Rancho Mesa clients. Contact the Client Services department at (619) 438-6869 to learn more about the COVID-19 General Awareness training.

For up-to-date COVID-19 information and HR resources please visit Rancho Mesa’s COVID-19 Information Page.

Nonprofits Eligible for Free Digital Advertising

Author, Sam Brown, Vice President, Human Services, Rancho Mesa Insurance Services, Inc.

To help avoid a decrease in private donations due to the Coronavirus pandemic, nonprofit leaders have turned their attention to a powerful tool used to increase website traffic and online donations: Google’s Ad Grant Program.

Author, Sam Brown, Vice President, Human Services, Rancho Mesa Insurance Services, Inc.

According to the Blackbaud Institute, charitable giving creeped up by only 1% in 2019… But online giving increased 6.8% last year and increased 10% over the last three years! To help avoid a decrease in private donations due to the Coronavirus pandemic, nonprofit leaders have turned their attention to a powerful tool used to increase website traffic and online donations: Google’s Ad Grant Program.

Consider how many organizations spend thousands of dollars each month on Google Ads to gain website traffic, market share, and online customers.

Now consider that Google Ad Grants provide up to $10,000 per month (maximum of $329/day) of free advertising on Google search result pages to eligible nonprofit organizations. The result: high-quality, converting traffic.

Marketing consultant Reese Harris, founder of Ree-Source, Inc, adds “Whether you are driving donations, increasing brand awareness, or amplifying engagement, the Google Ad Grant Program is essential for any nonprofit organization. We encourage all nonprofits to include this strategy in their marketing and outreach.”

To make this a successful strategy, most nonprofits should make use of Geo-Targeting. In other words, your ads should only show to searchers in locations that are important to your organization.

It’s also important to track and measure the results of your campaign. That’s the beauty…this is the internet, not a billboard! Google will provide you with a behind the scenes pass to view exactly which of your keywords attract converting traffic and which keywords aren’t working.

Google Ad Grants is an amazing tool nonprofit leaders can use to increase awareness, web traffic, and engagement. Regardless of your web-marketing experience, the learning and adjusting is an ever-evolving process that promises to deliver. Good luck!

Rancho Mesa understands the importance of every dollar that is raised by nonprofits through advertising efforts, donor relations and fundraisers. That is why we offer the risk management tools your organization needs to minimize costly risks and manage insurance costs, so more of your funds can serve your mission.

Critical Elements of a COVID-19 Safety Plan

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

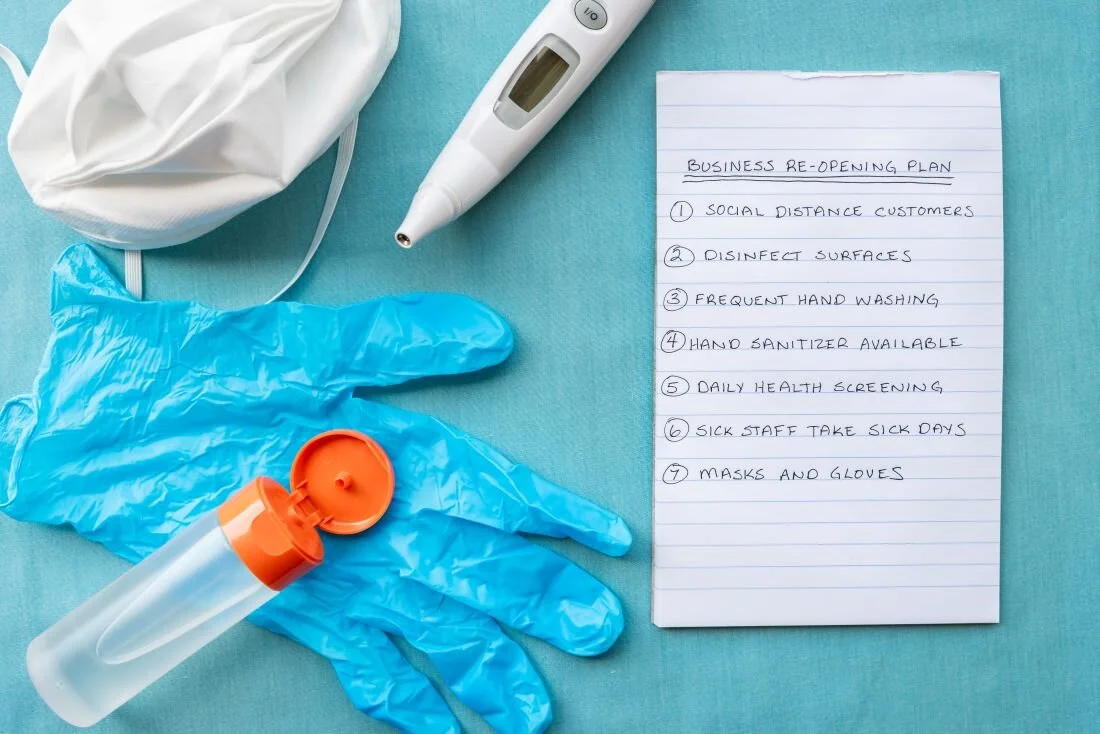

As businesses re-open across the country, it is important that we all do our part in preventing and slowing the spread of COVID-19. For many companies in construction and those in the service industry, employees often work in close proximity with others. Keeping your workforce and the public safe should be priority number one.

Author, Jeremy Hoolihan, Account Executive, Rancho Mesa Insurance Services, Inc.

As businesses re-open across the country, it is important that we all do our part in preventing and slowing the spread of COVID-19. For many companies in construction and those in the service industry, employees often work in close proximity with others. Keeping your workforce and the public safe should be priority number one.

The Centers for Disease Control and Prevention (CDC) recommends having a written COVID-19 Safety Plan in place. Check with your local city or county for specific Safety Plan (aka Safe Reopening Plan) requirements. A well implemented plan will assist in keeping its employees and the public safe. A Safety Plan should have three critical elements; purpose, responsibilities, and safety procedures. Below is a brief explanation of these three critical elements:

Purpose: A safety plan should provide the purpose for why it is in place.

What is Covid-19? Explain the effects of the virus and how it can spread to others.

Control Measures: Train personnel on ways of minimizing exposure of Covid-19.

Personal Protective Equipment: Maintaining recommended supplies, such as respirators, eye protection, gloves, and hand sanitizer.

Compliance: Making sure your business is in compliance with local, State, and Federal emergency response and health agencies.

Responsibilities: A Safety Plan should also provide specific responsibilities for management and staff, such as:

Training and informing all on safety procedures relating to COVID-19.

Implementing a plan across all personnel.

Monitoring the application of the plan.

Safety Procedures: A Safety Plan should have mandatory procedures in place that all personnel are trained on and are strictly adhered. A few examples include:

Practicing good hygiene.

Stop handshaking, use noncontact methods of greeting.

Guidelines on how to properly disinfect surfaces like doorknobs, tables, desks, and handrails.

Creating a COVID-19 Safety Plan which explains its purpose, the responsibilities of all personnel, and safety procedures will go a long way in minimizing COVID-19 exposure. It will also have a positive effect on employee and public moral as it shows you are doing your part to stop the spread of the virus.

As your business designs a formal COVID-19 Safety Plan, Rancho Mesa can assist you with a plethora of related safety resources available in both English and Spanish. Visit www.ranchomes.com/covid-19 for a list of available resources.

Resources:

COVID-19 Safety Plan/Return-to-Work Plan Resources

San Diego County Safe Reopening Plan Template

Imperial County Sample Agency COVID-19 Response Plan (4.27.20)

Riverside County Safe Reopening Guidelines 05212020

COVID-19’s Impact on the Non-Profit Insurance Marketplace

Author, Chase Hixson, Account Executive, Rancho Mesa Insurance Services, Inc.

Businesses of all sizes across the country have been impacted by COVID-19 in some way or another. As we begin to phase back into the “new normal,” the insurance industry is seeing several changes within the non-profit sector that will significantly impact pricing and coverage, moving forward.

Businesses of all sizes across the country have been impacted by COVID-19 in some way or another. As we begin to phase back into the “new normal,” the insurance industry is seeing several changes within the non-profit sector that will significantly impact pricing and coverage, moving forward.

Rate Increases

With many businesses completely shut down and sales way off projections, insurance companies are experiencing lower annual premiums while still needing to pay out for claims. Certain lines of coverage, in particular Employment Practices Liability and Workers’ Compensation are starting to see a significant uptick in claim frequency, which will likely cause rate increases to manage these unexpected costs.

Carriers not writing any new business

Some carriers have placed a moratorium on quoting any new accounts until they can fully assess the damage on longer term exposure of COVID-19. This translates to less options for non-profit risks at renewal.

Carriers Limiting or Excluding Coverage

Many carriers are starting to increase deductible levels, lower available Umbrella limits, and eliminate certain coverage territories for certain property as a way to limit their exposure to claims. Working closely with your broker to plan for these potential gaps at your pre-renewal meeting is critical for you and your management team.

Audited Policies

In many industries, General Liability policies are audited, annually. In the non-profit space, final audits are rarely performed. In order to better account for the loss of revenues due to the shelter-in-place restrictions, many carriers will be conducting end of year audits. This could severely impact those organizations that have not been properly accounting for their exposure, as they will most likely have their revenues, employee counts, and client counts verified at the end of the policy term. Again, developing a plan now with your broker is an important part of your renewal cycle and can help maximize what potentially could be return premiums at final audit.

Looking ahead, non-profits will need to make sure they are partnered with a broker who is proactive and knowledgeable about the marketplace, so that they can stay ahead of these changes and avoid financial hardship as much as possible.

Rancho Mesa offers tools like the Risk Management Center, RM365 HRAdvantage™ portal, RM365 Advantage Safety Star Program™, weekly newsletters and Safety & Risk Management Podcast to assist our clients with successfully managing their risk and improving their marketability to carriers.

Contact Rancho Mesa Insurance Services at (619) 937-0164. to discuss your non-profit’s insurance needs.

Aerial Lift Best Practices

Author, Rory Anderson, Account Executive, Rancho Mesa Insurance Services, Inc.

Aerial lifts have become extremely popular over the past few years in the arboriculture industry. An aerial lift is an ideal way to reach higher trees safely and securely. They can also make potentially hazardous tree removal safer and more efficient. This equipment requires extensive training to operate responsibly, and the lack of this training has led to an increase in accidents and injuries with aerial lift devices.

Author, Rory Anderson, Account Executive, Rancho Mesa Insurance Services, Inc.

Aerial lifts have become extremely popular over the past few years in the arboriculture industry. An aerial lift is an ideal way to reach higher trees safely and securely. They can also make potentially hazardous tree removal safer and more efficient. This equipment requires extensive training to operate responsibly, and the lack of this training has led to an increase in accidents and injuries with aerial lift devices. According to OSHA, between 2009 and 2013 there were 47 aerial lift operator fatalities among the tree care industry in the US. To make for a safer operation, here are a few suggestions and reminders about Best Practices for working with aerial lifts:

Inspect the Lift

Visual inspections ensure that lifts remain functional and safe, while often saving potentially hours of maintenance and future medical bills. Conducting the visual inspection should include a close eye on hydraulic leaks, cracks, loose bolts, and worn or discolored hoses. It’s important to remember to always be cautious and not use your hands or any body parts to check for hydraulic-fluid leaks - always use a piece of cardboard or wood. When hydraulic fluid is under pressure, it can penetrate deep into skin and poison flesh, causing disastrous injuries. Never stick your hand around a fitting or hose to feel for a leak.

Function Testing and Drift Testing

Before climbing into the bucket, lift operators should check the lower controls and run the lift through a full range of motion. These controls are critical as they could very well come into use while rescuing a lift operator from the bucket in an emergency situation.

After the lower controls have been tested, a drift test should also be performed to make sure there are no issues with the hydraulics. To test for drift, set a traffic cone off to the side of the lift and move the bucket over the top of the cone, leaving a few inches in between. Turn the truck off and wait five minutes to make sure the boom doesn't drift down and touch the cone. If it does drift, take the truck out of service until it can be repaired.

Suiting Up

It is now time to put on your fall-protection harness. Make sure your harness fits properly and has a dorsal attachment. Once your harness is on, attach your fall restraint system to the harness and then to the life support attachment on the lift. It is virtually impossible to fall out of an aerial lift device if you wear proper fall protection and make sure it’s attached to the lift, every time.

When used correctly, aerial lifts can be effective and efficient tools for Arborists. When properly set up and tested, they can move easily on the jobsite and provide safe access in hard to reach areas. Their design allows for mobility and flexibility which can increase the crew’s safety, production and profitability.

Rancho Mesa’s Risk Management Center offers training materials covering aerial lifts, elevated work platforms and fall protection as online courses, tailgate talks and posters, as well as sample evaluation forms and policies. For additional information on the use of aerial lifts or other Best Practice safety measures for the arborist industry, please reach out to me, Rory Anderson at randerson@ranchomesa.com and learn more about our TreeOne Program.